Business

Stamp duty: Five ways abolishing the tax could change the housing market

Kevin PeacheyCost of living correspondent

Getty Images

Getty ImagesThe debate around stamp duty is intensifying. When Kemi Badenoch said a future Conservative government would abolish it on the purchase of main homes, it went down well at the Tory Party conference.

There has also been speculation that the Chancellor, Rachel Reeves, is considering replacing it.

Scrapping stamp duty would be popular among some home buyers, including first-time buyers. There’s been widespread support in the housing sector as well as among some independent economists.

Analysts say there would be some significant consequences of scrapping stamp duty for primary residences, affecting buyers, sellers and the wider UK economy.

1. House prices might rise

Whenever there has been a temporary easing of stamp duty, such as in the immediate aftermath of the Covid lockdowns, house prices have then risen.

It is more difficult to judge whether a permanent abolition would have the same long-term impact on prices as the short-term sweetener of a stamp duty holiday.

However, greater demand is likely to feed through to asking prices.

“If, and this is a big if, it is a simple tax giveaway, the likelihood is that the current stamp duty bill simply passes through into prices,” says Lucian Cook, head of residential research at Savills.

In turn, that could mean first-time buyers paying less in stamp duty, but having to find a bigger deposit.

“Given the way stamp duty works, this would be unevenly distributed across the country,” Mr Cook added.

The most obvious point here is that the government in Westminster can only control stamp duty in England and Northern Ireland. Scotland and Wales have their own land and transaction taxes overseen by the devolved administrations.

2. Tax cut for wealthy

A swathe of first-time buyers do not pay stamp duty. That’s because, in England and Northern Ireland, they are exempt when buying properties of up to £300,000.

“For them, the enormous challenge is raising a deposit,” says Sarah Coles, head of personal finance at investment platform Hargreaves Lansdown.

Data from property portal Rightmove suggests that 40% of homes for sale in England are stamp duty free for first-time buyers.

While the vast majority of movers pay stamp duty, the rate increases at certain price thresholds.

So, the bigger the home, the bigger the benefit, if stamp duty was scrapped.

This will also mean a big regional difference in the impact of such a policy.

At the moment, 76% of properties on sale in the North East of England are free of stamp duty for first-time buyers, according to Rightmove’s figures. In London, it is only 11%.

Richard Donnell, from Zoopla, points out that 60% of all stamp duty is paid in southern England – so the majority of the benefit of abolition would be felt in the south.

3. Easier to find somewhere to move to

One of the great selling points of stamp duty abolition is the extra mobility it should provide for workers, buyers, sellers and downsizers, according to experts.

“Homeownership is the foundation of a fairer and more secure society – but stamp duty has denied that opportunity to too many for too long,” says Paula Higgins, chief executive of the Homeowners Alliance.

“Our research shows over 800,000 homeowners have shelved moving plans in the past two years, and stamp duty is a major barrier.”

The Institute for Fiscal Studies (IFS), an independent economic think tank, describes stamp duty as “one of the most econmically damaging taxes”. In its most recent analysis, it says particular winners will be those who want to move frequently, to more or less expensive homes.

It should, for example, clear an obstacle for older homeowners, who want to sell a family home but are discouraged by stamp duty. If they are more likely to move, then their homes become available to younger families and the whole market becomes more fluid.

However, others suggest the influence of stamp duty could be overblown.

“Take someone downsizing, from a £750,000 property to a £300,000 one. In England and Northern Ireland, they’d pay £5,000 in stamp duty. It’s a fraction of what they’re likely to pay in estate agency fees, and sits along a huge range of costs from conveyancing to removals,” Ms Coles from Hargreaves Lansdown says.

“It begs the question of whether removing the cost of the tax is a gamechanger.”

4. Potential tax rises elsewhere

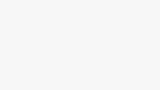

Stamp duty raises a lot of money for the Treasury, so scrapping it would leave a gap in the public finances.

The IFS said that the direct cost of the Conservative policy might be around £10.5bn to £11bn in 2029-30, although the Tories’ own estimate is about £9bn.

The question for any administration tempted to scrap or reduce stamp duty is how else it finds the money.

The Conservatives say they will make savings elsewhere. They also say the policy will boost growth and the housing sector in general, and therefore bring in more tax receipts.

The other option is to raise other taxes. As some analysts have said, the main consideration is not what is scrapped, but what replaces it.

5. Impact on renters

The idea of scrapping stamp duty for primary residences will benefit homeowners but could end up meaning less choice for renters.

The IFS suggests it could discourage the purchase of rental properties by landlords, as they would still have to pay stamp duty.

The think tank says it would increase the more favourable tax treatment of owner-occupation relative to renting.

Business

Shop price inflation eases but food costs still 3.5% up on a year ago

Shop price inflation eased in February but consumers are still paying 3.5% more for food than a year ago, figures show.

