Business

ITR Deadline Extension 2025 Live Updates: Has Income Tax Department Extended The Due Date?

ITR Filing Deadline 2025 Extension Live Updates: Today is the ITR filing last date for the assessment year 2025-26. Tax professionals and bodies are urging the income tax department to extend the deadline. However, the income tax department has clarified that the current September 15 deadline remains intact and warned taxpayers against a fake message that is spreading widely on social media and messaging app about the deadline extension.

So far, a total of 6.7 crore ITRs have been filed, as of 12:00 pm today, according to the income tax portal. Out of this, 6.03 crore ITRs have been verified by the taxpayers, and over 4 crore returns have been processed by the income tax department.

Last year, by July 31, 2024, 7.6 crore ITRs had been submitted.

Who Must File ITR Today?

The September 15 deadline is for non-audit taxpayers, including most salaried individuals, pensioners, NRIs, and those whose accounts do not require audit. For audit ITRs, the deadline remains October 31.

Usually, the ITR filing deadline every year is July 31. However, this year, the last date for filing non-audit returns was pushed to September 15 from the usual July 31 deadline, owing to delays in the release of updated ITR forms. The extension came after several tweaks were required following the interim Budget’s changes to the capital gains tax framework.

What Happens If You Miss Today’s Deadline?

Taxpayers filing after September 15 face a penalty of Rs 5,000 under Section 234F, though the fine is capped at Rs 1,000 for those with income below Rs 5 lakh. Late filers also lose the ability to carry forward certain losses, risk refund delays and may attract closer scrutiny from the tax department.

With the clock ticking, the department is urging taxpayers to file early to avoid last-minute issues. Whether the deadline is extended once again remains to be seen.

Business

Interest rates cut to 3.75% but further reductions to be ‘closer call’

Michael RaceBusiness reporter

Getty Images

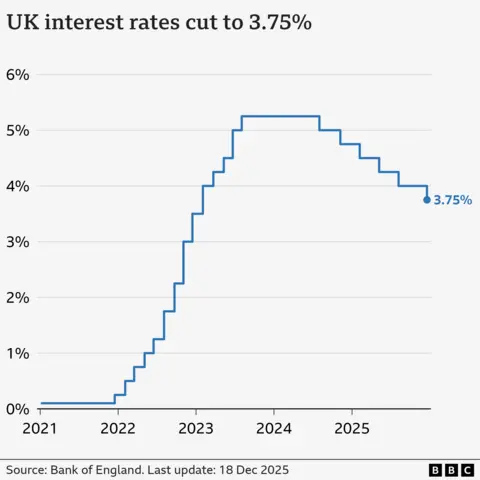

Getty ImagesInterest rates have been cut to 3.75%, the lowest level in almost three years, but further reductions are set to be a “closer call”, the Bank of England has said.

In a knife-edge vote, policymakers voted 5-4 in favour to lower rates from 4% reflecting concerns over rising unemployment and weak economic growth.

The Bank said rates were “likely to continue on a gradual downward path”, but warned judgements on further cuts next year would more contested.

Inflation is now expected to fall “closer to 2%” – the Bank’s target – next year, which is sooner than previous forecasts. However, the economy is predicted to see zero growth in the final few months of this year.

The decision to lower borrowing costs from 4% was widely expected, after figures this week showed inflation, the rate prices rise at, slowed further to 3.2% in the year to November.

“We still think rates are on a gradual path downward but with every cut we make, how much further we go becomes a closer call,” said the Bank’s governor, Andrew Bailey.

While the cut is likely to be good news for people looking to borrow cash or secure a mortgage, savers could see a reduction on their returns.

About 500,000 homeowners have a mortgage that “tracks” the Bank of England’s rate, and Thursday’s cut is likely to mean a typical reduction of £29 in monthly repayments.

Homeowners on standard variable rates are also likely to see lower payments, although the vast majority of mortgage customers have fixed-rate deals so are not affected by the latest decision.

