Business

What Is The Federal Reserve And Why Trump Removed Its Governor

Last Updated:

“Trump’s unprecedented removal of US Federal Reserve Board Governor Lisa Cook comes amid his criticism that the central bank’s high interest rates hurt his economic agenda

If Trump succeeds in removing Lisa Cook, he will be able to nominate her successor, potentially reshaping the Fed’s governing board for the next several years. (AP/File)

President Donald Trump on Monday abruptly removed Lisa Cook from her position as a governor of the US Federal Reserve Board, effective immediately. Cook, who has not faced any accusations or convictions, said her dismissal lacks legal justification and confirmed she has no intention of resigning.

This unprecedented move by Trump comes amidst his outspoken criticism of the Federal Reserve for not reducing interest rates, which he believes undermines his efforts to strengthen the US economy.

Cook, the first black woman to serve as a Fed governor, stated, “President Trump attempted to dismiss me ‘with reason’, while there is no such reason under the law. He has no right to do so.” She affirmed, “I will not resign. I will continue to perform my duties to help the US economy, as I have been doing since 2022.”

Cook, who was appointed by former President Joe Biden, has engaged high-profile lawyer Abbe Lowell to represent her. Cook previously held positions at the US Treasury and the White House under former President Barack Obama.

Lowell commented, “President Trump has once again resorted to social media to ‘attack via tweet’ and once again his threatening response is flawed. His demands lack any due process, basis, or legal authority.” He emphasised, “We will take whatever action is necessary to stop his illegal action.”

He said that Cook plans to file a lawsuit challenging her dismissal. A Federal Reserve spokesman did not immediately comment on Trump’s letter.

This episode could lead to a prolonged legal battle, with significant stakes including the credibility of the US dollar as the world’s safe currency.

The Federal Reserve And Its Board of Governors

The US Federal Reserve comprises 12 reserve banks, each with a president, and a seven-member board of governors. The Fed has five key roles: conducting US monetary policy, promoting financial system stability, supervising and regulating financial institutions, promoting the safety and efficiency of payment and settlement systems, and promoting consumer protection and community development.

The Board of Governors, an agency of the US federal government, plays a crucial role in guiding the operations of the Federal Reserve System and overseeing the reserve banks. Its members are nominated by the President and confirmed by the Senate, but the board reports to and is directly accountable to Congress.

Allegations Against Cook

Trump has accused Cook of making false statements regarding loans on two houses in 2021.

He wrote, “For example, as detailed in the criminal referral, you signed a document certifying that a property in Michigan would be your primary residence for the next year.”

He continued, “Two weeks later you signed another document for a property in Georgia, stating that it would be your primary residence for the next year.”

Trump claimed that it is unthinkable that Cook was not aware of her first commitment when she made the second.

He concluded, “Given your deceptive and potentially criminal conduct in financial matters, the American people cannot trust your honesty and neither do I. At a minimum, this conduct demonstrates gross negligence in financial transactions, which calls into question your qualifications and credibility as a financial regulator.” Interest rates on loans for houses designated as primary residences in the US are low.

Legality Of Trump’s Move

Under the Federal Reserve Act, each member holds office for a term of fourteen years from the expiration of their predecessor’s term, unless removed earlier by the president for cause. ‘Cause’ typically means misbehaviour or incapacity while in office.

Trump stated, “I have found that sufficient cause exists to remove you from office.”

In a statement issued through her lawyers, Cook maintained that Trump had attempted to fire her without any legal cause or authority. Questions arise whether Cook can be fired while the investigation is pending and if Trump has sufficient evidence to claim ’cause.’

Historically, the US central bank has been shielded from direct political actions, and the US Supreme Court indicated this May that it is willing to provide broader protections to Fed governors.

The court stated, “The Federal Reserve is a uniquely structured, quasi-private entity that follows the distinguished historical tradition of America’s First and Second Banks.”

Potential Outcome If Cook Is Removed

If Trump succeeds in removing Cook, he will be able to nominate her successor, potentially reshaping the Fed’s governing board for the next several years. Fed governors typically serve 14-year terms. Two of the current seven governors, Christopher Waller and Michelle Bowman, were appointed by Trump. Trump appointed Jerome Powell as the chairman of the Federal Reserve in 2017.

