Business

Pune Metro Phase-2 Extension: Cabinet Approves Kharadi–Khadakwasla Line 4, Nal Stop–Warje–Manik Baug Line 4A – Stations, Length, Other Details

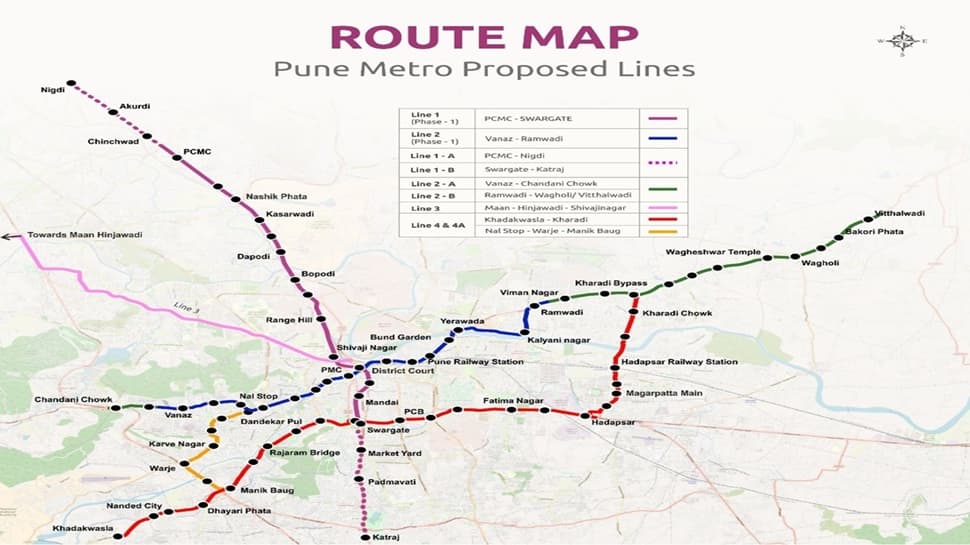

In a big boost for Pune’s local infra, the Union Cabinet has approved extension of Pune Metro’s Line 4 and Line 4A. Pune is set for another major boost in its public transport network as the Union Cabinet chaired by Prime Minister Narendra Modi, has approved Line 4(Kharadi–Hadapsar–Swargate–Khadakwasla) and Line 4A (Nal Stop–Warje–Manik Baug) under Phase-2. This is the second major project approved under Phase-2, following the sanction of Line 2A (Vanaz–Chandani Chowk) and Line 2B (Ramwadi–Wagholi/Vitthalwadi).

“Together spanning 31.636 km with 28 elevated stations, Line 4 and 4A will connect IT hubs, commercial zones, educational institutions, and residential clusters across East, South, and West Pune. The project will be completed within five years at an estimated cost of Rs 9,857.85 crore, to be jointly funded by the Government of India, Government of Maharashtra, and external bilateral/multilateral funding agencies,” said the Union Cabinet in a statement.

These lines are a vital part of Pune’s Comprehensive Mobility Plan (CMP) and will seamlessly integrate with operational and sanctioned corridors at Kharadi Bypass & Nal Stop (Line 2), and Swargate(Line 1). They will also provide an interchange at Hadapsar Railway Station and connect with future corridors towards Loni Kalbhor and Saswad Road, ensuring smooth multimodal connectivity across metro, rail, and bus networks.

From Kharadi IT Park to Khadakwasla’s scenic tourist belt, and from Hadapsar’s industrial hub to Warje’s residential clusters, Line 4 and 4A will knit together diverse neighbourhoods. Traversing Solapur Road, Magarpatta Road, Sinhagad Road, Karve Road, and the Mumbai–Bengaluru Highway, the project will ease congestion on Pune’s busiest routes while improving safety and promoting green, sustainable mobility.

According to projections, the daily ridership on Line 4 and 4A combined is expected to be 4.09 lakh in 2028, rising to nearly 7 lakh in 2038, 9.63 lakh in 2048, and over 11.7 lakh in 2058. Of this, the Kharadi–Khadakwasla corridor will account for 3.23 lakh passengers in 2028, growing to 9.33 lakh by 2058, while the Nal Stop–Warje–Manik Baug spur line will rise from 85,555 to 2.41 lakh passengers over the same period. These projections highlight the significant growth in ridership expected on Line 4 and 4A over the coming decades.

