Business

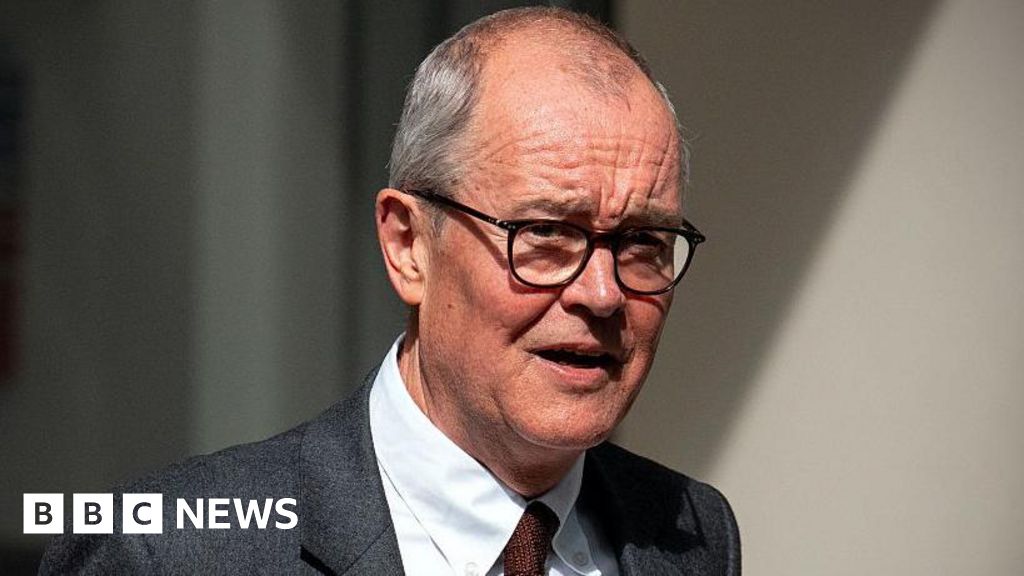

UK drug price rises ‘necessary’, says Lord Patrick Vallance

The price the NHS pays for medicines will need to rise to stop a wave of pharmaceutical investment leaving the UK, science minister Patrick Vallance has said.

His comments follow several recent announcements from some of the world’s largest drug companies either pausing or scrapping UK projects.

Critics in the sector say low prices for new drugs, a lack of government investment, and tariff pressure from US President Donald Trump have been pushing firms away from the UK.

Lord Vallance told the BBC “price increases are going to be a necessary part” of solving that problem.

“Where the additional money would come from to pay higher prices is a matter for the department of health and the Treasury to figure out,” he added.

Lord Vallance was speaking at the opening of US vaccine giant Moderna’s new centre in Oxfordshire where millions of flu and Covid jabs will be made.

Health Secretary Wes Streeting, who cut the ribbon at the development project on Wednesday, told the BBC there was “a live conversation between government departments and the pharma industry” on drug pricing.

Lord Vallance added: “We must end up with a deal of some sort… because it’s in the interest of the economy, it’s in the interest of patients.”

According to the government, Moderna is investing more than a £1bn in UK research and development as part of a 10-year partnership to create new treatments jobs and boost pandemic resilience.

Its commitment, made three years ago, stands in contrast to Merck’s decision this month to scrap a £1bn project in Liverpool and AstraZeneca’s pausing of a £200m investment in Cambridge, also this month.

Meanwhile, Novartis said in August that NHS patients will lose access to new cutting-edge treatments because of skyrocketing costs.

It said it was not considering the UK for major new investments in manufacturing, research, or advanced technology because of “systemic barriers”.

Another pharmaceutical firm Eli Lily told the Financial Times on Wednesday the UK was “probably the worst country in Europe” for drug prices.

Over the last 10 years, UK spending on medicines has fallen from 15% of the NHS budget to 9%, while the rest of the developed world spends between 14% and 20%.

Elsewhere, Trump has put pressure on pharmaceutical companies to lower prices and invest more in the US.

Last month, talks broke down between Streeting and pharma firms over the cost of medicines for the UK.

The UK government said at the time it had put forward a “generous and unprecedented offer to accelerate growth” in the pharmaceutical sector.

Streeting previously insisted that he would not allow pharma companies to “rip off” taxpayers and described drug companies’ approach as “short-sighted”.

However, he struck a more conciliatory tone on Wednesday saying “it’s a live conversation – not just domestically with the industry but internationally with the US as well”.

“There’s an intersection between the growth ambitions of the government, the health ambitions of the government, the trade ambitions of the government and bilateral relations with the US,” he added.

Business

Craft beer brewer BrewDog could be broken up as sale process begins

Beermaker BrewDog could be broken up after consultants were called in to help look for new investors.

The Scotland-based brewer, which makes craft beer such as Punk IPA and Elvis Juice, has appointed consultants AlixPartners to oversee a sale process.

Last month, BrewDog announced it was closing its distilling brands, sparking concerns for jobs at its facility in Ellon, Aberdeenshire.

The company, which was founded in 2007, said it made the decision to focus on its beer products.

No decision has been made in respect of the sale process.

A spokesperson for BrewDog said: “As with many businesses operating in a challenging economic climate and facing sustained macro headwinds, we regularly review our options with a focus on the long-term strength and sustainability of the company.

“Following a year of decisive action in 2025, which saw a focus on costs and operating efficiencies, we have appointed AlixPartners to support a structured and competitive process to evaluate the next phase of investment for the business.