As of Monday, the Board of Governors had six members, including Cook, with one seat vacant following Adriana Kugler’s resignation earlier this month. Trump has nominated Stephen Miran, chairman of the Council of Economic Advisors, to fill Kugler’s place. If Miran’s appointment is confirmed by the Senate and Trump succeeds in removing Cook and appointing her successor, Trump will secure a 4-3 majority on the board.

Read More

Business

‘Holistic And Forward-Looking’: Piyush Goyal Says Budget 2026 Reflects Future-Ready India

Last Updated:

Piyush Goyal termed the Budget “economically and fundamentally very strong”, and stated that it “reflects the aspirations of the youth of the country”.

Minister of Commerce and Industry Piyush Goyal. (File photo)

Union Minister Piyush Goyal on Sunday termed Budget 2026 “futuristic and holistic”, and stated that it “reflects the aspirations of the youth of the country and is forward-looking”.

Speaking exclusively to CNN-News18 on Budget 2026, presented by Finance Minister Nirmala Sitharaman, Goyal said, “This is a fabulous budget and it is very futuristic. The Budget 2026 has covered all sectors including technology, infrastructure, etc.”

“The technology sector has been given a thrust. The budget focuses on infrastructure. It is a holistic and forward-looking budget refecting future ready Bharat,” he said, adding, “The budget meets the aspirations of the youth and new India.”

Stating that the Budget is economically and fundamentally very strong, the Union Minister said, “Farmers, animal husbandry and labour-intensive sectors get a major push as this Budget focuses on investment, value addition and jobs.”

#Exclusive | “The Budget is economically and fundamentally very strong,”Preparing India for Viksit Bharat. Farmers, animal husbandry and labour-intensive sectors get a major push as the Budget focuses on investment, value addition and jobs.@Parikshitl in an exclusive… pic.twitter.com/tJr2SItcaW

— News18 (@CNNnews18) February 1, 2026

‘Budget 2026 Is Human-Centric’: PM Modi

Prime Minister Narendra Modi on Sunday said that the Union Budget 2026 is “human-centric and strengthens India’s foundation with path-breaking reforms.” The Prime Minister also described it as historic and a catalyst for accelerating the country’s reform trajectory and long-term growth.

Following the presentation of the Budget in Parliament, PM Modi said the proposals would energise the economy, empower citizens and give India’s youth fresh opportunities to scale new heights.

“This budget brings the dreams of the present to life and strengthens the foundation of India’s bright future. This budget is a strong foundation for our high-flying aspirations of a developed India by 2047,” he said.

Calling the government’s reform agenda a “Reform Express”, the Prime Minister added, “The reform express that India is riding today will gain new energy and new momentum from this budget.”

February 01, 2026, 19:01 IST

Read More

Business

How inflation rebound is set to affect UK interest rates

Interest rates are widely expected to remain at 3.75% as Bank of England policymakers prioritise curbing above-target inflation while also monitoring economic growth, according to expert analysis.

The Bank’s Monetary Policy Committee (MPC) is anticipated to leave borrowing costs unchanged when it announces its latest decision on Thursday, marking its first interest rate setting meeting of the year.

This follows a rate cut delivered before Christmas, which was the fourth such reduction.

At the time, Governor Andrew Bailey noted that the UK had “passed the recent peak in inflation and it has continued to fall”, enabling the MPC to ease borrowing costs. However, he cautioned that any further cuts would be a “closer call”.

