Business

Venezuela crisis: Donald Trump says US oil firms will enter country; assures supply to China – The Times of India

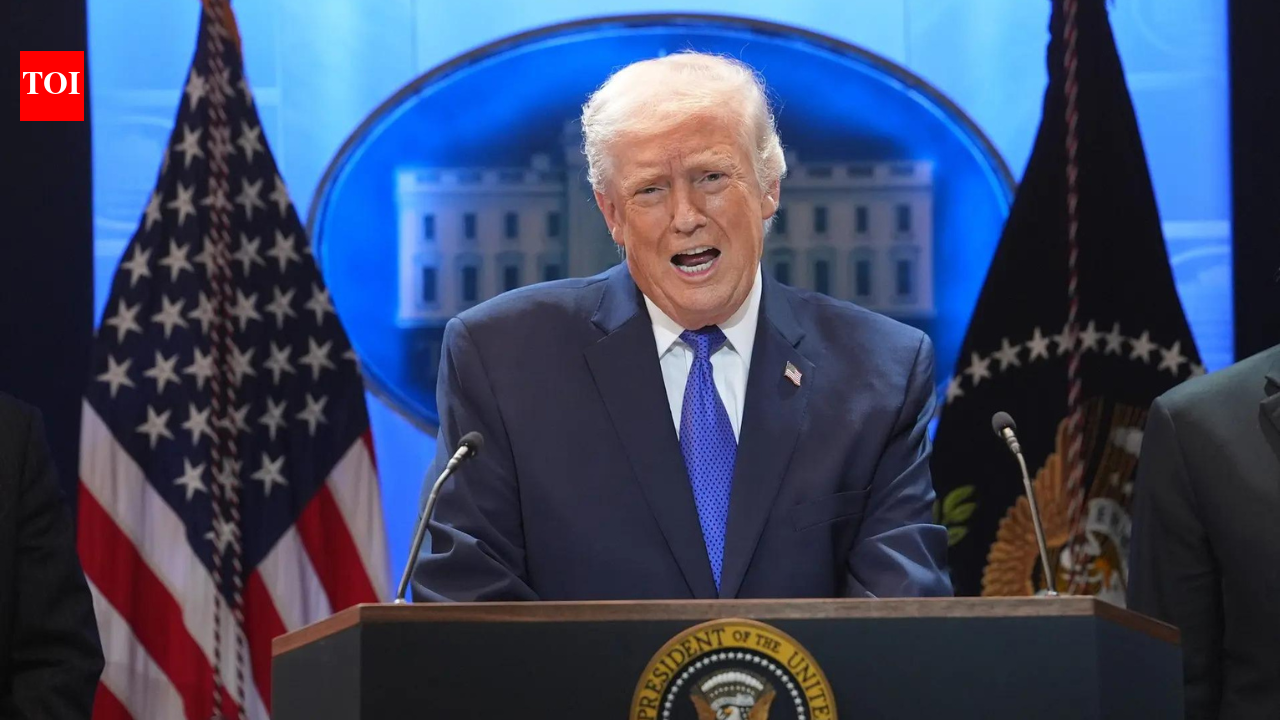

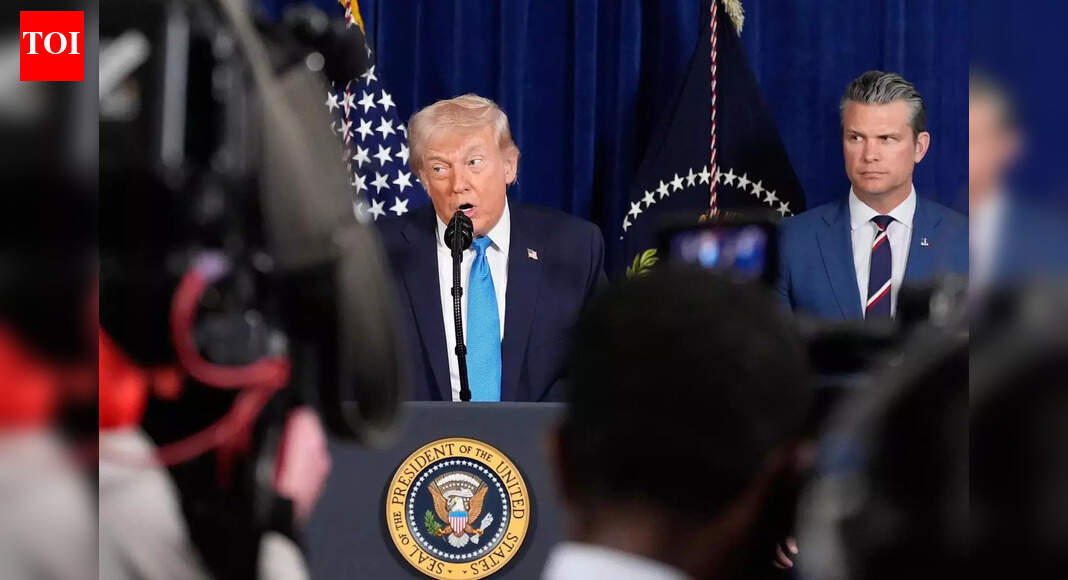

US President Donald Trump has said American oil companies will be allowed to move into Venezuela to tap its vast crude reserves following a US military operation that led to the capture of President Nicolás Maduro.Speaking at a press conference on Saturday, Trump said major US energy firms would invest billions of dollars to repair Venezuela’s damaged oil infrastructure and restart production. “We’re going to have our very large United States oil companies, the biggest anywhere in the world, go in, spend billions of dollars, fix the badly broken infrastructure, the oil infrastructure, and start making money for the country,” he said.Trump added that the United States would then sell “large amounts” of Venezuelan oil to other countries, according to AP.“We’re in the oil business. We’re going to sell it to them,” Trump said during the news conference. He added that oil companies will pay to rebuild Venezuela’s oil infrastructure.At the same time, he made it clear that US sanctions remain in place. “The embargo on all Venezuelan oil remains in full effect,” Trump said.Meanwhile, in a phone interview, President Donald Trump said the United States would ensure uninterrupted supply, dismissing concerns over China. Trump said he shared “very good relations” with Chinese President Xi Jinping and insisted there would be no problems with Beijing. “They will get the oil. We will let people have the oil,” he added.Venezuela has been under US oil sanctions since 2019 and currently produces about one million barrels of crude per day, much of which is sold on the black market at heavy discounts, as per AFP.Trump described Venezuela’s oil sector as a “total bust” for years despite holding the world’s largest proven crude reserves. He said the proposed US “partnership” would make Venezuelans “rich, independent and safe”, adding that Venezuelans living in the US would be “extremely happy” and “not going to suffer any more”, reported AFP.The president repeated similar remarks in a television interview, saying the US would be “very strongly involved” in Venezuela’s oil industry, without spelling out the details.Venezuela’s proven reserves are estimated at around 303 billion barrels, accounting for about 17 per cent of global reserves, as per The Hill.Trump’s comments came hours after Washington announced it had captured Maduro in an overnight