Business

Trainline shares accelerate on rosier earnings outlook

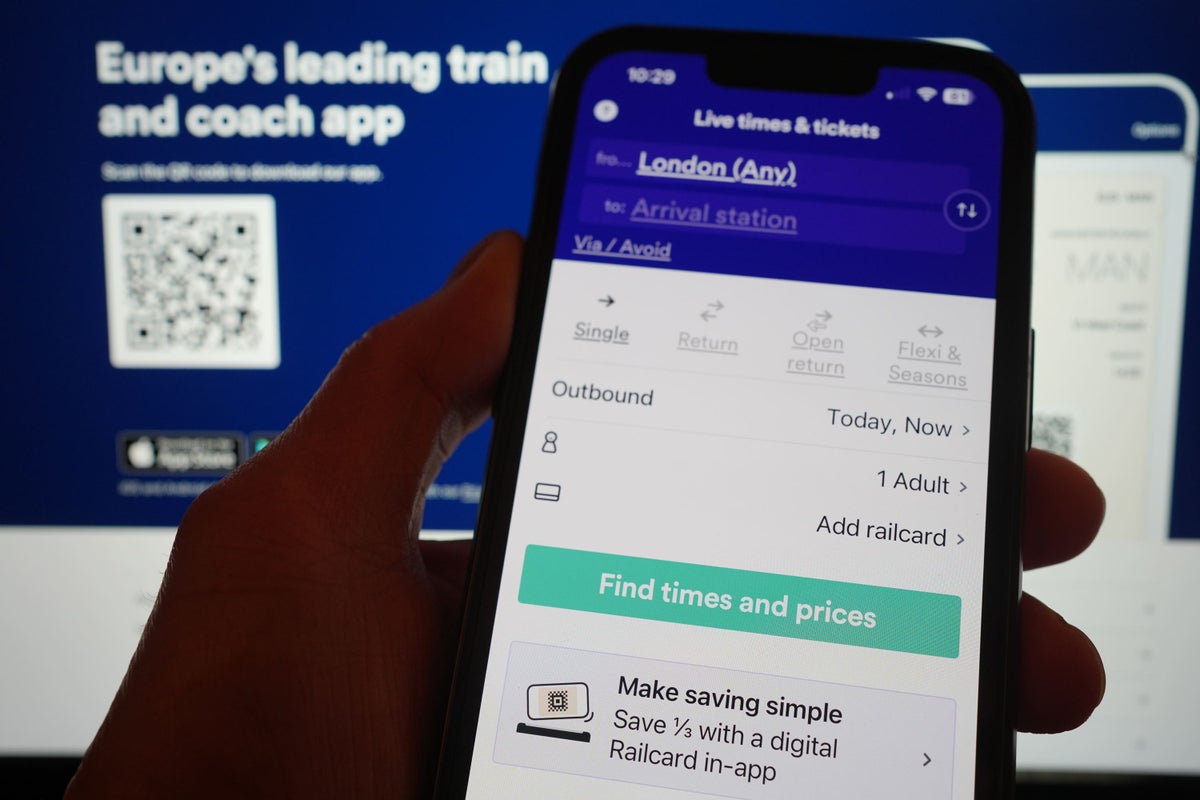

Trainline has seen shares surge higher after it boosted its earnings outlook despite a hit from the Government’s move to expand “tap-in and tap-out” contactless payment across more UK stations.

The online ticketing platform notched up an 8% rise in UK net consumer ticket sales to £2.1 billion in the six months to the end of August, thanks to a bounce back in demand for leisure travel and commuting, and as year-earlier trading was impacted by strike action.

But it said it took a hit from the first phase of the Department for Transport’s rollout of the contactless payment network to more stations, allowing passengers to tap-in and tap-out with bank cards and pay the guaranteed best fare available at that time of day.

Consumer revenues were flat at £107 million, it added.

In spite of this, London-listed Trainline – which also has operations across Europe – said it now expects full-year underlying earnings at the top end of its previous guidance, for between growth of 6% and 9%.

Shares in the FTSE 250 firm soared as much as 13% on Thursday morning trading, as it also cheered investors with plans to bolster returns with up to another £150 million in share buybacks.

