Business

Snapchat users share fury at upcoming fees for Memories storage

Liv McMahonTechnology reporter

Getty Images

Getty Images“Half of my life is on this app and now they expect us to pay for it.”

One-star reviews and a sense of injustice have dominated online discussion since the popular messaging app Snapchat became the latest tech firm to put a price tag on a service people previously enjoyed using for free.

The app’s parent company Snap announced in September it would start charging people if they have more than five gigabytes worth of previously shared images and videos saved as Memories.

For many, these retro posts act as a window to the past – leading some to accuse the firm of “corporate greed” in posts on social media and negative reviews on Google and Apple’s app stores.

Snap has compared its paid storage plans to those provided by Apple and Google for smartphones.

And as an alternative for those who don’t want to pay, users can download their Memories, which for some span tens of gigabytes of data, to their device.

The firm told the BBC only a small number of users would be affected by the changes.

It also acknowledged it was “never easy to transition from receiving a service for free to paying for it” – but suggested it would be “worth the cost” for users.

Many criticising the move online seem to disagree.

An online petition dubbed the fee a “memory tax”, with commenters calling it “dystopian” and “ridiculous” – while one person threatened never to use the app again.

Meanwhile, in a one-star review on the Google Play store, a person calling themselves Natacha Jonsson said it felt “very unethical”.

“If I know millennials right, most of us have years worth of memories on Snapchat,” they said.

“And most of us only kept the app mainly for that reason.

“5GB is absolutely nothing when you have years worth of memories… Bye Snap.”

And Guste Ven, a 20-year-old journalism student in London, shared on TikTok her plans to delete the app.

Allow TikTok content?

“I decided that I needed to download all my memories as soon as I could,” she told BBC News.

“Almost all of my teenage years have been documented through my Snapchat memories, all of the photos in there are really important to me.

“It just doesn’t make sense to start charging people for something that has been free for so many years.”

Snapchat has not yet said how much storage plans would cost in the UK – only that they are part of a “gradual global rollout”.

But 23-year-old Amber Daley, who also lives in London, said in a post on TikTok she would be “distraught” by such charges.

Allow TikTok content?

Amber told the BBC the app had become “a part of everyday life” since she started using it in 2014.

While she said she understood the platform needed to make money, Amber suggested the Memories feature means more to users than the company may have realised.

“I think it’s quite an unfair move to charge your customers who have been loyal and devoted,” she said.

“These aren’t just called Memories, these are our actual memories.”

‘Emotional artefacts’

Companies deciding to charge users for a service that was previously free is nothing new, and millions pay for services like iCloud and Google Drive to backup their photos and videos from their smartphone.

The reality of storing data in the cloud – which some in the tech industry like to refer to as simply “somebody else’s computer” – is it costs money.

“Hosting trillions of Memories on Snapchat isn’t a trivial amount,” social media consultant Matt Navarra told the BBC.

“Snapchat has to try to find a way to cover the cost of storage, bandwidth, back-ups, content delivery, encryption – all that stuff.”

Bloomberg via Getty Images

Bloomberg via Getty ImagesBut Mr Navarra said introducing fees for a service that had previously been free, and users had been encouraged to use as such, may feel like a “bait and switch” for some.

“Moving the goalposts after people have built this huge digital archive doesn’t really sit right,” he said.

And for many, he added, “Memories aren’t just data dumps, they’re emotional artefacts”.

The feeling was shared by those leaving critical reviews, with one person calling their Snapchat photos and videos “the most precious thing to me”.

“[Memories] have every aspect of my life within them from celebrations of new family members’ births, mourning of passed loved ones, memories with friends/family, [and] my whole teenage years,” they wrote.

Dr Taylor Annabell, a postdoctoral researcher at Utrecht University in the Netherlands, said Snapchat’s move shows the implications of commercial platforms being used to store sentimental personal content.

“They benefit from this trust, interdependence, and presumption of never-ending access, which even incentivises some users to remain with the platform or continue to use it in order to scroll back through their archive,” she told the BBC.

“But these are not benevolent guardians of personal memory.”

Business

The FTSE 100 has hit a record high. Is now the time to start investing?

Kevin PeacheyCost of living correspondent

Getty Images

Getty ImagesAs the new year got into its stride, so did the UK’s index of leading shares.

The FTSE 100 climbed above 10,000 points for the first time since it was created in 1984, cheering investors – and the chancellor, who wants more of us to move money out of cash savings and into investments.

