Business

US kicks off controversial financial rescue plan for Argentina

The US has purchased Argentine pesos, taking the next step in a controversial effort to calm a currency crisis hitting the South American country and its president, Trump ally Javier Milei.

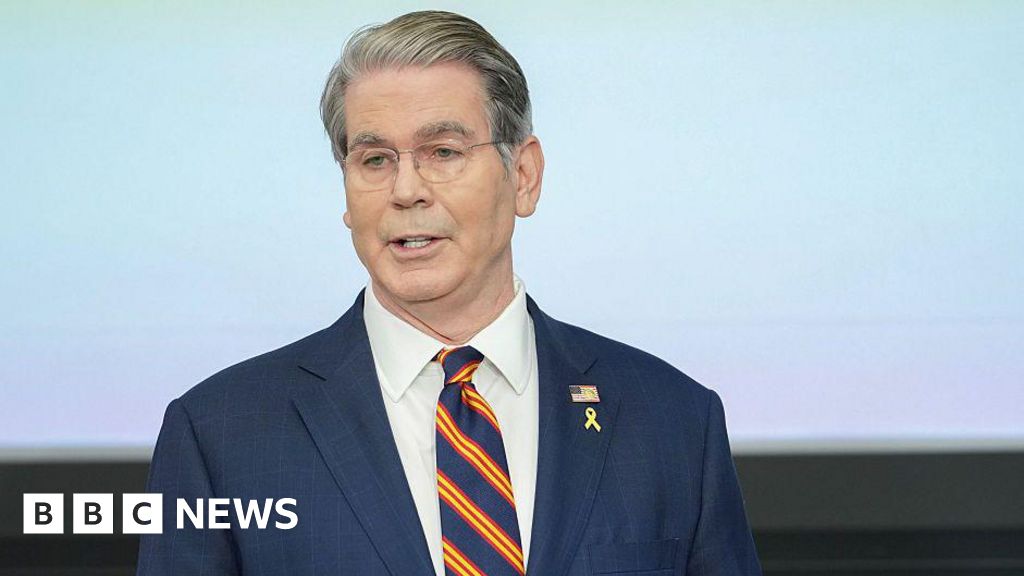

Treasury Secretary Scott Bessent announced the purchase on social media, while saying the US had finalised terms of a planned $20bn (£15bn) financial rescue for the country.

“The US Treasury is prepared, immediately, to take whatever exceptional measures are warranted,” he said.

The announcement helped boost the peso and Argentine debt on financial markets but renewed debate in the US, where the decision to extend financial support to Argentina at a time of spending cuts at home has drawn scrutiny.

“Instead of using our dollars to buy Argentine pesos, Donald Trump should help Americans afford health care,” Democratic Senator Elizabeth Warren wrote on social media in response to the announcement, referring to a key issue driving a stand-off over the government shutdown in the US.

Argentina has been facing increasing financial turmoil ahead of national midterm elections set for 26 October, as questions rise about whether voters will continue to back Milei’s cost-cutting, free-market reform agenda after recent losses in a provincial election.

The value of the peso has declined sharply in recent months, while investors have been dumping Argentine stocks and bonds.

Milei’s government has tried to stabilise the situation, but the moves have drained the country’s reserves a few months before billions in debt payments will come due.

Bessent, who made his name as a trader involved in the “Black Wednesday” episode in 1992 that forced the UK to devalue the pound, said in a statement that the success of Argentina’s “reform agenda” was of “systemic importance”.

“A strong, stable Argentina which helps anchor a prosperous Western Hemisphere is in the strategic interest of the United States,” he added. “Their success should be a bipartisan priority.”

The Treasury Department did not respond to questions seeking more detail about the US support, including how much of embattled peso the administration had purchased or the terms of the $20bn currency swap line, which will allow Argentina to exchange pesos for dollars.

Speaking later on Fox News, Bessent said the support was not a bailout for Argentina and that the peso was undervalued.

In a social media post, Milei thanked Trump and Bessent for support.

“Together, as the closest of allies, we will make a hemisphere of economic freedom and prosperity,” he said.

