Business

Walmart-backed fintech OnePay is bringing crypto to its banking app, sources say

OnePay, the fintech firm majority-owned by Walmart, will soon offer cryptocurrency trading and custody on its mobile app, CNBC has learned.

OnePay will offer customers access to bitcoin and ether later this year with help from the startup Zerohash, according to people with knowledge of the matter who declined to be identified before an official announcement.

The move shows that OnePay, founded by Walmart and venture firm Ribbit Capital in 2021, sees crypto as a core offering as it builds out its “everything app” for digital finance.

The fintech firm has methodically added new products in its quest to become an American super app akin to overseas offerings like WeChat. The company now offers banking services including high-yield savings accounts; credit and debit cards; buy now, pay later loans and even wireless plans.

By allowing OnePay users to hold bitcoin and ether in their mobile app, customers could presumably convert their crypto into cash and then use those funds to make store purchases or pay off card balances.

Spokespeople for New York-based OnePay and Chicago-based Zerohash declined to comment.

Walmart-backed OnePay offers credit and debit cards, high-yield savings accounts, buy now, pay later loans and a digital wallet with peer-to-peer payments.

Photo obtained from OnePay website

Crypto continues to gain mainstream adoption after the U.S. government’s stance towards the nascent technology flipped with the election of President Donald Trump. Big banks that couldn’t previously develop crypto offerings are now starting to do so; last month Morgan Stanley said it would soon offer retail clients direct access to crypto through its E-Trade subsidiary.

The overall trend has boosted a constellation of public and private companies involved in crypto. Last month, Zerohash raised $104 million in funding from financial firms including Morgan Stanley and Interactive Brokers, part of its strategy to enmesh itself with banks and brokers that are building crypto products.

For OnePay, which benefits from its ties with the world’s largest retailer, there are signs that its mobile app is gaining traction, even before the crypto rollout.

The fintech firm is now No. 5 on Apple’s app store ranking for free finance apps, ahead of larger companies including JPMorgan Chase, Robinhood and Chime. Nearly all the apps ahead of OnePay in that list, including PayPal, Venmo and Cash App, already offer crypto.

From the time it was created, OnePay’s big advantage was in its distribution channel. The firm’s app is integrated into the in-person and online checkout process at Walmart’s U.S. locations, giving it access to the 150 million Americans who shop there every week.

But OnePay was created as an entity separate from the retailer so it wouldn’t be limited to only Walmart customers, instead appealing to the broader population of Americans who are underserved by traditional banks.

Business

Gold Prices: Gold retreats on strong dollar after four-day rally – The Times of India

Gold slumped more than 5%, ending a four-day rally on Tuesday. The metal was weighed down by a stronger dollar and fading prospects of an interest rate cut as inflation concerns intensified against the backdrop of a potentially prolonged conflict in West Asia. Spot gold was down 5.6% at $5,029.59 an ounce whereas prices had hit an over four-week high in the previous session. US gold futures lost 5.1% to $5,041.50.The US dollar, a competing safe-haven asset, rose to an over one-month peak, making dollar-priced bullion less affordable for holders of other currencies. US Treasury yields rose for a second consecutive session.Indian bullion traders and associations are speculating that gold could attain Rs 2 lakh per 10 gm and silver may well scale Rs 3.5 lakh per kg if the conflict does not abate swiftly.Spot silver fell 11.2% to $79.42 an ounce after climbing to a more than four-week high on Monday. As the Iran conflict entered its fourth day, crude oil benchmarks jumped over 8% in response.

Business

Oil Prices: US, Israel attack Iran: With oil prices up, forex volatility set to continue – The Times of India

