Business

Profit-taking ahead of roll-over week pulls PSX into the red | The Express Tribune

The Pakistan Stock Exchange (PSX) ended Friday’s session in the red as investors resorted to profit-taking ahead of the upcoming roll-over week, despite the benchmark index touching a fresh all-time intra-day high earlier in the day.

“PSX witnessed a profit-taking day today as the market headed into the Roll-over week starting Monday,” said Ali Najib, Deputy Head of Trading at Arif Habib Ltd. The KSE-100 Index closed at 171,405 points, down 556 points or 0.32%.

The day unfolded in two distinct phases. During the morning session, the market extended yesterday’s bullish momentum and recorded a fresh intra-day all-time high of 172,675 points (+714 points; +0.42%). However, sentiment reversed in the afternoon as investors opted to close weekly positions, which weighed on the index and resulted in a negative close.

Read: Pakistan eyes January Panda Bond debut

On the macro front, the Sensitive Price Index (SPI) increased 3.75% YoY (0.24% WoW), while LSMI output grew 8.3% YoY and 3.7% MoM in Oct’25.

On the corporate side, Lucky Cement informed PSX that its Board has approved participation, as part of a consortium, in the ongoing privatisation process of PIACL. Additionally, MARI’s wholly owned subsidiary, Mari Minerals, entered into a joint venture with Globacore Minerals for mineral exploration in Balochistan.

Among major movers, LUCK, MEBL, SYS, UBL and SRVI collectively added 389 points, while FFC, HBL, MLCF, BAFL and ENGROH jointly shaved off 408 points.

Market activity remained moderate, with 796 million shares traded and a total turnover of Rs 42.1 billion. KEL led the volume chart with over 116 million shares.

PSX wrapped up the week on a positive note, posting a gain of 1,540 points or 0.91%. The KSE-100 Index opened at 170,550, touched a weekly high of 172,675, and recorded a low of 169,231 during the week. The benchmark eventually settled at 171,405.

Looking ahead, with the Roll-over scheduled for next week, the market is likely to face some selling pressure along with increased volatility, as typically observed during this period each month.

The 170k level remains a key support to sustain the prevailing bullish momentum; a decisive break below this level could trigger a renewed phase of consolidation in the KSE-100 Index.

Business

Trade deal done, says Trump; PM Modi thanks him for cutting tariff to 18% – The Times of India

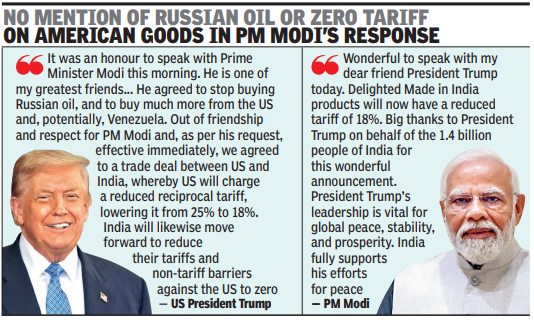

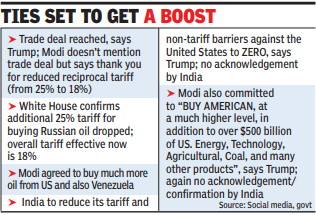

NEW DELHI/ WASHINGTON: After months of bruising trade tensions, India and the US on Monday announced a bilateral trade deal that will see Washington slash additional tariffs on Indian imports to 18%, from the current 50%, making it more competitive for textiles, leather and seafood exporters.While PM Narendra Modi, in a post on X, which followed US President Donald Trump’s announcement on Truth Social, said he had a wonderful conversation with “dear friend” Trump and thanked him on behalf of 1.4 billion people for the reduced tariff of 18% on Indian goods, he did not mention the trade deal at all in his post on X that followed Trump’s “wonderful” announcement.

