Fashion

US retailers split on holiday prospects amid consumer caution

By

Reuters

Published

August 20, 2025

Mixed sales and profit forecasts from major US retailers such as Target and Home Depot have prompted investors to question if this year’s crucial holiday season will yield the windfall typically associated with a year-end shopping surge.

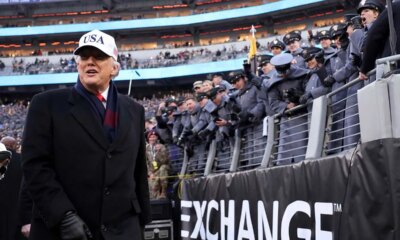

Rising costs driven by US President Donald Trump‘s import tariffs and subdued consumer spending have given rise to fresh worries about the resilience of the American shopper. “We are planning cautiously for the back half of the year, given continued uncertainty and volatility,” Target’s chief commercial officer, Rick Gomez, said on Wednesday.

Consumer and retail companies have also been among the worst hit by tariffs. The unpredictable nature of Trump’s trade policies has contributed to a decline in US consumer sentiment, as shoppers expect tepid economic growth and higher inflation in the coming months.

Overall inflation in the United States has been trending higher and economists are concerned that higher prices could be in store for consumers after a recent spike in wholesale-level inflation. Over the past few weeks, Adidas said it could launch new products at higher prices in the US, Levi Strauss said it would cut back on promotions, while Under Armour is considering bumping up prices for consumers who have the pricing power to tackle tariffs.

“We are learning a lot about the health of the consumer. They are still interested in spending, but not splurging. Some of the comments companies gave months ago about not hiking prices due to tariffs… (are) proving to be more lip-service than reality,” Brian Jacobsen, chief economist at Annex Wealth Management said.

While the broader stock market has performed well in 2025 – the S&P 500 is up more than 8% – consumer discretionary stocks have lagged, gaining only about 1%. On the other hand, TJX, parent of T.J. Maxx and Marshalls, touted a “strong start” to the second half of the year. Home Depot posted disappointing quarterly results, citing consumer hesitation on big-ticket purchases, but maintained its forecasts.

“Value is very top of mind for consumers right now. They’re looking to stretch their budget; they’re looking to navigate inflation and uncertainty around tariffs,” Target’s incoming CEO Michael Fiddelke said. Target reiterated that it would hike prices as a “last resort,” while Lowe’s said it would remain “price competitive”.

Target shares slumped nearly 8% on Wednesday after the company named Fiddelke as its new CEO and kept its forecasts intact. Lowe’s managed to beat earnings estimates but acknowledged that home improvement demand remains soft due to high borrowing costs. The company will continue to face challenges in the back half of the year due to high mortgage rates and cautious consumers, executives said in a post-earnings call.

The Reuters global tariff tracker shows that of the more than 300 companies that have reacted to the tariffs in some manner since February 1, about 38 consumer companies have withdrawn or cut their forecasts, while about 42 have mentioned price hikes.

© Thomson Reuters 2025 All rights reserved.

Fashion

Xreal files patent suit against rival smart glasses maker Viture

By

Bloomberg

Published

January 15, 2026

Xreal Inc., a Chinese pioneer in smart glasses, is suing Viture Inc. for patent infringement in the US, arguing its rival has unfairly capitalized on Xreal’s extensive research and investment in the segment.

The lawsuit, filed Thursday in federal court in eastern Texas, accuses San Francisco-founded Viture of unlawfully incorporating Xreal’s patented inventions into smart glasses such as the Luma Pro, Luma Ultra, and a high-end pair called The Beast.

Both Xreal and Viture manufacture augmented reality, or AR, glasses that plug into devices like smartphones and laptops, offering viewers a large virtual display for watching movies or handling productivity tasks. Technical specifications like display resolution and field of view- the size of the augmented world you can see at any given time- are often very similar between the two brands.

Their US legal battle comes ahead of what is expected to be a pivotal moment for the segment, with Apple Inc. expected to make its category debut as soon as this year, Bloomberg has reported.

Xreal holds over 800 patent and patent applications worldwide, including dozens in the US and Europe, it said in a statement Thursday announcing the lawsuit. “By comparison, Viture owns approximately or fewer than 70 patent and patent applications globally, with none in the United States or Europe,” it added.

“The lawsuit is not merely about enforcing a single patent,” Xreal said in the statement. “It is about stopping a pattern of intellectual property infringement that undermines the integrity of innovation and endangers continued technological development in this industry.”

Xreal holds more global market share than Viture in the AR eyewear category, according to research firm IDC. But both companies lag far behind Meta Platforms Inc., which has come the closest to mainstream success with its Ray-Ban line of smart glasses.

