Business

Pakistan–India ceasefire a ‘proud moment for diplomacy,’ says US

The United States played a key role in preventing a potential crisis between Pakistan and India during their recent hostilities, State Department spokeswoman Tammy Bruce said Tuesday, praising Washington’s swift and decisive actions in defusing tensions.

“Obviously, we had an experience with Pakistan and India when there was a conflict — one that could have escalated into something quite terrible,” Bruce told reporters at a State Department press briefing.

She recalled that at the time, there was “immediate concern and immediate action” from the Vice President, the President, and the Secretary of State to address the unfolding situation.

Bruce noted how US leaders swiftly engaged both sides. “Many of you who were here in the days that followed will remember our briefings on the phone calls made, the steps taken to halt the attacks, and the efforts to bring both parties together to work toward something lasting,” she said.

“It remains a very proud moment, and a strong example of the commitment shown by Secretary Rubio, Vice President Vance in that case, and our nation’s top leadership in preventing what could have been a disaster,” she added.

Bruce also emphasized that Washington continues to maintain positive relations with both Islamabad and New Delhi.

“I would say that our relationship with both nations is as it has been, which is good, and that is the benefit of having a president who knows everyone, talks to everyone, and that is how we can bring differences together in this case.

So it’s clear that the diplomats here are committed to both nations.”

She pointed to ongoing cooperation with Pakistan on security issues.

“I can tell you also that there has been a US-Pakistan Counterterrorism Dialogue that was established.

At this dialogue in Islamabad, the United States and Pakistan reaffirmed their shared commitment to combating terrorism in all its forms and manifestations during this latest round of the talks in Islamabad,” she said.

“The United States and Pakistan discussed ways to enhance cooperation to counter terrorist threats. And I think that for the region and for the world, the United States working with both those nations is good news and will promote a future that’s beneficial,” Bruce added.

Counter-terror cooperation talks

Earlier on Tuesday, Pakistan and the US renewed their shared commitment to combat terrorism in all its forms and manifestations.

The vow was made during the latest round of the Pakistan-US Counterterrorism Dialogue, held in Islamabad, according to a joint statement.

The meeting was co-chaired by Pakistan’s Special Secretary for the United Nations, Nabeel Munir and US Department of State Acting Coordinator for Counterterrorism Gregory D LoGerfo.

The dialogue took place a day after the US State Department listed the Baloch Liberation Army (BLA) and Majeed Brigade as foreign terrorist organisations after a string of deadly assaults claimed by the group.

Both delegations emphasised the critical need for effective strategies to counter terrorist threats, including those posed by the Balochistan Liberation Army (BLA), Daesh-Khorasan, and Tehreek-e-Taliban Pakistan (TTP).

The US delegation lauded Pakistan’s continued successes in containing terrorist entities that endanger regional and global peace and security.

Washington also expressed condolences over the loss of civilians and law enforcement personnel in recent attacks in Pakistan, including the Jaffar Express train assault and the Khuzdar school bus bombing.

Discussions focused on building stronger institutional frameworks and enhancing capabilities to respond to evolving security threats, including the misuse of emerging technologies for terrorist purposes.

Business

‘Indians been good actors’: Why US ‘agreed to let’ India resume buying Russian oil temporarily – The Times of India