Argentina has defaulted on its debt three times since 2001, including most recently in 2020.

But investors, including some with ties to Bessent such as Robert Citrone, had taken renewed interest in the country in recent years in a bet on Milei’s libertarian financial reforms.

Since he took office in 2023, he has introduced deregulation and sweeping cuts to public spending to curb inflation and achieve a fiscal surplus – where the state spends less than it takes in revenue.

Domestically, the austerity measures have been met with growing backlash, as people’s purchasing power declines and the country faces a likely economic recession.

But those measures have helped to rein in inflation and have been largely welcomed by international investors and the International Monetary Fund, a key lender to Argentina.

With Milei styling himself as a Trump-like figure, complete with “Make Argentina Great Again” rhetoric, they have also won admiration from many conservatives in the US. He has met repeatedly with Trump, with another visit expected next week.

Nonetheless, the decision to extend financial support to Argentina has sparked backlash among American farmers, a key part of Trump’s voter base, who have been concerned as China shifts purchases of soybeans to countries including Argentina.

“Why would USA help bail out Argentina while they take American soybean producers’ biggest market???” Republican Senator Chuck Grassley, who represents Iowa, a key soybean producer, wrote on social media last month, when the US first pledged its support.

Bessent’s announcement followed four days of meetings with Argentina’s economy minister Luis Caputo.

In his announcement, Bessent said the international community was “unified behind Argentina and its prudent fiscal strategy, but only the United States can act swiftly. And act we will.”

He has previously pushed back at suggestions that the support amounted to a bailout for what Warren, in a statement on Thursday, dubbed the administration’s “billionaire buddies”.

“This trope that we’re helping out wealthy Americans with interests down there couldn’t be more false,” Bessent told CNBC earlier this month.

“What we’re doing is maintaining US strategic interest in the Western hemisphere,” he said, warning that inaction risked a “failed state”.

Business

Anthropic officially designated a supply chain risk by Pentagon

The supply chain risk designation of the artificial intelligence firm is a first for a US company.

Source link

Business

FDA official calls UniQure’s gene therapy a ‘failed’ treatment for Huntington’s disease

Thomas Fuller | SOPA Images | Lightrocket | Getty Images

UniQure needs to run another study to prove that its gene therapy “actually helps people with Huntington’s disease,” a senior U.S. Food and Drug Administration official said on a call with reporters Thursday.

The official, who requested anonymity before discussing sensitive information, confirmed the agency has asked the company to run a placebo controlled trial of its treatment, which is administered directly into the brain. UniQure has said that type of study isn’t ethical because it would require putting people under general anesthesia for hours, a characterization the official disputed.

“So what is really going on? UniQure is the latest company to make a failed therapy for Huntington’s patients,” the official said. “They likely acknowledge or understand at some deep level that their trial failed years ago, and instead of doing the right thing and running the correct clinical study, UniQure is performing a distorted or manipulated comparison in the mind of FDA.”

The comments mark the latest development in a messy public spat between UniQure and the FDA, and as the agency comes under fire for a number of recent drug approval application rejections, including some where companies have accused it of going back on previous guidance. FDA Commissioner Marty Makary in an interview with CNBC’s Becky Quick last week seemingly criticized UniQure’s gene therapy for Huntington’s disease. Makary didn’t name UniQure but described its treatment.

UniQure then accused the FDA of reversing its stance that the company’s clinical trial data would be sufficient to seek approval. UniQure’s study used an outside database to measure how patients with Huntington’s disease might decline without treatment, known as an external control. UniQure has said it wouldn’t be feasible to run a true randomized, double-blind placebo-controlled study, considered the gold standard, because it wouldn’t be ethical to make people undergo a sham hours-long brain surgery.

The FDA official said the agency “never agreed to accept this distorted comparison” and the FDA “never makes such assurances.” Instead, the “FDA will always say, ‘Well, we have to see the data when we get it.'”

UniQure didn’t immediately comment.

The company’s stock rose more than 10% on Thursday and has fallen 58% this year as of Thursday afternoon.