The index tracks the performance of the 100 largest companies listed on the London Stock Exchange and rose by more than a fifth in 2025.

But with many people still struggling with everyday costs, and with talk of some stocks being overvalued, does the FTSE’s success really make it a good time to encourage first-time investors?

Investing v saving

People can invest their money in many different ways and in different things. Various apps and platforms have made it easy to do.

Crucially, the value of investments can go up and down. Invest £100 and there is no guarantee that the investment is still worth £100 after a month, a year, or 10 years.

But, in general, long-term investments can be lucrative. The rise of the FTSE 100 is evidence of that. Shareholders may also receive dividends, which they could take as income or reinvest.

For years, the advice has been to treat investments as a long-term strategy. Give it time, and your pot of money will grow much bigger than if it was in a savings account.

In contrast, cash savings are much more steady and safe. The amount of interest varies between account providers, but savers know what returns will be. Savings rates have held up quite well over the last year, but interest rates are generally thought to be on the way down.

Savings accounts are popular when putting money aside for emergencies, or for holidays, a wedding or a car – for one predominant reason: you can usually withdraw the money quickly and easily.

“It is important that everyone has savings. It gives you access when you need it,” says Anna Bowes, savings expert at financial advisers The Private Office (TPO).

“It means you do not need to cash out your investments at the wrong time.”

Getty Images

Getty ImagesEvangelists for investing agree that savings are an important part of the mix for everyone managing their money.

“People starting out should have a cash buffer in case of emergency before going into investing,” says Jema Arnold, a voluntary non-executive director at the UK Individual Shareholders Society (ShareSoc).

One in 10 people have no cash savings, and another 21% have less than £1,000 to draw on in an emergency, according to the regulator, the Financial Conduct Authority (FCA).

But Arnold and others point out that cash is not without risk either. As time goes on, the spending power of savings is eroded by the rising cost of living, unless the savings account interest rate beats inflation.

Risk and reward

Our brains make a judgement about risk and reward thousands of times every day. We consider the risk of crossing the road against the reward of getting to the other side and so on.

With money, those who are more risk-averse have tended to stick with savings, while others have moved into investments. It also helps if you have money you can afford to lose.

It is worth remembering that millions of people already have money for their pension invested, although it is often managed for them and they may not pay much attention to it.

The FCA says seven million adults in the UK with £10,000 or more in cash savings could receive better returns through investing.

Chancellor Rachel Reeves has advocated more risk-taking from consumers. For those with the money, she says the benefit of long-term investing for them, and the UK economy as a whole, is clear.

She is altering rules on tax-free Isas (Individual Savings Accounts) in a much-debated move aimed at encouraging investing.

It is also why, in a couple of months’ time, we are all going to be blitzed with an advertising campaign (funded by the investment industry) telling us to give investing some thought.

It will be a modern version of the Tell Sid campaign of the 1980s, which encouraged people to invest in the newly privatised British Gas.

British Gas

British GasBut is this a good time for such a campaign? Back then, lots of people invested in British Gas for a relatively quick profit.

Invest now, and there is a chance the value of your investment could take a short-term hit.

A host of commentators have suggested an AI tech bubble is about to burst. In other words, they say there is a chance the value of companies heavily into AI has been over-inflated and will plunge – meaning anyone investing in those companies will see the value of those investments plunge too.

It isn’t only commentators. The Bank of England has warned of a “sharp correction” in the value of major tech companies. America’s top banker Jamie Dimon, the chief executive of US bank JP Morgan, said he was worried, and Google boss Sundar Pichai told the BBC there was “irrationality” in the current AI boom.

In truth, nobody really knows if and when this will happen.

New rules on getting investment help

All of this may leave people keen for some help, and the regulator has come up with plans to allow banks to offer some assistance.

Currently financial advice can be expensive, and regulated advisers may not bother with anyone who hasn’t got tens of thousands of pounds to invest.

Financial influencers have tried to fill the gap on social media. Some have been accused of promoting financial schemes and risky trading strategies with glitzy get-rich-quick promises in front of fancy cars – but without authorisation or any explanation of the risks involved.

Some first-time investors have turned to AI for tips. Some are vulnerable to fraudsters offering investment opportunities that are too good to be true.

Nearly one in five people turned to family, friends or social media for help making financial decisions, according to a survey by the FCA.

So, from April, registered banks and other financial firms will be allowed to offer targeted support, preferably for free. It will stop short of individually tailored advice, which can only be provided by an authorised financial adviser for a fee. But it will allow them to make investment and pensions recommendations to customers based on what similar groups of people could do with their money.