PM Modi and Trump

Modi also did not comment on Trump’s claim that in their conversation the PM had agreed to stop buying Russian oil and purchase much more energy from the US, and potentially Venezuela. Trump had said Modi had agreed to stop buying Russian oil and to buy much more from the US — $500 billion of energy, technology and farm products — a step that the President claimed would help end the war in Ukraine.According to the American President, Modi also agreed to bring down tariff and non-tariff barriers against the US to zero. A US embassy spokesperson confirmed that the final tariff now on India is 18%, down from the earlier 50%. This is a better deal for India than countries such Vietnam, Bangladesh, Indonesia, South Korea and China, which face higher tariffs. The Trump-Modi conversation coincided with the visit of EAM S Jaishankar to US for a critical minerals ministerial that will be chaired by Secretary of State Marco Rubio this week.The announcement came six days after India and the EU announced the completion of talks for a comprehensive trade agreement.Trump leadership vitalfor global peace: ModiThe deal had drawn sharp comments from some members of the Trump administration, including attacks on the EU.In his X post, PM said, “When two large economies and the world’s largest democracies work together, it benefits our people and unlocks immense opportunities for mutually beneficial cooperation”. He added that Trump’s leadership was vital for global peace, stability, and prosperity. India fully supports his efforts for peace. Modi said he was looking forward to working closely with Trump to take the partnership to unprecedented heights.Apart from reciprocal tariff, Trump had announced an additional 25% tariff on India for its purchase of Russian oil.Trump said the US had agreed to the trade deal with India out of friendship and respect for Modi, and at the latter’s request. “Our amazing relationship with India will be even stronger going forward. PM Modi and I are two people that GET THINGS DONE, something that cannot be said for mos,” he added.Trump in his social media post also said that it was an honour to speak with Modi whom he described as “one of my greatest friends and, a Powerful and Respected Leader of his Country”.

Ties set to get boost

While the US had acknowledged in past few months that India had cut down its Russian purchase, it had not eliminated the additional tariff.Trump also said, “We spoke about many things, including Trade, and ending the War with Russia and Ukraine. He agreed to stop buying Russian Oil, and to buy much more from the US and, potentially, Venezuela. This will help END THE WAR in Ukraine, which is taking place right now, with thousands of people dying each and every week!”Following the announcement last week of the successful conclusion of FTA negotiations with EU, India had suggested that India and US might be close to finalising the trade agreement they have been discussing since Feb last year.Trump’s disclosure of the trade deal was preceded by two India-related posts a few hours before, one of which featured him and Modi on a magazine cover with the caption “The Mover and the Shaker”. Another post featured New Delhi’s India Gate, which Trump called “India’s beautiful Triumphal Arch” and said, “Ours will be the greatest of them all!” — referring to a similar monument he wants to build in Washington DC.

Business

Union Budget 2026: Five changes in rules that could directly affect you

New Delhi: Union Finance Minister Nirmala Sitharaman delivered presented the Budget 2026 on February 1 in Parliament. At first glance, the announcements seemed limited in impact for the average citizen. Closer analysis, however, reveals several changes that could have consequences across investment, property, digital assets and overseas remittances.

The tax slabs were not changed, but multiple announcements received attention for their long-term effects. One of the changes affects Sovereign Gold Bonds. The government removed the capital gains tax exemption on bonds purchased from secondary markets. Investors will now receive tax benefits only if the bonds were bought directly from the Reserve Bank of India during the primary issuance and held until maturity. Bonds purchased on exchanges and held beyond April 1, 2026, will attract tax on gains.

Another major announcement targets derivatives trading. The government increased the Securities Transaction Tax on futures and options. Futures transactions will now attract a 0.05 percent STT instead of 0.02 percent, while options will see the rate rise to 0.15 percent from 0.10 percent. This change increases the cost of each transaction and directly impacts profits on trading.

The budget also eased property purchase procedures for non-resident Indians (NRIs). Indian buyers acquiring property from NRIs no longer need a separate Tax Deduction and Collection Account Number (TAN) for Tax Deducted at Source (TDS) payments. They can use their PAN number, similar to property purchases from domestic sellers. This simplification reduces paperwork and makes transactions smoother.

Cryptocurrency regulations were tightened. From April 1, 2026, failing to provide accurate crypto transaction information will result in a daily penalty of Rs 200. Providing incorrect data without correcting it can attract fines up to Rs 50,000. This move aims to ensure proper reporting and compliance for digital assets.

