Business

ITR Filing 2025: Only 30 Days Left; Will The Deadline Be Extended Again?

Last Updated:

The Gujarat Chamber of Commerce & Industry asked the CBDT to extend the ITR filing deadline for AY 2025-26 due to delays in utility releases and software updates.

Income tax filing 2025

ITR Deadline: Taxpayers may get more time to file their returns if the Gujarat Chamber of Commerce & Industry (GCCI’s)request to extend the due date is accepted. In a letter to the CBDT as per ET Wealth report, the chamber said the ITR filing process for AY 2025–26 has been hit by delays in the release of utilities, arriving nearly three months later than usual. Many forms were still unavailable in early August, leaving little time for preparation. Frequent changes to utilities and slow software updates add to the strain, especially in areas with patchy internet.

GCCI has also pushed for a new deadline for tax audits, currently set at September 30.

It’s important to note that although the central government extended the ITR filing deadline for individuals not subject to a tax audit from July 31, 2025, to September 15, 2025, the move offered limited relief. The ITR forms were released much later than usual, leaving taxpayers with little extra time to prepare and file. This is the key reason why the GCCI has submitted its representation seeking a further extension.

The chamber added that frequent changes to the utilities, coupled with poor internet access in several regions, have left taxpayers and professionals with limited time to ensure accurate filings, as per ET Wealth report. It has also requested an extension of the September 30 deadline for tax audit reports.

For Assessment Year 2025–26, the dates of release for the latest Income Tax Return (ITR) utilities and forms are as follows:

-

ITR-1, ITR-2, ITR-3, and ITR-4 were all released on between May, June and July.

-

ITR-5 was released on 8 August 2025.

-

ITR-6 Excel Utility was released on 15 August 2025.

-

ITR-7 has not yet been released.

-

Form 3CA-3CD was released on 29 July 2025.

-

Form 3CB-3CD was released on 29 July 2025.

Different Deadlines For Taxpayers:

September 15 Deadline For Those Who Don’t Require Audit

The tax department has extended the deadline for those taxpayers who don’t require audit to file the taxes. The changes in income tax forms, new slabs under new income tax and capital gain taxes have prompted the department to extend the dates.

Who Can File ITR By October 31, 2025?

Taxpayers whose accounts need to be audited—such as companies, proprietorships, and working partners in firms—have until October 31, 2025, to file their income tax returns (ITR) for the financial year 2024-25 (assessment year 2025-26).

Before they can do that, they must ensure their audit report is submitted by September 30, 2025. As of now, the Income Tax Department has not announced any extension to this deadline.

Deadline for Those with International Dealings

If a taxpayer is involved in international transactions or certain specified domestic transactions, they are required to submit a report under Section 92E. In this case, the due date for filing ITR is November 30, 2025.

To stick to this timeline, their audit report must be submitted by October 31, 2025. Just like in other categories, the government has not given any update about extending this due date.

A team of writers and reporters decodes vast terms of personal finance and making money matters simpler for you. From latest initial public offerings (IPOs) in the market to best investment options, we cover al…Read More

A team of writers and reporters decodes vast terms of personal finance and making money matters simpler for you. From latest initial public offerings (IPOs) in the market to best investment options, we cover al… Read More

view comments

Read More

Business

Bharat Coking Coal IPO To List Tomorrow: GMP Indicates Over 50% Bumper Gains

Last Updated:

Bharat Coking Coal IPO, a Coal India subsidiary, lists on BSE and NSE January 19, 2026, with a strong GMP.

Bharat Coking Coal IPO: Listing Price Prediction. Shares to be listed tomorrow, January 19, 2026.

Bharat Coking Coal IPO Listing Price Prediction, GMP: The allotment of the Bharat Coking Coal IPO was concluded on January 14, 2026. Now, investors are eyeing the listing of the shares on the Bombay Stock Exchange (BSE) and National Stock Exchange (NSE), which is likely to take place on Monday, January 19, 2026.

The investors who have been allotted the unlisted shares of the Bharat Coking Coal IPO might be checking the grey market premium regularly.

The IPO was open for public subscription between January 9 and January 13. It received a massive overall subscription of 143.85 times subscription. Its retail category received 49.37x subscription, its non-institutional investor (NII) category received 240.49 times subscription, and its qualified institutional buyer (QIB) portion got 310.81 times bidding.