military operation. Maduro and his wife were taken from a military base and flown out of the country aboard a US warship, with Trump saying they were headed to New York to face criminal charges. He also said the US planned to run Venezuela temporarily until a “safe, proper and judicious transition” of power could take place, reported AP.As part of a weeks-long military pressure campaign ahead of the raid, US forces seized at least two oil tankers that Washington said were operating in violation of sanctions.Trump also issued a warning to other political and military figures in Venezuela, saying “what happened to Maduro can happen to them,” according to AFP. He again accused Caracas of using oil revenues to finance “drug terrorism, human trafficking, murder and kidnapping”, allegations long denied by the Venezuelan government, as per AFP.Trump said he personally watched the military operation in real time and praised it as “extremely successful”, adding that US forces were prepared for further action if required.While US oil major Chevron already operates in Venezuela under limited sanctions waivers, Trump’s remarks signal a far deeper American role in the country’s energy sector once political control is restructured. How and when US oil firms would enter Venezuela, and under what legal framework, remains unclear.

Business

PM Modi warns against ‘Digital Arrest’ scams, Urges citizens to keep KYC updated

New Delhi: In his latest Mann Ki Baat address to the nation, Prime Minister Narendra Modi urged citizens to stay vigilant against growing digital scams that target unsuspecting users — especially those involving fraudulent claims of digital arrests or legal actions.

The Prime Minister also highlighted the importance of keeping Know Your Customer (KYC) information up to date across financial and digital platforms to avoid becoming a victim of fraud and to ensure seamless access to essential services.

What Are Digital “Arrest” Scams?

Digital arrest scams are a type of online fraud where criminals send messages — typically through SMS, email or messaging apps — claiming that the recipient has been “digitally arrested” or faces some legal trouble. These messages often include:

Fake links

Threatening language

Instructions to click or respond immediately

Once a victim interacts with the link, attackers can steal personal data, banking information, or install malware on the device. PM Modi warned that such scams are increasing in frequency, and citizens should be wary of unexpected messages that create panic or urgency.

