Business

Tesco not ‘losing grip’ on UK grocery market despite persistent price war

Tesco is showing no signs of “losing its grip” as the UK’s biggest supermarket – despite battling an persistent price war and a plethora of higher business costs, experts say.

Investors will be hoping the grocery giant is maintaining sales growth when it publishes its half-year financial results on Thursday.

Tesco revealed its group sales rose by 4.6% in its first quarter, compared with the prior year, having been boosted by growing demand for own-brand and premium products.

It has been steadily growing its share of the UK grocery market – picking up 0.8 percentage points over the past year to 28.4%, according to the latest analysis by Worldpanel by Numerator.

Meanwhile, its biggest rivals Sainsbury’s and Asda have seen their share of the market edge lower, while German discounters Aldi and Lidl continue to gain customers.

Tesco’s shares have soared to their highest price in more than a decade amid the strengthening performance.

Richard Hunter, head of markets for Interactive Investor, said: “Expectations will be high as ever for the supermarket, although at the first quarter numbers in June there were no signs that the company was losing its grip on dominating the British aisles.

“Indeed, the juggernaut powered on, maintaining the light between the group and its nearest rivals.”

However, Tesco’s boss Ken Murphy acknowledged at the company’s most recent trading update that the grocery market was “intensely competitive”.

It comes amid continued pressure on pricing from rival supermarkets, with Asda slashing prices this year in a bid to help turn around its fortunes.

In April, Tesco said it expects to make as much as £400 million less in profit this financial year due to heightened competition.

Mr Hunter said the prospect of a grocery price war was “not one which Tesco is taking lightly, and is mindful of a renewed attack from Asda”.

He added that any updates to its annual profit forecast on Thursday would be “warmly received” by shareholders.

A group of analysts for AJ Bell said the grocery price war is expected to impact profits, but that Tesco was also experiencing “input cost pressure, notably wages, national insurance contributions and food prices”.

It is among major retailers to back calls to the Government to limit further tax rises on the industry, as they warn it is becoming increasingly difficult to “absorb” higher costs.

It comes amid concerns about food inflation, which has been accelerating for five months in a row.

Business

South East Water faces £22m fine for supply failures

The firm was unable to cope during high demand, Ofwat says, leading to “immense stress” for customers.

Source link

Business

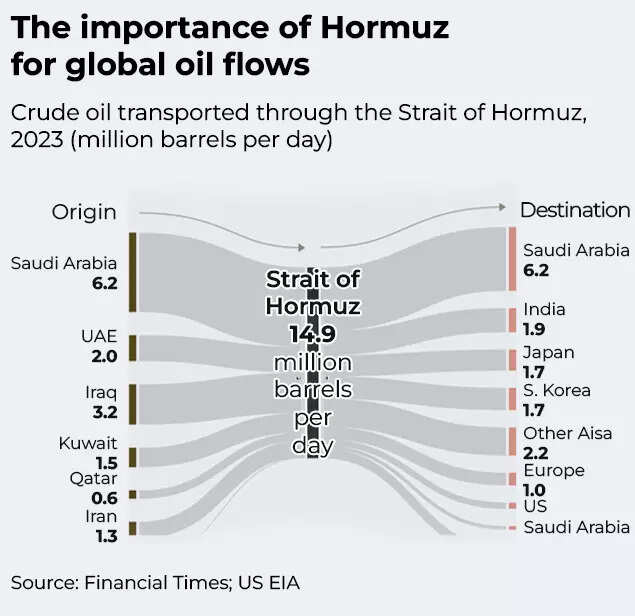

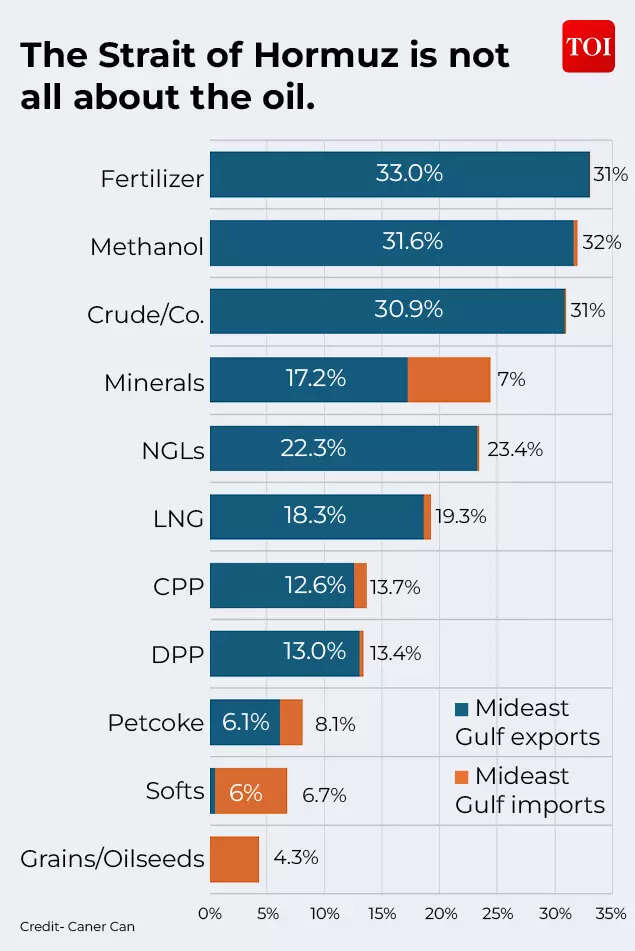

Middle East heat may ripple across India’s energy supply chain, flags Goldman Sachs – The Times of India

