Business

ITR Deadline Gone: What Will You Pay Now? Know Penalties & Consequences

Last Updated:

Section 234F of the Income Tax Act prescribes a late-filing fee of up to Rs 5,000 for returns filed after the due date.

Section 234A imposes interest at 1% per month or part of a month on the tax liability outstanding from the due date until the date of filing.

If you missed the September 16, 2025, deadline to submit the income tax return (ITR) for AY 2025-26, you can still file. But, it comes at a cost — a late-filing fee, interest on any unpaid tax, and the risk of losing some tax benefits. The window for filing a belated return this year runs only until December 31, 2025, so acting quickly will limit additional interest and penalties.

How much is the late fee?

Section 234F of the Income Tax Act prescribes a late-filing fee of Rs 5,000 for returns filed after the due date. However, if your annual income is below Rs 5 lakh, the late fee is capped at Rs 1,000.

Apart from the late fee, you must pay interest on any unpaid tax. Section 234A imposes interest at 1% per month or part of a month on the tax liability outstanding from the due date until the date of filing. Interest is computed on the balance tax (tax payable after accounting for TDS, TCS and advance tax).

For example, if you owe Rs 50,000 in tax and file three months late, interest under Section 234A would be Rs 50,000 × 1% × 3 = Rs 1,500, in addition to the late fee. If advance tax instalments were short or unpaid, additional interest under Sections 234B and 234C may also apply.

There are non-monetary costs too. Filing a belated return may mean you lose the right to carry forward certain kinds of losses to future years. In practice, that usually means business losses and capital losses cannot be carried forward if the return for the year in which the loss arose is filed late.

If you are owed a refund, filing late does not forfeit the refund itself, but it can delay processing. The income tax department processes refunds after the return is filed and verified; a belated return only restarts that clock. Also, bear in mind that certain features, like switching tax regimes or claiming some deductions, can be restricted or complicated after the original due date, so check the rules that apply to your form and income profile before filing.

What you should do right now

First, calculate your tax liability accurately for the year, accounting for TDS, TCS and any advance tax already paid. If there is tax due, pay the self-assessment tax and any interest before filing — the return will show the tax paid and the portal will accept it. Compute interest under Section 234A (1% per month) from the day after the original due date to the date you file, and include that payment while submitting the belated return.

Next, complete and file the appropriate ITR form online and e-verify the return immediately; an unverified return is treated as if it has not been furnished. The Income Tax Department’s FAQs describe accepted e-verification methods and timelines. Keep receipts of tax payments and verification for your records.

Can you revise a belated return if you spot an error? Yes, a belated return can be revised.

If you miss September 16, file before December 31 to remain compliant for this assessment year. Yes, you will likely pay a late fee and interest at 1% per month on unpaid tax, and you may lose the right to carry forward certain losses. If you are due a refund, file the belated return and e-verify. Refunds are processed only after the return is filed and verified.

Haris is Deputy News Editor (Business) at news18.com. He writes on various issues related to personal finance, markets, economy and companies. Having over a decade of experience in financial journalism, Haris h…Read More

Haris is Deputy News Editor (Business) at news18.com. He writes on various issues related to personal finance, markets, economy and companies. Having over a decade of experience in financial journalism, Haris h… Read More

September 17, 2025, 15:44 IST

Read More

Business

Trade deal done, says Trump; PM Modi thanks him for cutting tariff to 18% – The Times of India

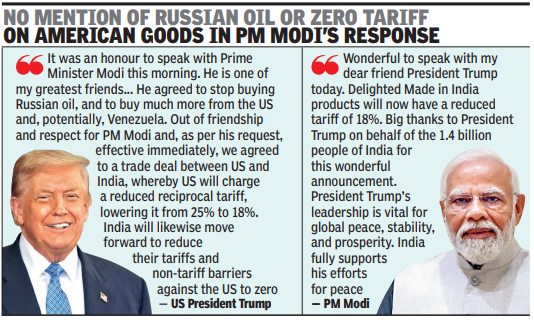

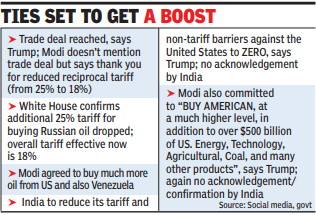

NEW DELHI/ WASHINGTON: After months of bruising trade tensions, India and the US on Monday announced a bilateral trade deal that will see Washington slash additional tariffs on Indian imports to 18%, from the current 50%, making it more competitive for textiles, leather and seafood exporters.While PM Narendra Modi, in a post on X, which followed US President Donald Trump’s announcement on Truth Social, said he had a wonderful conversation with “dear friend” Trump and thanked him on behalf of 1.4 billion people for the reduced tariff of 18% on Indian goods, he did not mention the trade deal at all in his post on X that followed Trump’s “wonderful” announcement.