Why Keeping KYC Updated Matters

KYC — short for Know Your Customer — is a process used by banks, telecom companies, digital payment apps and financial institutions to verify a person’s identity. Updated KYC records help:

Prevent fraud and identity theft

Enable secure access to banking and financial services

Ensure government welfare and subsidy schemes reach the right beneficiaries

The Prime Minister reminded people that keeping KYC details updated makes it harder for fraudsters to misuse personal information and easier for individuals to access services without interruption.

Tips to Avoid Digital Scams

PM Modi shared practical advice for all citizens to protect themselves online:

Don’t click on suspicious links — especially from unknown senders or unexpected messages.

Verify messages claiming legal issues — contact official authorities instead of reacting to urgent claims.

Use secure apps and websites — check URLs carefully and only use trusted platforms.

Regularly update passwords and security settings — avoid sharing OTPs or passwords with anyone.

The emphasis was on caution and common sense — an informed user is a safer user.

Broader Digital Awareness

Digital scams are not limited to arrest threats. Other common fraud tactics include:

Fake investment or win-money schemes

Fraudulent job offers

Phone call impersonations

Fake customer care messages

By staying alert and informed, citizens can spot red flags and report suspicious activity swiftly.

PM’s Message on Digital Safety

In his address, the Prime Minister emphasized that the digital revolution — from online banking to mobile payments and e-commerce — has brought tremendous convenience, but it also requires responsible use. While technology empowers users, it also opens opportunities for misuse if proper precautions aren’t taken.

Citizens were encouraged to educate family members, especially the elderly or less digitally fluent, about common scam patterns and digital safety measures.

Keep KYC Status Current

Updating your KYC might feel like a small administrative task, but PM Modi highlighted it as a key defense against fraud. Many services — such as bank accounts, mobile connections, insurance policies, mutual funds, and digital wallets — require up-to-date KYC to function smoothly.

Failing to update KYC can lead to:

Account blocks or freezes

Inability to receive government transfers or benefits

Greater risk of identity misuse

Regularly checking KYC status and updating it when required protects both your financial accounts and digital credibility.

The Bottom Line

In his Mann Ki Baat message, Prime Minister Narendra Modi delivered a simple but powerful point: stay alert, stay informed, and keep your digital and financial details updated. In an era where scams evolve rapidly, proactive citizens are the first line of defense.

By understanding common threats and following basic security practices — such as avoiding suspicious links and maintaining updated KYC — Indians can enjoy the benefits of digital connectivity without falling victim to fraud.

Business

Trump’s tariffs struck down, what’s next? SBI suggests adopting a ‘counter-intuitive’ approach – The Times of India

US Supreme Court’s recent striking down of President Donald Trump’s tariff framework could lift the policy outlook and influence the current climate of uncertainty. A recent report by SBI Research has suggested that countries may have to negotiate with a “counter-intuitive” approach in the interim phase, given that the final say on tariff matters rests with a closely divided US Congress.It further cautioned that the interaction between inter-sovereign treaties and the actions of juristic persons on tariff issues could complicate, and possibly disrupt, the effort to establish a consistent tariff regime.

“Unscrapping of the tariff structure by the Court(s) can upend uncertainty going forward while jurisdictions need to put in place counter intuitive negotiation to position themselves strategically in the intermittent period where ultimate power lies with a delicately balanced US Congress,” the report stated.The assessment comes after a landmark judgment by the US Supreme Court, which invalidated the President’s use of the International Emergency Economic Powers Act (IEEPA), 1977, to levy tariffs. SBI Research pointed out that the statute had never previously been deployed by any President for tariff imposition and has limited grounding during peacetime.Meanwhile, after the verdict, the executive branch has turned to Section 122 of the Trade Act of 1974 to introduce a temporary 10% global tariff on all imports into the United States. The report highlighted that this is the first time Section 122 powers have been exercised. The measure will come into force on 24 February 2026 and is set to run for 150 days, ending in July unless Congress approves its continuation.Under provisions of the Trade Act, the President may impose temporary import surcharges of up to 15% or apply quotas to address balance of payments concerns. Such actions, however, cannot extend beyond 150 days unless lawmakers pass legislation to prolong them.The newly imposed 10% tariff includes carve-outs. Goods from Canada and Mexico that meet the requirements of the US-Mexico-Canada Agreement (USMCA) are exempt, as are certain national security tariffs that are already operational.SBI Research expects the administration to use the interim window to complete investigations and potentially impose tariffs through Section 301 and Section 232 mechanisms.The report also observed that the court’s ruling may not fully block Trump from introducing similar tariffs under other statutory authorities.It further warned of implications for existing trade arrangements. Because IEEPA-related tariffs have supported trade agreements worth trillions of dollars, including those involving China, the United Kingdom and Japan, the judgment could create fresh uncertainty around several current deals, the report said.