The Bank said that, following the tax and spending policies announced in last month’s Budget and easing oil and gas prices, inflation was likely to fall close to 2% in the spring/summer of next year. Previously it did not expect this to happen until 2027.

Chancellor Rachel Reeves announced the government would cut £150 off household energy bills in the Budget, as well as freeze fuel duty and rail fares.

However, the Bank said weaker economic growth in November had led it to expect zero growth for the final few months of this year.

It said information gathered from businesses around the country suggested a “lacklustre economy”, with firms concerned by the speculation ahead of the Budget.

The Bank said consumers remained “cautious and keenly focused on value for money”, adding that food shops were “smaller than usual”.

“Some supermarkets have been concerned that the Budget will dampen spending on Christmas food and drink, but discounters say that early sales of lowered priced seasonal food are solid so far,” it added.

Latest figures showed the price of food was the main driver behind November’s drop in inflation.

The inflation rate has fallen in recent months, but this drop does not mean that prices are falling, rather they are rising at a slower rate.

Mr Bailey reiterated that the Bank believed inflation had passed its peak.

Reacting to the Bank’s decision, the chancellor said it was the “sixth interest rate cut since the election – that’s the fastest pace of cuts in 17 years, good news for families with mortgages and businesses with loans”.

But shadow chancellor Mel Stride said while lower interest rates would be “welcome news for many families”, the cut reflected “growing concerns about the weakness of our economy”.

“The economic mismanagement of Rachel Reeves has left the Bank of England with an impossible dilemma, balancing high inflation against a fragile economy.”

EPA

EPAThe Bank, which is independent of the government, sets interest rates in an attempt to try to keep consumer price rises under control.

The theory behind increasing interest rates to tackle inflation is that by making borrowing more expensive, more people will cut back on spending and that leads to demand for goods falling and price rises easing.

But it is a balancing act, as high interest rates can harm the economy as businesses hold off from investing in production and jobs.

The government has made growing the economy its main priority as part of its efforts to boost living standards.

In its most recent Monetary Policy Report, the Bank predicted UK economic growth would be 1.5% this year, but forecast it would fall to 1.2% next year before rising to 1.6% in 2027 and 1.8% in 2028.

Get our flagship newsletter with all the headlines you need to start the day. Sign up here.

Business

Bank of England cuts interest rates to near three-year low

The Bank of England has cut interest rates to the lowest level in nearly three years, as it said measures in the Budget will help bring down inflation quicker than previously thought.

The Bank’s Monetary Policy Committee (MPC) voted to reduce rates from 4% to 3.75%.

Governor Andrew Bailey said the UK has “passed the recent peak in inflation and it has continued to fall”, allowing the MPC to cut borrowing costs for the fourth time this year.

It takes the bank’s base interest rate to its lowest level since early 2023.

The nine-person committee voted five-to-four for a cut, with Mr Bailey among those preferring to lower rates at the Bank’s final meeting of the year.

The decision comes after official figures showed Consumer Prices Index (CPI) inflation fell sharply to 3.2% in November, from 3.6% in October.

Minutes of the MPC’s meeting read: “This was above the 2% target but, following the Budget announcements on administered prices and indirect taxes, headline inflation was now expected to fall back more quickly in April, to closer to 2%.”

It means CPI will near the Bank’s target level considerably earlier than the early 2027 timeframe that it had forecast in November.

Measures in the autumn Budget, delivered by Chancellor Rachel Reeves last month, are likely to lower CPI inflation by around 0.5 percentage points, according to the MPC.

This includes one-off support for household energy bills and freezing fuel duty which will kick in from April next year.

“We still think rates are on a gradual path downward,” Mr Bailey said.

“But with every cut we make, how much further we go becomes a closer call.”

Meanwhile, the MPC said it was expecting the economy to show no growth over the final quarter of 2025.

This comes after official data showed a 0.1% contraction in October, which was weaker than it had been expecting.

Meagre economic growth as well as a weakening jobs market and slower pay growth pointed to underlying inflation pressures reducing, the Bank said.

However, the four MPC members who voted to keep interest rates unchanged were more concerned about prolonged inflation persistence, particularly within the services sector and among wage growth.

