Business

PPF calculator: Public Provident Fund can make you a crorepati, but is it the right investment option for you? Explained – The Times of India

Public Provident Fund or PPF is one of the most popular investment options available – and one that can make you a crorepati with disciplined investing. In fact if you were to start a PPF account by the age of 21, you can easily become a crorepati by the age of 46 – way ahead of the conventional retirement age.PPF is a government-backed investment which currently offers an interest rate of 7.1% making it a suitable option for not only risk-averse investors, but also those who are looking at fixed income instruments. Who can open a PPF account and what is the maximum investment limit? Are there any tax benefits of PPF and how long is the lock-in period? Importantly, is PPF the right investment option for you to become a crorepati? How do other investment alternatives compare? Here is a detailed explainer:

Who Can Open a PPF Account?

Any resident Indian can open one PPF account in their own name. Additionally, an individual can open one PPF account on behalf of a minor child or a person with mental illness or intellectual disability, provided they serve as the guardian.However, PPF does not allow for joint accounts. Each minor or dependent is allowed only one account and that too through a guardian.PPF accounts can be opened at post offices, designated banks, and e-banking services.

PPF: What is the minimum & maximum investment limit?

- Minimum investment: Rs 500 per financial year

- Maximum investment: Rs 1.5 lakh per financial year

Deposits can be made in one lump sum or in multiple installments. The overall limit of Rs 1.5 lakh includes contributions made to your own account as well as any accounts you operate for minors.

PPF: What are the tax benefits?

PPF is a EEE product – making it a preferred option for tax saving investments. EEE products or Exempt, Exempt, Exempt are those instruments where the principal investment, interest, and maturity amount are all tax-free.All PPF contributions qualify for tax deduction under Section 80C. This means that individuals opting for the old income tax regime can avail a deduction of up to Rs 1.5 lakh for their PPF investment. While Section 80C benefits are not available under the new income tax regime, the interest earned and the final maturity amount continue to be tax-free.

PPF Interest: How Earnings Are Calculated

Interest rate on PPF is reviewed quarterly by the Ministry of Finance. For your PPF account, the interest calculation is done monthly on the lowest balance between the 5th and the last day of the month. This interest is credited annually, typically at the end of the financial year.This means that to accrue the maximum benefit of the full Rs 1.5 lakh investment limit for a year, investors should look at a lump sum deposit between April 1-5 of a financial year.

PPF: Premature Withdrawal, Loan & More

You can opt for premature withdrawal after five years from the end of the year in which the account was opened. Account holders may withdraw up to 50% of the balance—calculated based on either the fourth year preceding the withdrawal year or the previous year, whichever is lower. Any outstanding loan must be fully repaid before a withdrawal can be made, and discontinued accounts are not eligible for this facility. You can take a loan against your PPF balance between the 3rd and 6th financial year, up to 25% of the balance from two years prior. The loan must be repaid within 36 months, after which only 1% interest per year is charged — but delays push this to 6%. Only one loan can be taken in a year, and no new loan is allowed until the previous one is fully repaid.Premature closure of a PPF account is permitted only under specific circumstances: life-threatening illness of the account holder or immediate family, higher education needs of the account holder or dependent children, or a change in residency status to NRI. In such cases, the account earns interest at a rate 1% lower than originally credited over time. In the event of the account holder’s death, the PPF account must be closed; the nominee or legal heir cannot continue it, although interest is payable until the end of the month preceding the final payout.

