Fashion

UK’s Mulberry cuts H1 loss as margin strengthens despite revenue dip

Mulberry has narrowed its H1 loss as revenue dipped 4 per cent to £53.9 million (~$70.61 million) but gross margin rose to 69.2 per cent on reduced discounting.

Retail and digital revenue fell 8 per cent, while wholesale jumped 36 per cent.

Europe grew strongly, but Asia Pacific declined 17 per cent.

Costs fell 16 per cent, helping improve profitability.

Source link

Fashion

UK GDP expected to grow 1.4% in 2026: Goldman Sachs Research

They predict that the labour market will keep weakening, but also anticipate a boost to the economy from a significant cooling of inflation and further rate cuts from the Bank of England (BoE).

Goldman Sachs Research expects ‘another mixed year’ for the UK economy, which is expected to grow at 1.4 per cent in 2026—up from around 1 per cent in 2025.

It expects the unemployment rate to rise to 5.3 per cent by March, and then stabilising.

Consumption is expected to grow at 1.3 per cent in 2026 versus 0.7 per cent in 2025.

The fiscal position looks less vulnerable than some other European nations.

The UK labour market weakened significantly in 2025 as slow economic growth and the increase in national insurance contributions weighed on employment. A recent rise in layoffs points to ‘further labour market softening ahead’, according to Moberly and Stehn.

Goldman Sachs Research expects the unemployment rate to rise to 5.3 per cent by March. But as growth picks up towards potential, it sees the unemployment rate stabilising for the remainder of this year, the report says.

Given rising slack in the job market, lower headline inflation, and a smaller increase in the national living wage, the company’s economists expect wage growth to normalise this year. Private sector regular pay growth slowed to 3.8 per cent from around 6 per cent over the last 12 months, and the team forecasts further cooling to 3.1 per cent by the end of 2026.

Consumer spending in the UK is low, and the household savings rate is elevated. “Real disposable income growth is likely to remain weak in coming quarters given wage growth moderation, elevated mortgage rates, and a larger fiscal drag on household incomes,” Moberly and Stehn write.

The team’s models suggest that the savings rate will likely decline this year as interest rates fall and consumption catches up with recent increases in real inflation-adjusted incomes.

Consumption is expected to grow at 1.3 per cent in 2026 versus 0.7 per cent last year.

The team anticipates further progress on inflation in the coming months given unwinding base effects. Goldman Sachs Research projects headline inflation to decelerate to 2.1 per cent in the second quarter this year.

The fiscal trajectory, political risk, and efforts to boost economic growth are likely to be key areas of focus this year, according to the company.

“Our analysis suggests that the UK’s fiscal position looks less vulnerable than some other European countries, notably France,” Moberly and Stehn add.

Fibre2Fashion News Desk (DS)

Fashion

Kanuk ventures beyond Québec, setting off from Italy to expand worldwide

Published

January 16, 2026

What an honour for Italy at Pitti Uomo 109! For the first time, Canadian clothing brand Kanuk is stepping beyond Québec to reach the rest of the world. President Elisa Dahan confirmed as much to FashionNetwork.com. “Yes, it’s true. If we exclude an episode in the United States a few years ago, this is the first time we are presenting ourselves outside our province. I mean truly outside Québec: we had never really begun to develop beyond Québec towards a global dimension- not even in the rest of Canada. And since we are a fashion brand rooted in outerwear, of course we’re starting with Italy.”

Kanuk, a play on the slang nickname for Canadians (Canucks), has the snowy owl as its emblem. “We chose it because it never migrates; it always stays in Québec, no matter the temperature. It feels tailor-made for the philosophy of comfortable, welcoming Canadian country living,” Dahan points out. “A bit like us so far: we were founded in 1974 in a small workshop in Montréal with the mission of creating outerwear suited to Québec’s particular climate and lifestyle, and today we offer a total look.”

With a lifestyle focus, Kanuk is inspired by the spirit of rural Canadian life- farm-to-table family traditions, a distinctive generational heritage, and outdoor pursuits- while applying uncompromising artisanal standards to production. In the Autumn/Winter 2026/27 Heritage Collection, featuring 30 men’s and 30 women’s styles in a range of colours, the brand expands its ready-to-wear with new jumpers, knit sets, wool pieces, corduroy outerwear, and increased use of Kanuk’s signature sherpa, designed to complement its parkas. The colour palette reflects the season’s defining landscapes: warm earth tones, leafy greens, deep browns, and the muted golds of Canada’s transforming trees.

With two mono-brand stores, one in Montréal and the second just opened in Québec City- “attracting strong tourist traffic,” according to the president- Kanuk sees e-commerce “performing very well and accounting for about a third of the business; but don’t forget that right now we are only distributed in about 30 major stores in Québec. The sky is the limit for what we can achieve from now on,” she smiles.

Elisa Dahan is very confident that Kanuk’s products will be highly appreciated in Europe, “because in Europe the weather starts one way during the day and can shift in the evening and at night- sometimes in the opposite direction- so you need functional versatility, style and lasting durability in what you wear: precisely Kanuk’s attributes, with its timeless pieces and 3-in-1 models with removable layers,” she says.

Kanuk is not only apparel but also accessories, including gloves, scarves, and a super-plush bag, once again featuring the snowy owl. These designs are intended especially for cold climates. Across both the product range and the Canadian brand’s revenue- which rose by double digits last fiscal year- menswear and womenswear are split evenly, 50/50. Accessories account for 10% of turnover.