As tensions continue to heat up in the Middle East, concerns are raising about disruptions to one of the world’s most critical energy shipping routes, the Strait of Hormuz. Any disruption could significantly affect major oil-importing countries such as India, as the narrow Strait of Hormuz is central to global energy trade. The strait sees almost 20 million barrels of oil passing through each day, or about a fifth of the world’s consumption, pass through the route. The waterway also carries roughly 19% of global liquefied natural gas (LNG) shipments, making it a crucial corridor for energy-importing economies.A recent report by Goldman Sachs has flagged early signs of stress in the region. The report warned that tanker traffic through the Strait of Hormuz has already begun showing signs of disruption, with shipping firms, oil producers and insurers adopting a cautious approach following reports of damaged vessels in nearby waters.According to the firm, financial markets have already begun factoring in the geopolitical risk. Oil prices currently carry an estimated risk premium of $18-per-barrel, reflecting the potential market impact if energy flows through the Strait of Hormuz were disrupted for about a month.

Even is the oil facilities are not directly damaged, a shutdown of the shipping route could expose a significant portion of global supply. The report estimates that in an event of full closure, about 16 million barrels per day of oil flows could be affected, despite the availability of some pipeline routes designed to bypass the strait.And the risks are not limited to crude oil shipments with almost 80 million tonnes of LNG exports annually, much of it from Qatar, moving through the passage. Any prolonged disruption could tighten gas supply globally and potentially drive European benchmark gas prices back to levels seen during the 2022 energy crisis.

Asian economies stand among the most exposed to such disruptions. Major importers such as China, India, Japan and South Korea depend heavily on oil and LNG shipments that transit through the strategic corridor.While global oil inventories and spare production capacity could help cushion short-term shocks, the report warned that sustained disruption to Gulf shipping routes could trigger sharp volatility in global energy markets and push prices higher across oil, gas and refined fuel products.Market participants and governments are closely watching tanker traffic in the Strait of Hormuz, along with diplomatic and military developments involving the United States, Iran and Gulf nations, to assess whether the current disruptions remain temporary or escalate into a broader energy supply shock.

Business

Saudi Oil Supply Assurance Lifts Pakistan Stock Market – SUCH TV

KARACHI: The Pakistan Stock Exchange rallied on Thursday after Saudi Arabia assured Pakistan of facilitating crude oil shipments through the Red Sea port of Yanbu Port, easing concerns over potential fuel supply disruptions.

The benchmark KSE-100 Index climbed sharply during the trading session, rising 4,439.93 points (2.85%) to reach an intraday high of 160,217.14 points.

Market Recovery

Analysts attributed the market rebound to renewed institutional buying and improving investor sentiment after Saudi assurances on oil supplies.

Market expert Ahsan Mehanti, CEO of Arif Habib Commodities, said easing fuel supply concerns played a key role in the recovery.

He added that rising global crude prices, expectations of a new International Monetary Fund loan tranche for Pakistan, and positive economic indicators also boosted investor confidence.

Alternative Oil Route

Pakistan sought an alternative supply route after Iran announced the closure of the Strait of Hormuz, a crucial global oil transit corridor.

Federal Petroleum Minister Ali Pervaiz Malik held talks with Nawaf bin Said Al-Malki, requesting Saudi support for uninterrupted energy supplies.

Saudi authorities reportedly assured Pakistan that oil shipments could be routed through Yanbu, and one crude vessel has already been prepared for dispatch.

Global Oil Market Impact

Oil prices continued to rise amid tensions in the Middle East conflict involving Iran, Israel and the United States.

Brent crude: up 3.26% to $83.99 per barrel

West Texas Intermediate (WTI): up 3.70% to $77.42 per barrel

Energy markets remain volatile as shipping disruptions threaten supply through the Strait of Hormuz, a route that handles nearly 20% of global oil trade.

Analysts say the Saudi assurance helped calm fears about Pakistan’s energy supply chain, contributing to the strong recovery at the PSX.

-

Business6 days ago

Business6 days agoIndia Us Trade Deal: Fresh look at India-US trade deal? May be ‘rebalanced’ if circumstances change, says Piyush Goyal – The Times of India

-

Politics1 week ago

Politics1 week agoWhat are Iran’s ballistic missile capabilities?

-

Business7 days ago

Business7 days agoAttock Cement’s acquisition approved | The Express Tribune

-

Business1 week ago

Business1 week agoHouseholds set for lower energy bills amid price cap shake-up

-

Politics1 week ago

Politics1 week agoUS arrests ex-Air Force pilot for ‘training’ Chinese military

-

Fashion7 days ago

Fashion7 days agoPolicy easing drives Argentina’s garment import surge in 2025

-

Sports6 days ago

Sports6 days agoLPGA legend shares her feelings about US women’s Olympic wins: ‘Gets me really emotional’

-

Fashion6 days ago

Fashion6 days agoTexwin Spinning showcasing premium cotton yarn range at VIATT 2026