Overall shop inflation fell slightly to 1.1% from January’s 1.5%, in line with the three-month average of 1.1%, as fierce competition between retailers kept price rises in check and customers benefited from promotions across health, beauty and fashion, according to the British Retail Consortium (BRC) and NIQ.

Prices of products other than food were down 0.1% year on year, a significant drop from January’s growth of 0.3%.

Overall food inflation fell slightly to 3.5% from 3.9% in January, while fresh food prices remained 4.3% higher than last February, a slight drop from January’s 4.4% and above the three-month average of 4.2%.

However falling global costs pushed ambient food inflation down to 2.3% – its lowest level in four years and a significant fall from January’s 3.1%.

BRC chief executive Helen Dickinson said: “Households got some welcome relief in February as shop price inflation eased.

“While the direction of travel is promising, prices are still rising, and many consumers remain under pressure.”

Mike Watkins, head of retailer and business insight at NIQ, said: “Since the start of the year, we have seen some competitive pricing across both the food and non-food channels which is helping to bring down inflation.

“Whilst the inclement weather and weak sentiment is making consumer demand rather unpredictable for retailers, at least shoppers are now seeing some of their cost-of-living pressures start to ease.”

Business

West Asia conflict: Govt may ask companies to cut exports, increase auto fuel, LPG supplies – The Times of India

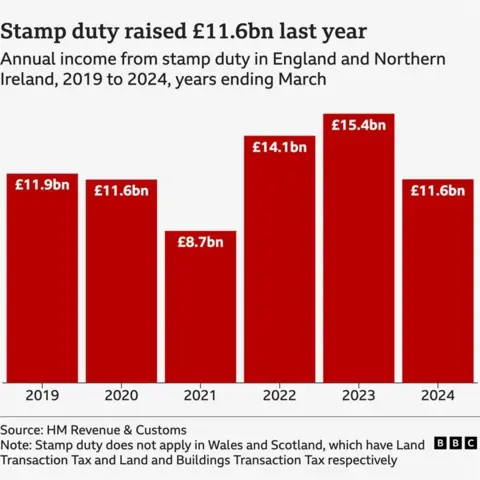

NEW DELHI: Amid fears of a shortage in crude supplies, govt is looking to nudge refiners to divert more auto fuel and LPG to the domestic market by cutting on exports and also increase cooking gas production so that there is no disruption in local supplies.While govt and oil companies insisted there’s no shortage, refiners are looking at alternate sources to partly compensate for crude coming from war-hit West Asia.