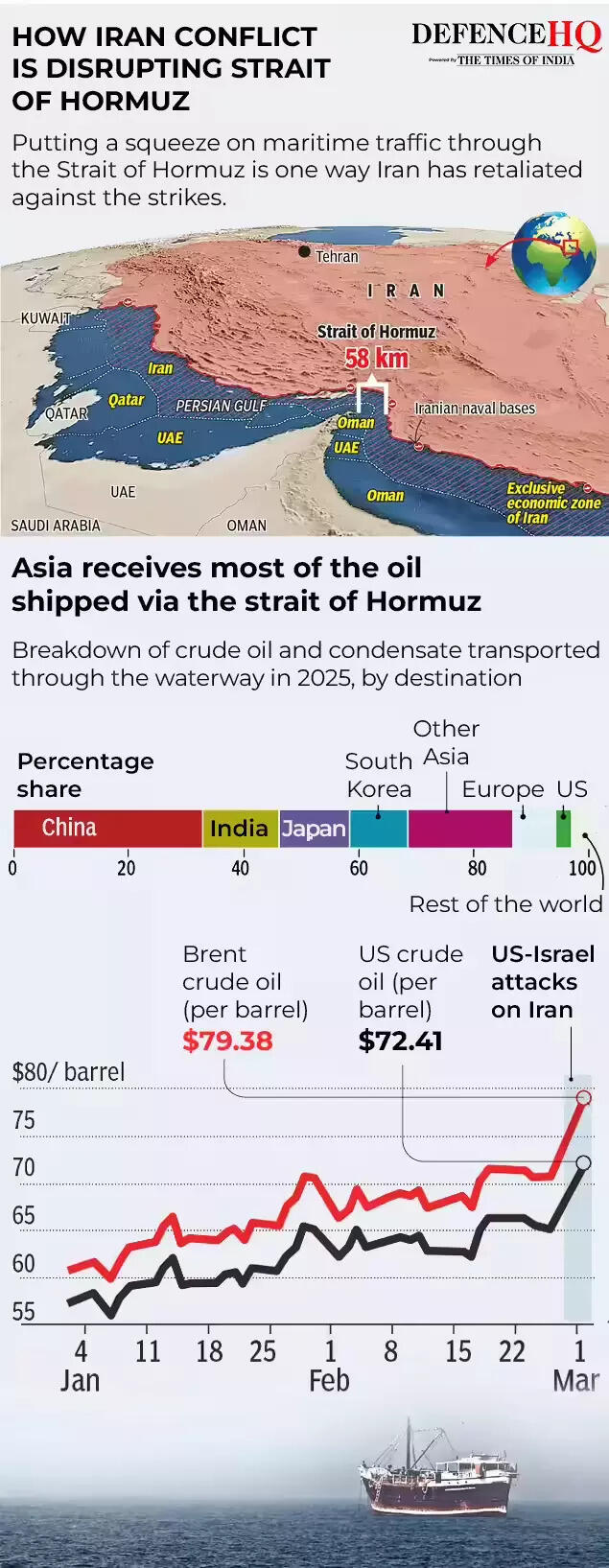

The United States has given “permission” to India to buy Russian oil already stranded at sea issuing a temporary waiver aimed at stabilising global oil supplies amid disruptions caused by the escalating conflict in West Asia.US President Donald Trump’s aide Scott Bessent referred to India as a “very good actor” for previously complying with Washington’s request to halt purchases of sanctioned Russian oil and said the temporary measure would help ease supply pressures in the global market.

The move comes a day after Washington issued a 30-day waiver permitting the sale of Russian crude currently stranded at sea to continue to India.

US cites temporary supply concerns

Speaking to Fox Business, US treasury secretary Bessent said the decision was intended to ease short-term supply constraints during the ongoing crisis.“The world is very well supplied in oil. The Treasury (Department) agreed to let our allies in India start buying Russian oil that was already on the water,” Bessent said.“The Indians had been very good actors. We had asked them to stop buying sanctioned Russian oil this fall. They did. They were going to substitute it with US oil,” he said.“But to ease the temporary gap of oil around the world, we have given them permission to accept the Russian oil. We may unsanction other Russian oil,” he added.Bessent also noted that a large volume of sanctioned crude remains stranded at sea stating that, “There are hundreds of millions of sanctioned barrels of sanctioned crude on the water,” he said, adding that “by unsanctioning them, Treasury can create supply.”“And we are looking at that. We are going to keep a cadence of announcing measures to bring relief to the market during this conflict,” he added.

‘Short term measures to help keep oil prices down’

Other officials in the Trump administration have also confirmed that Washington has “permitted” India to buy Russian crude that is already loaded on ships.Earlier, US energy secretary Chris Wright said the step was intended to quickly move existing oil supplies into the market.“We have implemented short term measures to help keep oil prices down. We are allowing our friends in India to take oil that is already on ships, refine it, and move those barrels into the market quickly. A practical way to get supply flowing and ease pressure,” Wright said in a post on X.In an interview with ABC News Live, Wright emphasised that the measure was temporary.“But as oil gets bid up a little bit because of those constraints coming out of the Strait of Hormuz, we’re taking a short-term action to say all this floating Russian oil storage that’s around Southern Asia, it’s China just backed up, China does not treat their suppliers well, so there’s a bunch of floating barrels just sitting there,” he said.“We’ve reached out to our friends in India and said, ‘Buy that oil. Bring it into your refineries’. That pulls stored oil immediately into Indian refineries and releases the pressure on other refineries around the world to buy oil that they’re no longer competing with the Indians for in that marketplace,” Wright added.“So we have a number of measures like that that are short-term and temporary. This is no change in policy towards Russia. This is a very brief change in policy just to keep oil prices down a little bit better than we could otherwise,” he further noted.

Waiver amid Strait of Hormuz tensions

The US Treasury earlier issued an order granting a 30-day licence allowing delivery and sale of Russian crude and petroleum products to India. The decision comes as shipping routes through the strategically important Strait of Hormuz face disruptions due to the ongoing conflict in the region.“President Trump’s energy agenda has resulted in oil and gas production reaching the highest levels ever recorded. To enable oil to keep flowing into the global market, the Treasury Department is issuing a temporary 30-day waiver to allow Indian refiners to purchase Russian oil,” Bessent said earlier.He stressed that the step was a limited measure and would not significantly benefit Moscow.“This deliberately short-term measure will not provide significant financial benefit to the Russian government, as it only authorises transactions involving oil already stranded at sea,” he said.“India is an essential partner of the United States, and we fully anticipate that New Delhi will ramp up purchases of US oil. This stop-gap measure will alleviate pressure caused by Iran’s attempt to take global energy hostage,” he added.