Jody Ford, chief executive of Trainline, said: “Trainline has delivered a robust performance in the first half and today announces improved guidance for the full-year alongside an enhanced £150 million share buyback programme.”

He added: “Rail liberalisation in Europe continues to demonstrate the value Trainline brings as the pre-eminent domestic aggregator, most recently in south-east France where increased carrier competition between Paris, Lyon and Marseille has driven second quarter sales growth of 34%.”

In the update ahead of interim results in November, Trainline said overall group revenues lifted 2% to £235 million in the first half, as net ticket sales rose 8%.

The firm said it was keeping guidance unchanged for full-year group-wide growth of 0% to 3% for revenues and 6% to 9% for net ticket sales.

Russ Mould, investment director at AJ Bell, said: “The shares had been weak this year amid concerns about new competitive threats in the UK, but the trading update is a reminder that Trainline is a bigger beast.

“France is acting like a rocket for the company’s sales growth and that is helping to offset pockets of weakness elsewhere.

“The overall tone is upbeat and that’s exactly what the market needed to hear to get the share price moving higher again.”

Business

New Income Tax Act 2025 to come into effect from April 1, key reliefs announced in Budget 2026

New Delhi: Finance Minister Nirmala Sitharaman on Sunday said that the Income Tax Act 2025 will come into effect from April 1, 2026, and the I-T forms have been redesigned such that ordinary citizens can comply without difficulty for ease of living.

The new measures include exemption on insurance interest awards, nil deduction certificates for small taxpayers, and extension of the ITR filing deadline for non-audit cases to August 31.

Individuals with ITR 1 and ITR 2 will continue to file I-T returns till July 31.

“In July 2024, I announced a comprehensive review of the Income Tax Act 1961. This was completed in record time, and the Income Tax Act 2025 will come into effect from April 1, 2026. The forms have been redesigned such that ordinary citizens can comply without difficulty, for) ease of living,” she said while presenting the Budget 2026-27

In a move that directly eases cash-flow pressure on individuals making overseas payments, the Union Budget announced lower tax collection at source across key categories.

“I propose to reduce the TCS rate on the sale of overseas tour programme packages from the current 5 per cent and 20 per cent to 2 per cent without any stipulation of amount. I propose to reduce the TCS rate for pursuing education and for medical purposes from 5 per cent to 2 per cent,” said Sitharaman.

She clarified withholding on services, adding that “supply of manpower services is proposed to be specifically brought within the ambit of payment contractors for the purpose of TDS to avoid ambiguity”.

“Thus, TDS on these services will be at the rate of either 1 per cent or 2 per cent only,” she mentioned during her Budget speech.

The Budget also proposes a tax holiday for foreign cloud companies using data centres in India till 2047.

Business

Budget 2026 Live Updates: TCS On Overseas Tour Packages Slashed To 2%; TDS On Education LRS Eased

Union Budget 2026 Live Updates: Union Budget 2026 Live Updates: Finance Minister Nirmala Sitharaman is presenting the Union Budget 2026-27 in Parliament, her record ninth budget speech. During her Budget Speech, the FM will detail budgetary allocations and revenue projections for the upcoming financial year 2026-27. Sitharaman is notably dressed in a Kanjeevaram Silk saree, a nod to the traditional weaving sector in poll-bound Tamil Nadu.

The budget comes at a time when there is geopolitical turmoil, economic volatility and trade war. Different sectors are looking to get some support with new measures and relaxations ahead of the budget, especially export-oriented industries, which have borne the brunt of the higher US tariffs being imposed last year by the Trump administration.

On January 29, 2026, Sitharaman tabled the Economic Survey 2025-26, a comprehensive snapshot of the country’s macro-economic situation, in Parliament, setting the stage for the budget and showing the government’s roadmap. The survey projected that India’s economy is expected to grow 6.8%-7.2% in FY27, underscoring resilience even as global economic uncertainty persists.

Budget 2026 Expectations

Expectations across key sectors are taking shape as stakeholders look to the Budget for support that sustains growth, strengthens jobs and eases financial pressures:

Taxpayers & Households: Many taxpayers want practical improvements to the income tax structure that preserve simplicity while supporting long-term financial planning — including broader deductions for home loan interest and diversified retirement savings options.

