Business

Property tech ‘winter’ is over, but climate investment is still struggling, says Fifth Wall CEO

Fifth Wall co-founder and CEO Brendan Wallace.

Courtesy of Fifth Wall

A version of this article first appeared in the CNBC Property Play newsletter with Diana Olick. Property Play covers new and evolving opportunities for the real estate investor, from individuals to venture capitalists, private equity funds, family offices, institutional investors and large public companies. Sign up to receive future editions, straight to your inbox.

As with much of the real estate industry, property technology, generally defined as the use of tech and software to make real estate and property management more efficient, took a big hit in recent years.

Higher interest rates, a capital market retraction and a push by almost all venture capital into artificial intelligence collectively hit property tech hard. While there is, of course, some AI in property tech, it hasn’t been enough to really drive interest in a sector that has historically been extremely slow to modernize.

“I’d say we just lived through probably the most challenging three years that certainly I’ve ever experienced,” said Brendan Wallace, co-founder and CEO of Fifth Wall. “You saw a lot of companies and new businesses and venture funds die. We just lived through an extinction event.”

Fifth Wall is a venture capital fund managing over $3 billion in capital, the largest investment firm focused on technology for the built environment.

Wallace said the winter is over for property tech, citing last year’s IPO of ServiceTitan, a cloud-based field service management software for trades such as HVAC, plumbing, electrical and landscaping. The company raised about $625 million in its initial public offering, and shares jumped 42% in their Nasdaq debut.

Wallace also noted new unicorns, such as Juniper Square and Bilt, which bode well for the future of property tech investing. Bilt, a platform offering loyalty rewards for housing, raised $250 million in July at a $10.75 billion valuation in a funding round led by General Catalyst and GID, including a strategic investment from United Wholesale Mortgage.

“The amount of enterprise value destruction that happened to prop tech was unprecedented from 2022 to 2024, but the amount of enterprise value creation that has just happened in the last 15 months has also been unprecedented,” Wallace said.

That is not the case, however, in climate-related property tech. That space is becoming increasingly challenged due to the political winds in the U.S. that have shifted dramatically away from sustainability and climate resilience, not to mention climate science overall. As a result, the entire climate tech ecosystem in real estate is suffering.

Again, real estate has always been slow to modernize and was particularly slow to decarbonize. It got a huge boost, however, from President Joe Biden’s administration and billions of dollars in public funding, much of which went to decarbonizing real estate overall. Then, Wallace said, the world shifted under its feet.

“Many climate funds are struggling to raise. Many real estate owners are deprioritizing sustainability, decarbonization and ESG [environmental, social and governance], and there is a palpable, negative sentiment shift that has set on climate-related prop tech,” Wallace explained. “And so what that means is we’re still supporting our companies. We’re actually still seeing lots of good progress, but the sentiment is negative.”

Despite the shift, he said he is optimistic about the sector for one powerful reason: While national policy may be anti-climate, local governments are not. Cities are running out of money, and carbon taxes are a very attractive way of raising capital. New York City is a prime example. It is not only moving much further left in its politics, but it has consistently been more environmentally progressive.

Fifth Wall, one of the biggest investors in this space, is taking the long-term play, investing while the negative “halo” around climate persists because valuations are attractive.

“My view is the real estate industry is still responsible for 40% of carbon emissions. It’s still this industry that has shirked its responsibility for years, and it’s going to cost a lot to decarbonize. It’s a lot of money, and capital is going to flow into that space … which is one of the reasons why we’re still deploying capital, because we’re the only ones,” Wallace said.