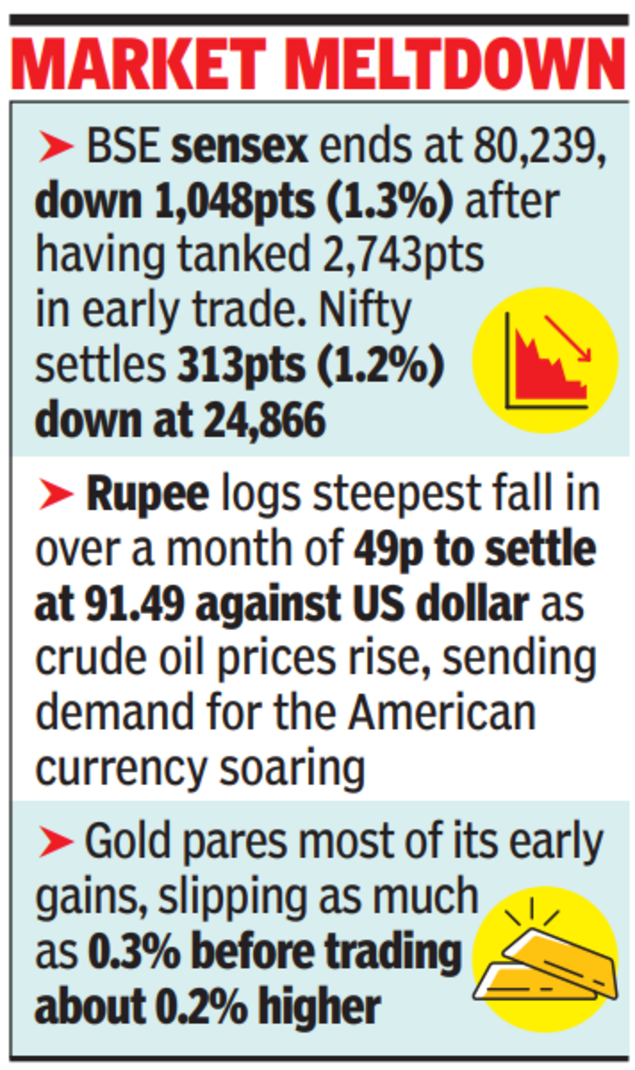

The tension has led to a spike in oil and gas prices, and given India’s dependence on imports, inflating the import bill and stoking inflationary pressures. Officials, however, said retail fuel prices may not rise immediately, as oil marketing companies follow a calibrated approach — absorbing losses when global prices are high and recouping them when prices soften. Retail petrol and diesel prices have remained unchanged since April 2022.Mantri meets oil cos to assess availability of crude and gasOn a day when Iranian drones damaged part of Saudi Aramco refinery and Qatar Energy’s facilities, the world’s largest LNG producer, announced an export pause, petroleum minister Hardeep Singh Puri and his team of officials met oil companies on Monday to assess the availability of crude and gas. “We are continuously monitoring the evolving situation, and all steps will be taken to ensure availability and affordability of major petroleum products in the country,” the oil ministry said in a post on X.India imports nearly 90% of its crude requirement. It also meets 60-65% of its LPG demand and about 60% of its LNG needs through imports, largely from West Asia, with shipments routed via Strait of Hormuz, which risks being choked due to the war.

According to the International Energy Agency, in 2023, 5.9% of the country’s production was being exported. Between April and Dec 2025, India exported petroleum products worth nearly $330 billion, with the Netherlands, UAE, the US, Singapore, Australia and China being the main destinations. In 2024, it also exported petroleum gas worth $454 million, mostly to Nepal, China, and Myanmar. The Reliance refinery in Jamnagar is the largest exporter in the country.An oil company executive said refiners are already in contact with traders to tie up capacities amid fears of the blockade of Strait of Hormuz. By Monday, the global market had caught the jitters from Qatar’s decision to suspend gas shipments.An oil executive said while disruption could cause difficulties in the immediate term, Indian players had a wide portfolio that they can tap for LNG, including the US, with vessels being routed through the Suez Canal.“Even if there is a force majeure, we have other sources of supply, which we can tap. Besides, no one is going to stop supplies indefinitely,” the executive said. While oil and gas prices rose Monday, the focus is on ensuring that supply lines remain open.

Business

Travel stocks fall after thousands of flights grounded following Iran strikes

A display board shows canceled flights to Dubai and Doha amid regional airspace closures at Noi Bai International Airport, amid the U.S.-Israel conflict with Iran, in Hanoi, Vietnam, March 2, 2026. Picture taken with a mobile phone.

Thinh Nguyen | Reuters

Airline and travel stocks slipped Monday after airspace closures throughout the Middle East forced carriers to cancel thousands of flights, disrupting trips as far as Brazil and the Philippines.

Cruise lines stocks also fell sharply, with Royal Caribbean Cruises dropping 3% and Carnival Corp. losing more than 7%.

Norwegian Cruise Line Holdings‘ stock fell 10% after its earnings call disappointed investors. Elliott Investment Management said last month that it had built a more than 10% stake in the company and that it’s seeking changes. New CEO John Chidsey told analysts that “our strategy is sound, our execution and coordination have not been, and a culture of accountability is essential and necessary going forward.”

Oil prices also rose, potentially driving up airlines’ biggest cost after labor. Flights through the Middle East were grounded, including to destinations like Tel Aviv and Dubai.

United Airlines, which has the most international exposure of the U.S. carriers, fell nearly 3%. Service to Tel Aviv, Israel, one of the airline’s most profitable routes, was halted, but airlines were also was forced to pause flights to Dubai, in the United Arab Emirates, one of the busiest airport hubs in the world. Dubai is also a home base for the airline Emirates.

Shares of American Airlines lost 4% while Delta Air Lines fell 2%.

More than 11,000 Middle East flights have been canceled since the U.S.-Israeli strikes this weekend, according to aviation-data firm Cirium.

International travel has been a bright spot in the travel sector. In January, international air travel demand jumped 5.9% from a year ago while domestic flight demand was nearly flat, the International Air Transport Association, an airline industry group, said in a report Monday.

— CNBC’s Contessa Brewer contributed to this report.

-

Business6 days ago

Business6 days agoHouseholds set for lower energy bills amid price cap shake-up

-

Politics5 days ago

Politics5 days agoWhat are Iran’s ballistic missile capabilities?

-

Entertainment1 week ago

Entertainment1 week agoTalking minerals and megawatts

-

Sports1 week ago

Sports1 week agoEileen Gu comments on Alysa Liu’s historic gold medal

-

Business6 days ago

Business6 days agoLucid widely misses earnings expectations, forecasts continued EV growth in 2026

-

Politics1 week ago

Politics1 week agoSupreme Court ruling angers Trump: Global tariffs to rise from 10% to 15%

-

Sports1 week ago

Sports1 week agoSouth Africa thrash India by 76 runs in T20 World Cup Super 8 – SUCH TV

-

Business1 week ago

Business1 week agoGovt to return unclaimed EPFO deposits, expand scholarships for unorganised workers’ children – The Times of India