Business

LG Electronics India’s stellar 50% premium listing: $13 billion giant more valuable than South Korean parent! Top 5 takeaways – The Times of India

LG Electronics India on Tuesday had a stellar listing on the stock exchanges NSE and BSE, debuting at a whopping premium of 50% above its share price issue. Trading commenced at Rs 1,715 on BSE and Rs 1,710.10 on NSE, considerably above the Rs 1,140 per share issue price, resulting in day-one returns exceeding 50% for investors.The Rs 11,607-crore public offering consisted solely of shares divested by LG Electronics Inc. The issue garnered overwhelming interest, securing 54-fold oversubscription. The qualified institutional buyers’ segment witnessed 166 times subscription, whilst retail investors’ portion achieved 3.5 times subscription.Before the official listing, the shares attracted strong demand in the grey market, trading at a 31% premium, reflecting strong investor confidence.The debut takes place in India’s second-busiest IPO quarter, though recent major listings, including WeWork India and Tata Capital, experienced relatively modest market debuts.So why is the LG Electronics India listing important and what does it mean for the IPO market in India?

LG Electronics’ Stellar listing

The IPO performance stands as the most impressive among Indian offerings exceeding one billion dollars since 2021, placing the organisation ahead of rivals such as Whirlpool, Voltas and Havells.The rise pushed the organisation’s market valuation beyond other listed Indian consumer durables firms, including Whirlpool of India ($1.7 billion), Voltas ($5.8 billion) and Havells India ($10.4 billion).

LG Electronics India more valuable than South Korean parent company!

Interestingly, LG’s market capitalisation reached Rs 1.16 lakh crore (approximately $13.13 billion), surpassing its South Korean parent LG Electronics Inc’s value of $8-9 billion on the Seoul exchange!According to experts, the company’s success stems from its sensible valuations, market leadership position and clear earnings prospects. LG holds a dominant position in India’s consumer durables sector with its diverse range of home appliances, TVs and ACs, consistently outperforming competitors in profitability and expansion, according to an ET report.Ambit Capital assigned a Buy rating with a 12-month target of Rs 1,820, noting several positive factors supporting the company’s outlook, including localisation, premium product focus, increased exports and GST-driven market recovery.“LG’s under-penetration across categories leaves ample room for growth. The Six City plant will double capacity and boost exports by 4 percentage points by FY28E,” the brokerage said. Their forecast indicates 11% revenue and 13% EBITDA CAGR through FY25-28.The IPO pricing proved appealing to investors. At 35x FY25 earnings, LG presented better value compared to listed competitors trading at 45-60x multiples. Additional factors strengthening investor trust included its debt-free status, consistent ROE exceeding 30%, and stable EBITDA margins above 10%.

LG Stands Tall In Rs 10,000 crore IPO Club

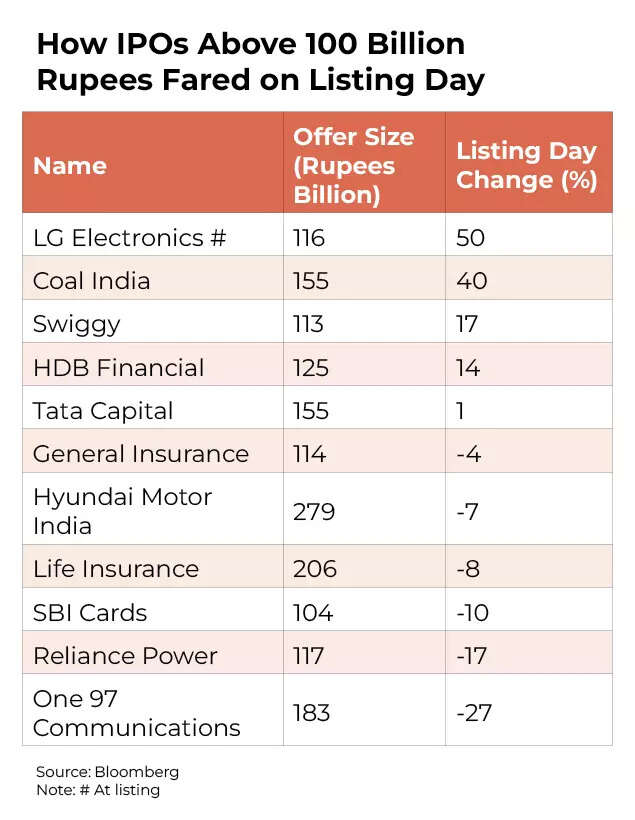

The listing proved exceptionally rewarding for investors and set a new benchmark among India’s Rs 10,000-crore-plus IPOs, where such issues typically struggle to maintain momentum post-listing. LG India recorded the highest day-one premium of 50.4% amongst IPOs exceeding Rs 10,000 crore.Historical data of significant Indian listings reveals diverse outcomes. Coal India’s public offering in 2010, which raised Rs 15,199 crore, remains amongst the successful ventures, beginning 40% higher.