Business

West Asia conflict: Govt may ask companies to cut exports, increase auto fuel, LPG supplies – The Times of India

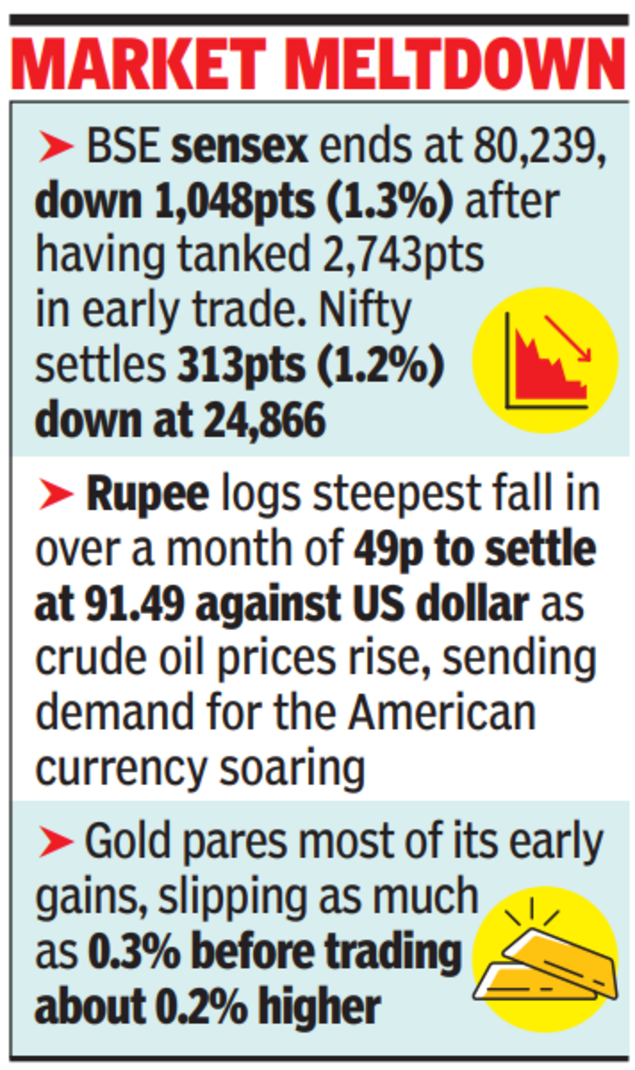

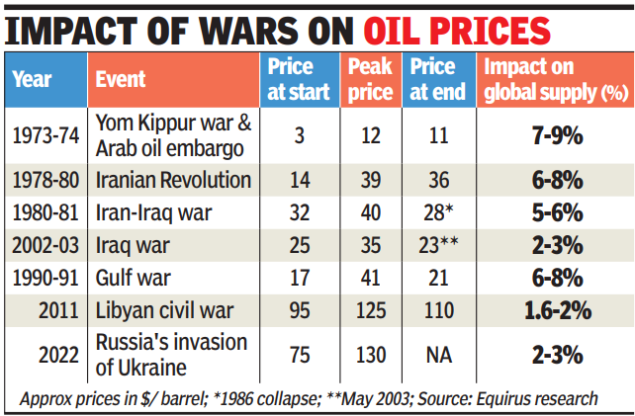

NEW DELHI: Amid fears of a shortage in crude supplies, govt is looking to nudge refiners to divert more auto fuel and LPG to the domestic market by cutting on exports and also increase cooking gas production so that there is no disruption in local supplies.While govt and oil companies insisted there’s no shortage, refiners are looking at alternate sources to partly compensate for crude coming from war-hit West Asia.

The tension has led to a spike in oil and gas prices, and given India’s dependence on imports, inflating the import bill and stoking inflationary pressures. Officials, however, said retail fuel prices may not rise immediately, as oil marketing companies follow a calibrated approach — absorbing losses when global prices are high and recouping them when prices soften. Retail petrol and diesel prices have remained unchanged since April 2022.Mantri meets oil cos to assess availability of crude and gasOn a day when Iranian drones damaged part of Saudi Aramco refinery and Qatar Energy’s facilities, the world’s largest LNG producer, announced an export pause, petroleum minister Hardeep Singh Puri and his team of officials met oil companies on Monday to assess the availability of crude and gas. “We are continuously monitoring the evolving situation, and all steps will be taken to ensure availability and affordability of major petroleum products in the country,” the oil ministry said in a post on X.India imports nearly 90% of its crude requirement. It also meets 60-65% of its LPG demand and about 60% of its LNG needs through imports, largely from West Asia, with shipments routed via Strait of Hormuz, which risks being choked due to the war.

