Business

Wisdom beyond markets: What is Warren Buffett’s success mantra & how to recreate it? – The Times of India

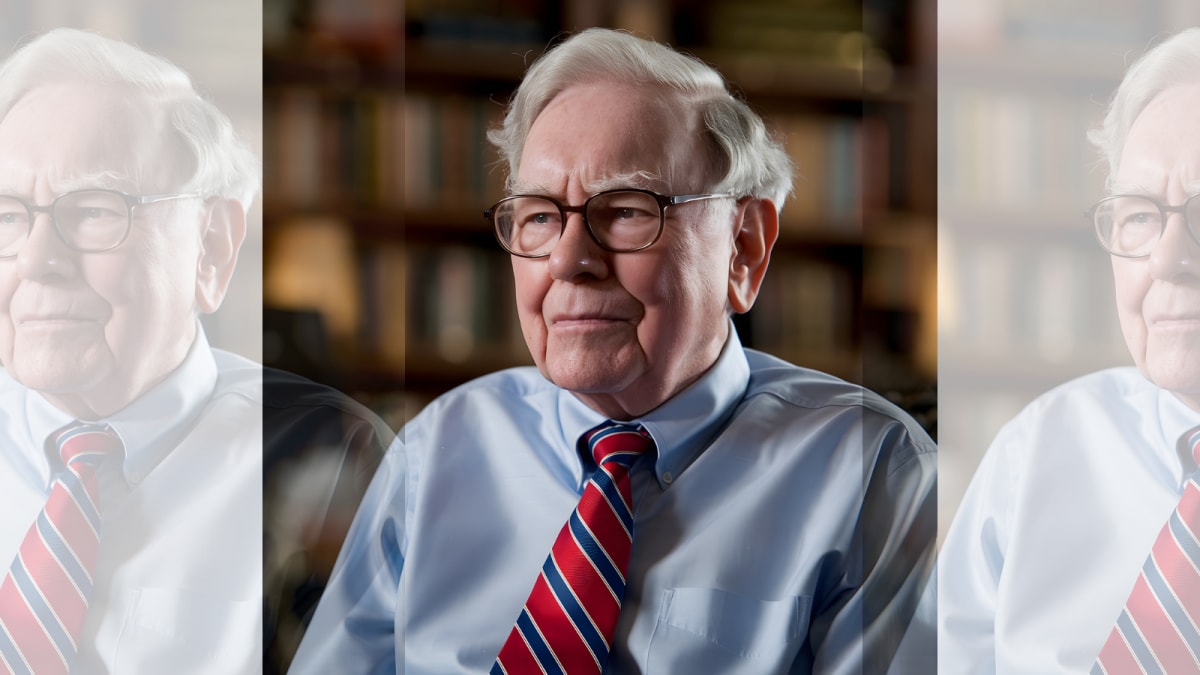

Warren Buffett is known for many things – he is one of the richest persons in the world, a master of investment, the ‘Oracle of Omaha’, Zen master and more. When it comes to business acumen and mastering the stock markets, Buffett’s mantras are cited as near-gospel by investors.As the 95-year-old approaches his retirement as Berkshire Hathaway’s CEO later this year, his remarkable investment acumen has garnered widespread recognition. His achievements have established him amongst history’s most accomplished investors, accumulating wealth estimated at $150 billion.But Buffett’s lessons don’t just extend to markets and investment – they are often regarded as pearls of wisdom for dealing with life’s ups and downs.According to a CNN report, Buffett’s teachings incorporate diverse philosophical traditions, drawing from Zen Buddhism, Confucian thought, Stoic philosophy and New Testament teachings. These principles provide guidance for navigating both financial markets and personal difficulties.

