Business

This Woman Began Her Entrepreneurial Journey at 50, Today She’s A Billionaire

Falguni Nayar’s rise from a top investment banker to one of India’s most successful self‑made billionaires is one of the most remarkable entrepreneurial stories of the last decade. Today, she is the founder and CEO of Nykaa, a beauty and lifestyle powerhouse that reshaped how Indians discover and shop for cosmetics. Her journey blends corporate expertise, late‑career reinvention, and a sharp understanding of India’s evolving consumer landscape. (Image: X)

Falguni Nayar was born and raised in a Gujarati family in Mumbai. She completed her Commerce degree at Sydenham College and later earned an MBA in Finance from the Indian Institute of Management Ahmedabad, one of India’s most prestigious business schools. Her strong academic foundation in finance and business strategy would later become the backbone of her entrepreneurial success. (Image: X)

Before Nykaa, Nayar spent nearly 20 years at Kotak Mahindra Bank, eventually becoming the Managing Director of Kotak Mahindra Capital, the bank’s investment banking arm. (Image: X)

During her tenure (1993-2012), she advised some of India’s biggest companies on IPOs, mergers, and acquisitions. This experience gave her a deep understanding of capital markets, strong relationships with corporate leaders, insight into building and scaling businesses, and the confidence to eventually launch her own venture. Despite her success, she always harbored an entrepreneurial dream. (Image: X)

In 2012, at the age of 50, Falguni Nayar left her high‑profile banking career to start Nykaa, a move many considered risky. She launched the company as FSN E‑Commerce Ventures, named after her initials (Falguni Sanjay Nayar). (Image: X)

Her vision was clear: India needed a trusted, curated beauty retailer similar to Sephora, offering authentic products and expert guidance. Nykaa began as an online beauty store but quickly expanded into multi‑brand retail stores, private‑label beauty and fashion lines, and a massive influencer‑driven content ecosystem. (Image: X)

Nykaa grew rapidly by focusing on

– Authenticity: At a time when counterfeit beauty products were common, Nykaa’s “100% authentic” promise built trust.

– Content + Commerce Strategy: Tutorials, reviews, and influencer partnerships helped educate consumers and drive sales.

– Omnichannel Expansion: Nykaa opened physical stores across India, blending online convenience with offline experience.

– Category Diversification: Nykaa Fashion, launched later, expanded the brand into apparel and accessories. (Image: X)

In 2021, Nykaa went public in one of India’s most celebrated IPOs, making Falguni Nayar one of the country’s richest self‑made women. According to the Forbes India Rich List (2024), Falguni Nayar and family ranked 71st with a net worth of $4.2 billion. She is one of only two self‑made female billionaires in India. Her achievements have earned her numerous awards and global recognition as a trailblazing entrepreneur. (Image: Mexy Xavier/ForbesIndia)

Business

Gas prices rocket as Qatar halts production after Iranian attacks

Gas prices have leapt at the fastest pace since the outbreak of war in Ukraine, after Qatar halted production of liquified natural gas after attacks by Iran.

Oil prices also soared and global financial markets reeled from the fallout of an intensifying conflict between Iran and US-Israeli forces.

European whole gas prices soared by 52% on Monday, marking the sharpest rise since prices were pushed dramatically higher by the Russian invasion of Ukraine in March 2022.

The surge came after Qatar’s state-backed energy company QatarEnergy said it “ceased production” because of attacks on its facilities.

Qatari ministers had said earlier on Monday that an Iranian drone had attacked one of the company’s production facilities.

Qatar is a major producer of LNG, cooled gas which can be transported via ships, responsible for about a fifth of global supplies.

On Monday in London, the price of natural gas for delivery in April was up by about 43% to 115p per therm.

In the UK, gas prices are a key driver for the cost of domestic energy bills, indicating that a sustained spike could affect households in the coming months.

Neil Wilson, Saxo UK investor strategist, said: “Qatar is a top three LNG exporter, controlling roughly a quarter of expected supply over the next decade.

“Looks like Iran’s tactic is to pressure Gulf states so they in turn pressure the US and Israel to back off.

“I am much more concerned about European natural gas prices than oil prices, in terms of seeing a repeat of the 2022 European energy crisis.”

Global financial markets faltered after intense strikes across the Middle East and attacks on ships drove fears of energy supply disruption.

