Business

Pakistan signs crypto deal linked to Trump family to explore stablecoin payments | The Express Tribune

Finance minister says digital innovation will be pursued in line with regulation and national interest

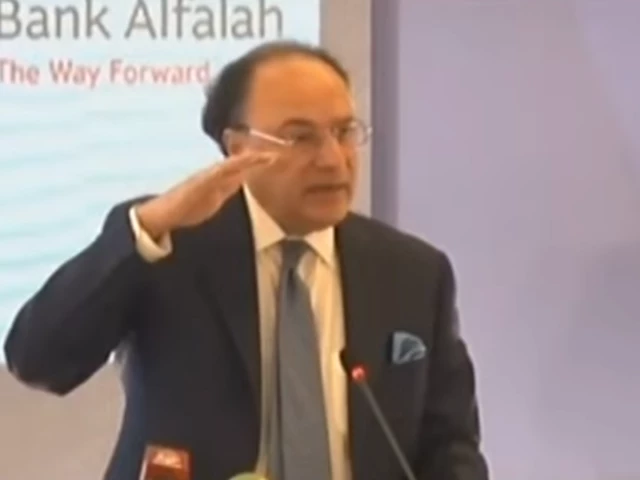

Finance Minister Muhammad Aurangzeb signs a memorandum of understanding with SC Financial Technologies on January 14. — Photo via X/@PakistanVARA

Pakistan has signed an agreement with a company affiliated with World Liberty Financial, the main crypto business linked to the family of US President Donald Trump, to explore the use of a dollar linked stablecoin for cross border payments, the government said on Wednesday.

The Pakistan Virtual Asset Regulatory Authority said it had signed a memorandum of understanding with SC Financial Technologies, which it described as an affiliated entity of World Liberty Financial. The agreement will allow dialogue and technical engagement around “emerging digital payment architectures”.

Today, World Liberty Financial signed an MoU with the Ministry of Finance to explore innovation in digital finance, particularly the use of stablecoins for cross-border transactions, signalling growing global interest in Pakistan as a key market for digital assets. pic.twitter.com/rYzbfHYysd

— Pakistan Virtual Assets Regulatory Authority (@PakistanVARA) January 14, 2026

The development marks one of the first publicly announced partnerships between World Liberty Financial, a crypto based finance platform launched in September 2024, and a sovereign state. It also comes amid warming ties between Pakistan and the United States.

Read: Billion dollar digital fraud: call for effective cyber governance

Under the agreement, SC Financial Technologies will work with Pakistan’s central bank to explore integrating its USD1 stablecoin into a regulated digital payments framework, allowing it to operate alongside Pakistan’s own digital currency infrastructure, a source involved in the deal told Reuters.

The announcement coincided with a visit to Pakistan by Zach Witkoff, co founder and chief executive of World Liberty Financial and chief executive of SC Financial Technologies. Witkoff is the son of US special envoy Steve Witkoff.

According to the regulator, Witkoff met with senior Pakistani stakeholders to discuss digital payment infrastructure, cross border settlement and foreign exchange processes.

“Our focus is to stay ahead of the curve by engaging with credible global players, understanding new financial models, and ensuring that innovation, where explored, is aligned with regulation, stability, and national interest,” Finance Minister Muhammad Aurangzeb said.

Read More: ‘Is This Legit?’ to fight AI deceit

SC Financial Technologies, registered in Delaware, co owns the USD1 stablecoin brand with World Liberty Financial, according to documentation on the token’s reserves from July 2025.

Stablecoins, which are digital tokens typically pegged to the US dollar, have expanded rapidly in recent years. Under President Trump, the United States has introduced federal rules widely viewed as favourable to the crypto sector, while countries globally are assessing the role of stablecoins in payment systems.

Pakistan has been exploring digital currency initiatives as it seeks to reduce cash usage and improve cross border payments, including remittances, a key source of foreign exchange. The central bank governor said in July that Pakistan was preparing to launch a pilot for a digital currency and finalising legislation to regulate virtual assets.

Business

Netflix likely to adjust Warner Bros. Discovery offer to make it all-cash

Netflix is likely to amend its offer for Warner Bros. Discovery’s assets, making an all-cash bid, CNBC’s David Faber reported on Wednesday.

In December, Netflix reached a deal to purchase WBD’s streaming platform HBO Max and the Warner Bros. film studio in a transaction comprised of cash and stock. The deal is currently valued at $27.75 per WBD share. This would put the deal’s equity value at $72 billion, with a total enterprise value of approximately $82.7 billion.

Bloomberg first reported this week that Netflix was considering adjusting its offer to be all-cash.

An amended offer would allow WBD shareholders to vote to approve the offer on a faster timeline, Faber reported, citing sources familiar with the matter.

Under the current deal, shareholders are expected to vote on the deal in the spring or early summer, Faber reported. Deals comprised of stock typically mean more financials and accounting need to be issued as part of seeking approval, which requires more time and expense, Faber added.