Bharat Coking Coal IPO Listing Date

The shares of Bharat Coking Coal Ltd (BCCL), a subsidiary of Coal India Ltd (CIL), will be listed on both the BSE and the NSE on January 19, Monday.

Bharat Coking Coal IPO Listing Price Prediction, GMP Today

According to market observers, unlisted shares of Bharat Coking Coal Ltd are currently trading at Rs 35.4 apiece in the grey market, which is a 53.91 per cent premium over the IPO price of Rs 23. It indicates a strong listing gains for investors. Its listing will take place on Monday, January 19.

The GMP is based on market sentiments and keeps changing. ‘Grey market premium’ indicates investors’ readiness to pay more than the issue price.

Bharat Coking Coal IPO Allotment Status

The Bharat Coking Coal IPO allotment has already been finalised.

The allotment status can be checked online by following these steps:

Via Official Registrar

1) Visit registrar Kfin Technologies’ portal – https://ipostatus.kfintech.com/.

2) Under ‘Select Company’, select ‘Bharat Coking Coal Limited’ from the drop-box.

3) Enter your application number, demat account, or permanent account number (PAN).

5) Then, click on the ‘Submit’ button.

Your share application status will appear on your screen.

Via the BSE

1) Go to the official BSE website via the URL — https://www.bseindia.com/investors/appli_check.aspx.

2) Under ‘Issue Type’, select ‘Equity’.

3) Under ‘Issue Name’, select ‘Bharat Coking Coal Limited’ in the drop box.

4) Enter your application number, or the Permanent Account Number (PAN). Those who want to check their allotment status via PAN can select the ‘Permanent Account Number’ option.

5) Then, click on the ‘I am not a robot’ to verify yourself and hit the ‘Search’ option.

Your share application status will appear on your screen.

Via NSE’s Website

The allotment status can also be checked on the NSE’s website at https://www.nseindia.com/invest/check-trades-bids-verify-ipo-bids.

Bharat Coking Coal IPO: More Details

According to the red herring prospectus (RHP), the maiden public issue is entirely an offer for sale (OFS) of 46.57 crore equity shares by Coal India.

The listing of BCCL is part of the government’s broader divestment push in the coal sector, aimed at unlocking value in Coal India’s subsidiaries and enhancing transparency through market discipline.

In its prospectus, the company stated that the IPO will help achieve the benefits of listing.

BCCL will make its stock market debut on January 16. The company said that half of the issue size has been reserved for qualified institutional buyers, 35 per cent for retail investors and the remaining 15 per cent for non-institutional investors.

Last year, Central Mine Planning and Design Institute Ltd (CMPDIL), another wholly-owned arm of Coal India, had also filed its draft papers with Sebi for an IPO via the OFS route.

While BCCL is a coal-producing entity, CMPDIL serves as Coal India’s technical and planning arm.

Bharat Coking Coal was the largest coking coal producer in India in fiscal 2025, according to a Crisil report. It produces various grades of coking coal, non-coking coal and washed coals for applications primarily in the steel and power industries.

The company was incorporated in 1972 to mine and supply coking coal concentrated in mines located at Jharia, Jharkhand and Raniganj, West Bengal coalfields.

The public sector firm has expanded operations significantly over the years, with coal production increasing from 30.51 million tonnes in fiscal 2022 to 40.50 million tonnes in fiscal 2025, which is an increase of 33 per cent. Its coal production stood at 15.75 million tonnes in the six months ended September 30, 2025, as compared to 19.09 million tonnes in the year-ago period.

The company operates a network of 34 operational mines, including 4 underground mines, 26 opencast mines, and 4 mixed mines as of September 30, 2025.

On the financial front, Bharat Coking Coal’s revenues from operations stood at Rs 13,802 crore and profit of Rs 1,204 crore in FY25.

BCCL’s issue comes against the backdrop of a blockbuster year for the primary market.

In 2025, companies raised a record nearly Rs 1.76 lakh crore through IPOs, buoyed by strong domestic liquidity, resilient investor sentiment and a supportive macroeconomic environment. This surpassed the Rs 1.6 lakh crore mobilised by 90 firms in 2024 and the Rs 49,436 crore raised by 57 companies in 2023.

Disclaimer: The views and investment tips by experts in this News18.com report are their own and not those of the website or its management. Users are advised to check with certified experts before taking any investment decisions.

