Business

Trump proposes slashing fuel efficiency standards for passenger cars

Traffic on Interstate 80 in San Pablo, California, US, on Wednesday, Nov. 26, 2025.

David Paul Morris | Bloomberg | Getty Images

President Donald Trump on Wednesday proposed big cuts to strict fuel economy standards for passenger cars enacted under the Biden administration.

“We are officially terminating Joe Biden’s ridiculously burdensome, horrible actually, CAFE standards that imposed expensive restrictions,” Trump said at the Oval Office, flanked by the CEOs of Ford Motor and Stellantis.

The Corporate Average Fuel Economy, or CAFE, standards date back to 1975 and have been tightened over the years to make vehicles more efficient.

Former President Joe Biden had required automakers to increase the fuel efficiency of passenger cars and light trucks to about 50 miles per gallon by 2031. These stricter standards were expected to stimulate the production and sale of electric vehicles in the U.S.

The standards proposed by the Trump administration would require cars to get about 34 miles to the gallon by 2031, according to the National Highway Traffic Safety Administration.

Trump has sought to dismantle pollution regulations and federal support for electric vehicles as well as renewable energy since taking office.

The oil industry group the American Petroleum Institute has lobbied the Trump administration to repeal the Biden fuel economy standards, contending that they aim to phase out liquid fuel vehicles.

The announcement was attended by Ford CEO Jim Farley and Stellantis CEO Antonio Filosa, as well as a plant manager for General Motors from Michigan.

Ford CEO Jim Farley and Stellantis CEO Antonio Filosa listen as U.S. President Donald Trump announces new fuel economy standards, in the Oval Office at the White House in Washington, D.C., U.S., December 3, 2025.

Brian Snyder | Reuters

Many of the officials in attendance, including U.S. dealers, said the new standards are more in line with the vehicles customers want to buy rather than the more costly ones automakers have been pushed to produce due to regulations.

Trump and other officials also touted the new regulations as assisting in vehicle affordability, which has been an ongoing concern for the automotive industry, as the average new vehicle purchased hovers around $50,000.

The Alliance for Automotive Innovation, a trade group that represents the majority of automakers operating in the U.S., also praised the cuts.

“We’re reviewing NHTSA’s announcement, but we’re glad the agency has proposed new fuel economy standards,” John Bozzella, CEO of the organization, said in a statement. “We’ve been clear and consistent: The current CAFE rules finalized under the previous administration are extremely challenging for automakers to achieve given the current marketplace for EVs.”

U.S. EV leader Tesla did not respond for comment regarding the reduced standards.

— CNBC’s Phil LeBeau and Lora Kolodny contributed to this report.

Business

South East Water faces £22m fine for supply failures

The firm was unable to cope during high demand, Ofwat says, leading to “immense stress” for customers.

Source link

Business

Middle East heat may ripple across India’s energy supply chain, flags Goldman Sachs – The Times of India