It is a big change in money guidance but, as with investments, no guarantees that it will be successful.

Business

Budget 2026: Punjab, Telangana flag higher fiscal burden under VB-G RAM G; seek more central funds – The Times of India

Opposition-ruled states Punjab and Telangana on Saturday sought additional fiscal support from the Centre in the Union Budget 2026-27, arguing that the proposed Viksit Bharat Guarantee for Rozgar and Ajeevika Mission (Gramin) (VB-G RAM G) will place a heavier financial burden on states due to its revised cost-sharing formula, PTI reported.The demands were raised at the pre-Budget meeting chaired by Union Finance Minister Nirmala Sitharaman, which was attended by finance ministers of states and Union Territories, along with Union Minister of State for Finance Pankaj Chaudhary. The meeting also saw participation from the Governor of Manipur, chief ministers of Delhi, Goa, Haryana, Jammu and Kashmir, Meghalaya and Sikkim, and deputy chief ministers of several states, including Telangana.Opposition-ruled states said the changes to the rural employment framework weaken the employment guarantee and go against the spirit of cooperative federalism.Parliament last month passed the VB-G RAM G Bill, replacing the two-decade-old Mahatma Gandhi National Rural Employment Guarantee Act (MGNREGA). Under the new scheme, the Centre will bear 60 per cent of the cost and states 40 per cent, compared with the 90:10 funding pattern under MGNREGA.Punjab Finance Minister Harpal Singh Cheema strongly opposed the proposed changes, saying the new framework dilutes the employment guarantee while shifting a significant financial burden to states.“Proposed MGNREGA changes weaken employment guarantee and burden states,” Cheema said at the meeting, calling for the restoration of the original demand-driven structure and funding pattern of the scheme.Telangana Finance Minister Mallu Bhatti Vikramarka said the Union government had replaced MGNREGA with VB-G RAM G without consulting states. He noted that the shift from a 90:10 to 60:40 funding ratio would further strain state finances.He also pointed out that any additional man-days beyond the normative allocation would now have to be borne by states, which would create a serious obstacle in providing demand-based work to job seekers.“This is entirely against the spirit of cooperative federalism and starving them of funds for capital outlay, which is essential for maintaining growth momentum,” Vikramarka said.The Telangana finance minister also suggested that surcharges on income tax and corporation tax be credited to a non-lapsable infrastructure fund, from which states could receive grants for infrastructure development. Alternatively, he said, surcharges should be merged with basic tax rates to expand the divisible pool of central taxes.On GST reforms, Vikramarka said GST 2.0 may boost demand but questioned its sustainability, warning that states’ revenues could fall due to rate reductions. He called for a suitable mechanism to compensate states for any revenue loss.Punjab also sought a special fiscal package, citing the “double whammy” of border tensions and floods in 2025. On GST, Cheema said Punjab is facing an annual revenue loss of nearly Rs 6,000 crore following GST 2.0 and pressed for a predictable GST stabilisation or compensation mechanism for states.

Business

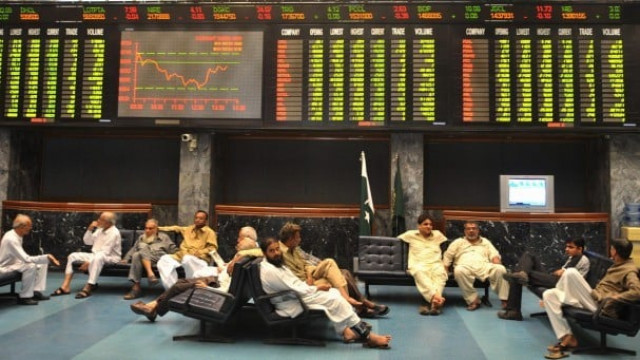

CY26 buying, macros propel PSX further higher | The Express Tribune

Shares of 324 companies were traded. At the end of the day, 90 stocks closed higher, 211 declined and 23 remained unchanged. PHOTO: FILE

KARACHI:

Pakistan’s equity market opened the new year on a strong footing as the benchmark KSE-100 index extended its bullish momentum in the second week, climbing 5,375 points, or 3% week-on-week (WoW), to close at 184,410.