January 18, 2026, 09:31 IST

Read More

Business

DGCA slaps IndiGo with fine of Rs 22 crore for flight disruptions – The Times of India

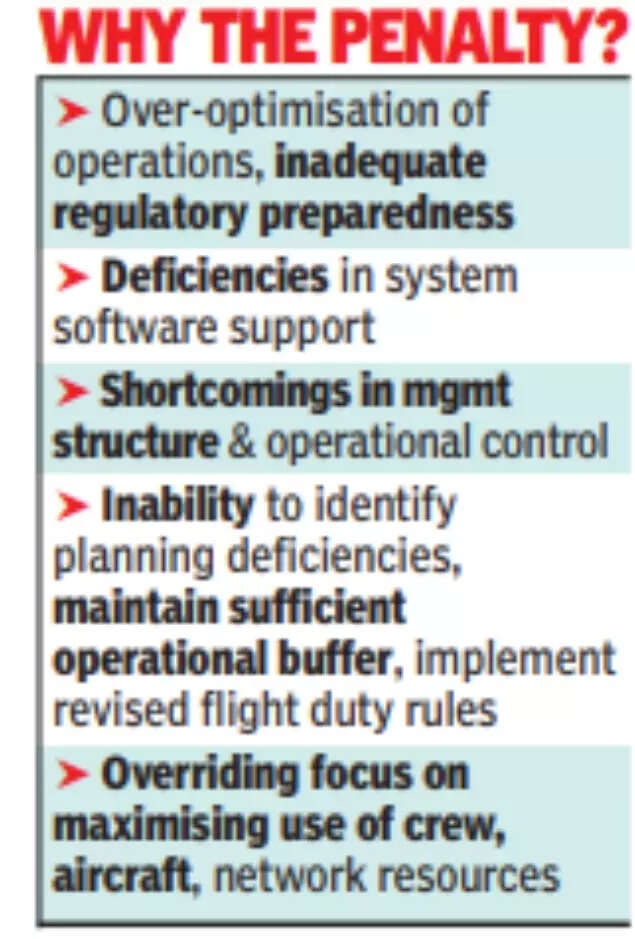

EW DELHI: The Directorate General of Civil Aviation (DGCA) has slapped IndiGo with the steepest fine ever for an Indian carrier – Rs 22.2 crore – for its massive flight disruptions last month.Additionally, the airline has to submit a bank guarantee of Rs 50 crore whose release is tied to implementing, among other things, the more humane flight duty norms for pilots aimed to enhancing flight safety. The regulator has warned senior airline officials, including the CEO & COO. The senior VP of operation control centre has to be removed from his position.

The senior VP of operation control centre has to be removed from his position and not given any accountable position in the future. The aviation ministry has ordered “an internal inquiry to identify and implement systemic improvements within DGCA”.The regulator late on Saturday night released key findings of the report by its four-member panel that probed IndiGo schedule collapse last month. The airline’s unpreparedness and consequent inability to implement DGCA’s new flight duty time limitation (FDTL) for pilots has cost it dear. Each day’s exemption given for its Airbus A320 family pilots to ensure the airline was able to start resuming flights staring the second week of Dec is costing it Rs 30 lakh. This works out to Rs 20.4 crore for 68 days between Dec 5, 2025, & Feb 10, 2026.The airline has been fined one-time Rs 30 lakh each on six more counts, which add up the fine to Rs 22.2 crore. The six failures include failure to comply with new FDTL rules, rest periods, “inadequate buffer margins in roster planning… failure to strike balance between commercial imperatives and crew members’ ability to work effectively and failure of accountable management to ensure overall functioning, financing, and conduct of operations to DGCA standards.“Between Dec 3 and 5, 2,507 IndiGo flights were cancelled and 1,852 were delayed that left over 3 lakh passengers stranded at airports across the airline’s network. Flights had resumed gradually over the next week or so.What caused the crisis:“Over-optimisation of operations, inadequate regulatory preparedness along with deficiencies in system software support and shortcomings in management structure & operational control on the IndiGo”, have been identified as the “primary causes for the disruption” by the DGCA probe panel. “The airline’s management failed to adequately identify planning deficiencies, maintain sufficient operational buffer, and effectively implement the revised FDTL provisions,” the report says.Action against IndiGo:Apart from fines, the airline’s CEO has been cautioned “for inadequate overall oversight of flight ops and crisis management.” Accountable manager & COO, Isidre Porqueras, has been warned for “failure to assess impact of winter schedule 2025 and revised FDTL leading to widespread disruptions.” Senior VP (ops control centre) has been asked to be relieved from the post and not be given any accountable position in future. Warnings have been issued to flight ops and crew resource planning “for operational, supervisory, manpower planning and roster management lapses.”Way ahead:DGCA has asked IndiGo to take appropriate action against any other personnel identified through its inquiry and submit a compliance report regarding the same. Sources say IndiGo has been made aware of the lapses of its senior officials, especially COO, and now the airline is expected to take action against them. “The findings underscore the need for operational planning, and effective management oversight to ensure sustainable operations and passenger safety & convenience,” report says.IndiGo statement:Confirming receipt of DGCA ruling, airline said it is “committed to taking full cognisance of the orders and will, in a thoughtful and timely manner, take appropriate measures… an in-depth review of the robustness and resilience of the internal processes at IndiGo (is) underway to ensure that the airline emerges stronger out of these events in its otherwise pristine record of 19 plus years of operations”.