Warren Buffett’s Zen-like principles

Although not religious himself, Buffett’s career reflects substantial engagement with spiritual principles. Religious scholars and practitioners studying Buffett’s approach recognise him not only as a business leader but also as someone who embodies Zen-like wisdom in his methods and teachings, says CNN.Warren Buffett’s spiritual influence has extended globally over the years. His followers attend Berkshire Hathaway shareholder meetings to see the individual whom a financial expert described as “the God of investing.”Buffett himself serves as the primary source of his spiritual wisdom, having developed his own philosophical perspective. Both investors and non-investors study his sayings and teachings, including statements like “Someone is sitting in the shade today because someone planted a tree a long time ago.” He also notes that wealth “lets you be in more interesting environments, but it can’t change how many people love you or how healthy you are.“Such philosophical observations from Buffett have led Leo Babauta, who practises Zen Buddhism, to recognise Buffett’s alignment with Zen principles.“He’s one of the richest men in the world, and yet I really don’t feel like he has made that a central part of who he is,” Babauta, author of “The Power of Less: The Fine Art of Limiting Yourself to the Essential…in Business and in Life,” tells CNN.“He’s surrounded by people who are focused on making money, and he sees how people are deluded (by that). That’s one of the central ideas of Zen: We’re all living these illusions of what’s going to make us happy.”In Buffett’s perspective, excellence in investing and personal integrity are inseparable. He suggests that one can always be in a bull market by adhering to three spiritual guidelines, which he articulates in his own words: ‘Envy and greed go hand in hand’The Ten Commandments include the directive against coveting, whilst envy features amongst the seven deadly sins. According to Buffett, amongst the seven deadly sins, envy stands alone as the only one devoid of pleasure. He has said, “Being envious of someone else is pretty stupid. Wishing them badly, or wishing you did as well as they did — all it does is ruin your day. Doesn’t hurt them at all, and there’s zero upside to it. If you’re going to pick a sin, go with something like lust or gluttony. That way at least you’ll have something to remember the weekend for.”This mindset has implications for investment strategies. Babauta’s analysis of Buffett’s investment approach reveals a conservative methodology rooted in Zen principles. Buffett acknowledges his own boundaries, particularly regarding technology investments, due to his limited understanding of the sector.“You would never find him chasing after cryptocurrency or the latest AI thing,” Babauta says according to CNN. “He looks for things that are fundamentally sound and that kind of discipline can only happen if he didn’t need to chase after things because of his contentment. That contentment, in his case, led to a lot of discipline.”‘More blessed to give than to receive’In June 2006, Buffett announced a big philanthropic commitment through a series of letters, pledging most of his wealth to foundations and charitable organisations. This philanthropic spirit continued in his recent shareholder letter, where he discussed plans to accelerate his charitable giving, allocating approximately a billion dollars to four family foundations.According to the CNN report, Buffett exemplifies the New Testament principle of giving over receiving, setting him apart amongst America’s wealthy. This characteristic inspired Robert L. Bloch, whose father established H&R Block, to compile “The Warren Buffett Book of Investing Wisdom: 350 Quotes from the World’s Most Successful Investor”. Speaking to CNN, Bloch identifies Buffett’s gratitude and generosity as essential spiritual values.Buffett demonstrates genuine concern for underprivileged and ordinary citizens, expressing a desire to contribute to society’s welfare, as Bloch notes. “That’s very spiritual. Not many billionaires are like that.”His charitable nature aligns with ancient Greco-Roman Stoic principles. Philosophers like Epictetus and Marcus Aurelius advocated that virtuous living was essential for happiness, whilst viewing material attachments as obstacles to self-control. As documented by Ryan Holiday, author of popular books on Stoicism, Aurelius, whilst serving as Roman emperor, liquidated palace possessions to reduce empire debt and support Roman citizens.According to Bloomberg Opinion columnist Beth Kowitt, Buffett credits his success to luck. “He is very clear that a lot of his success comes from being born a white male American in the year 1930. I think he believes that his wealth is a product of the system. It’s not all. He doesn’t buy into his own hype. And I think that is really different from what we see from a new cohort of Silicon Valley CEOs who seem to feel that they’ve contributed so much more to society than they’ll get back,” she tells Bloomberg. “This is a little bit of the secret of his success. It’s kind of helped him avoid hubris and the mistakes that come with it. And I think, you cannot recreate Warren Buffett’s luck, but you can certainly try to recreate this mentality,” she says.

