Fashion

$6 bn of India’s T&A exports to the EU concentrated in 20 HS codes

Analysis at the product level

Over $6 billion of India’s textile and apparel exports to the EU are concentrated in just 20 four-digit HS codes, out of a total export base of ~$7.5 billion, making the India–EU FTA a sharply product-specific opportunity rather than a broad-based boost.

Finished apparel emerges as the primary beneficiary, as tariff parity improves India’s competitiveness against other Asian suppliers.

India and the European Union have signed the long-awaited Free Trade Agreement (FTA), with the pact expected to come into force in early 2027 (or earlier) following ratification. While trade flows will remain largely unchanged in the near term, product-wise export data indicates that the agreement could reshape India’s textile and apparel exports to the EU over the medium term, with gains concentrated in finished apparel rather than intermediate products.

India’s EU-facing textile and apparel exports are highly concentrated. The top 20 four-digit HS codes account for more than $6 billion, out of total textile and apparel exports of roughly $7.5 billion to the EU, underscoring where the FTA’s eventual impact is likely to be most visible.

Apparel dominates India’s EU export basket

Finished apparel forms the backbone of India’s textile and apparel exports to the EU, led by women’s wear, knitted garments, and core woven apparel. Home textiles represent the second pillar, while yarns, fabrics, and fibre-based products contribute a smaller share in value terms.

Table 1: India’s total Textile and Apparel exports to the EU-27 – Top 20 four-digit HS codes (2025)

Export growth in 2026 is expected to remain moderate as buyers focus on audits, compliance checks, and limited pilot orders ahead of implementation. A clearer divergence is expected from 2027, once tariff concessions take effect, with finished apparel emerging as the most responsive category.

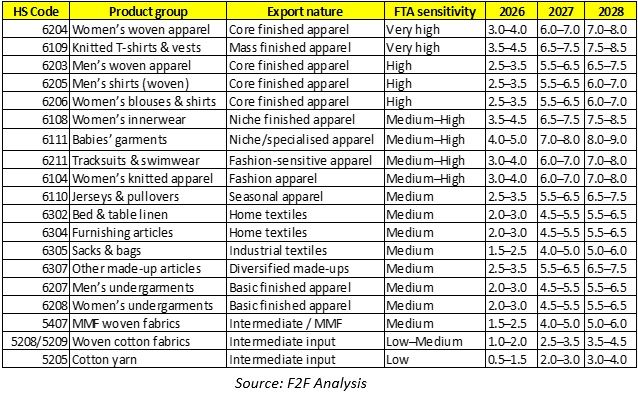

Table 2: India–EU textile exports – Product-wise growth outlook (YoY growth %, indicative)

What to watch till 2027

Product readiness is expected to improve fastest in high-volume apparel categories, while home textiles see incremental upgrades rather than greenfield expansion. Compliance alignment, particularly on sustainability and traceability will be a key differentiator, with cotton-based segments better positioned than MMF apparel. Buyer engagement is likely to intensify through audits and pilot orders ahead of implementation, while competing suppliers such as Bangladesh and Vietnam are expected to defend share through pricing and buyer integration rather than capacity expansion. Final tariff schedules and rules of origin will determine which products benefit first.

The India–EU FTA signals a medium-term reset, not an immediate surge. With over $6 billion concentrated in the top 20 product groups, finished apparel is best positioned to lead post-2027 gains, while home textiles compound steadily and intermediates remain less responsive.

Fibre2Fashion News Desk (AA)

Fashion

US brand NikeSKIMS unveils Spring ’26 head-to-toe women’s collection

Crafted to fit every curve, the new Spring line offers a fresh take on performance silhouettes with five apparel collections, the introduction of the NikeSKIMS Rift Satin and updated accessories.

NikeSKIMS will debut its Spring ’26 collection with a head-to-toe system of dress inspired by the modern ballerina.

The range spans five performance-led apparel material stories, updated accessories and the new NikeSKIMS Rift Satin footwear.

Fronted by Lisa and filmed in Paris, the campaign highlights grace, strength and engineered comfort for every body.

“This Spring ‘26 Collection celebrates the timeless poise and elegance of ballerinas but with a distinct modern twist,” says Kim Kardashian, Co-Founder and Chief Creative Officer, SKIMS. “We obsessed every detail — from the soft lines and feminine colors to the premium materials. Each piece is a statement of beauty and allows women to move with confidence and grace.”

The Spring line offers five material collections across Matte, Stretch Knit, Ribbed Seamless, Weightless Layers and Woven Nylon. The Matte collection includes smooth, sculpting pieces with Dri-FIT technology and two levels of compression. Stretch Knit offers styles that are soft to the touch and lightweight with a flattering drape. The Ribbed Seamless collection includes soft and stretchy ribbed styles with a vintage wash and moisture-wicking tech. Weightless Layers pieces are semi-sheer, ultra-lightweight and feature quick-dry tech. Woven Nylon offers relaxed third layers designed for softness, function and movement.