Business

Amid plans to induct Noel’s son, Tata trust cancels meet – The Times of India

MUMBAI: The Sir Ratan Tata Trust (SRTT) cancelled its Saturday board meeting, which was expected to consider the induction of chairman Noel Tata’s son, Neville Tata, as a trustee. In contrast, board meetings of Sir Dorabji Tata Trust (SDTT) and Tata Education and Development Trust (TEDT) proceeded as scheduled.The cancellation suggests that Neville’s appointment may have been pushed back to give trustees more time for discussions – since appointing a trustee requires unanimous approval. No new date for the SRTT meeting has been notified. An email query to Tata Trusts on the cancellation of the board meeting received no response. Sir Ratan Tata Trust (SRTT), Sir Dorabji Tata Trust (SDTT), and Tata Education and Development Trust (TEDT) have several trustees in common. Except for Jehangir HC Jehangir and Jimmy Tata, the other SRTT trustees — Noel, Venu Srinivasan, Vijay Singh and Darius Khambata — also serve on SDTT’s board and participated in its meeting on Saturday, people familiar with the matter said. Jimmy, Noel’s older half-brother, usually does not attend SRTT meetings.Saturday’s development comes amid unresolved issues from the last round of inductions in Nov 2025 when the inductions of Neville and former Titan MD Bhaskar Bhat were approved by SDTT but failed to secure approval at SRTT. SDTT, together with SRTT, controls India’s largest conglomerate, the Tata Group.At the Nov 11, 2025 SDTT meeting, Khambata proposed Neville’s appointment, while Noel proposed Bhat, as TOI reported in its Nov 12 edition. Neither name was on the formal board agenda. All trustees of SDTT approved the appointments (Srinivasan did not attend the meeting as his term had expired). Later, at SRTT’s meeting on the same day, both proposals were put off for consideration at a later date.Srinivasan, who participated in the SRTT meeting, reportedly expressed reservations, stating that these proposals were not on the agenda and that such matters should not be raised under “any other items for discussion.” While items not listed on the agenda can be introduced with the chairman’s permission, Srinivasan suggested they be considered at the next board meeting, according to a person familiar with the discussion.This time, Neville’s appointment was formally listed on the SRTT agenda but the meeting was cancelled. Bhat’s name did not appear on Saturday’s agenda. Neville participated at the SDTT meeting on Saturday, marking his first formal role at the flagship foundation.

-

Tech5 days ago

Tech5 days agoNew Proposed Legislation Would Let Self-Driving Cars Operate in New York State

-

Sports1 week ago

Sports1 week agoClock is ticking for Frank at Spurs, with dwindling evidence he deserves extra time

-

Sports1 week ago

Commanders go young, promote David Blough to be offensive coordinator

-

Entertainment5 days ago

Entertainment5 days agoX (formerly Twitter) recovers after brief global outage affects thousands

-

Fashion1 week ago

Fashion1 week agoSouth India cotton yarn gains but market unease over US tariff fears

-

Fashion1 week ago

Fashion1 week agoChina’s central bank conducts $157-bn outright reverse repo operation

-

Business1 week ago

Business1 week agoSoftBank reduces Ola Electric stake to 13.5% from 15.6% – The Times of India

-

Sports1 week ago

Sports1 week agoUS figure skating power couple makes history with record breaking seventh national championship