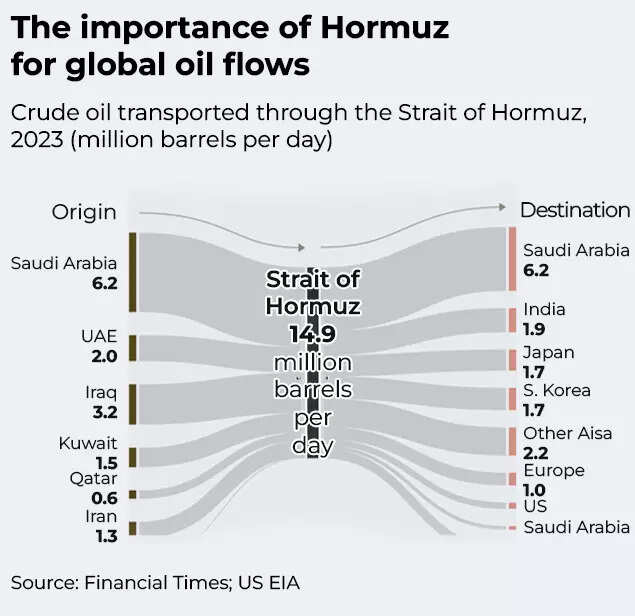

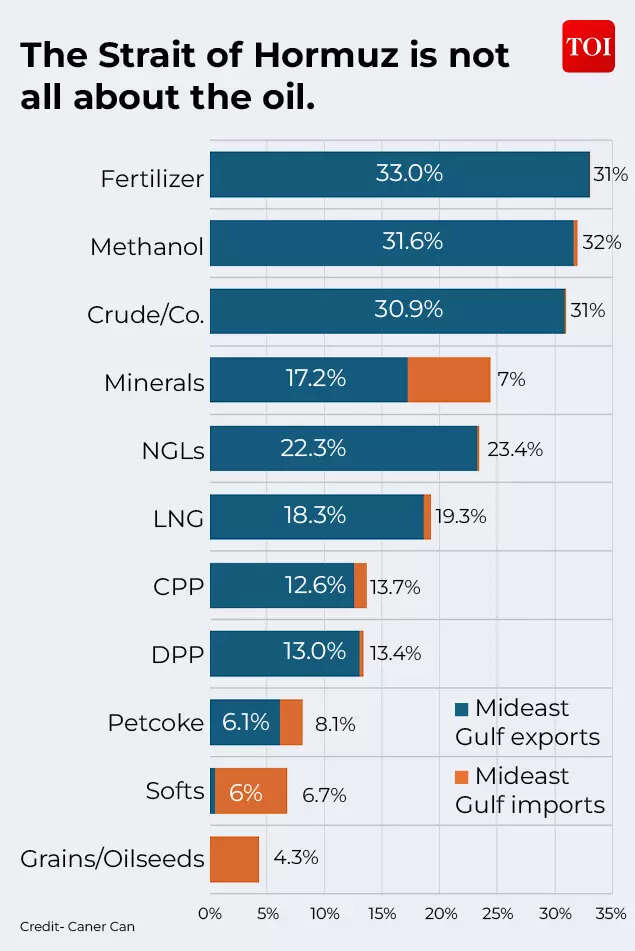

As tensions continue to heat up in the Middle East, concerns are raising about disruptions to one of the world’s most critical energy shipping routes, the Strait of Hormuz. Any disruption could significantly affect major oil-importing countries such as India, as the narrow Strait of Hormuz is central to global energy trade. The strait sees almost 20 million barrels of oil passing through each day, or about a fifth of the world’s consumption, pass through the route. The waterway also carries roughly 19% of global liquefied natural gas (LNG) shipments, making it a crucial corridor for energy-importing economies.A recent report by Goldman Sachs has flagged early signs of stress in the region. The report warned that tanker traffic through the Strait of Hormuz has already begun showing signs of disruption, with shipping firms, oil producers and insurers adopting a cautious approach following reports of damaged vessels in nearby waters.According to the firm, financial markets have already begun factoring in the geopolitical risk. Oil prices currently carry an estimated risk premium of $18-per-barrel, reflecting the potential market impact if energy flows through the Strait of Hormuz were disrupted for about a month.

Even is the oil facilities are not directly damaged, a shutdown of the shipping route could expose a significant portion of global supply. The report estimates that in an event of full closure, about 16 million barrels per day of oil flows could be affected, despite the availability of some pipeline routes designed to bypass the strait.And the risks are not limited to crude oil shipments with almost 80 million tonnes of LNG exports annually, much of it from Qatar, moving through the passage. Any prolonged disruption could tighten gas supply globally and potentially drive European benchmark gas prices back to levels seen during the 2022 energy crisis.

Asian economies stand among the most exposed to such disruptions. Major importers such as China, India, Japan and South Korea depend heavily on oil and LNG shipments that transit through the strategic corridor.While global oil inventories and spare production capacity could help cushion short-term shocks, the report warned that sustained disruption to Gulf shipping routes could trigger sharp volatility in global energy markets and push prices higher across oil, gas and refined fuel products.Market participants and governments are closely watching tanker traffic in the Strait of Hormuz, along with diplomatic and military developments involving the United States, Iran and Gulf nations, to assess whether the current disruptions remain temporary or escalate into a broader energy supply shock.

Business

Saudi Oil Supply Assurance Lifts Pakistan Stock Market – SUCH TV

KARACHI: The Pakistan Stock Exchange rallied on Thursday after Saudi Arabia assured Pakistan of facilitating crude oil shipments through the Red Sea port of Yanbu Port, easing concerns over potential fuel supply disruptions.

The benchmark KSE-100 Index climbed sharply during the trading session, rising 4,439.93 points (2.85%) to reach an intraday high of 160,217.14 points.

Market Recovery

Analysts attributed the market rebound to renewed institutional buying and improving investor sentiment after Saudi assurances on oil supplies.

Market expert Ahsan Mehanti, CEO of Arif Habib Commodities, said easing fuel supply concerns played a key role in the recovery.

He added that rising global crude prices, expectations of a new International Monetary Fund loan tranche for Pakistan, and positive economic indicators also boosted investor confidence.

Alternative Oil Route

Pakistan sought an alternative supply route after Iran announced the closure of the Strait of Hormuz, a crucial global oil transit corridor.

Federal Petroleum Minister Ali Pervaiz Malik held talks with Nawaf bin Said Al-Malki, requesting Saudi support for uninterrupted energy supplies.

Saudi authorities reportedly assured Pakistan that oil shipments could be routed through Yanbu, and one crude vessel has already been prepared for dispatch.

Global Oil Market Impact

Oil prices continued to rise amid tensions in the Middle East conflict involving Iran, Israel and the United States.

Brent crude: up 3.26% to $83.99 per barrel

West Texas Intermediate (WTI): up 3.70% to $77.42 per barrel

Energy markets remain volatile as shipping disruptions threaten supply through the Strait of Hormuz, a route that handles nearly 20% of global oil trade.

Analysts say the Saudi assurance helped calm fears about Pakistan’s energy supply chain, contributing to the strong recovery at the PSX.

-

Business6 days ago

Business6 days agoIndia Us Trade Deal: Fresh look at India-US trade deal? May be ‘rebalanced’ if circumstances change, says Piyush Goyal – The Times of India

-

Politics1 week ago

Politics1 week agoWhat are Iran’s ballistic missile capabilities?

-

Business7 days ago

Business7 days agoAttock Cement’s acquisition approved | The Express Tribune

-

Business1 week ago

Business1 week agoHouseholds set for lower energy bills amid price cap shake-up

-

Politics1 week ago

Politics1 week agoUS arrests ex-Air Force pilot for ‘training’ Chinese military

-

Fashion7 days ago

Fashion7 days agoPolicy easing drives Argentina’s garment import surge in 2025

-

Sports6 days ago

Sports6 days agoLPGA legend shares her feelings about US women’s Olympic wins: ‘Gets me really emotional’

-

Fashion6 days ago

Fashion6 days agoTexwin Spinning showcasing premium cotton yarn range at VIATT 2026