Business

Trump affirms Gaza ceasefire remains intact despite fresh Israeli airstrikes – SUCH TV

The strikes, which targeted multiple Hamas sites in southern Gaza, came after Israel accused the group of attacking its troops in “a clear breach” of the nine-day-old ceasefire.

When asked by reporters whether the truce was still valid, Trump replied, “Yes, it is.”

The president, who played a key role in brokering the agreement, suggested that the alleged attacks may not have been ordered by Hamas leadership but rather carried out by “some rebels within.”

“We want to ensure peace with Hamas,” Trump said. “It will be managed firmly but fairly.”

According to Gaza’s civil defence agency, operating under Hamas authorities, at least 45 people were killed in the latest airstrikes. Hospitals across Gaza confirmed the death toll to AFP.

Israel’s military said it was reviewing the reports of civilian casualties, reiterating that it had “reimposed enforcement of the ceasefire” while warning it would “respond decisively to any breach.”

A Hamas official denied the allegations, accusing Israel of fabricating excuses to reignite the conflict.

An Israeli security official also said that aid deliveries into Gaza had been temporarily halted following the alleged ceasefire violations a move that humanitarian agencies fear could worsen the already severe crisis in the territory.

Israel repeatedly cut off aid to Gaza during the war, exacerbating dire humanitarian conditions, with the United Nations saying it caused a famine there.

Blood has returned

The ceasefire, which began on October 10, halted more than two years of devastating war between Israel and Hamas.

The deal established the outline for hostage and prisoner exchanges, and proposed an ambitious roadmap for Gaza’s future. But it has quickly faced challenges to its implementation.

Israel said on Sunday that two of its soldiers died in clashes in the city of Rafah.

“Earlier today, terrorists fired anti-tank missiles and opened fire on IDF (Israeli army) forces,” in Rafah, the military said in a statement. “The IDF responded with air strikes by fighter jets and artillery fire, targeting the Rafah area.”

Palestinian witnesses told AFP clashes erupted in the southern city in an area still held by Israel.

One witness, a 38-year-old man who asked not to be named, said that Hamas had been fighting a local Palestinian gang known as Abu Shabab but the militants were “surprised by the presence of army tanks”.

“The air force conducted two strikes from the air,” he added.

Abdullah Abu Hasanin, 29, from Al‑Bureij camp in central Gaza where Israel launched strikes, said: “The situation is as if the war has returned anew.

“We had hoped the agreement would hold, but the occupation respects nothing — not an agreement, not anything.”

He said he had rushed to the site of the bombing to help, adding: “The scene is indescribable. Blood has returned again.”

Security illusion

AFP images from Bureij showed Palestinians running for cover from the strikes, as well as the dead and wounded arriving at Deir al-Balah hospital, accompanied by grieving relatives.

Defence Minister Israel Katz warned Hamas would “pay a heavy price for every shot and every breach of the ceasefire”, adding Israel’s response would “become increasingly severe”.

A statement from Izzat Al-Rishq, a member of Hamas’s political bureau, reaffirmed the group’s commitment to the ceasefire.

Israel, it said, “continues to breach the agreement and fabricate flimsy pretexts to justify its crimes”.

Hamas’s armed wing insisted on Sunday that it had “no knowledge” of any clashes in Rafah.

On Sunday, US Vice President JD Vance called on Gulf Arab countries to establish a “security infrastructure” to ensure that Hamas disarmed — a key part of the peace deal.

Under Trump’s 20-point plan, Israeli forces have withdrawn beyond the so-called Yellow Line. That leaves them in control of around half of Gaza, including the territory’s borders but not its main cities.

Bodies returned

Hamas in turn has released 20 surviving hostages and is in the process of returning the remaining bodies of those who have died.

Israel returned the bodies of 15 Palestinians to Gaza on Sunday, bringing the total number handed over to 150, the health ministry in the Hamas-run territory said.

Israel has linked the reopening of the Rafah crossing — the main gateway into Gaza — to the recovery of all of the deceased.

Hamas has said it needs time and technical assistance to recover the remaining bodies from under Gaza’s rubble.

The war, triggered by Hamas’s October 7, 2023 attack on Israel, has killed at least 68,159 people in Gaza, according to the health ministry in the Hamas-run territory, figures the United Nations considers credible.

The data does not distinguish between civilians and combatants but indicates that more than half of the dead are women and children.

Hamas’s 2023 attack on Israel resulted in the deaths of 1,221 people, mostly civilians, according to an AFP tally based on official Israeli figures.

Business

Next buys shoe brand Russell & Bromley but 400 jobs still at risk

High street fashion giant Next has bought shoe retailer Russell & Bromley which had collapsed in to administration.

Next paid £2.5m in a rescue deal for the upmarket British footwear and accessories seller — but the future for most of the chain’s current staff and shops remains uncertain

Next will own the brand and three of Russell & Bromley’s 36 stores, as well as some existing stock for which it is paying an additional £1.3m.