Keeping the faith

People in the US have faced significant challenges recently. A Politico survey reveals nearly 50% of citizens struggle with essential expenses like food and healthcare. Various polls indicate that over half of Americans believe the country’s peak has passed.Nevertheless, Buffett maintains optimism in America. This optimistic outlook mirrors the Christian virtue of faith, despite his non-religious stance. According to Christianity’s central figure, faith possesses transformative power. Another New Testament author defines it as “confidence in what we hope for and assurance of what we do not see.”Warren Buffett stands as America’s foremost optimist. During challenging economic periods and political turmoil, he has maintained his positive outlook with statements like, “For 240 years, it’s been a terrible mistake to bet against America, and now is no time to start.” And: “We always live in an uncertain world. What is certain is that the United States will go forward over time.”This unwavering confidence motivated Bloch to explore Buffett’s statements in detail.“You got to have faith that it’s going to get better and we will come out of this,” Bloch explains to CNN, referring to the current political and economic climate in the US. “Look at 1776, 1820, and the Great Depression. America just got bigger and better throughout history.”This steadfast belief appears to be the source of Buffett’s consistent positive attitude. His wholesome Midwestern outlook is captured in his retirement letter: “Kindness is costless, but also priceless.”Unlike many billionaires who display domineering attitudes, Buffett maintains courtesy even towards critical voices at shareholder meetings and avoids associations with questionable individuals. As he stated, “You can’t make a good deal with a bad person.”He frequently discusses an unexpected topic in the competitive investment world: love.His perspective on love is clear: “The only way to get love is to be lovable” as money cannot purchase genuine affection. He believes in the reciprocal nature of love, stating, “The more you give love away, the more you get.”This approach, rather than his successful investments in Coca-Cola, Wells Fargo and Kraft Heinz, might be considered his most significant contribution. He has earned widespread respect in America not solely for his financial success but for his consistent consideration of others.His investment in human relationships may prove to be his most valuable achievement.

Business

Gold and silver sell-off gathers steam in correction after record highs

Gold and silver prices have continued to drop sharply in a “brutal” sell-off after hitting record highs in recent weeks.

The precious metals began falling on Friday in response to US President Donald Trump’s nomination for the incoming chairman of the Federal Reserve.

His choice for former Fed governor Kevin Warsh to replace current chairman Jerome Powell when his term ends in May soothed some investor nerves, which boosted the US dollar but saw appetite for safe-haven investments gold and silver slump in response.

Gold and silver suffered their worst trading days for decades on Friday and were down heavily again on Monday, with spot prices off by another 7% and 11% respectively at one stage.

Silver had plunged by nearly 30% on Friday and gold dropped over 9% in its worst one-day drop since 1983.

Gold and silver had been enjoying a record breaking rally as investors sought refuge amid global geopolitical uncertainty, conflict and tariff woes.

Ipek Ozkardeskaya, senior analyst at Swissquote, said: “The sell-off has been far more brutal than I, and many, expected.”

He added: “For silver, the rally on the way up was faster than gold’s, so the correction on the way down is faster too.”

Kathleen Brooks, research director at XTB, added: “If the sell off continues, then gold and silver are at risk of eroding their losses for the year so far.

“The historic move lower in silver prices has not stemmed a fall at the start of this week.

“Traders have not yet found a level that they are happy to buy the dips, and the timing of Chinese Lunar New Year in mid-February could accelerate the sell off, as Chinese traders reduce risk ahead of the holiday.”

UK and US stock markets are expected to open in the red on Monday, as the gold and silver rout has a knock on effect on mining giants, while Brent oil was also 5% lower.

Derren Nathan, head of equity research at Hargreaves Lansdown, said: “Mining stocks are likely to feel the heat as metal prices scramble to find a floor.

“Oil prices are also trending the wrong way for investors in commodity-focused companies.”

Business

Budget’s mild fiscal consolidation to be positive for GDP growth: Report

Mumbai: Lower revenue as a share of GDP has been more than offset by cuts to subsidies and spending on current schemes, leading to the smallest fiscal consolidation in six years, likely positive for growth, a new report has said.

The fiscal consolidation for FY27 is the slowest in six years. And the budgeted disinvestment, which is a below-the-line funding item, is likely to see the highest rise in six years, the report from HSBC Global Investment Research said.

“The central government continues with fiscal consolidation, though signing up for a gentler path for FY27; the fiscal impulse will likely turn neutral after several years in the negative, and this should be good news for GDP growth,” the research firm added.

The report said that the services sector was the focus of the Budget, “with ambitious plans and increased outlays for medical institutions, universities, tourism, sports facilities, and the creative economy.”

Urban infrastructure saw a renewed push with each City Economic Region (CER) set to receive get Rs 50 billion over 5 years.

Seven new high-speed rail corridors will connect major cities, the report noted, adding large cities will also get an incentive of Rs 1 billion if they issue municipal bonds worth more than Rs 10 billion.

The report highlighted policy priorities, saying, “new manufacturing sectors were given incentives, namely biopharma, semiconductors, electronic components, rare earth corridors, chemical parks, container manufacturing, and high-tech tool rooms.”

