Business

With Trump’s tax bill set to dent giving by the wealthy, can middle-class donors make up the difference?

A woman puts money into a Salvation Army red kettle outside of Giant Supermarket in Alexandria, Virginia on November 22, 2023.

Eric Lee | The Washington Post | Getty Images

A version of this article first appeared in CNBC’s Inside Wealth newsletter with Robert Frank, a weekly guide to the high-net-worth investor and consumer. Sign up to receive future editions, straight to your inbox.

New tax laws risk reducing charitable giving by the wealthy next year, economists and academic experts say, leaving less-wealthy Americans to make up the difference.

Under President Donald Trump’s “big beautiful bill,” signed into law in July, several tax benefits for wealthy donors will be reduced. Top earners will also have their effective tax benefit cut from 37% to 35%. The Indiana University Lilly Family School of Philanthropy estimates this cap alone will reduce giving by $4.1 billion to approximately $6.1 billion annually.

In addition, the bill also limits tax incentives for itemizers, who will only be able to deduct donations in excess of 0.5% of their adjusted gross income.

At the same time, the bill also creates new incentives for middle- and lower-income filers to give. Starting next year, roughly 140 million taxpayers who do not itemize will still be able to deduct up to $1,000 in cash donations per filer. About 90% of taxpayers take the standard deduction since it was raised in 2017 during the first Trump administration.

While the tax changes may help broaden the base of giving, making it less dependent on the ultra-wealthy, experts are skeptical that the math will balance out.

Elena Patel, co-director of the Urban-Brookings Tax Policy Center, told Inside Wealth she is not optimistic that middle- and lower-income donors will be able to make up the shortfall as top earners give less.

“The nonprofit sector says that every dollar matters, and so incentivizing small donations from every household could have a meaningful impact for certain kinds of organizations. But the truth is that those kinds of contributions, however, just are not the bulk of charitable giving in the charitable sector,” she said. “That 2-percentage-point reduction [for top earners] might not seem like a big deal, but you have to keep in mind the scale of gifts that are being given among the highest-net-worth individuals in the United States.”

What the ‘K-shaped’ economy means for philanthropy

Charitable giving by American households continues to rise, reaching $392.45 billion last year, per the latest report by the Lilly School of Philanthropy for Giving USA. That’s up 52% since 2014.

But while donations are increasing, fewer Americans are giving as wealthy donors make up an increasing share of philanthropy, according to the university’s research.

Amir Pasic, dean of the Lilly School of Philanthropy, said incentivizing Americans of all income levels to donate is valuable in and of itself.

“We’ve had this general problem of dollars going up but the number of donors going down. This is a positive development because this could really increase the number of donors,” he said.

However, Pasic said, financial stress has limited everyday donors’ ability to give, while wealthier ones have been donating more. The share of Americans who donate dropped from 66.2% to 45.8% between 2000 and 2020, according to the university’s research.

“Economic uncertainty is always worrisome for people’s giving planning,” Pasic said.

This lopsided, or “K-shaped,” economy shows signs of getting worse amid tariff hikes and inflation. Lower- and middle-income consumers are spending less on everything from McDonald’s burgers to flights, while wealthier Americans flex their spending power.

Will the new deduction move the needle?

Economist Daniel Hungerman said he questions whether the new deduction would spur a substantial number of donations or mainly reward taxpayers who would have given anyway.

While the new deduction is larger, at $1,000 per single filer and $2,000 for married joint filers, a similar legislative effort in the ’80s failed to move the needle on charitable giving, he said. A temporary $300 deduction in 2020 spurred by the Covid pandemic only increased charitable donations by 5%, according to the Tax Foundation.

Trump’s tax bill also permanently raises the standard deduction, which significantly dampens charitable giving, Hungerman said. His study estimated that the higher deduction led to a permanent annual drop of $16 billion after the 2017 reforms.

However, raising the cap on the federal deduction for state and local taxes (better known as SALT) may provide some relief, he said. More taxpayers in high-cost states will benefit from itemizing, which encourages donations.

Hungerman said encouraging everyday donors to get in the habit of giving now could lead to higher levels of donating later if they increase their wealth.