Administrators Interpath said it was considering the future of the remaining stores, which for the moment remain open, as well as nine concession stores which all employ around 400 people.

Russell & Bromley’s chief executive Andrew Bromley said it was a “difficult decision” but the sale of the brand was the best way to secure its future.

The company is around 150 years old but has become the latest to struggle in a tough retail environment.

It joins other brands in a familiar path to largely disappearing off the high street via a process of administration, which means companies are often broken up and the highest value assets sold off to the highest bidder.

The Original Factory Shop and accessories retailer Claire’s are both currently going through a process of administration, with site closures and jobs at risk. Around 1,000 people lost their jobs after Bodycare collapsed in September, while River Island will close some stores to avoid a total collapse. The woes all come after a tranche of high profile closures such as Debenhams and Wilko.

In a statement, Next said it secured “the future of a much loved British footwear brand.”

“Next intends to build on this legacy and provide the operational stability and expertise to support Russell & Bromley’s next chapter, allowing it to return to its core mission: the design and curation of world-class, premium footwear and accessories for many years to come.”

The three stores Next will acquire are in high-end shopping destinations in or around London: Chelsea, Mayfair and Kent.

Next has seen relatively solid performance in the current turbulent retail landscape – unlike Russell & Bromley which has been loss-making in recent years.

Its saviour has experience in failing circumstances: last year, Next bought out of administration fashion maternity label Seraphine, and began rolling out its FatFace concessions a few years after snapping it up.

Business

Over 80% of below 40 entrepreneurs self-made – The Times of India

MUMBAI: Nearly four out of five of India’s leading young entrepreneurs are self-made, underscoring a shift in the country’s business landscape from inheritance to merit, according to the Avendus Wealth – Hurun India Uth Series 2025. The report shows that about 80% of business leaders under 40 featured in the ranking are first-generation founders.The study tracks entrepreneurs aged up to 40 whose companies meet minimum valuation thresholds ranging from $25 million to $200 million, based on age cohort and whether the founder is first- or next-generation. Of the 436 entrepreneurs shortlisted, 349 are self-made, pointing to a growing ecosystem driven by new ideas and technology rather than legacy ownership.Among first-generation founders, Ritesh Agarwal, founder of OYO, leads the list. At 31, Agarwal has built one of the most capitalised startups in the country, raising $3.7 billion. He is followed by Aadit Palicha and Kaivalya Vohra, both 22, whose quick-commerce firm Zepto has raised $1.95 billion.Other prominent first-generation entrepreneurs include Nikhil Kamath of Zerodha, now among India’s most-followed entrepreneurs on LinkedIn; Alakh Pandey of Physics Wallah, who disrupted the ed-tech space; and Ghazal Alagh, the most-followed woman entrepreneur on the list.Next-generation leaders account for about 20% of the ranking and continue to shape large family-run businesses. Key names include Isha Ambani of Reliance Retail, which employs more than 2.47 lakh people; Abhyuday Jindal, who is driving sustainability initiatives at Jindal Stainless; and Vidhi Shanghvi, who recently led Sun Pharmaceutical’s $355 million acquisition of US-based Checkpoint Therapeutics.The report categorises entrepreneurs across three age groups—under 30, under 35 and under 40. Together, the companies led by these 436 entrepreneurs are valued at more than $950 billion, higher than Switzerland’s GDP. Bengaluru tops the list with 109 entrants, followed by Mumbai with 87 and New Delhi with 45. Software products and services dominate with 77 entrepreneurs, ahead of financial services and healthcare, highlighting the tilt toward digital and technology-led businesses.

Business

Are UK interest rates expected to fall again?

Kevin PeacheyCost of living correspondent

Getty Images

Getty ImagesThe Bank of England has cut interest rates from 4% to 3.75%, the lowest level since February 2023.

Analysts are divided about whether the Bank will cut again when it next meets in February.

Interest rates affect mortgage, credit card and savings rates for millions of people.

What are interest rates and why do they change?

An interest rate tells you how much it costs to borrow money, or the reward for saving it.

The Bank of England’s base rate is what it charges other banks and building societies to borrow money, which influences what they charge their own customers for mortgages as well as the interest rate they pay on savings.

The Bank moves interest rates up and down in order to keep UK inflation – the rate at which prices are increasing – at or near 2%.

When inflation is above that target, the Bank typically puts rates up. The idea is that this encourages people to spend less, reducing demand for goods and services and limiting price rises.

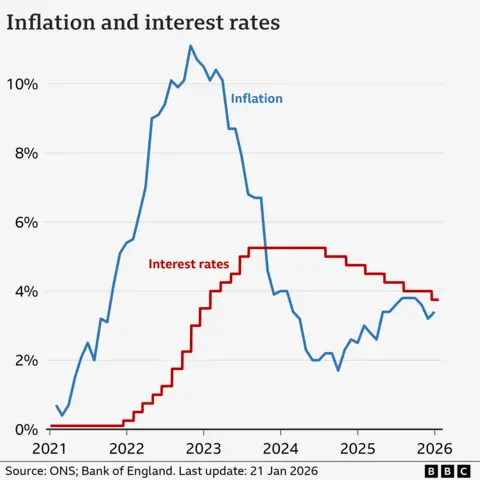

What has been happening to UK interest rates and inflation?