Business

Ogra warns of strict action against illegal hoarding of petroleum products – SUCH TV

The Oil and Gas Regulatory Authority (Ogra) on Thursday warned of strict action against any individual or entity found involved in the illegal hoarding of petroleum products at unauthorised locations, particularly at places other than duly licensed oil depots and retail outlets of Oil Marketing Companies (OMCs).

In a statement, an Ogra spokesperson said: “Any premises found involved in the illegal storage of petroleum products will be sealed.”

The spokesperson assured the public that the country currently holds sufficient stocks of petroleum products to meet national demand and that there is no need for panic buying or hoarding.

In view of the prevailing geopolitical situation, the official said that the authorities are closely monitoring the petroleum supply chain to ensure the uninterrupted availability of products across the country.

“The existing stock position remains comfortable and well within the prescribed requirements,” read the statement.

Reports have indicated that certain elements may attempt to hoard petroleum products for profiteering under such circumstances, the spokesperson said, adding: “To curb such practices, all provincial chief secretaries have been requested to direct deputy commissioners (DCs) to conduct inspections within their respective jurisdictions.”

Meanwhile, teams of Ogra are actively monitoring the situation in the field, the official added.

Inspections are being carried out at oil depots and retail outlets to ensure the smooth supply of petroleum products and to prevent any malpractice, read the statement.

Ogra advised the public not to pay attention to rumours and to maintain normal consumption patterns, as the petroleum supply situation in the country remains stable.

Uninterrupted petroleum supply top priority: FinMin

Separately, Finance Minister Muhammad Aurangzeb has said that ensuring uninterrupted availability of petroleum products across the country is the government’s top priority.

The finance czar made the remarks while chairing a meeting of the committee to Monitor Petrol Prices in the Wake of the Emerging Situation in the region, constituted by Prime Minister Shehbaz Sharif, in Islamabad today.

The committee was briefed that national reserves remain at comfortable levels, with sufficient cover available for key products, and that there is no immediate cause for concern regarding the availability of petroleum products.

It reviewed multiple supply and pricing scenarios to ensure preparedness under different contingencies and to maintain stability in domestic energy supplies.

The committee will finalise its recommendations by tomorrow for onward submission to the prime minister.

It will continue to meet on a daily basis to monitor developments, review stock positions and supply chain movements, and ensure timely execution across all stakeholders.

The committee also noted that “war premium” dynamics and intensified competition for energy cargoes, particularly in Asian markets, could raise external account pressures if volatility persists.

The body reviewed ongoing efforts to strengthen supply assurance through diversified sourcing and logistics arrangements.

The committee also considered shipping and operational measures to reduce time lags, including facilitation of timely berthing and the use of available national shipping capacity where feasible.

To safeguard orderly market conditions, the committee discussed measures to deter hoarding, illegal storage, and diversion, including coordinated enforcement actions by provincial administrations in close collaboration with the Ogra and relevant agencies.

The committee emphasised that preventing outward smuggling and ensuring uninterrupted domestic distribution will remain a top operational priority, and that real-time field intelligence and strict action against violations will be maintained.

-

Fashion1 week ago

Fashion1 week agoPolicy easing drives Argentina’s garment import surge in 2025

-

Politics1 week ago

Politics1 week agoWhat are Iran’s ballistic missile capabilities?

-

Business7 days ago

Business7 days agoIndia Us Trade Deal: Fresh look at India-US trade deal? May be ‘rebalanced’ if circumstances change, says Piyush Goyal – The Times of India

-

Business1 week ago

Business1 week agoAttock Cement’s acquisition approved | The Express Tribune

-

Politics1 week ago

Politics1 week agoUS arrests ex-Air Force pilot for ‘training’ Chinese military

-

Business6 days ago

Business6 days agoGreggs to reveal trading amid pressure from cost of living and weight loss drugs

-

Sports6 days ago

Sports6 days agoLPGA legend shares her feelings about US women’s Olympic wins: ‘Gets me really emotional’

-

Fashion7 days ago

Fashion7 days agoTexwin Spinning showcasing premium cotton yarn range at VIATT 2026