If Netflix were to make its offer all-cash the shareholder vote could move up to as early as late February or early March, Faber reported.

The change would come as Paramount Skydance has turned up the heat on its hostile push to acquire all of Warner Bros. Discovery’s business.

Earlier this week Paramount sued Warner Bros. Discovery and CEO David Zaslav seeking more information about why the company’s board continues to reject its $30-per-share offer in favor of Netflix.

Paramount has repeatedly argued its deal is superior in value, given the estimated value of Warner Bros. Discovery’s TV networks. It has also amended its bid to solidify the backing of Oracle co-founder and billionaire Larry Ellison, the father of Paramount CEO David Ellison.

Business

Infosys Q3 results: Net profit slips 2.2% to Rs 6,654 crore; revenue climbs 8.9% to Rs 45,479 crore – The Times of India

IT services major Infosys on Wednesday reported a 2.2 per cent decline in consolidated net profit to Rs 6,654 crore for the October–December quarter of FY26, even as revenue from operations rose nearly 9 per cent year-on-year.The Bengaluru-headquartered company had posted a net profit attributable to owners of the company of Rs 6,806 crore in the corresponding quarter last year, PTI reported.Revenue from operations increased 8.89 per cent to Rs 45,479 crore in Q3 FY26, compared with Rs 41,764 crore in the same period of the previous financial year.On a sequential basis, profit declined 9.6 per cent from the September quarter (Q2 FY26), while revenue grew 2.2 per cent quarter-on-quarter.Commenting on the performance, Infosys CEO and managing director Salil Parekh said the company delivered a strong third-quarter showing, driven by demand for enterprise AI solutions under Infosys Topaz.“Clients increasingly view Infosys as their AI partner with demonstrated expertise, innovation capabilities and strong delivery credentials. This has helped them unlock business potential and enhance value realisation,” Parekh said, adding that the company’s focus on re-skilling and empowering its workforce remains central to its AI-led growth strategy.Shares of Infosys ended marginally higher at Rs 1,599.05 on the BSE, up 0.07 per cent from the previous close. The results were announced after market hours.

Business

Indias GDP Likely To Grow At 7.5-7.8% In FY26: Report

New Delhi: India’s GDP will likely expand 7.5-7.8 per cent in the current fiscal (FY26), driven by festive demand and robust services activity, a report said on Wednesday. The report from Deloitte India, however, noted that the growth could moderate to 6.6–6.9 per cent in FY27 because of a high base and lingering global uncertainties.

The business consultancy noted that real GDP grew 8 per cent in the first half of 2025–26 (April–September), underscoring the economy’s resilience amid trade disruptions, policy shifts in advanced economies and volatile capital flows.

“India’s resilience is no accident. It stems from sustained pro-growth policies,” Deloitte India, Economist, Rumki Majumdar said. “With demand-side levers largely addressed, policy focus in 2026 will shift toward supply-side reforms, focusing on MSMEs, and developing tier-2 and tier-3 cities as new engines of growth,” Majumdar added.

Though external risks remain elevated, their full impact may not materialise in FY26, Majumdar said, adding that the India-US trade deal is likely to conclude by the end of this fiscal, which should revive foreign investment and stabilise the currency. The report credited the decisive policy moves in 2025 including tax exemptions, policy rate cuts and GST rationalisation, driving the growth by shoring up domestic demand and supporting the recovery.

Favourable inflation trends added buoyancy, while trade recalibration through multiple FTAs strengthened exports, the report said. The business consultancy highlighted a strategic pivot in trade policy, with India signing agreements with the UK, New Zealand and Oman, operationalising the EFTA deal and initiating negotiations with Israel.

“These partnerships unlock manufacturing opportunities and expand India’s services footprint beyond the US, while reinforcing investor confidence and paving the way for increased FDI, which remains critical for financing infrastructure and industrial expansion,” Majumdar said.

Another recent report from a fund house cited 8.2 per cent GDP growth in Q2FY26, a sharp rebound in industrial output and stable GST collections as the positives of domestic fundamentals. Softer crude prices, easing global rates and policy support through tax and GST cuts are expected to further support consumption and investment, the fund house predicted.

-

Entertainment7 days ago

Entertainment7 days agoDoes new US food pyramid put too much steak on your plate?

-

Politics7 days ago

Politics7 days agoUK says provided assistance in US-led tanker seizure

-

Entertainment7 days ago

Entertainment7 days agoWhy did Nick Reiner’s lawyer Alan Jackson withdraw from case?

-

Business7 days ago

Business7 days agoTrump moves to ban home purchases by institutional investors

-

Sports7 days ago

Sports7 days agoPGA of America CEO steps down after one year to take care of mother and mother-in-law

-

Sports4 days ago

Sports4 days agoClock is ticking for Frank at Spurs, with dwindling evidence he deserves extra time

-

Business1 week ago

Business1 week agoBulls dominate as KSE-100 breaks past 186,000 mark – SUCH TV

-

Business1 week ago

Business1 week agoGold prices declined in the local market – SUCH TV