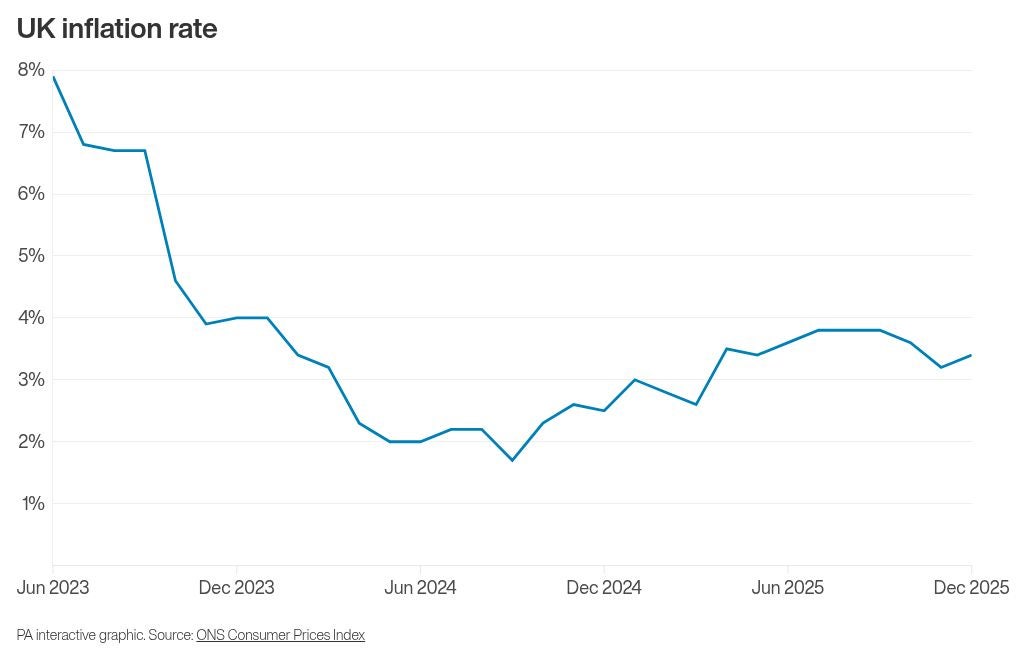

Since that decision, official data has revealed that inflation unexpectedly rebounded in December, rising for the first time in five months.

The Consumer Prices Index (CPI) inflation rate reached 3.4% for the month, an increase from 3.2% in November, with factors such as tobacco duties and airfares contributing to the upward pressure on prices.

Economists suggest this inflation uptick is likely to reinforce the MPC’s inclination to keep rates steady this month.

Philip Shaw, an analyst for Investec, stated: “The principal reason to hold off from easing again is that at 3.4% in December, inflation remains well above the 2% target.”

He added: “But with the stance of policy less restrictive than previously, there are greater risks that further easing is unwarranted.”

Shaw also highlighted other data points the MPC would consider, including gross domestic product (GDP), which saw a return to growth of 0.3% in November – a potentially encouraging sign for policymakers.

Matt Swannell, chief economic advisor to the EY ITEM Club, affirmed: “Keeping bank rate unchanged at 3.75% at next week’s meeting looks a near-certainty.”

He noted that while some MPC members who favoured a cut in December still have concerns about persistent wage growth and inflation, recent data has not been compelling enough to prompt back-to-back reductions.

Edward Allenby, senior economic advisor at Oxford Economics, forecasts the next rate cut to occur in April.

He explained: “The MPC will continue to face a delicate balancing act between supporting growth and preventing inflation from becoming entrenched, with forthcoming data on pay settlements likely to play a decisive role in shaping the next policy move.”

The Bank’s policymakers have consistently voiced concerns regarding the pace of wage increases in the UK, which can fuel overall inflation.

Business

Budget 2026: India pushes local industry as global tensions rise

India’s budget focuses on infrastructure and defence spending and tax breaks for data-centre investments.

Source link

-

Sports5 days ago

Sports5 days agoPSL 11: Local players’ category renewals unveiled ahead of auction

-

Tech1 week ago

Tech1 week agoStrap One of Our Favorite Action Cameras to Your Helmet or a Floaty

-

Sports1 week ago

Sports1 week agoWanted Olympian-turned-fugitive Ryan Wedding in custody, sources say

-

Entertainment1 week ago

Entertainment1 week agoThree dead after suicide blast targets peace committee leader’s home in DI Khan

-

Tech1 week ago

Tech1 week agoThis Mega Snowstorm Will Be a Test for the US Supply Chain

-

Fashion1 week ago

Fashion1 week agoSpain’s apparel imports up 7.10% in Jan-Oct as sourcing realigns

-

Entertainment1 week ago

Entertainment1 week agoUFC Head Dana White credits Trump for putting UFC ‘on the map’

-

Entertainment5 days ago

Entertainment5 days agoClaire Danes reveals how she reacted to pregnancy at 44