The main inflation measure, CPI, has dropped significantly since the high of 11.1% recorded in October 2022.

However, it was 3.4% in the year to December 2025 – up from 3.2% in November, and slightly higher than analysts had expected.

The Office for National Statistics (ONS) – which measures inflation – said the increase was driven by higher tobacco prices and the cost of airfares over the Christmas and New Year period.

The Bank of England’s base rate reached a recent high of 5.25% in 2023. It remained at that level until August 2024, when the Bank started cutting.

Five cuts brought rates down to 4%, before the Bank held rates at its meetings in September and November 2025 before the December cut.

Are interest rates expected to fall again?

Most analysts had expected the December cut, but the vote among members of the nine-member monetary policy committee (MPC) was divided, with only five in favour.

The Bank said rates were likely to continue dropping in the future, but warned decisions on further cuts in 2026 would be contested.

“We still think rates are on a gradual path downward but with every cut we make, how much further we go becomes a closer call,” said the Bank’s governor Andrew Bailey.

If inflation continues to rise – or just fails to fall – further rate cuts are less likely.

Mr Bailey has also repeatedly warned about the continuing impact of US tariffs, and political uncertainty around the world.

The next interest rate decision is on Thursday 5 February.

How do interest rate cuts affect mortgages, loans and savings rates?

Getty Images

Getty ImagesMortgages

Just under a third of households have a mortgage, according to the government’s English Housing Survey.

About 500,000 homeowners have a mortgage that “tracks” the Bank of England’s rate. A 0.25 percentage point cut is likely to mean a reduction of £29 in the monthly repayments for the average outstanding loan.

For the additional 500,000 homeowners on standard variable (SVR) rates – assuming their lender passed on the benchmark rate cut – there would typically be a £14 a month fall in monthly payments for the average outstanding loan.

But the vast majority of mortgage customers have fixed-rate deals. While their monthly payments aren’t immediately affected by a rate change, future deals are.

Mortgage rates have been falling recently, partly owing to the expectation the Bank would cut rates in December.

As of 21 January, the average two-year fixed residential mortgage rate was 4.77%, according to financial information company Moneyfacts. A five-year rate was 4.87%.

The average two-year tracker rate was 4.41%.

About 800,000 fixed-rate mortgages with an interest rate of 3% or below are expected to expire every year, on average, until the end of 2027. Borrowing costs for customers coming off those deals are expected to rise sharply.

Mortgage calculator

You can see how your mortgage may be affected by future interest rate changes by using our calculator:

Credit cards and loans

Bank of England interest rates also influence the amount charged on credit cards, bank loans and car loans.

Lenders can decide to reduce their own interest rates if Bank cuts make borrowing costs cheaper.

However, this tends to happen very slowly.

Getty Images

Getty ImagesSavings

The Bank base rate also affects how much savers earn on their money.

A falling base rate is likely to mean a reduction in the returns offered to savers by banks and building societies.

The current average rate for an easy access savings account is 2.45%, according to Moneyfacts.

Any further cut in rates could particularly affect those who rely on the interest from their savings to top up their income.

What is happening to interest rates in other countries?

In recent years, the UK has had one of the highest interest rates in the G7 – the group representing the world’s seven largest so-called “advanced” economies.

In June 2024, the European Central Bank (ECB) started to cut its main interest rate for the eurozone from an all-time high of 4%.

At its meeting in June 2025 the ECB cut rates by 0.25 percentage points to 2% where they have remained.

The US central bank – the Federal Reserve – has cut interest rates three times since September 2025, taking them to the current range of 3.5% to 3.75%, the lowest since 2022.

President Trump had repeatedly attacked the Fed for not cutting earlier.

-

Tech1 week ago

Tech1 week agoNew Proposed Legislation Would Let Self-Driving Cars Operate in New York State

-

Entertainment1 week ago

Entertainment1 week agoX (formerly Twitter) recovers after brief global outage affects thousands

-

Sports6 days ago

Sports6 days agoPak-Australia T20 series tickets sale to begin tomorrow – SUCH TV

-

Politics4 days ago

Politics4 days agoSaudi King Salman leaves hospital after medical tests

-

Business5 days ago

Business5 days agoTrump’s proposed ban on buying single-family homes introduces uncertainty for family offices

-

Tech6 days ago

Tech6 days agoMeta’s Layoffs Leave Supernatural Fitness Users in Mourning

-

Tech7 days ago

Tech7 days agoTwo Thinking Machines Lab Cofounders Are Leaving to Rejoin OpenAI

-

Fashion4 days ago

Fashion4 days agoBangladesh, Nepal agree to fast-track proposed PTA