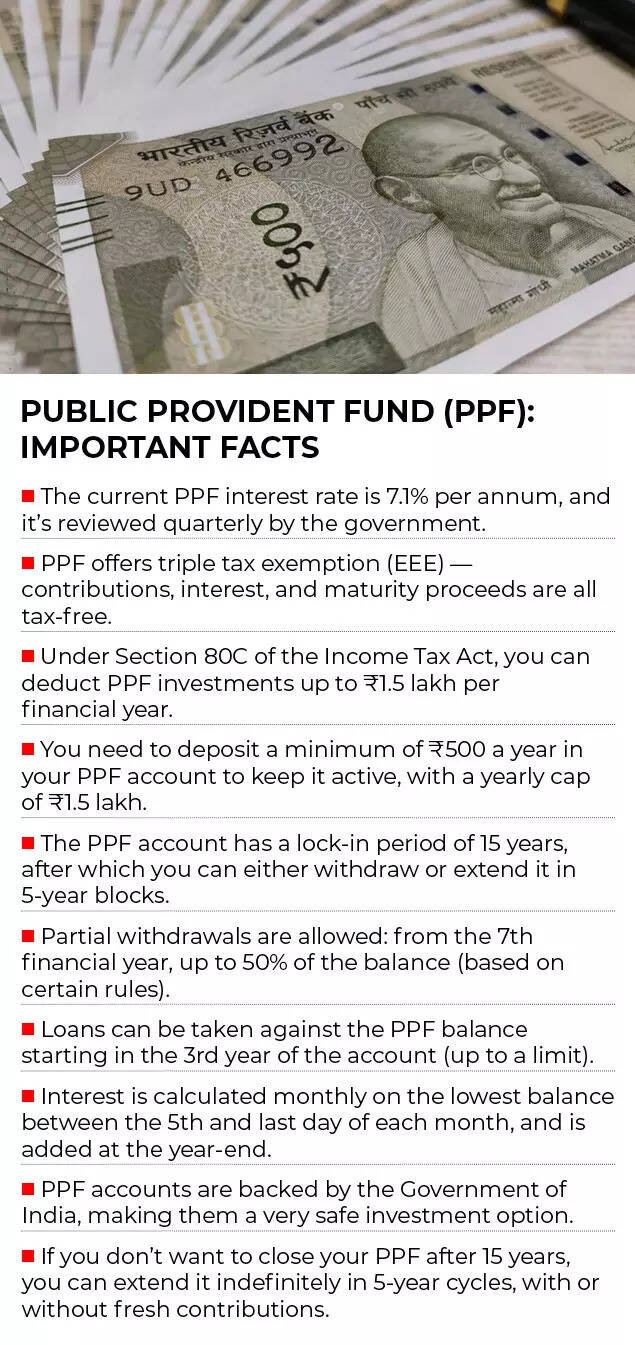

PPF Important Facts

Understanding PPF Account Maturity & Extension

A PPF account matures 15 years after the end of the financial year in which it was opened. At maturity, you have three options:

1. Close the Account

You may withdraw the entire balance and close the account.

2. Continue Without Further Deposits

You may choose to let the account remain active without additional deposits. The balance continues to earn interest, and you may make one withdrawal per year. However, once you opt for continuation without deposits, you cannot revert to deposit-based continuation later.

3. Extend in Blocks of 5 Years With Deposits

You may continue the account with deposits for additional 5-year blocks, provided the request is submitted within one year of maturity. It is this provision that allows you to become a crorepati – as explained in the section below

How to become crorepati with PPF

The provision to extend your PPF account beyond the lock-in period of 15 years allows you to earn the benefits of compounding. The biggest advantage of a PPF investment is compounding. Your money grows – not just on the amount you invest each year – but also on the interest that you accumulate over time, creating a powerful snowball effect. Since PPF has a long 15-year lock-in, the interest added annually continues to earn more interest in the following years, leading to exponential growth—especially in the later years of the account. Even though the yearly contribution limit is capped, compounding ensures that disciplined, consistent deposits can grow into a significantly larger corpus by maturity. This makes PPF one of the most effective long-term wealth-building tools for risk-free, tax-free returns. Let’s understand this better over different investment time-frames. In a scenario where you invest the full Rs 1.5 lakh investment limit every year, you will accumulate a corpus of over Rs 40 lakh in 15 years, of which you would have invested Rs 22.5 lakh. But, if you continue to contribute to your PPF account in blocks of 5 years – then with 25 years of investment your accumulated corpus would be over Rs 1 crore, with an investment of only Rs 37.5 lakh! The interest accrued as a result of compounding would be over Rs 65 lakh!

Is PPF the right investment for you?

The answer depends entirely on your investment time-frame, risk taking ability and investment purpose. Experts say that PPF is ideal for conservative investors – backed by the government of India – and offering 7.1% returns with the benefits of compounding, it works well for risk averse individuals, long-term wealth builders and those who are looking to save tax.Apart from the above-mentioned category of investors, Mohit Gang – Co-Founder & CEO Moneyfront says PPF is ideal for investors looking for stable debt allocation, and those without EPF/NPS.According to Prableen Bajpai, Founder, Finfix Research & Analytics, in India, fixed income continues to dominate investor portfolios. “These asset classes provide a sense of security and comfort, but while they are popular, they often fail to reward investors over the long term. For example, bank fixed deposits do not offer true compounding, are rarely able to beat inflation, and are not tax-efficient—especially for high-income individuals,” she tells TOI.However, Prableen is of the view that government-backed schemes such as the PPF stand out due to their specific benefits. “Within the fixed-income category, PPF remains one of the best vehicles for building a long-term portfolio, particularly when the Employee Provident Fund (EPF) is not available as an investment option,” she says.

