Business

Sweaty Betty offered Middlesbrough trainer £4k for slogan use and silence

Stuart Whincup and

Tom Burgess,North East and Cumbria

BBC

BBCA personal trainer has revealed women’s activewear brand Sweaty Betty offered her a settlement of £4,000 over a disputed slogan if she agreed not to further challenge the firm’s use of it, and agreed to keep the deal confidential.

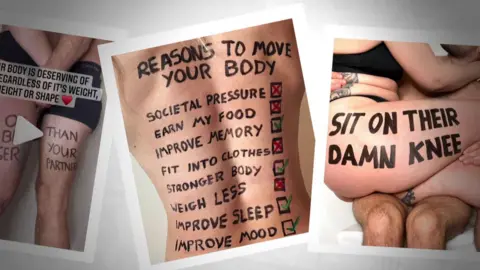

Georgina Cox, from Middlesbrough, said the company used the “Wear The Damn Shorts” phrase from her Instagram posts without crediting her in its latest campaign.

She had used the slogan, and others like it, in a number of posts encouraging women to wear what they wanted, regardless of body shape, before being contacted by the firm, she said.

Sweaty Betty said it “respectfully disagreed” with her claims and said the slogan had been part of its campaign for three years.

A company spokesperson said: “We have offered and continue to offer to meet with Ms Cox as we remain committed to resolving this matter constructively and reaching a fair and amicable resolution.”

The fitness trainer said she came up with the slogan for her younger sister in 2020 and the words quickly went viral.

In 2023, she was approached by a Sweaty Betty marketing executive, who said the firm was planning a campaign “with similar messaging as your Wear the Damn Shorts post a few years ago” and asking if she was happy for it to do so.

Georgina Cox

Georgina CoxMs Cox was subsequently paid £3,500 to promote the campaign in social media posts.

The company contacted her again the following year before its new campaign, but did not do so before the third year, she said.

“The third year they just omitted me completely, I didn’t know it was happening,” she said.

“I was so hurt in that moment because nobody had reached out to me.

“They’re meant to care about women, they’re meant to support them and empower them, and I’ve never felt less empowered than I have this year.”

Ms Cox’s lawyer sent the company a legal “cease and desist” letter, asking that it stop using the phrase, but she said the response described her as “bitter”.

She had also been threatened with legal action for defamation after posting about the situation online, she said.

Georgina Cox

Georgina CoxMs Cox said she had been “terrified” and the stress had affected her physically and mentally.

“They are such a big company and I am just one woman and to be threatened by them is incredibly scary,” she said.

The fitness influencer said she had not been sleeping, her hair was falling out and she was having panic attacks.

She wanted an apology from the company and a pledge from them to pay the influencers they work with, such as her, fairly, she said.

In correspondence with Ms Cox, Sweaty Betty said it was willing to offer £4,000 as a final settlement, provided she agreed the firm would continue to use the slogan, she would not challenge this use, she would not make any public statements about the firm, and the terms of this settlement would be confidential.

The company said: “We have great respect for the community Ms Cox has built around body confidence and empowerment, and were surprised and saddened to find ourselves in this situation.

“‘Wear the Damn Shorts’ has been part of our campaign for three years, and we chose it because it perfectly captures what Sweaty Betty stands for.

“While none of us has exclusive legal rights to this phrase, we have always aimed to respect Ms Cox’s association with it.

“Since she first raised her concerns earlier this year, we’ve been in regular contact.”

Business

Govt keeps petrol, diesel prices unchanged for coming fortnight – SUCH TV

The government on Thursday kept petrol and high-speed diesel (HSD) prices unchanged at Rs253.17 per litre and Rs257.08 per litre respectively, for the coming fortnight, starting from January 16.

This decision was notified in a press release issued by the Petroleum Division.

Earlier, it was expected that the prices of all petroleum products would go down by up to Rs4.50 per litre (over 1pc each) today in view of variation in the international market.

Petrol is primarily used in private transport, small vehicles, rickshaws, and two-wheelers, and directly impacts the budgets of the middle and lower-middle classes.