London’s FTSE 100 was weaker as trading was knocked by the growing conflict between Iran and US-Israeli forces.

The blue chip share index shed 130 points, closing 1.2% lower at 10,780.11.

Other European indexes suffered bigger drops with France’s Cac 40 down about 2.2% and Germany’s Dax tumbling 2.4% on Monday.

But it was a more tentative start to trading over on Wall Street with the S&P 500 relatively flat, and Dow Jones dipping by about 0.1% by the time European markets had closed.

Israel launched strikes on Lebanon’s capital Beirut on Monday after missiles were fired by militant group Hezbollah.

The latest strikes came after the US and Israel hit targets across Iran on Sunday as part of an intensifying military campaign which followed the killing of Supreme Leader Ayatollah Ali Khamenei.

Oil supplies could be affected by the conflict after Iran reportedly warned tankers on the strait of Hormuz that no ships would be allowed to pass through.

UK Maritime Trade Operations Centre officials said that two vessels have been struck near to the key trade artery.

The Strait of Hormuz is used by tankers carrying about one fifth of the world’s oil supplies and seaborne gas.

On Monday, the price of Brent crude oil soared by as much as 13%, rising above 82 dollars a barrel, before paring back.

It was 8.4% higher at 79.2 dollars a barrel shortly before 2pm, before easing slightly to be 5.5% higher at 76.9 dollars a barrel by early evening.

Nevertheless, City analysts have said the markets have been relatively contained so far in reaction to the conflict.

Chris Beauchamp, chief market analyst at IG, said: “While we have seen a significant surge in oil prices since markets opened last night, the gains appear contained for now as we wait to see if shipping through Hormuz can continue at lower levels or will be blocked entirely.

“Oil and gas infrastructure in the region has not yet been extensively targeted, keeping oil well south of the 100 dollar barrel range that many expected as a result of the weekend.”

Meanwhile, the pound dipped in value against the US dollar to its weakest level since December.

The fall is partly linked to the strength of the dollar, with investors pouring funds into the US “safe haven” currency.

The pound was down about 0.8% at 1.338 versus the dollar during the day, before parring back some losses to be down around 0.3% at 1.34 against the dollar by early evening.

London stocks were broadly weaker, with travel stocks among those dropping particularly sharply.

Cruise giant Carnival slid by 8%, while airline firm IAG, the parent firm of British Airways, dipped by 7.6%.

Rival Wizz Air, which typically runs flights to Dubai and Abu Dhabi, was also down 7.3% in early trading on Monday, while travel-focused retail groups SSP and WH Smith were also firmly lower.

However, defence stocks were among the gainers, with BAE Systems lifting by 7.4% to 2,268p.

Elsewhere, oil and energy stocks were also stronger – Shell and BP rose by 4.5% and 3.5% respectively as prices lift.

International stock markets also opened weaker after the start of trading, with the Nikkei 225 in Tokyo falling by 1.5% after Asian markets opened.

Business

Oil prices spike! Will petrol, diesel rates be hiked in India as crude nears $80 mark on Middle East tensions? – The Times of India

Internationally, oil prices have risen by around 9-10% following Israel-US strikes on Iran, and amid the rising tensions in the Middle East are likely to remain elevated. Does that mean that petrol and diesel prices in India will go up?Brent crude, the international benchmark, moved close to $80 per barrel, while US crude futures advanced 8.6 per cent to $72.79, compared with roughly $67 on Friday.

India, which meets about 88% of its crude oil demand through imports before refining it into fuels such as petrol and diesel, faces a higher import burden when global prices rise, along with possible inflationary effects.

Middle East tensions : Will petrol, diesel prices go up?

Despite the sharp increase in global oil prices, retail petrol and diesel prices in India are not expected to be revised upward in the immediate future, according to a PTI report.According to sources quoted in the report, the government is maintaining a calibrated approach that allows oil marketing companies to improve margins during periods of lower international prices while protecting consumers when global rates increase.Also Read | Middle East oil shock risks: How much do China, India, Japan depend on Middle Eastern crude, gas?Pump prices for petrol and diesel have remained unchanged since April 2022. During this period, state-run retailers including Indian Oil Corporation, Bharat Petroleum Corporation Ltd and Hindustan Petroleum Corporation Ltd have absorbed losses when crude prices were elevated and benefited when prices declined.As a result, domestic fuel prices have stayed steady even when global fuel rates climbed due to higher crude costs. Likewise, when international fuel prices softened in line with lower crude, retail rates in India did not see a reduction.Sources added that the government intends to continue shielding consumers under this policy framework, unless crude prices witness an exceptionally sharp surge.With assembly elections approaching in key states such as West Bengal, Tamil Nadu and Assam, the government is keen to avoid developments that could provide political ammunition to the opposition, the report said.