Cabinet approved expansion of Pune Metro Rail Project (₹9,858 Cr | 32 km)

Line 4: Kharadi – Khadakwasla (25.5 km, 22 stations)

Line 4A: Nal Stop – Manik Baug (6.1 km, 6 stations)Will ease traffic, reduce pollution, and improve commute within the city

Pune Metro… pic.twitter.com/ng6w75cmIJ

— Ashwini Vaishnaw (@AshwiniVaishnaw) November 26, 2025

The project will be implemented by Maharashtra Metro Rail Corporation Limited (Maha-Metro), which will carry out all civil, electrical, mechanical, and systems works. Pre-construction activities such as topographical surveys and detailed design consultancy are already underway.

With this latest approval, Pune Metro’s network will expand beyond the 100 km milestone, a significant step in the city’s journey towards a modern, integrated, and sustainable urban transit system.

With Line 4 and 4A, Pune will not just get more metro tracks, it will gain a faster, greener, and more connected future. These corridors are designed to give back hours of commuting time, reduce traffic chaos, and provide citizens with a safe, reliable, and affordable alternative. In the years ahead, they will emerge as the true lifelines of Pune, reshaping urban mobility and redefining the city’s growth story.

Business

Limited flights leave UAE while disruption continues amid Iran strikes

From the UK, flights have also been cancelled for many Middle East destinations, including all flights to Israel and Bahrain, three-quarters of the day’s scheduled flights to the United Arab Emirates, and more than two-thirds (69%) of flights to Qatar.

Business

IIP sees 4.8% YoY growth in January; manufacturing & electricity support rise – The Times of India

India’s Index of Industrial Production saw a 4.8% increase year-on-year in January 2026, according to the Ministry of Statistics & Programme Implementation. The rise in industrial output was largely driven by a 4.8 per cent expansion in manufacturing and a 5.1 per cent improvement in electricity generation. Mining activity also supported overall growth, registering a 4.3 per cent uptick during the month.Estimates placed IIP at 169.4 for January 2026, compared with 161.6 in January 2025. This follows a stronger reading in December 2025, when industrial production had grown by 7.8 per cent. For January 2026, the sector-specific indices stood at 157.2 for mining, 167.2 for manufacturing and 212.1 for electricity.Within manufacturing, 14 of the 23 industry groups at the NIC two-digit level posted year-on-year gains in January. The strongest contributors were manufacture of basic metals, which rose 13.2 per cent; manufacture of motor vehicles, trailers and semi-trailers, up 10.9 per cent; and manufacture of other non-metallic mineral products, which increased 9.9 per cent. Growth in basic metals was supported by items such as flat products of alloy steel, MS slabs, and hot-rolled coils and sheets of mild steel.The automobile category advanced on the back of higher output of auto components and spare parts, commercial vehicles, and bus and minibus bodies or chassis. In the non-metallic mineral products segment, cement of all types, cement clinkers and stone chips were key contributors.According to use-based classification, output of primary goods grew 3.1 per cent, capital goods rose 4.3 per cent and intermediate goods increased 6 per cent compared with January 2025. Infrastructure and construction goods recorded the sharpest rise at 13.7 per cent, while consumer durables expanded 6.3 per cent. In contrast, consumer non-durables declined by 2.7 per cent. The ministry identified infrastructure and construction goods, intermediate goods and primary goods as the leading drivers of growth under this classification.

Business

Will petrol and diesel prices go up now?

There might also be a more direct impact on food. “Some elements of crude oil are used in fertiliser, and so there could be a cost implication in terms of food prices,” Benjamin Goodwin, partner at banking advisory firm PRISM Strategic Intelligence told the BBC.

-

Politics1 week ago

Politics1 week agoPakistan carries out precision strikes on seven militant hideouts in Afghanistan

-

Tech1 week ago

Tech1 week agoThese Cheap Noise-Cancelling Sony Headphones Are Even Cheaper Right Now

-

Entertainment1 week ago

Entertainment1 week agoViral monkey Punch makes IKEA toy global sensation: Here’s what it costs

-

Sports1 week ago

Sports1 week agoKansas’ Darryn Peterson misses most of 2nd half with cramping

-

Sports1 week ago

Mike Eruzione and the ‘Miracle on Ice’ team are looking for some company

-

Business6 days ago

Business6 days agoHouseholds set for lower energy bills amid price cap shake-up

-

Politics1 week ago

Politics1 week agoTrump says he will raise US global tariff rate from 10% to 15%, following court ruling

-

Entertainment1 week ago

Entertainment1 week agoTalking minerals and megawatts