“Maybe what is even more compelling to me is the long game, if we can send a message that everybody should give like this, and we change some of these people’s giving behavior,” he said. “Somewhere out there is the Bill Gates of tomorrow.”

What donors can do now

Currently, taxpayers who plan to take the standard deduction would benefit from waiting until 2026 to make donations. However, itemizers and high-income donors will get more bang for their buck by giving before the end of the year.

Robert Westley, senior vice president and regional wealth advisor at Northern Trust, said he is recommending that clients accelerate their donations to this year if they were planning to donate over the next four years.

Filers can only deduct up to 60% of their adjusted gross income for cash donations to public charities per year. The percentage drops to 30% for contributions of long-term appreciated assets like stock or real estate.

However, taxpayers can generally carry forward excess deductions over five years, he said. Still, it’s unclear how much bang they will get for their buck as the IRS has yet to specify whether excess deductions will be subject to the new floor and ceiling on charitable deductions, according to Westley.

For donors who want to give more now but are unsure of how to do so, he said he suggests giving to a donor-advised fund, or DAF. With a DAF, donors get an upfront deduction but can wait to allocate those funds to specific charities. For donors wanting to offload appreciated assets, it is much simpler to donate stock to a DAF than directly to a nonprofit.

Given this year’s stock run up, Westley said many of his clients are looking to donate appreciated stock, especially in tech, to offset gains as well as rebalance their portfolios.

“Their equities have appreciated, and some of them might now represent a higher percentage of the portfolio than their target asset allocation,” he said. “When you donate those risk assets to charity, you get the tax benefit, you don’t realize the gain, and when it’s done you’ve lowered your risk-asset allocation.”

Lawyers and tax planners are still waiting for guidance from the IRS on a bevy of issues stemming from the changes. For instance, it’s still unclear whether deductions will be capped for non-grantor trusts that make charitable donations, according to Westley.

But high-income donors still have many tools at their disposal, he said. Top earners who are 73 and older can effectively reduce their taxable income dollar-for-dollar by giving their required minimum distributions from an IRA to charity.

Westley said this tactic is popular among his retirement-age clients and likely to become even more so with the raised SALT cap. Filers can lower their income to qualify for the enhanced SALT deduction, which maxes out at $40,000 for taxpayers with incomes of $500,000 or less.

“You’re not even dealing with any of the itemized deduction rules,” he said. “There’s no ceiling on the tax benefit and there’s no floor or hurdle to get over for the deduction.”

Business

Gas prices rocket as Qatar halts production after Iranian attacks

Gas prices have leapt at the fastest pace since the outbreak of war in Ukraine, after Qatar halted production of liquified natural gas after attacks by Iran.

Oil prices also soared and global financial markets reeled from the fallout of an intensifying conflict between Iran and US-Israeli forces.

European whole gas prices soared by 52% on Monday, marking the sharpest rise since prices were pushed dramatically higher by the Russian invasion of Ukraine in March 2022.

The surge came after Qatar’s state-backed energy company QatarEnergy said it “ceased production” because of attacks on its facilities.

Qatari ministers had said earlier on Monday that an Iranian drone had attacked one of the company’s production facilities.

Qatar is a major producer of LNG, cooled gas which can be transported via ships, responsible for about a fifth of global supplies.

On Monday in London, the price of natural gas for delivery in April was up by about 43% to 115p per therm.

In the UK, gas prices are a key driver for the cost of domestic energy bills, indicating that a sustained spike could affect households in the coming months.

Neil Wilson, Saxo UK investor strategist, said: “Qatar is a top three LNG exporter, controlling roughly a quarter of expected supply over the next decade.

“Looks like Iran’s tactic is to pressure Gulf states so they in turn pressure the US and Israel to back off.

“I am much more concerned about European natural gas prices than oil prices, in terms of seeing a repeat of the 2022 European energy crisis.”

Global financial markets faltered after intense strikes across the Middle East and attacks on ships drove fears of energy supply disruption.

London’s FTSE 100 was weaker as trading was knocked by the growing conflict between Iran and US-Israeli forces.

The blue chip share index shed 130 points, closing 1.2% lower at 10,780.11.