Source: Finfix

Mohit Gang says that PPF’s nominal return (historically ~7–9%) beats inflation, but only by a small margin. To put it simply, the long-term average rate of return for PPF is around 8%, while the average inflation is around 6%, which makes the real return around 2%, he says.

Mohit Gang shares a practical comparison of PPF with commonly chosen Indian debt & hybrid options:

A.NPS (National Pension System)

Better than PPF when:

• You want equity exposure + tax efficiency• You want 80CCD(1B) extra ₹50,000 tax benefit• Investment horizon is very long (till age 60)

Worse than PPF:

• Partial withdrawal restrictions• Taxable annuity at retirement• No guaranteed return

B. EPF/VPF (Employee Provident Fund)

Better when:

• EPF rate (usually ~8.1–8.25%) > PPF• Mandatory contributions form the base; voluntary VPF can top-up• Salary-based compounding is larger for high earners

Worse than PPF:

• Only available for salaried employees• Interest rate is revised annually and can reduce• Withdrawals are restricted unless conditions met

C. Debt Mutual Funds (post 2023 tax rules)

Better:

• Liquidity• Potentially higher returns depending on category• No lock-in

Worse:

• Gains are fully taxable at slab rate (no indexation) after April 2023 amendments• No guarantee of returns• Credit & duration risk possible• For >30% tax slab investors, post-tax returns become unattractive

D. Sukanya Samriddhi Yojana (SSY) – only if you have a girl child

Better:

• Highest guaranteed small-savings rate (8.2% currently)• Similar EEE tax advantages

Worse:

• Use-case limited• Long lock-in

So should PPF be a part of your portfolio?

Prableen believes that any long-term portfolio should ideally include a mix of debt and equity, and PPF can serve as an effective fixed-income component. “But if a higher-interest, employer-linked EPF is available, then PPF can be replaced with other higher return–generating fixed-income alternatives,” she adds.

(Disclaimer: Recommendations and views on the stock market, other asset classes or personal finance management tips given by experts are their own. These opinions do not represent the views of The Times of India)

Business

EV adoptions gathers pace in 2025: Sales hit 2.3 million units; UP, Maharashtra lead sales – The Times of India

India sold were at 2.3 million units of electric vehicle in 2025, making up 8 per cent of all new vehicle registrations, according to a new report by the India Energy Storage Alliance, based on Vahan Portal data, cited by ANI. This boost was driven by incentives offered by the government and festive seasons. The majority portion of the sales were two-wheelers at 1.28 million units.The total registrations recorded in the overall passenger car market in the year 2025 stood at 28.2 million. Two-wheelers marked the most registrations 20 million registrations, while passenger cars were at 4.4 million and agricultural vehicles recorded 1.06 million. The recorded sales rose steadily throughout the year though slightly improved in the festival seasons due to GST benefits.Electric two-wheelers were the stars of the EV market, grabbing 57 per cent of sales. Three-wheelers came second with 0.8 million units (35 per cent), while four-wheelers logged 175,000 units. The report spotted good progress in electric delivery vehicles, especially in smaller commercial segments.Uttar Pradesh was at the forefront in this, with 400,000 units sold, taking an 18 percent market share in India’s EV segment. Maharashtra followed, with 266,000 units sold, contributing 12 percent to the segment, followed by Karnataka, with 200,000 units sold, contributing 9 percent to the market. The three accounted for over 40 percent in the country’s EV sales.Some smaller states recorded a very encouraging uptake of EVs. Delhi, Kerala, and Goa were able to reach an EV-to-ICE ratio of 14 percent, 12 percent, and 11 percent respectively. Meanwhile, states from the Northeast, Tripura, and Assam, achieved ratios of 18 percent and 14 percent, respectively.A major achievement was recorded in the three-wheeler segment, which attained a market penetration of 32 per cent. The government also created a record with their biggest ever order of electric buses—10,900 unit—valued at a massive Rs 10,900 crore through the PM E-DRIVE scheme.The report also stated that that while smaller vehicles led EV adoption, government efforts to electrify larger commercial vehicles and develop charging infrastructure were setting up India’s EV sector for continued growth beyond 2025.