India assesses oil security

Amid intensifying hostilities in the Middle East, Oil Minister Hardeep Singh Puri on Monday assessed the crude oil, LPG and petroleum products situation in a meeting with senior officials from his ministry and executives of public sector oil companies.

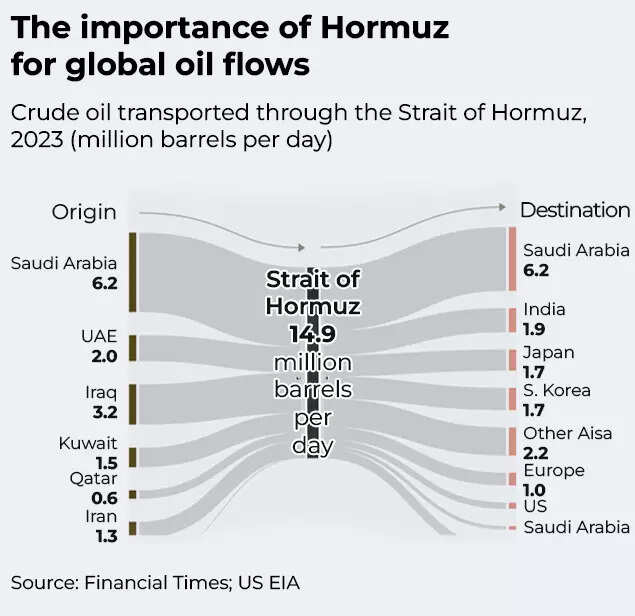

Importance of Hormuz for global oil flows

Much of India’s crude oil and gas supplies transit through the Strait of Hormuz, which Iranian authorities have threatened to close following US and Israeli strikes.“They have sufficient buffers to manage this kind of price spike,” a source with direct knowledge of the matter said, referring to oil companies. “We witnessed crude touching $119 per barrel in June 2022 after Russia’s invasion of Ukraine. That year their profits were modest, but in FY24 they recorded a record profit of Rs 81,000 crore.”Should interruptions continue, cargoes may need to be diverted around the Cape of Good Hope, resulting in longer transit durations and higher transportation expenses, along with increased freight and insurance costs.According to media accounts, the ongoing hostilities have in effect shut down the Strait of Hormuz, the vital artery for worldwide energy transportation. Nearly one-third of global seaborne crude oil exports and around 20 per cent of liquefied natural gas cargoes pass through this narrow channel.Also Read | 1970s-style oil shock loading? Crude may hit $100 if Strait of Hormuz shuts amid Middle East tensions – what it means

Business

Limited flights leave UAE while disruption continues amid Iran strikes

From the UK, flights have also been cancelled for many Middle East destinations, including all flights to Israel and Bahrain, three-quarters of the day’s scheduled flights to the United Arab Emirates, and more than two-thirds (69%) of flights to Qatar.

-

Politics1 week ago

Politics1 week agoPakistan carries out precision strikes on seven militant hideouts in Afghanistan

-

Tech1 week ago

Tech1 week agoThese Cheap Noise-Cancelling Sony Headphones Are Even Cheaper Right Now

-

Business6 days ago

Business6 days agoHouseholds set for lower energy bills amid price cap shake-up

-

Entertainment1 week ago

Entertainment1 week agoTalking minerals and megawatts

-

Business6 days ago

Business6 days agoLucid widely misses earnings expectations, forecasts continued EV growth in 2026

-

Entertainment1 week ago

Entertainment1 week agoHailee Steinfeld shares big life update amid excitement for baby’s arrival

-

Politics1 week ago

Politics1 week agoSupreme Court ruling angers Trump: Global tariffs to rise from 10% to 15%

-

Sports1 week ago

Sports1 week agoSouth Africa thrash India by 76 runs in T20 World Cup Super 8 – SUCH TV