Business

Ofgem price cap – what is happening to my energy bill?

Latest predictions suggest Ofgem will reduce the energy price cap by £117 to £1,641 a year for a typical dual fuel household from April 1 when it makes its announcement on Wednesday.

– What is Ofgem’s price cap?

The energy price cap sets a maximum price that suppliers can charge customers in England, Scotland and Wales for each unit of gas and electricity they use.

It also sets a maximum daily standing charge – the cost of having your home connected to the grid.

The headline price cap figure provided by Ofgem indicates what a household using gas and electricity, and paying by direct debit, can expect to pay if their energy consumption is typical.

It is important to note that it does not limit a home’s total bills because people still pay for the amount of energy they use – so if it is above the average they will pay more, and if it is below they will pay less.

Energy is regulated separately in Northern Ireland.

– What’s changing with my energy bill this time?

The next price cap, which will take effect from April 1, will be the first to reflect Chancellor Rachel Reeves’ promise last November that £150 would be cut from the average household bill.

She is achieving this by shifting 75% of the Renewables Obligation (RO) costs from household energy bills into general taxation, and scrapping the Energy Company Obligation (Eco) scheme introduced by the Tories in government which was funded by bills and designed to tackle fuel poverty by improving housing conditions, but which has been beset with delivery problems.

This will mainly translate through to customer bills by a cut to households’ electricity unit rates, with an expected reduction of around 3.37p per kilowatt hour (kWh) from the previous quarter.

– Why won’t I see a £150 discount on my bill?

The discount will be applied via a lower unit rate rather than a one-off amount.

It should also be stressed that the £150 figure is an average, and amounts will vary based on the size and type of household and how much energy they use.

Also, industry analysts Cornwall Insight have said the changes are likely to reduce the cap by about £145 a year once VAT and other pricing allowances are taken into account.

It added that increases in costs associated with the operation and maintenance of gas and electricity networks, which are paid for from customer bills, have offset part of these savings.

– Do I need to do anything?

Households should look out for information arriving from their suppliers after the price cut is announced, particularly around the rates they pay for each unit of gas and electricity.

This information will be important for those considering switching away from the price cap to a cheaper fixed tariff, and those looking for a new fixed tariff, as comparing unit prices is key to finding a good deal.

– Is now a good time to switch?

It is always worth investigating fixed deals, taking into account any length-of-time obligations that could result in exit fees.

As a rule of thumb, Which? recommends looking for deals cheaper than the price cap (this is where comparing gas and electricity unit rates is important, rather than looking at headline figures), not longer than 12 months and without significant exit fees.

However, the End Fuel Poverty Coalition said it understood that some fixed tariffs will include announced cuts from February 25, and some will not.

It warned that this could make switching and fixing – that is already confusing – “even more difficult to gauge”.

It said households may prefer to wait for the dust to settle on Wednesday’s announcement before signing up to a fixed term deal or changing supplier.

– Are prices going to keep going down, or should we expect increases in the future?

Cornwall Insight currently expects the price cap to remain relatively steady throughout 2026, with a small fall forecast in July.

However, it said these predictions may shift as wholesale markets change and potential policy cost announcements happen.

-

Entertainment5 days ago

Entertainment5 days agoQueen Camilla reveals her sister’s connection to Princess Diana

-

Tech5 days ago

Tech5 days agoRakuten Mobile proposal selected for Jaxa space strategy | Computer Weekly

-

Politics5 days ago

Politics5 days agoRamadan moon sighted in Saudi Arabia, other Gulf countries

-

Entertainment5 days ago

Entertainment5 days agoRobert Duvall, known for his roles in "The Godfather" and "Apocalypse Now," dies at 95

-

Politics5 days ago

Politics5 days agoTarique Rahman Takes Oath as Bangladesh’s Prime Minister Following Decisive BNP Triumph

-

Tech5 days ago

Tech5 days agoBusinesses may be caught by government proposals to restrict VPN use | Computer Weekly

-

Sports5 days ago

Sports5 days agoUsman Tariq backs Babar and Shaheen ahead of do-or-die Namibia clash

-

Business5 days ago

Business5 days agoTax Saving FD: This Simple Investment Can Help You Earn And Save More