The rally was triggered by renewed buying in heavyweight stocks amid improved market participation, supportive macroeconomic indicators, and positive company-specific developments, while easing yields in the latest T-bill auction and robust remittances further strengthened investor sentiment. On a day-on-day basis, the bullish momentum at the Pakistan Stock Exchange (PSX) continued unabated on Monday as the KSE-100 index surged past 182k, closing at 182,408, up 3,373 points (+1.88%).

On Tuesday too, the market’s surge continued, when the index gained 2,654 points (+1.45%) to close at 185,602. The powerful and sustained bullish trend remained intact on Wednesday as well, with the bourse maintaining its full strength and closing at a fresh all-time high of 186,518. In the initial five sessions of CY26, the index added a massive 12,464 points (+7.2%).

However, following the sharp rally, the PSX witnessed its first profit-taking session on Thursday, where the index closed at 185,543, down 976 points (-0.52%). On Friday, the PSX took a breather and the KSE-100 remained volatile, swinging in both directions before closing at 184,410, down 1,133 points (-0.61%). Despite the decline, the CY26-to-date gains stood strong at 5.95%, equivalent to a rise of 10,356 points.

Arif Habib Limited’s (AHL) weekly report noted that the KSE-100 index climbed from 179,035 points last week to 184,410 in the outgoing week, gaining 5,375 points (+3%), supported by a rally in heavyweight stocks driven by new year buying, and positive company-specific news and updates.

Among economic developments, the government through a T-bill auction raised Rs979.3 billion against the target of Rs850 billion. Yields were down across all tenors by 28.6 to 33.8 basis points. Participation remained strong at Rs2,554.6 billion.

Worker remittances reached $3.6 billion in Dec’25, marking a 17% year-on-year (YoY) increase. Cumulatively, 1HFY26 remittances clocked in at $19.7 billion, up 11% YoY.

AHL mentioned that tariff rebasing, following shift from financial year to calendar year, was likely to pull the power purchase price down by Rs0.51 per kilowatt-hour (kWh) in CY26 versus FY26. Cotton arrivals in factories remained stable as of end-Dec’25. In Punjab, cotton arrivals declined 4% in CY25, while Sindh arrivals improved by 4% YoY. However, total production are estimated at 6.8 million bales in FY26, representing a significant 33% shortfall against projections.

Meanwhile, the central government debt stood at Rs77.5 trillion as of Nov’25 compared with Rs70.4 trillion in Nov’24, up 10.2% YoY and 0.7% month-on-month, AHL added.

JS Global’s Syed Danyal Hussain, in his report, said that the benchmark KSE-100 index extended its bullish run in the second week of the year, closing at 184,410, up 3% WoW. The rally was largely led by banks, which contributed 57% to index gains, while cement stocks (8%) and auto shares (5%) provided limited support. Market participation improved notably, with average daily traded volumes rising 25% WoW.

On the macro front, he said, Pakistan recorded monthly remittances of $3.6 billion in Dec’25, reflecting a 17% YoY increase. Meanwhile, total public debt declined by Rs345 billion to Rs77.5 trillion in 5MFY26, largely supported by the transfer of State Bank’s profits to the government.

In policy developments, the government was exploring options to seek relaxations from the IMF ahead of the FY27 budget, with key proposals including a phased reduction in super tax over the next four years and lower power tariffs to enhance competitiveness.

Separately, the gas-sector circular debt climbed to Rs3.2 trillion, driven mainly by a sharp rise in late payment surcharges (Rs1.45 trillion). In the T-bill auction, the government raised Rs979 billion against the target of Rs850 billion, with yields falling by 29-33 basis points across different tenors. SBP’s reserves rose $141 million to $16 billion.

-

Sports6 days ago

Sports6 days agoVAR review: Why was Wirtz onside in Premier League, offside in Europe?

-

Entertainment3 days ago

Entertainment3 days agoDoes new US food pyramid put too much steak on your plate?

-

Politics3 days ago

Politics3 days agoUK says provided assistance in US-led tanker seizure

-

Entertainment3 days ago

Entertainment3 days agoWhy did Nick Reiner’s lawyer Alan Jackson withdraw from case?

-

Sports6 days ago

Sports6 days agoSteelers escape Ravens’ late push, win AFC North title

-

Politics6 days ago

Politics6 days agoChina’s birth-rate push sputters as couples stay child-free

-

Business6 days ago

Business6 days agoAldi’s Christmas sales rise to £1.65bn

-

Business6 days ago

Business6 days ago8th Pay Commission: From Policy Review, Cabinet Approval To Implementation –Key Stages Explained