Business

PTA warns consumers against fake calls and UAN numbers, reason revealed – SUCH TV

Pakistan Telecommunication Authority has warned users against fake calls and UAN numbers.

A video message released by PTA states that scammers are impersonating PTA, FIA, and banks to steal your personal and financial information. No government agency will ever ask you for OTP, PIN, identity card or biometrics over a call or message. Mobile users should be vigilant and verify only through official channels.

It should be noted that earlier, PTA had warned users in a statement that using a SIM registered in the name of another person is a violation of relevant regulations.

The PTA had stressed that the full responsibility for any misuse of the SIM will lie with the registered user, therefore, users should ensure responsible use of their SIMs and mobile connections at all times. Registered users will be held individually accountable for all calls, messages and data usage made through their SIMs or devices.

The PTA further appealed to users to abide by all relevant laws and regulations, warning that action will be taken in case of violation.

Business

Budget 2026: CII pitches demand-led disinvestment plan; proposes four-step privatisation roadmap – The Times of India

The Confederation of Indian Industry (CII) suggested a four-fold privatisation process in their recommendations on the Union Budget 2026-27. They called for faster and more predictable disinvestment. The industry body claimed that a calibrated privatisation approach would help sustain capital expenditure and fund development priorities, particularly in sectors where private participation can improve efficiency, technology adoption, and competitiveness. CII Director General Chandrajit Banerjee highlighted the role of private enterprise in India’s growth. “A forward-looking privatisation policy, aligned with the vision of Viksit Bharat, will enable the government to focus on its core functions while empowering the private sector to accelerate industrial transformation and job creation,” he said, as quoted by ANI. To accelerate the government’s exit from non-strategic Public Sector Enterprises (PSEs), CII outlined a four-pronged strategy. First, CII recommended adopting a demand-led approach for selecting PSEs for privatisation. Contrary to short-listing entities and then checking the appetite for them, it was proposed that government needs to start by measuring market interest for a larger list of entities and short-list those with better interest and valuation. Second, the industry body called for announcing a rolling three-year privatisation pipeline in advance. According to CII, greater visibility would give investors time to plan, deepen participation, and improve price discovery. Third, CII proposed setting up a dedicated institutional mechanism to oversee privatisation. This would include a ministerial board for strategic direction, an advisory panel of industry and legal experts, and a professional execution team to handle due diligence, market engagement, and regulatory coordination. Fourth, acknowledging that complete privatisation is complex and time-consuming, CII suggested a calibrated disinvestment route as an interim measure. The government could initially reduce its stake in listed PSEs to 51 per cent, retaining management control, and later bring it down further to between 33 per cent and 26 per cent. CII estimated that lowering government ownership to 51 per cent in 78 listed PSEs could unlock nearly Rs 10 lakh crore. In the first two years, disinvestment in 55 PSEs could raise about Rs 4.6 lakh crore, followed by Rs 5.4 lakh crore from 23 additional enterprises. “A calibrated reduction of government stake balances strategic control with value creation,” Banerjee said, adding that the proceeds could fund healthcare, education, green infrastructure, and fiscal consolidation while maintaining control in strategic sectors. The Union Budget for 2026–27 will be presented on February 1.

-

Sports6 days ago

Sports6 days agoVAR review: Why was Wirtz onside in Premier League, offside in Europe?

-

Entertainment4 days ago

Entertainment4 days agoDoes new US food pyramid put too much steak on your plate?

-

Politics4 days ago

Politics4 days agoUK says provided assistance in US-led tanker seizure

-

Entertainment4 days ago

Entertainment4 days agoWhy did Nick Reiner’s lawyer Alan Jackson withdraw from case?

-

Sports6 days ago

Sports6 days agoSteelers escape Ravens’ late push, win AFC North title

-

Politics6 days ago

Politics6 days agoChina’s birth-rate push sputters as couples stay child-free

-

Entertainment6 days ago

Entertainment6 days agoMinnesota Governor Tim Walz to drop out of 2026 race, official confirmation expected soon

-

Sports6 days ago

Sports6 days agoFACI invites applications for 2026 chess development project | The Express Tribune