How above Rs 100 billion IPOs fares on listing

In contrast, Reliance Power’s 2008 issue started 17% lower, while Paytm’s Rs 18,300-crore offering in 2021 fell 27% at listing. State-backed enterprises encountered difficulties too, with LIC’s Rs 20,557-crore issue opening 7.8% lower and GIC Re’s Rs 11,257-crore offering starting with a 4.6% decline.Considering these precedents, LG India’s market debut stands out amongst substantial Indian IPOs, reflecting both scale and strong investor confidence.

More IPOs loading – what LG’s stellar listing means

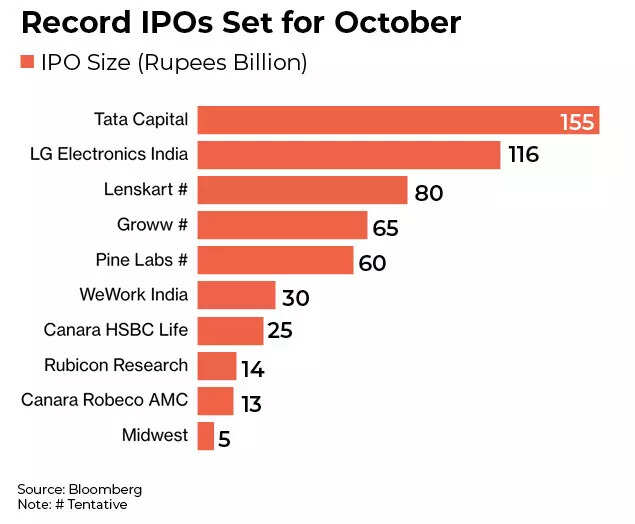

The impressive first-day performance serves as a positive indicator for upcoming Indian corporate listings, particularly following Tata Capital Ltd.’s modest 1.4% increase during its debut in the nation’s largest initial public offering this year.Over the past two years, India has emerged as one of the world’s most active markets for public listings, attracting international investors keen to participate in its rapidly expanding consumer market.October is poised to set a record for Indian IPOs, with anticipated proceeds exceeding $5 billion. The market has closely monitored both LG and Tata’s offerings as indicators of stability in one of the world’s most vibrant IPO markets.

Record IPOs Set for October

According to Bloomberg data, these recent offerings have pushed the total IPO proceeds in India beyond $15 billion this year. The surge in significant offerings has generated confidence that the total could exceed last year’s milestone of nearly $21 billion. Jefferies Financial Group previously indicated that India’s primary market is positioned for substantial growth following a quiet start, projecting fundraising of up to $18 billion in the latter half of the year.

IPOs a Hit Even As Nifty, Sensex Still Below Highs

Amidst international market fluctuations, India maintains its status as the second-largest IPO market globally, following the United States. This position is supported by sound economic fundamentals, improved regulatory framework, and increased participation from retail investors.Although foreign investors have been consistently selling in the secondary market, they maintain substantial confidence in India’s leading growth narrative by participating as committed anchor investors in companies’ initial public offerings.The Indian IPO sector demonstrates exceptional vitality, generating approximately 1% of the nation’s GDP, R. Venkataraman, Managing Director of IIFL Capital told ET recently.The prevailing robust valuations and conducive market environment are allowing business owners to secure capital for expansion whilst partially realising their investments.Experts are of the view that companies at their listing stage are typically in their early growth phase, potentially offering higher returns compared to established listed entities, according to Shah. Additional advantages of IPOs include minimal price impact from bulk purchases and opportunities to invest in unique business models at competitive valuations.(Disclaimer: Recommendations and views on the stock market and other asset classes given by experts are their own. These opinions do not represent the views of The Times of India)

Business

Govt keeps petrol, diesel prices unchanged for coming fortnight – SUCH TV

The government on Thursday kept petrol and high-speed diesel (HSD) prices unchanged at Rs253.17 per litre and Rs257.08 per litre respectively, for the coming fortnight, starting from January 16.