According to the International Energy Agency, in 2023, 5.9% of the country’s production was being exported. Between April and Dec 2025, India exported petroleum products worth nearly $330 billion, with the Netherlands, UAE, the US, Singapore, Australia and China being the main destinations. In 2024, it also exported petroleum gas worth $454 million, mostly to Nepal, China, and Myanmar. The Reliance refinery in Jamnagar is the largest exporter in the country.An oil company executive said refiners are already in contact with traders to tie up capacities amid fears of the blockade of Strait of Hormuz. By Monday, the global market had caught the jitters from Qatar’s decision to suspend gas shipments.An oil executive said while disruption could cause difficulties in the immediate term, Indian players had a wide portfolio that they can tap for LNG, including the US, with vessels being routed through the Suez Canal.“Even if there is a force majeure, we have other sources of supply, which we can tap. Besides, no one is going to stop supplies indefinitely,” the executive said. While oil and gas prices rose Monday, the focus is on ensuring that supply lines remain open.

Business

Travel stocks fall after thousands of flights grounded following Iran strikes

A display board shows canceled flights to Dubai and Doha amid regional airspace closures at Noi Bai International Airport, amid the U.S.-Israel conflict with Iran, in Hanoi, Vietnam, March 2, 2026. Picture taken with a mobile phone.

Thinh Nguyen | Reuters

Airline and travel stocks slipped Monday after airspace closures throughout the Middle East forced carriers to cancel thousands of flights, disrupting trips as far as Brazil and the Philippines.

Cruise lines stocks also fell sharply, with Royal Caribbean Cruises dropping 3% and Carnival Corp. losing more than 7%.

Norwegian Cruise Line Holdings‘ stock fell 10% after its earnings call disappointed investors. Elliott Investment Management said last month that it had built a more than 10% stake in the company and that it’s seeking changes. New CEO John Chidsey told analysts that “our strategy is sound, our execution and coordination have not been, and a culture of accountability is essential and necessary going forward.”

Oil prices also rose, potentially driving up airlines’ biggest cost after labor. Flights through the Middle East were grounded, including to destinations like Tel Aviv and Dubai.

United Airlines, which has the most international exposure of the U.S. carriers, fell nearly 3%. Service to Tel Aviv, Israel, one of the airline’s most profitable routes, was halted, but airlines were also was forced to pause flights to Dubai, in the United Arab Emirates, one of the busiest airport hubs in the world. Dubai is also a home base for the airline Emirates.

Shares of American Airlines lost 4% while Delta Air Lines fell 2%.

More than 11,000 Middle East flights have been canceled since the U.S.-Israeli strikes this weekend, according to aviation-data firm Cirium.

International travel has been a bright spot in the travel sector. In January, international air travel demand jumped 5.9% from a year ago while domestic flight demand was nearly flat, the International Air Transport Association, an airline industry group, said in a report Monday.

— CNBC’s Contessa Brewer contributed to this report.

Business

Brewdog: Bars close and hundreds lose jobs as beer firm sold in £33m deal

Beverage and cannabis company Tilray acquires the brewery, the brand and 11 bars after Brewdog went into administration.

Source link

-

Business6 days ago

Business6 days agoHouseholds set for lower energy bills amid price cap shake-up

-

Politics5 days ago

Politics5 days agoWhat are Iran’s ballistic missile capabilities?

-

Entertainment1 week ago

Entertainment1 week agoTalking minerals and megawatts

-

Business6 days ago

Business6 days agoLucid widely misses earnings expectations, forecasts continued EV growth in 2026

-

Sports1 week ago

Sports1 week agoEileen Gu comments on Alysa Liu’s historic gold medal

-

Sports5 days ago

Sports5 days agoSri Lanka’s Shanaka says constant criticism has affected players’ mental health

-

Tech6 days ago

Tech6 days agoHere’s What a Google Subpoena Response Looks Like, Courtesy of the Epstein Files

-

Politics1 week ago

Politics1 week agoSupreme Court ruling angers Trump: Global tariffs to rise from 10% to 15%