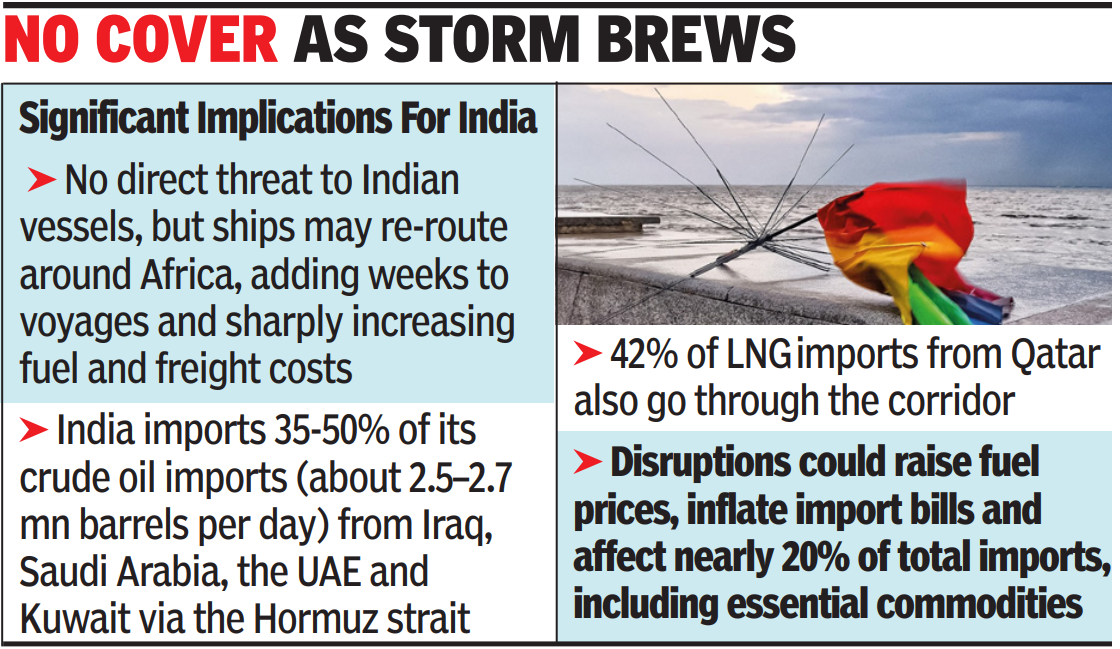

MUMBAI: The rupee is likely to come under renewed pressure when forex markets open on Wednesday as the conflict in West Asia has worsened the trade and energy situation beyond expectations of analysts.On Tuesday, the Indonesian rupiah, South Korean won and Thai baht each fell by more than 1%, leading losses in Asia, while broader emerging-market currency indices dropped about 0.5% in their worst session since Nov 2024. The selloff followed a sharp escalation in the conflict, with Iran moving to effectively choke tanker traffic through the Strait of Hormuz, sending crude prices up roughly 9% in London trading. The spike in oil heightened concerns over inflation, wider current account deficits and delayed rate cuts in oil-importing economies. Investors rushed into the US dollar and gold, pushing the dollar to multi-month highs and triggering capital outflows from riskier assets.According to KN Dey, forex consultant, the rupee is most likely to breach 92 level this week. “Oil prices have risen sharply and supply chains are getting disrupted. Most Asian currencies have already fallen, with the Korean won and the Malaysian ringgit down over 1%. The rupee will open under pressure and a gap-down start is likely. Stop-loss levels could trigger early, adding to volatility,” he said. “Going ahead would be very tough, RBI’s intervention would only act as a speedy breaker.“What has worsened the conflict situation is that it has created a supply-chain crisis. “Beyond the immediate risk to oil and gas supplies from the Gulf, the broader concern is how the conflict may influence trade behavior across Asia,” said Choon Hong Chua, senior director, Moody’s. “This raises the risk of selective export restrictions, informal boycotts, and tighter customs scrutiny as govts seek to limit exposure to secondary sanctions or political repercussions,” he added.

Business

Iran Conflict: Middle East tensions: Global insurers exit Iranian waters as conflict deepens – The Times of India

MUMBAI: India’s trade and energy supplies face fresh risks after reinsurers and Protection & Indemnity (P&I) clubs announced cancellation of war risk insurance for vessels transiting the Strait of Hormuz and Iranian waters, following an escalation in the Iran conflict. The cancellations, effective from this week, have left over 150 vessels stranded and disrupted a corridor that handles nearly one-fifth of global oil flows.P&I clubs are mutual, non-profit insurance associations owned by shipowners. They provide third-party liability cover through a pooled premium for risks such as cargo damage, pollution, crew injuries and collisions that are not covered under hull insurance. The clubs also provide legal support and dispute resolution across jurisdictions.“The industry is currently in a wait-and-watch mode, as much depends on how long the conflict persists. If it turns prolonged, insurers are likely to come together to create additional capacity for war-risk cover. Typically, there is an immediate surge in demand when hostilities break out, but that demand tends to ease quickly if the situation stabilises in a short span,” said Tapan Singhel, MD & CEO, Bajaj General Insurance.

Brokers said that in the past when international reinsurers ceased to provide cover for some risks like terrorism the Indian market had provided the capacity by building an insurance pool where domestic companies come together and share the risks. However, this tie state-owned reinsurer GIC Re, which leads domestic marine pools, has itself issued cancellation notices for marine hull war risk covers effective March 3, 2026, mirroring global reinsurers and P&I clubs. The crisis has brought marine insurance centerstage, the share of this line of non-life had shrunk to around 2% of industry premium as risks ebbed due to containarisation and more safety in transport. The size of the premium also determines the capacity of the industry to provide large covers.Their role is central to global shipping. Without P&I cover, shipowners face potentially unlimited liabilities in the event of accidents, pollution or war-related damage. In high-risk zones, the absence of insurance effectively halts voyages, as operators are unwilling to expose vessels to uninsured losses. In previous crises in the Red Sea, war risk exclusions by insurers sharply curtailed traffic and drove up freight rates.In the current episode, major P&I clubs and reinsurers have issued notices cancelling war risk cover for Iranian waters, the Persian Gulf and the Strait of Hormuz, citing tanker damage, casualties and threats from Iranian forces. Reports of VHF warnings and GPS disruptions have added to concerns. Insurers have invoked standard cancellation clauses following US and Israeli strikes on Iran, with broader policy implications if the conflict further widens.Fresh war risk cover may be available, but at sharply higher premiums. Rates that were around 0.25% of vessel value have surged multiple times, rendering transits commercially unviable for many operators. Even where cover is available, shipowners remain wary of risks such as seizures or missile strikes.

-

Politics6 days ago

Politics6 days agoWhat are Iran’s ballistic missile capabilities?

-

Politics6 days ago

Politics6 days agoUS arrests ex-Air Force pilot for ‘training’ Chinese military

-

Business1 week ago

Business1 week agoHouseholds set for lower energy bills amid price cap shake-up

-

Sports1 week ago

Sports1 week agoTop 50 USMNT players of 2026, ranked by club form: USMNT Player Performance Index returns

-

Sports6 days ago

Sports6 days agoSri Lanka’s Shanaka says constant criticism has affected players’ mental health

-

Business1 week ago

Business1 week agoLucid widely misses earnings expectations, forecasts continued EV growth in 2026

-

Fashion5 days ago

Fashion5 days agoPolicy easing drives Argentina’s garment import surge in 2025

-

Fashion5 days ago

Fashion5 days agoTexwin Spinning showcasing premium cotton yarn range at VIATT 2026