Direct taxes are expected to grow faster than nominal GDP while indirect taxes will expand more slowly, with gross tax revenues budgeted to rise about 8 per cent year‑on‑year, the report said.

Central government set a fiscal deficit target of 4.3 per cent of GDP for FY27 after a 4.4 per cent estimate for FY26, and nominal GDP growth was pegged at 10 per cent.

Business

India’s $5 trillion economy push: How ‘C+1’ strategy could turn country into world’s factory

New Delhi: India is preparing for a major economic transformation. The Union Budget 2026-27 lays out measures that could make the country the top choice for global manufacturing using the popular ‘China +1’ (C+1) strategy. This comes as international companies rethink supply chains after COVID-19 disruptions, rising trade tariffs and geopolitical tensions.

India has positioned itself as the backup factory for the world that is ready to absorb international demand in case of any crisis in China or Taiwan.

The government has offered tax breaks for cell phone, laptop, and semiconductor makers, making India more attractive to foreign investors. Reducing bureaucratic hurdles for global firms, the budget also strengthens the National Single Window System to simplify business procedures. The message is clear: India is ready to step in as a global manufacturing hub, ensuring supply continuity for the world.

The expressway to a $5 trillion economy

China presently dominates about 40% of global manufacturing. Its factories supply critical products worldwide, but 2026 is expected to be a turning point. Expanding influence and economic opacity have made global companies seek alternatives.

India has leveraged this moment, offering a comprehensive incentive package for foreign manufacturers. Analysts call it more than policy; it is a blueprint to become a $5 trillion economy and reclaim India’s historic position as a global industrial leader.

Why the world needs India now

The COVID-19 pandemic exposed the dangers of over-reliance on a single supplier. When China halted medical exports, nations realised the need for diversified supply chains. Major companies such as Apple and Samsung now see India as a dependable alternative.

China’s aging workforce and rising labour costs further enhance India’s appeal. With 65% of its population under 35, India offers a vast, skilled and affordable workforce for decades. The geopolitical uncertainty surrounding Taiwan, which produces 90% of advanced chips, has also created demand for a secure manufacturing backup. India is stepping in to fill that gap.

How India stands to gain from China’s challenges

India’s budget, 2026-27, slashes import duties on cell phone and laptop components, turning the country into a hub for component manufacturing, not just assembly. Electronics exports are projected to cross $120 billion by 2025.

The government has also launched a Rs 1.5 lakh crore semiconductor mission, attracting companies like Tata and Micron to establish advanced chip plants in India. In the chemical sector, stricter environmental regulations in China have shut down several plants, benefiting Indian companies such as Privi Specialty and Aarti Industries, which are now filling gaps in global supply chains.

Incentives for companies

The Production Linked Incentive (PLI) scheme promises cash rewards for output, covering over 14 sectors. This is India’s answer to Chinese subsidies. From land acquisition to electricity connections, the National Single Window System now enables businesses to clear all approvals through a single portal.

Infrastructure investment has also received a massive boost, with Rs 11.11 lakh crore allocated under PM GatiShakti. New ports and dedicated freight corridors are being built to ensure that exports from India reach the world faster and cheaper than ever before.

India’s moves points to a strategic shift in global manufacturing. By rolling out the red carpet for foreign companies and investing heavily in infrastructure, technology and policy reforms, the country is poised to become the go-to destination for global supply chains. The C+1 formula is not only a concept; it is a roadmap to turn India into the next industrial superpower and a $5 trillion economy.

-

Sports6 days ago

Sports6 days agoPSL 11: Local players’ category renewals unveiled ahead of auction

-

Entertainment5 days ago

Entertainment5 days agoClaire Danes reveals how she reacted to pregnancy at 44

-

Tech1 week ago

Tech1 week agoICE Asks Companies About ‘Ad Tech and Big Data’ Tools It Could Use in Investigations

-

Business6 days ago

Business6 days agoBanking services disrupted as bank employees go on nationwide strike demanding five-day work week

-

Fashion1 week ago

Fashion1 week agoSpain’s apparel imports up 7.10% in Jan-Oct as sourcing realigns

-

Sports5 days ago

Sports5 days agoCollege football’s top 100 games of the 2025 season

-

Politics1 week ago

Politics1 week agoFresh protests after man shot dead in Minneapolis operation

-

Business1 week ago

Business1 week agoShould smartphones be locked away at gigs and in schools?