Also new this season is the NikeSKIMS Rift Satin, which brings the brand’s considered design ethos to footwear. The NikeSKIMS Rift Satin features the iconic tabi-toe design of the original Nike Rift, a sleek strap across the midfoot for quick entry and a secure fit, a soft satin upper material, a minimalist midsole and a textured logo outsole. The NikeSKIMS Rift Satin will be available in two colors, Silt Red and Black.

The NikeSKIMS Spring ’26 Collection comes to life through a campaign starring LISA of Blackpink. LISA is the ultimate multi-hyphenate: a rapper, singer, dancer, actress and style icon.

“When I’m performing, it’s all about looking great while still being able to move and dance,” says LISA. “The NikeSKIMS collection is so comfortable and light that I feel confident wearing it everywhere — from rehearsals to traveling or even relaxing at home. It’s easy to move in, looks amazing and fits perfectly into my everyday life.”

Directed by Sergio Reis, the campaign film celebrates the grace and strength of motion and form while spotlighting LISA’s artistry and passion for movement and dance. Filmed in Paris, the campaign also features professional ballerinas and dancers who helped bring the Spring ’26 Collection look book to life.

NikeSKIMS offers women a complete system of dress that is built on the strength of both brands. From footwear to foundational pieces and bold silhouettes, every product has been meticulously designed to sculpt and engineered to perform for every body.

“The NikeSKIMS Spring ’26 Collection is a true head-to-toe system of dress, designed to make women feel confident and feminine,” says Jamie Jeffries, VP, Global Apparel, Nike. “We’ve paid attention to every detail — from style and function to comfort — so every piece works together seamlessly. By combining Nike’s expertise in performance innovation with SKIMS’s inclusive fit and sculpting technologies, we’re delivering something truly unique for women everywhere.”

Note: The headline, insights, and image of this press release may have been refined by the Fibre2Fashion staff; the rest of the content remains unchanged.

Fibre2Fashion News Desk (RM)

Fashion

South Indian cotton yarn steady ahead of Union Budget

In the Mumbai market, cotton yarn prices did not see significant movement after last week’s rise. The market reported average demand for cotton yarn from the consumer industry. A Mumbai-based trader told Fibre*Fashion, “Cotton yarn demand is expected to improve in the coming weeks. Buyers want to wait for the outcome of the Union Budget, although there is little possibility of major changes for the textile industry. Cash flow is another cause for concern. Traders are diverting funds into precious metals and the stock market for quicker and more lucrative returns, which is slowing payment flows across the textile value chain.”

In Mumbai, ** carded yarn of warp and weft varieties were traded at ****;*,***–*,*** (~$**.**–**.**) and ****;*,***–*,*** per * kg (~$**.**–**.**) (excluding GST), respectively. Other prices include ** combed warp at ****;***–*** (~$*.**–*.**) per kg, ** carded weft at ****;*,***–*,*** (~$**.**–**.** per *.* kg, **/** carded warp at ****;***–*** (~$*.**–*.**) per kg, **/** carded warp at ****;***–*** (~$*.**–*.**) per kg and **/** combed warp at ****;***–*** (~$*.**–*.**) per kg, according to trade sources.

Fashion

US’ VF Corporation posts firm Q3 as revenue rises despite Dickies exit

VF Corporation has reported a solid Q3 FY26, with revenue up 1 per cent YoY and 4 per cent excluding Dickies.

Strong holiday demand in the Americas and DTC drove performance.

Operating income and margins improved, supported by lower SG&A.

The North Face and Timberland led brand growth.

The company also announced a $0.09 per share dividend and maintained a positive FY26 outlook.

Source link

-

Business1 week ago

Business1 week agoSuccess Story: This IITian Failed 17 Times Before Building A ₹40,000 Crore Giant

-

Entertainment1 week ago

Entertainment1 week agoDrake takes legal battle over Kendrick Lamar track to next level

-

Entertainment1 week ago

Entertainment1 week agoHarry Styles world tour promises unforgettable star packed nights

-

Business1 week ago

Business1 week agoSilver ETFs Jump Up To 10%, Gold ETFs Gain Over 3% On Record Bullion Prices

-

Tech1 week ago

Tech1 week agoRuckus gears up for networking partnership with TGR Haas F1 Team | Computer Weekly

-

Sports1 week ago

Sports1 week agoSenegal coach defends team’s AFCON final walkoff and chaos

-

Fashion1 week ago

Fashion1 week agoSouth Korea tilts sourcing towards China as apparel imports shift

-

Business1 week ago

Business1 week agoVideo: Why Trump’s Reversal on Greenland Still Leaves Europe on Edge