Other European indexes suffered bigger drops with France’s Cac 40 down about 2.2% and Germany’s Dax tumbling 2.4% on Monday.

But it was a more tentative start to trading over on Wall Street with the S&P 500 relatively flat, and Dow Jones dipping by about 0.1% by the time European markets had closed.

Israel launched strikes on Lebanon’s capital Beirut on Monday after missiles were fired by militant group Hezbollah.

The latest strikes came after the US and Israel hit targets across Iran on Sunday as part of an intensifying military campaign which followed the killing of Supreme Leader Ayatollah Ali Khamenei.

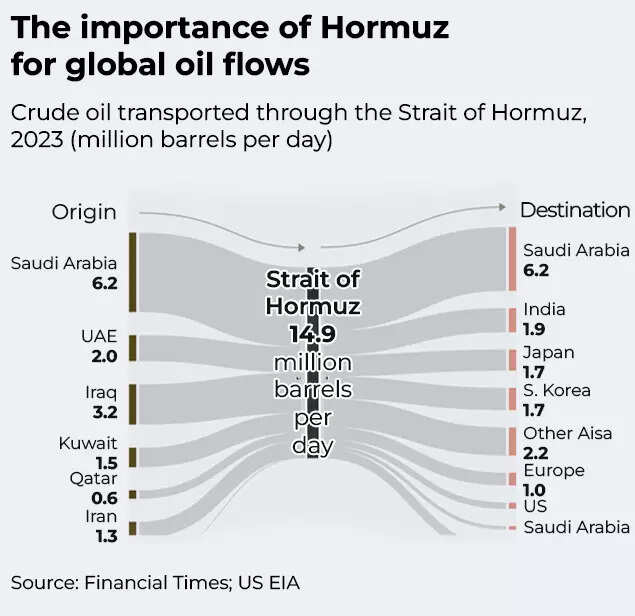

Oil supplies could be affected by the conflict after Iran reportedly warned tankers on the strait of Hormuz that no ships would be allowed to pass through.

UK Maritime Trade Operations Centre officials said that two vessels have been struck near to the key trade artery.

The Strait of Hormuz is used by tankers carrying about one fifth of the world’s oil supplies and seaborne gas.

On Monday, the price of Brent crude oil soared by as much as 13%, rising above 82 dollars a barrel, before paring back.

It was 8.4% higher at 79.2 dollars a barrel shortly before 2pm, before easing slightly to be 5.5% higher at 76.9 dollars a barrel by early evening.

Nevertheless, City analysts have said the markets have been relatively contained so far in reaction to the conflict.

Chris Beauchamp, chief market analyst at IG, said: “While we have seen a significant surge in oil prices since markets opened last night, the gains appear contained for now as we wait to see if shipping through Hormuz can continue at lower levels or will be blocked entirely.

“Oil and gas infrastructure in the region has not yet been extensively targeted, keeping oil well south of the 100 dollar barrel range that many expected as a result of the weekend.”

Meanwhile, the pound dipped in value against the US dollar to its weakest level since December.

The fall is partly linked to the strength of the dollar, with investors pouring funds into the US “safe haven” currency.

The pound was down about 0.8% at 1.338 versus the dollar during the day, before parring back some losses to be down around 0.3% at 1.34 against the dollar by early evening.

London stocks were broadly weaker, with travel stocks among those dropping particularly sharply.

Cruise giant Carnival slid by 8%, while airline firm IAG, the parent firm of British Airways, dipped by 7.6%.

Rival Wizz Air, which typically runs flights to Dubai and Abu Dhabi, was also down 7.3% in early trading on Monday, while travel-focused retail groups SSP and WH Smith were also firmly lower.

However, defence stocks were among the gainers, with BAE Systems lifting by 7.4% to 2,268p.

Elsewhere, oil and energy stocks were also stronger – Shell and BP rose by 4.5% and 3.5% respectively as prices lift.

International stock markets also opened weaker after the start of trading, with the Nikkei 225 in Tokyo falling by 1.5% after Asian markets opened.