PM Modi and Trump

Modi also did not comment on Trump’s claim that in their conversation the PM had agreed to stop buying Russian oil and purchase much more energy from the US, and potentially Venezuela. Trump had said Modi had agreed to stop buying Russian oil and to buy much more from the US — $500 billion of energy, technology and farm products — a step that the President claimed would help end the war in Ukraine.According to the American President, Modi also agreed to bring down tariff and non-tariff barriers against the US to zero. A US embassy spokesperson confirmed that the final tariff now on India is 18%, down from the earlier 50%. This is a better deal for India than countries such Vietnam, Bangladesh, Indonesia, South Korea and China, which face higher tariffs. The Trump-Modi conversation coincided with the visit of EAM S Jaishankar to US for a critical minerals ministerial that will be chaired by Secretary of State Marco Rubio this week.The announcement came six days after India and the EU announced the completion of talks for a comprehensive trade agreement.Trump leadership vitalfor global peace: ModiThe deal had drawn sharp comments from some members of the Trump administration, including attacks on the EU.In his X post, PM said, “When two large economies and the world’s largest democracies work together, it benefits our people and unlocks immense opportunities for mutually beneficial cooperation”. He added that Trump’s leadership was vital for global peace, stability, and prosperity. India fully supports his efforts for peace. Modi said he was looking forward to working closely with Trump to take the partnership to unprecedented heights.Apart from reciprocal tariff, Trump had announced an additional 25% tariff on India for its purchase of Russian oil.Trump said the US had agreed to the trade deal with India out of friendship and respect for Modi, and at the latter’s request. “Our amazing relationship with India will be even stronger going forward. PM Modi and I are two people that GET THINGS DONE, something that cannot be said for mos,” he added.Trump in his social media post also said that it was an honour to speak with Modi whom he described as “one of my greatest friends and, a Powerful and Respected Leader of his Country”.

Ties set to get boost

While the US had acknowledged in past few months that India had cut down its Russian purchase, it had not eliminated the additional tariff.Trump also said, “We spoke about many things, including Trade, and ending the War with Russia and Ukraine. He agreed to stop buying Russian Oil, and to buy much more from the US and, potentially, Venezuela. This will help END THE WAR in Ukraine, which is taking place right now, with thousands of people dying each and every week!”Following the announcement last week of the successful conclusion of FTA negotiations with EU, India had suggested that India and US might be close to finalising the trade agreement they have been discussing since Feb last year.Trump’s disclosure of the trade deal was preceded by two India-related posts a few hours before, one of which featured him and Modi on a magazine cover with the caption “The Mover and the Shaker”. Another post featured New Delhi’s India Gate, which Trump called “India’s beautiful Triumphal Arch” and said, “Ours will be the greatest of them all!” — referring to a similar monument he wants to build in Washington DC.

Business

New York AG issues warning around prediction markets ahead of Super Bowl

New York Attorney General Letitia James speaks to the media, after she attended a hearing and pleaded not guilty to charges that she defrauded her mortgage lender, outside the U.S. District Court for the Eastern District of Virginia, in Norfolk, Virginia, U.S., Oct. 24, 2025.

Jonathan Ernst | Reuters

Days before Super Bowl 60, New York Attorney General Letitia James has a message for consumers: Be careful about placing trades on prediction markets.

“New Yorkers need to know the significant risks with unregulated prediction markets,” James said in a statement Monday. “It’s crystal clear: so-called prediction markets do not have the same consumer protections as regulated platforms. I urge all New Yorkers to be cautious of these platforms to protect their money.”

Prediction platforms like Kalshi and Polymarket are expected to generate billions of dollars in trading volume around the Super Bowl.

Consumers can make trades on game events — similar to online sportsbooks like DraftKings or FanDuel — as well as on predetermined outcomes, such as which companies will advertise during the Super Bowl, an issue CNBC Sport reported on last week.

James said the platforms’ products are bets “masquerading” as event contracts.

She warned there are concerns about the nascent prediction market industry, including “upholding prohibitions against insider betting and requiring regulatory review to ensure the financial stability and integrity of gambling operators.”

“Prediction markets may appear as modern, high-tech platforms for speculation or ‘forecasting,’ but in practice, many operate as unregulated gambling without the basic protections New York consumers both deserve and expect from properly licensed operators,” James said in the statement.

Prediction market contracts trade somewhat similarly to all-or-nothing options, with contracts priced between $0 and $1. The contracts trade up or down depending on the action.