Business

Insurers told to make travel and home policies easier to understand

Getty Images

Getty ImagesInsurers need to do more to improve how they handle claims and make it clearer to customers what their policies cover, the UK’s finance regulator has said.

The Financial Conduct Authority (FCA) was responding to a “super-complaint” by consumer group Which? about the home and travel insurance sectors.

The regulator acknowledged some problems needed addressing, and said it would expand its scrutiny of how claims are processed and how clear policies are to customers.

Consumer groups said the FCA must follow this up with strong action and see it as a first step to fundamental reform.

A super-complaint is rare, and only used by consumer groups when they believe a large number of people are being significantly harmed by practices across a particular sector.

Consumer group Which? had argued that the home and travel insurance sectors were “broken”. It said that in some cases making a claim to an insurance company could be a worse experience than the distress of the original incident.

The super-complaint was based on three areas of concern. The first was the way that claims are handled, with many being outsourced by insurers to specialists.

The second was the sales practices of insurers, which the consumer group argued were inappropriate and led to widespread confusion over what was covered in a policy.

Finally, it accused the FCA, as the regulator, of failing to provide an appropriate degree of protection for consumers.

Getty Images

Getty ImagesMillions of people across the UK take out insurance policies they hope they will never need to draw on.

Some 22 million home insurance policies were in force last year, with consumers paying more than £7bn in premiums. During the year, consumers made almost 900,000 claims, with insurers paying out a total of £3.2bn.

There were more than 6.8 million travel insurance policies, with premiums of £1.2bn paid last year. Some 600,000 claims led to payouts of more £400m.

But Which? highlighted that acceptance of claims and subsequent payouts were much less likely among home and travel insurance than motor and pet policies.

The FCA found that in 2024, 99% of motor claims were accepted, compared with 80% of standalone single trip travel claims and 74% of home content-only claims.

The regulator said that this, in part, reflected the lower levels of understanding among consumers of what their insurance policy covered.

Graeme Reynolds, director of competition at the FCA, said the regulator would “expand our existing workplan” to ensure improvements to the claims process and consumer understanding of their cover.

“We will continue to hold firms and their senior leaders to account for making improvements, to help build trust and make sure people get fair value insurance,” he said.

The Association of British Insurers (ABI), which represents companies, said the improvements demanded by the FCA were “a top priority” for the sector.

The FCA said it had already addressed various areas of concern in the sector, but consumer groups – including Which? – said more action was needed.

Rocio Concha, Which? director of policy and advocacy, said the FCA must now bring about meaningful change for consumers.

“These issues have been allowed to fester for years, so the FCA must now seize the opportunity to take strong action to stamp out widespread bad practice and issues with how the markets are working,” she said.

James Daley, managing director of consumer group Fairer Finance, said: “The [FCA] response is unlikely to be sufficient to get to grips with the many and growing problems in this sector.

“The insurance market is caught in a race to the bottom on price – leading to the hollowing out of products, as well as poorer claims experiences.”

-

Business5 days ago

Business5 days agoHitting The ‘High Notes’ In Ties: Nepal Set To Lift Ban On Indian Bills Above ₹100

-

Politics1 week ago

Politics1 week agoTrump launches gold card programme for expedited visas with a $1m price tag

-

Tech1 week ago

Tech1 week agoJennifer Lewis ScD ’91: “Can we make tissues that are made from you, for you?”

-

Business1 week ago

Business1 week agoRivian turns to AI, autonomy to woo investors as EV sales stall

-

Sports1 week ago

Sports1 week agoPolice detain Michigan head football coach Sherrone Moore after firing, salacious details emerge: report

-

Fashion1 week ago

Fashion1 week agoTommy Hilfiger appoints Sergio Pérez as global menswear ambassador

-

Business1 week ago

Business1 week agoCoca-Cola taps COO Henrique Braun to replace James Quincey as CEO in 2026

-

Tech1 week ago

Tech1 week agoGoogle DeepMind partners with UK government to deliver AI | Computer Weekly