Meanwhile, most of the transport sector runs on HSD. Its price is considered inflationary, as it is mostly used in heavy transport vehicles, trains, and agricultural engines such as trucks, buses, tractors, tube wells, and threshers, and particularly adds to the prices of vegetables and other eatables.

The government is currently charging about Rs100 per litre on petrol and about Rs97 per litre on diesel.

Business

Serial rail fare evader faces jail over 112 unpaid tickets

One of Britain’s most prolific rail fare dodgers could face jail after admitting dozens of travel offences.

Charles Brohiri, 29, pleaded guilty to travelling without buying a ticket a total of 112 times over a two-year period, Westminster Magistrates’ Court heard.

He could be ordered to pay more than £18,000 in unpaid fares and legal costs, the court was told.

He will be sentenced next month.

District Judge Nina Tempia warned Brohiri “could face a custodial sentence because of the number of offences he has committed”.

He pleaded guilty to 76 offences on Thursday.

It came after he was convicted in his absence of 36 charges at a previous hearing.

During Thursday’s hearing, Judge Tempia dismissed a bid by Brohiri’s lawyers to have the 36 convictions overturned.

They had argued the prosecutions were unlawful because they had not been brought by a qualified legal professional.

But Judge Tempia rejected the argument, saying there had been “no abuse of this court’s process”.

Business

JSW Likely To Launch Jetour T2 SUV In India This Year: Reports

JSW Jetour T2 Launch: JSW Motors Limited, the passenger vehicle arm of the JSW Group, is reportedly preparing to enter the Indian car market this year. It has partnered with Jetour, a China-based automotive brand owned by Chery Automobile, and the Jetour T2 SUV could be the company’s first product, according to the reports.

Media reports suggest that the launch will happen independently and not under the JSW MG Motor India joint venture. The SUV will wear a JSW badge and name, instead of the Jetour branding. The upcoming SUV will be assembled at JSW’s upcoming greenfield manufacturing facility in Chhatrapati Sambhaji Nagar, Maharashtra.

According to the reports, the company plans to have the vehicle on sale by the third quarter of this year. With this move, JSW aims to establish itself as a standalone carmaker in India.

Expected Powertrain

The SUV is likely to arrive with a 1.5-litre plug-in hybrid setup. Internationally, this hybrid powertrain is offered with both front-wheel drive and all-wheel drive options. It is still unclear which version will be introduced in India.

Design

In terms of design, the T2 is a large and rugged-looking SUV. It has a boxy and upright stance, similar to vehicles like the Land Rover Defender. Despite its tough appearance, it uses a monocoque chassis instead of a ladder-frame construction.

Size

The SUV measures around 4.7 metres in length and nearly 2 metres in width. This makes it larger than the Tata Safari, even though it is a five-seater. A longer 7-seat version is also sold in some markets.

Price

Pricing details for India are yet to be announced. For reference, the front-wheel-drive five-seat T2 i-DM is priced at AED 1,44,000 (around Rs 35 lakh) in the UAE.

Jetour

Jetour is a brand owned by Chinese automaker Chery. Launched in 2018, it focuses mainly on SUVs and is present in markets across China, the Middle East, Africa, Southeast Asia and Latin America.

-

Politics1 week ago

Politics1 week agoUK says provided assistance in US-led tanker seizure

-

Entertainment1 week ago

Entertainment1 week agoDoes new US food pyramid put too much steak on your plate?

-

Entertainment1 week ago

Entertainment1 week agoWhy did Nick Reiner’s lawyer Alan Jackson withdraw from case?

-

Business1 week ago

Business1 week agoTrump moves to ban home purchases by institutional investors

-

Sports1 week ago

Sports1 week agoPGA of America CEO steps down after one year to take care of mother and mother-in-law

-

Sports5 days ago

Sports5 days agoClock is ticking for Frank at Spurs, with dwindling evidence he deserves extra time

-

Business1 week ago

Business1 week agoBulls dominate as KSE-100 breaks past 186,000 mark – SUCH TV

-

Sports6 days ago

Commanders go young, promote David Blough to be offensive coordinator