In addition to contracts on Super Bowl commercials, both Polymarket and Kalshi are offering other trades related to the game, including on matters like “What songs will be played at the halftime show?,” “Who will attend the big game?,” and more traditional sportsbook “bets” such as “Seattle vs. New England: Most Rushing Yards,” as CNBC reported last week.

There are laws that prohibit insider trading on prediction markets, just as on traditional financial markets. But industry experts say they’re skeptical that the Commodity Futures Trading Commission, recently gutted as part of widespread government cuts, has the will or the means to police those problems.

Last week, CFTC Chairman Michael Selig said he had directed agency staff to withdraw a proposed rule that would have banned prediction trades on sports and politics. He said new rules would be coming.

Disclosure: CNBC has a commercial relationship with Kalshi.

Business

India-US trade deal: 25% penal tariffs linked to Russian oil gone? Here’s what we know – The Times of India

US President Donald Trump has reportedly agreed to remove the 25% tariff America imposed on India for its crude oil imports from Russia. A New Delhi–based source quoted in a Bloomberg report said that the US has agreed to withdraw the 25% penal tariff for India’s Russian oil procurement. In the meantime, India and the US have announced a trade deal, with the Trump administration lowering the tariffs on Indian exports to 18%. Trump took to social media platform Truth Social to announce the trade deal, which was later confirmed by PM Narendra Modi confirming it via X (Twitter). However, India is yet to confirm the details of the trade deal shared by Trump in his post.

Also Read | India-US trade deal announced by US President Donald Trump; check detailsUS Ambassador to India Sergio Gor also told a TV channel that the final figure of tariff on India will be 18%, indicating that the 25% penal tariff linked to Russian crude has also been removed.He also said that the 18% tariff rate is effective immediately, and that India would buy $500 billion worth of US energy, coal, technology and agricultural products.Russia has been the largest supplier of crude for India since the start of the former’s war with Ukraine. The share in India’s oil import basket has gone up to almost 40%. But recently, after US sanctions on Russian oil firms, Indian refiners had been forced to reduce Russian crude oil purchases.

India-US Trade Deal: What PM Modi, Trump said

PM Modi posted on X, “Wonderful to speak with my dear friend President Trump today. Delighted that Made in India products will now have a reduced tariff of 18%. Big thanks to President Trump on behalf of the 1.4 billion people of India for this wonderful announcement. When two large economies and the world’s largest democracies work together, it benefits our people and unlocks immense opportunities for mutually beneficial cooperation. President Trump’s leadership is vital for global peace, stability, and prosperity. India fully supports his efforts for peace. I look forward to working closely with him to take our partnership to unprecedented heights.”Before Trump had posted on social media, “It was an Honor to speak with Prime Minister Modi, of India, this morning. He is one of my greatest friends and, a Powerful and Respected Leader of his Country. We spoke about many things, including Trade, and ending the War with Russia and Ukraine. He agreed to stop buying Russian Oil, and to buy much more from the United States and, potentially, Venezuela. This will help END THE WAR in Ukraine, which is taking place right now, with thousands of people dying each and every week! Out of friendship and respect for Prime Minister Modi and, as per his request, effective immediately, we agreed to a Trade Deal between the United States and India, whereby the United States will charge a reduced Reciprocal Tariff, lowering it from 25% to 18%. They will likewise move forward to reduce their Tariffs and Non Tariff Barriers against the United States, to ZERO. The Prime Minister also committed to “BUY AMERICAN,” at a much higher level, in addition to over $500 BILLION DOLLARS of U.S. Energy, Technology, Agricultural, Coal, and many other products. Our amazing relationship with India will be even stronger going forward. Prime Minister Modi and I are two people that GET THINGS DONE, something that cannot be said for most. Thank you for your attention to this matter!”

-

Sports6 days ago

Sports6 days agoPSL 11: Local players’ category renewals unveiled ahead of auction

-

Entertainment6 days ago

Entertainment6 days agoClaire Danes reveals how she reacted to pregnancy at 44

-

Tech1 week ago

Tech1 week agoICE Asks Companies About ‘Ad Tech and Big Data’ Tools It Could Use in Investigations

-

Fashion1 week ago

Fashion1 week agoSpain’s apparel imports up 7.10% in Jan-Oct as sourcing realigns

-

Sports6 days ago

Sports6 days agoCollege football’s top 100 games of the 2025 season

-

Business6 days ago

Business6 days agoBanking services disrupted as bank employees go on nationwide strike demanding five-day work week

-

Politics6 days ago

Politics6 days agoTrump vows to ‘de-escalate’ after Minneapolis shootings

-

Business6 days ago

Business6 days agoBoeing’s quarterly sales jump 57% as CEO says there’s ‘a lot to be optimistic about’