India’s oil supply position

The move comes months after the Trump administration imposed 25% punitive tariffs on India over its purchases of Russian oil, arguing that such imports were helping finance Moscow’s war against Ukraine.However, the tariffs were later lifted after the two countries agreed on a framework for an interim trade agreement and India committed to reducing imports from Russia while increasing purchases of American energy.India currently imports nearly 5.5–5.6 million barrels of crude oil per day, accounting for about 90% of its domestic consumption. Officials say the country’s energy position remains comfortable despite the regional tensions.Around 15 million barrels of crude are currently on tankers in the Arabian Sea and the Bay of Bengal, while vessels carrying another seven million barrels are waiting near Singapore. Additional tankers in the Mediterranean and the Suez Canal are also heading towards Indian ports and could arrive within a week.According to data from Kpler, India imported slightly over 1 million barrels per day of Russian crude in February, compared with 1.1 million bpd in January and 1.2 million bpd in December.Before the Ukraine war in 2022, Russian crude accounted for just 0.2% of India’s imports, but purchases increased sharply after Moscow began offering deep discounts.

Business

Home heating oil: ‘Most of my pension has gone on home heating oil’

Rising heating oil prices are hitting Northern Ireland harder than the rest of the UK – here’s everything you need to know.

Source link

Business

FDA vaccine head will step down in April after string of controversial decisions

The logo for the Food and Drug Administration is seen ahead of a news conference at the Health and Human Services Headquarters in Washington, April 22, 2025.

Nathan Posner | Anadolu | Getty Images

A key U.S. Food and Drug Administration official who oversees vaccines and biotech treatments will step down from the agency following multiple decisions that raised concerns within the industry.

Vinay Prasad, director of the Center for Biologics Evaluation and Research, will leave the FDA at the end of April, an agency spokesperson confirmed on Friday. It is his second departure from the position: He briefly left the post in July following backlash over his regulatory decisions, and returned only two weeks later in August.

In a post on X, FDA Commissioner Marty Makary said the FDA will appoint a successor before Prasad returns next month to the University of California San Francisco, where he taught before taking the FDA position last year. Makary said Prasad “got a tremendous amount accomplished” during his tenure at the agency.

Prasad’s decision to step down comes after criticism of the FDA mounted within the biotech and pharmaceutical industry and among former health officials. In the past year, the agency has denied or discouraged the approval applications of at least eight drugs, according to RTW Investments, after taking issue with data the companies used to support their applications. The FDA also initially refused to review Moderna’s flu shot before it later reversed course.

All of those companies accused the FDA of reversing previous guidance about the evidence they could use to back their applications, sparking criticism within the industry that an unreliable regulatory process could stifle development of drugs for hard-to-treat diseases.

A former FDA official who spoke to CNBC on the condition of anonymity to speak freely on the issue called the reversals the worst kind of regulatory uncertainty because companies say they are being told one thing and then experience another.

In a statement earlier Friday, an FDA spokesperson said there was “no regulatory uncertainty,” adding the agency “makes decisions based on the evidence, but does not make assurances about outcomes.” The spokesperson said the FDA is “conducting rigorous, independent reviews and not rubber-stamping approvals.”

The most recent controversy came after the FDA discouraged UniQure from applying for expedited approval of its experimental treatment for Huntington’s disease.

The agency, which underwent staff cuts and an overhaul under Health and Human Services Secretary Robert F. Kennedy Jr., has faced broader backlash for its drug and vaccine approvals process. Critics have worried the agency could stifle the development of new treatments and risk the safety of patients.

The Wall Street Journal earlier reported Prasad’s departure.

-

Business1 week ago

Business1 week agoAttock Cement’s acquisition approved | The Express Tribune

-

Politics1 week ago

Politics1 week agoUS arrests ex-Air Force pilot for ‘training’ Chinese military

-

Fashion1 week ago

Fashion1 week agoPolicy easing drives Argentina’s garment import surge in 2025

-

Politics1 week ago

Politics1 week agoWhat are Iran’s ballistic missile capabilities?

-

Business1 week ago

Business1 week agoIndia Us Trade Deal: Fresh look at India-US trade deal? May be ‘rebalanced’ if circumstances change, says Piyush Goyal – The Times of India

-

Entertainment1 week ago

Entertainment1 week agoBobby J. Brown, “The Wire” and “Law & Order: SUV” actor, dies of smoke inhalation after reported fire

-

Sports1 week ago

Sports1 week agoLPGA legend shares her feelings about US women’s Olympic wins: ‘Gets me really emotional’

-

Sports1 week ago

Sports1 week agoSri Lanka’s Shanaka says constant criticism has affected players’ mental health