Business

Oil prices spike! Will petrol, diesel rates be hiked in India as crude nears $80 mark on Middle East tensions? – The Times of India

Internationally, oil prices have risen by around 9-10% following Israel-US strikes on Iran, and amid the rising tensions in the Middle East are likely to remain elevated. Does that mean that petrol and diesel prices in India will go up?Brent crude, the international benchmark, moved close to $80 per barrel, while US crude futures advanced 8.6 per cent to $72.79, compared with roughly $67 on Friday.

India, which meets about 88% of its crude oil demand through imports before refining it into fuels such as petrol and diesel, faces a higher import burden when global prices rise, along with possible inflationary effects.

Middle East tensions : Will petrol, diesel prices go up?

Despite the sharp increase in global oil prices, retail petrol and diesel prices in India are not expected to be revised upward in the immediate future, according to a PTI report.According to sources quoted in the report, the government is maintaining a calibrated approach that allows oil marketing companies to improve margins during periods of lower international prices while protecting consumers when global rates increase.Also Read | Middle East oil shock risks: How much do China, India, Japan depend on Middle Eastern crude, gas?Pump prices for petrol and diesel have remained unchanged since April 2022. During this period, state-run retailers including Indian Oil Corporation, Bharat Petroleum Corporation Ltd and Hindustan Petroleum Corporation Ltd have absorbed losses when crude prices were elevated and benefited when prices declined.As a result, domestic fuel prices have stayed steady even when global fuel rates climbed due to higher crude costs. Likewise, when international fuel prices softened in line with lower crude, retail rates in India did not see a reduction.Sources added that the government intends to continue shielding consumers under this policy framework, unless crude prices witness an exceptionally sharp surge.With assembly elections approaching in key states such as West Bengal, Tamil Nadu and Assam, the government is keen to avoid developments that could provide political ammunition to the opposition, the report said.

India assesses oil security

Amid intensifying hostilities in the Middle East, Oil Minister Hardeep Singh Puri on Monday assessed the crude oil, LPG and petroleum products situation in a meeting with senior officials from his ministry and executives of public sector oil companies.

Importance of Hormuz for global oil flows

Much of India’s crude oil and gas supplies transit through the Strait of Hormuz, which Iranian authorities have threatened to close following US and Israeli strikes.“They have sufficient buffers to manage this kind of price spike,” a source with direct knowledge of the matter said, referring to oil companies. “We witnessed crude touching $119 per barrel in June 2022 after Russia’s invasion of Ukraine. That year their profits were modest, but in FY24 they recorded a record profit of Rs 81,000 crore.”Should interruptions continue, cargoes may need to be diverted around the Cape of Good Hope, resulting in longer transit durations and higher transportation expenses, along with increased freight and insurance costs.According to media accounts, the ongoing hostilities have in effect shut down the Strait of Hormuz, the vital artery for worldwide energy transportation. Nearly one-third of global seaborne crude oil exports and around 20 per cent of liquefied natural gas cargoes pass through this narrow channel.Also Read | 1970s-style oil shock loading? Crude may hit $100 if Strait of Hormuz shuts amid Middle East tensions – what it means

Business

Limited flights leave UAE while disruption continues amid Iran strikes

From the UK, flights have also been cancelled for many Middle East destinations, including all flights to Israel and Bahrain, three-quarters of the day’s scheduled flights to the United Arab Emirates, and more than two-thirds (69%) of flights to Qatar.

-

Politics1 week ago

Politics1 week agoPakistan carries out precision strikes on seven militant hideouts in Afghanistan

-

Tech1 week ago

Tech1 week agoThese Cheap Noise-Cancelling Sony Headphones Are Even Cheaper Right Now

-

Entertainment1 week ago

Entertainment1 week agoViral monkey Punch makes IKEA toy global sensation: Here’s what it costs

-

Sports1 week ago

Mike Eruzione and the ‘Miracle on Ice’ team are looking for some company

-

Business6 days ago

Business6 days agoHouseholds set for lower energy bills amid price cap shake-up

-

Entertainment1 week ago

Entertainment1 week agoTalking minerals and megawatts

-

Business6 days ago

Business6 days agoLucid widely misses earnings expectations, forecasts continued EV growth in 2026

-

Fashion1 week ago

Fashion1 week agoIndia, Switzerland review TEPA implementation & boost investment ties