“This is a deliberate and disciplined step with a focus on strengthening the long-term future of the BrewDog brand and its operations.

“BrewDog remains a global pioneer in craft beer: a world-class consumer brand, the number one independent brewer in the UK and with a highly engaged global community.

“We believe that this combination will attract substantial interest, though no final decisions have been made.

“Our breweries, bars, and venues continue to operate as normal. We will not comment on any further speculation.”

Brewdog operates 72 bars around the world as well as four breweries.

Business

‘Better to abolish RERA’: Supreme court says law helping defaulting builders

New Delhi: The Supreme Court has raised serious concerns over how real estate regulatory authorities are functioning across the country. Taking a sharp view, the top court said it may be “better to abolish” these bodies, suggesting they have failed to protect homebuyers and instead appear to benefit defaulting builders. The court added that states should reconsider the very need for such authorities if they are not serving their intended purpose.

A Bench led by Chief Justice of India Surya Kant and Justice Joymalya Bagchi said states should rethink the original purpose behind introducing RERA. The court observed that instead of protecting homebuyers, the law appears to be helping defaulting builders and not serving its intended role.

Expressing strong concern, CJI Surya Kant said states should reflect on the purpose for which RERA was created. He suggested the institution is failing to serve homebuyers and instead appears to benefit defaulting builders. “All states should now think of the people for whom the institution of RERA was created. Except facilitating builders in default, it is not doing anything else. Better to just abolish this institution,” CJI Kant said, quoted by Bar and Bench.

Last year, the High Court had stayed the state government’s decision to shift the RERA office, pointing out that the move was taken “without even identifying an alternative office location”. The court also noted that transferring 18 outsourced employees to other boards and corporations, as requested, “would render the functioning of Rera defunct”.

The Supreme Court, however, set aside the High Court’s order and allowed the state government to shift the RERA office to Dharamshala. It also permitted the relocation of the appellate tribunal to the same location. “With a view to ensure that persons affected by Rera orders are not inconvenienced, the principal appellate is also moved to Dharamshala,” the apex court said.

What Is RERA And Why It Matters

RERA, introduced in 2016, was aimed at addressing project delays, improving transparency and safeguarding homebuyers’ interests. Earlier, each state and union territory operated its own RERA website. However, in September 2025, the Ministry of Housing and Urban Affairs launched a unified RERA portal that brings together data from across states and UTs on a single platform.

Business

SEBI Proposes Overhaul Of Gold And Silver ETF Price Bands After Sharp Swings

Last Updated:

SEBI proposes stricter base price and band rules for gold, silver ETFs, including cooling-off periods after sharp global price swings to curb volatility.

Amid Global Commodity Volatility, SEBI Plans New Price Band Rules for Gold, Silver ETFs

The market regulator has sought to curb extreme volatility in gold and silver Exchange Traded Funds (ETFs) by proposing changes to the base price and price band framework. Currently, there are no separate price bands for ETFs aligned with their underlying assets, making them vulnerable to sharp price movements.

The proposal comes after sharp volatility in gold and silver ETFs triggered by fluctuations in global commodity prices. On some days, these ETFs fell by over 15%, while on others, they recorded sharp gains.

Stock exchanges currently apply a fixed price band of plus or minus 20% on the base price of ETFs, except for Overnight ETFs investing only in TREPs, which have a price band of plus or minus 5%.

Moreover, the base price for applying price bands to ETFs is taken as the T-2 day closing Net Asset Value (NAV) by exchanges, instead of the T-1 day closing NAV or price, as is the case with indices and individual stocks. This creates a challenge, as the closing NAV of ETFs typically differs between T-1 and T-2 days. Corporate actions such as bonuses and dividends are adjusted manually, increasing the risk of errors.

What Are the Key Proposals?

SEBI has proposed that the base price be determined using either the closing price of the ETF on T-1 day (weighted average price of the last 30 minutes), the closing NAV of T-1 day, or the average indicative NAV (iNAV) of the last 30 minutes of T-1 day.

Further, the regulator has proposed an initial price band of plus or minus 10% for equity and debt ETFs, which can be flexed up to plus or minus 20%. A cooling-off period of 15 minutes will apply, and up to two flexes will be allowed in a day.

For gold and silver ETFs, the regulator has proposed an initial price band of plus or minus 6%, which can be flexed up to plus or minus 20%. This will also include a 15-minute cooling-off period.

February 14, 2026, 16:08 IST

Read More

-

Entertainment1 week ago

Entertainment1 week agoHow a factory error in China created a viral “crying horse” Lunar New Year trend

-

Business4 days ago

Business4 days agoAye Finance IPO Day 2: GMP Remains Zero; Apply Or Not? Check Price, GMP, Financials, Recommendations

-

Tech1 week ago

Tech1 week agoNew York Is the Latest State to Consider a Data Center Pause

-

Tech1 week ago

Tech1 week agoNordProtect Makes ID Theft Protection a Little Easier—if You Trust That It Works

-

Tech1 week ago

Tech1 week agoPrivate LTE/5G networks reached 6,500 deployments in 2025 | Computer Weekly

-

Fashion4 days ago

Fashion4 days agoComment: Tariffs, capacity and timing reshape sourcing decisions

-

Business1 week ago

Business1 week agoStock market today: Here are the top gainers and losers on NSE, BSE on February 6 – check list – The Times of India

-

Business1 week ago

Business1 week agoMandelson’s lobbying firm cuts all ties with disgraced peer amid Epstein fallout