At the CES technology trade show earlier this month, Xreal unveiled a new entry-level pair of glasses and a co-branded set of glasses developed with Taiwan’s Asustek Computer Inc. It also announced that it’s extending a partnership with Alphabet Inc.’s Google.

Xreal said in the statement that these and other collaborators are “owed confidence that their co-developed products will not also be threatened by infringers attempting to benefit from infringement or undermined by unauthorized usage of IP.”

Fashion

Soshiotsuki wows with international debut at Pitti Uomo 109

Published

January 15, 2026

Designer Soshi Otsuki won himself a huge ovation at the key gala show of Pitti Uomo on Thursday after presenting a brilliant collection that celebrated classic western tailoring, even as it subverted its codes.

A tour de force of draping, cutting, and silhouette, this fall 2026 collection from his brand Soshiotsuki was definitely a major fashion statement.

In a moment of volume in menswear, Otsuki opened the action with a perfectly judged trio of to-die-for double-breasted suits with peak lapels in crepe and fine wool in various shades of grey- cement, mud, or dove.

He cut his jackets to end well below the hip and his trousers were something else. Made with a half-dozen front pleats, they were elephantine but never outrageous. Otsuki is such a great natural tailor, the exaggeration merely added to the elegance.

Soshi is no slouch when it comes to leather either. From his copper-hued leather rock god suit to his cocoon style leather bomber jacket. And, just when you thought he was playing a little too safe, he sent out some fab jeans, so degraded they almost looked moth-eaten. Tokyo street style meets sartorial Italian.

Playing on couture techniques, the designer also whipped up several bias-cut green corduroy blazers and suits marrying Japanese eccentricity and British aplomb.

The show was the latest Italian/Japanese marriage at this edition of Pitti that began with a Sebiro Sanpo tailoring association Japanese suit march inside the Fortezza da Basso, the giant fortress where the salon is staged. Remarkably, Otsuki has never actually studied suiting formally, but he somehow understands it instinctively.

The soundtrack, culled from composer Joe Hisaishi’s soundtrack to Takeshi Kitano’s 2000 gangster movie Brother, featured a beautifully yearning saxophone solo. It would have felt just right for one of Douglas Sirk’s 1950s melodramas starring Rock Hudson. One almost expected Rock to take the final passage.

Presented inside the beautiful Refetterio Santa Maria della Novella, a looming Gothic refectory at the back of the legendary Renaissance Basilica, this was a bravura display.

Altogether, a bases loaded, home run, smash hit collection. One could say it felt like a star is born moment in menswear, except that Soshi Otsuki was already acclaimed. He is the latest winner of the LVMH Prize.

Talk about backing up winning an award with a great fashion statement.

Copyright © 2026 FashionNetwork.com All rights reserved.

Fashion

Skincare brand Genaura promotes marketer Young to MD

Published

January 15, 2026

Luxury skincare brand Genaura has promoted Nicola Young to managing director, moving up from chief marketing officer following the brand’s product launch to market in September.

Young’s promotion is underscored by “an impressive career”, which has included senior positions at Carlton Screen Advertising, marketing director at Jazz FM and Magic 105.4FM, and group director of Marketing at radio conglomerate Global Player.

Most notably, her beauty industry involvement included director of Media UK at Estée Lauder Co.

Young said the launch of Genaura “has the potential to revolutionise the beauty and wellness sector… my experience in this field has helped drive the marketing vision so far, and I look forward to progressing even further”.

She added: “Looking to… the growth of Genaura, I am excited to scale and innovate whilst remaining authentic to the scientific background of the product, planning global recognition of this revolutionary ingredient exclusive to Genaura.”

Available in the UK currently, the business has “aspirations for 2026 and beyond… extending skincare products within the range.”

Genaura claims to be a “world first in skincare”, with its Genaura Levagen + Smart Face serum “boasting a powerhouse formula alongside patented technology… creating an ‘age-proofing’ approach to the skin and supporting the skin’s natural barrier function”.

Copyright © 2026 FashionNetwork.com All rights reserved.

-

Politics1 week ago

Politics1 week agoUK says provided assistance in US-led tanker seizure

-

Entertainment1 week ago

Entertainment1 week agoDoes new US food pyramid put too much steak on your plate?

-

Entertainment1 week ago

Entertainment1 week agoWhy did Nick Reiner’s lawyer Alan Jackson withdraw from case?

-

Business1 week ago

Business1 week agoTrump moves to ban home purchases by institutional investors

-

Sports5 days ago

Sports5 days agoClock is ticking for Frank at Spurs, with dwindling evidence he deserves extra time

-

Sports1 week ago

Sports1 week agoPGA of America CEO steps down after one year to take care of mother and mother-in-law

-

Business1 week ago

Business1 week agoBulls dominate as KSE-100 breaks past 186,000 mark – SUCH TV

-

Sports6 days ago

Commanders go young, promote David Blough to be offensive coordinator