New Tax Regime vs Old Tax Regime | New Income Tax Rules | Income Tax 2026

Businesses & Industry: With industrial output and investment showing resilience, firms are looking for policies that bolster capital formation, ease compliance, and expand infrastructure spending — especially in manufacturing and technology-driven sectors that promise jobs and exports.

Startups & Innovation: The startup ecosystem expects incentives around employee stock options and capital access, along with regulatory tweaks that encourage risk capital and talent retention without increasing compliance burdens.

Also See: Stock Market Updates Today

The Budget speech will be broadcast live here and on all other news channels. You can also catch all the updates about Budget 2026 on News18.com. News18 will provide detailed live blog updates on the Budget speech, and political, industry, and market reactions.

We are providing a full, detailed coverage of the union budget 2026 here, with a lot of insights, experts’ views and analyses. Stay tuned with us to get latest updates.

Also Read: Budget 2026 Live Streaming

Here are the Live Updates of Union Budget 2026:

Business

Budget 2026: Cabinet gives green signal to Union Budget 2026–27

New Delhi: The Cabinet on Sunday approved the Union Budget 2026-27 during a meeting in Parliament chaired by Prime Minister Narendra Modi. A meeting of the Union Cabinet was held at Sansad Bhawan at 10 a.m., and after the Cabinet’s approval, Finance Minister Nirmala Sitharaman proceeded to Parliament to present the Budget.

Earlier, FM Sitharaman met President Droupadi Murmu and offered her a copy of the digital budget. The President also offered ‘dahi-cheeni’ (curd and sugar) to Sitharaman when she arrived at the Rashtrapati Bhavan. The Finance Minister was seen carrying her trademark ‘bahi-khata’, a tablet wrapped in a red-coloured cloth bearing a golden-coloured national emblem on it.

Minister of State for Finance Pankaj Chaudhary, Chief Economic Advisor Dr V. Anantha Nageswaran, Central Board of Direct Taxes (CBDT) Chairman Ravi Agrawal and other officials were seen accompanying the Finance Minister. Sitharaman was set to present her ninth consecutive Union Budget in the Lok Sabha. In 2021, she switched to using a digital tablet to carry the Budget papers, further promoting a modern and eco-friendly approach.

The ‘bahi-khata’ is a red pouch that holds the digital tablet containing the Budget documents. This year, Sitharaman opted for a deep maroon Kanjeevaram saree from Tamil Nadu. The saree featured a deep maroon base with a contrasting border and subtle gold detailing, paired with a yellow blouse.

The Budget is likely to strike a deft balance of sustaining growth momentum and maintaining fiscal consolidation. It also needs to address near-term challenges emanating from unprecedented geopolitical flux, said economists. According to economists, the budget is likely to focus more on capital expenditure, especially in sectors deemed to be strategically important owing to prevailing geopolitical compulsions.

While the FY26 Budget was more tilted towards stimulating middle-class consumption with tax reliefs, the FY27 Budget’s approach to stimulating consumption will be selective, they added.

-

Business1 week ago

Business1 week agoSuccess Story: This IITian Failed 17 Times Before Building A ₹40,000 Crore Giant

-

Fashion1 week ago

Fashion1 week agoSouth Korea tilts sourcing towards China as apparel imports shift

-

Sports5 days ago

Sports5 days agoPSL 11: Local players’ category renewals unveiled ahead of auction

-

Sports1 week ago

Sports1 week agoWanted Olympian-turned-fugitive Ryan Wedding in custody, sources say

-

Entertainment1 week ago

Entertainment1 week agoThree dead after suicide blast targets peace committee leader’s home in DI Khan

-

Tech1 week ago

Tech1 week agoStrap One of Our Favorite Action Cameras to Your Helmet or a Floaty

-

Tech1 week ago

Tech1 week agoThis Mega Snowstorm Will Be a Test for the US Supply Chain

-

Sports1 week ago

Sports1 week agoStorylines shaping the 2025-26 men’s college basketball season