Overseas education and medical remittances received relief. The Tax Collected at Source (TCS) on funds sent under the Liberalised Remittance Scheme for education and medical needs exceeding Rs 10 lakh has been reduced from 5 percent to 2 percent. This measure lowers costs for students and patients sending funds abroad.

The TCS is collected by banks or authorised dealers when sending money abroad and is adjusted against the total tax liability during income tax filing. Excess payments are refunded. The Liberalised Remittance Scheme allows Indian residents to send up to $2.5 lakh per year for different purposes, including education, medical treatment, travel, gifts or foreign investment.

These five changes in Union Budget 2026 introduce new rules for gold bonds, derivatives, property purchases from NRIs, cryptocurrencies and foreign remittances. Each announcement has the potential to affect citizens and investors in meaningful ways, highlighting the government’s evolving focus on financial regulation, investment and cross-border transactions.

Business

New York AG issues warning around prediction markets ahead of Super Bowl

New York Attorney General Letitia James speaks to the media, after she attended a hearing and pleaded not guilty to charges that she defrauded her mortgage lender, outside the U.S. District Court for the Eastern District of Virginia, in Norfolk, Virginia, U.S., Oct. 24, 2025.

Jonathan Ernst | Reuters

Days before Super Bowl 60, New York Attorney General Letitia James has a message for consumers: Be careful about placing trades on prediction markets.

“New Yorkers need to know the significant risks with unregulated prediction markets,” James said in a statement Monday. “It’s crystal clear: so-called prediction markets do not have the same consumer protections as regulated platforms. I urge all New Yorkers to be cautious of these platforms to protect their money.”

Prediction platforms like Kalshi and Polymarket are expected to generate billions of dollars in trading volume around the Super Bowl.

Consumers can make trades on game events — similar to online sportsbooks like DraftKings or FanDuel — as well as on predetermined outcomes, such as which companies will advertise during the Super Bowl, an issue CNBC Sport reported on last week.

James said the platforms’ products are bets “masquerading” as event contracts.

She warned there are concerns about the nascent prediction market industry, including “upholding prohibitions against insider betting and requiring regulatory review to ensure the financial stability and integrity of gambling operators.”

“Prediction markets may appear as modern, high-tech platforms for speculation or ‘forecasting,’ but in practice, many operate as unregulated gambling without the basic protections New York consumers both deserve and expect from properly licensed operators,” James said in the statement.

Prediction market contracts trade somewhat similarly to all-or-nothing options, with contracts priced between $0 and $1. The contracts trade up or down depending on the action.

In addition to contracts on Super Bowl commercials, both Polymarket and Kalshi are offering other trades related to the game, including on matters like “What songs will be played at the halftime show?,” “Who will attend the big game?,” and more traditional sportsbook “bets” such as “Seattle vs. New England: Most Rushing Yards,” as CNBC reported last week.

There are laws that prohibit insider trading on prediction markets, just as on traditional financial markets. But industry experts say they’re skeptical that the Commodity Futures Trading Commission, recently gutted as part of widespread government cuts, has the will or the means to police those problems.

Last week, CFTC Chairman Michael Selig said he had directed agency staff to withdraw a proposed rule that would have banned prediction trades on sports and politics. He said new rules would be coming.

Disclosure: CNBC has a commercial relationship with Kalshi.

-

Sports6 days ago

Sports6 days agoPSL 11: Local players’ category renewals unveiled ahead of auction

-

Entertainment6 days ago

Entertainment6 days agoClaire Danes reveals how she reacted to pregnancy at 44

-

Sports6 days ago

Sports6 days agoCollege football’s top 100 games of the 2025 season

-

Business7 days ago

Business7 days agoBanking services disrupted as bank employees go on nationwide strike demanding five-day work week

-

Fashion1 week ago

Fashion1 week agoSpain’s apparel imports up 7.10% in Jan-Oct as sourcing realigns

-

Politics6 days ago

Politics6 days agoTrump vows to ‘de-escalate’ after Minneapolis shootings

-

Sports6 days ago

Sports6 days agoTammy Abraham joins Aston Villa 1 day after Besiktas transfer

-

Entertainment6 days ago

Entertainment6 days agoK-Pop star Rosé to appear in special podcast before Grammy’s