After Pitti Uomo 109, where she forged many connections with buyers, agents, and distributors, Elisa Dahan aims over the next two to three years to expand the brand into a strong network of quality retailers across Europe. “I’m not interested in quantity; ours is a beautiful brand with a lot of potential, but it needs to be surrounded by the right brands; for me, location is the most important factor to get right, and the business results will follow,” says the Kanuk president, who is also open to launching pop-ups or temporary stores in winter resorts as well as summer destinations, in Italy and beyond.

This article is an automatic translation.

Click here to read the original article.

Copyright © 2026 FashionNetwork.com All rights reserved.

Fashion

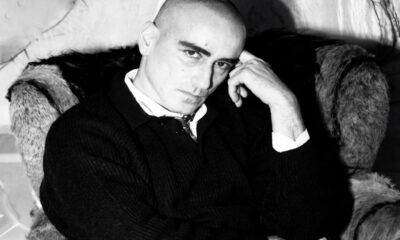

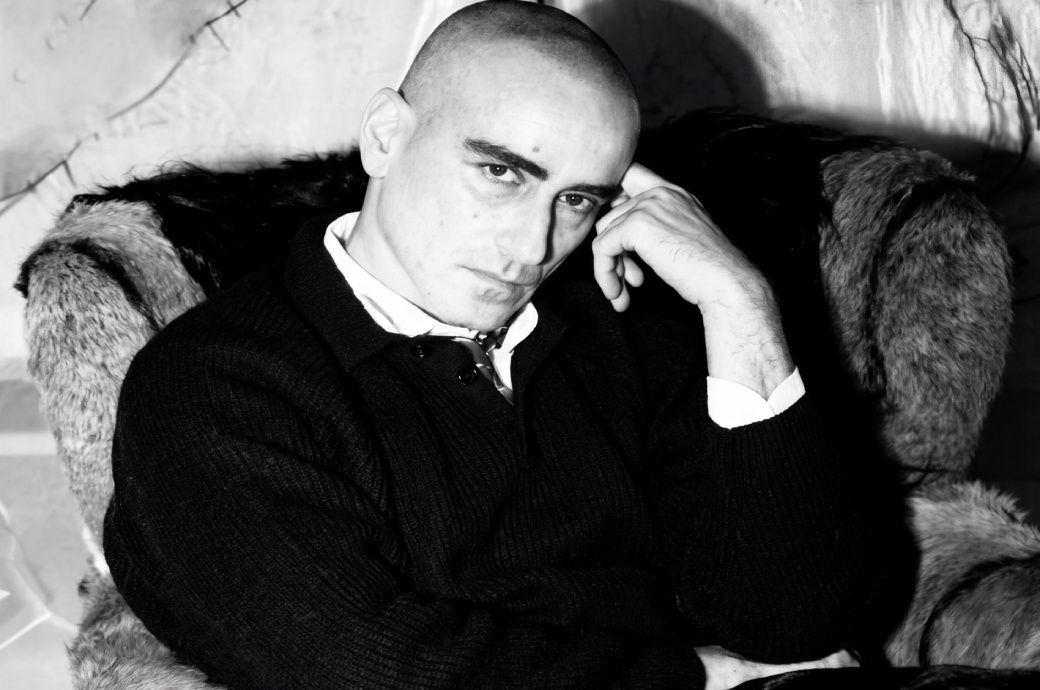

Japan’s Fast Retailing names Francesco Risso as GU creative director

Alongside his appointment at GU, Risso, who helmed the UNIQLO and Marni collection in 2022, will develop a new collaboration line with UNIQLO, set to launch in 2026.

Further details on both initiatives will be announced at a later date.

Fast Retailing has appointed Francesco Risso as creative director of GU to strengthen the brand’s global presence.

Risso will lead GU’s creative direction, with his debut collection set for fall/winter 2026.

He will also develop a new collaboration line with Uniqlo launching in 2026, following his earlier Uniqlo and Marni project.

Italian-born designer Francesco Risso studied fashion in Florence, New York, and London. He spent a decade at Prada, developing a rigorous approach to narrative and craft while gaining extensive design experience. From 2016 to 2025 he served as Creative Director at Marni, shaping a boldly original vision for the house inspired by music, art, and cultural exploration. A passionate educator, Risso has held guest positions at the world’s top art and design schools.

Note: The headline, insights, and image of this press release may have been refined by the Fibre2Fashion staff; the rest of the content remains unchanged.

Fibre2Fashion News Desk (RM)

-

Politics1 week ago

Politics1 week agoUK says provided assistance in US-led tanker seizure

-

Entertainment1 week ago

Entertainment1 week agoWhy did Nick Reiner’s lawyer Alan Jackson withdraw from case?

-

Sports6 days ago

Sports6 days agoClock is ticking for Frank at Spurs, with dwindling evidence he deserves extra time

-

Tech4 days ago

Tech4 days agoNew Proposed Legislation Would Let Self-Driving Cars Operate in New York State

-

Business1 week ago

Business1 week agoTrump moves to ban home purchases by institutional investors

-

Sports1 week ago

Sports1 week agoPGA of America CEO steps down after one year to take care of mother and mother-in-law

-

Sports7 days ago

Commanders go young, promote David Blough to be offensive coordinator

-

Fashion6 days ago

Fashion6 days agoSouth India cotton yarn gains but market unease over US tariff fears