This decision was notified in a press release issued by the Petroleum Division.

Earlier, it was expected that the prices of all petroleum products would go down by up to Rs4.50 per litre (over 1pc each) today in view of variation in the international market.

Petrol is primarily used in private transport, small vehicles, rickshaws, and two-wheelers, and directly impacts the budgets of the middle and lower-middle classes.

Meanwhile, most of the transport sector runs on HSD. Its price is considered inflationary, as it is mostly used in heavy transport vehicles, trains, and agricultural engines such as trucks, buses, tractors, tube wells, and threshers, and particularly adds to the prices of vegetables and other eatables.

The government is currently charging about Rs100 per litre on petrol and about Rs97 per litre on diesel.

Business

Serial rail fare evader faces jail over 112 unpaid tickets

One of Britain’s most prolific rail fare dodgers could face jail after admitting dozens of travel offences.

Charles Brohiri, 29, pleaded guilty to travelling without buying a ticket a total of 112 times over a two-year period, Westminster Magistrates’ Court heard.

He could be ordered to pay more than £18,000 in unpaid fares and legal costs, the court was told.

He will be sentenced next month.

District Judge Nina Tempia warned Brohiri “could face a custodial sentence because of the number of offences he has committed”.

He pleaded guilty to 76 offences on Thursday.

It came after he was convicted in his absence of 36 charges at a previous hearing.

During Thursday’s hearing, Judge Tempia dismissed a bid by Brohiri’s lawyers to have the 36 convictions overturned.

They had argued the prosecutions were unlawful because they had not been brought by a qualified legal professional.

But Judge Tempia rejected the argument, saying there had been “no abuse of this court’s process”.

Business

JSW Likely To Launch Jetour T2 SUV In India This Year: Reports

JSW Jetour T2 Launch: JSW Motors Limited, the passenger vehicle arm of the JSW Group, is reportedly preparing to enter the Indian car market this year. It has partnered with Jetour, a China-based automotive brand owned by Chery Automobile, and the Jetour T2 SUV could be the company’s first product, according to the reports.

Media reports suggest that the launch will happen independently and not under the JSW MG Motor India joint venture. The SUV will wear a JSW badge and name, instead of the Jetour branding. The upcoming SUV will be assembled at JSW’s upcoming greenfield manufacturing facility in Chhatrapati Sambhaji Nagar, Maharashtra.

According to the reports, the company plans to have the vehicle on sale by the third quarter of this year. With this move, JSW aims to establish itself as a standalone carmaker in India.

Expected Powertrain

The SUV is likely to arrive with a 1.5-litre plug-in hybrid setup. Internationally, this hybrid powertrain is offered with both front-wheel drive and all-wheel drive options. It is still unclear which version will be introduced in India.

Design

In terms of design, the T2 is a large and rugged-looking SUV. It has a boxy and upright stance, similar to vehicles like the Land Rover Defender. Despite its tough appearance, it uses a monocoque chassis instead of a ladder-frame construction.

Size

The SUV measures around 4.7 metres in length and nearly 2 metres in width. This makes it larger than the Tata Safari, even though it is a five-seater. A longer 7-seat version is also sold in some markets.

Price

Pricing details for India are yet to be announced. For reference, the front-wheel-drive five-seat T2 i-DM is priced at AED 1,44,000 (around Rs 35 lakh) in the UAE.

Jetour

Jetour is a brand owned by Chinese automaker Chery. Launched in 2018, it focuses mainly on SUVs and is present in markets across China, the Middle East, Africa, Southeast Asia and Latin America.

-

Politics1 week ago

Politics1 week agoUK says provided assistance in US-led tanker seizure

-

Entertainment1 week ago

Entertainment1 week agoDoes new US food pyramid put too much steak on your plate?

-

Entertainment1 week ago

Entertainment1 week agoWhy did Nick Reiner’s lawyer Alan Jackson withdraw from case?

-

Business1 week ago

Business1 week agoTrump moves to ban home purchases by institutional investors

-

Sports5 days ago

Sports5 days agoClock is ticking for Frank at Spurs, with dwindling evidence he deserves extra time

-

Sports1 week ago

Sports1 week agoPGA of America CEO steps down after one year to take care of mother and mother-in-law

-

Business1 week ago

Business1 week agoBulls dominate as KSE-100 breaks past 186,000 mark – SUCH TV

-

Sports6 days ago

Commanders go young, promote David Blough to be offensive coordinator