Business

Kodak faces financial struggles even as Gen Z sparks a film resurgence

Rolls of Kodak Gold film hang on a shelf at the Precision Camera & Video store on August 12, 2025 in Austin, Texas.

Brandon Bell | Getty Images

Clair Sapilewski has dozens of rolls of camera film ready to use in her cupboard at all times.

A photography major at American University, the 21-year-old said she always keeps her film stocked to achieve that aesthetic that only film cameras can capture.

“It teaches you how to slow down, how to look at things more carefully and how to choose your shots more wisely,” she said.

It’s part of an ongoing trend as members of Generation Z have taken an interest in film cameras. Sapilewski said while her professors taught her the basics, she and her friends have used their film cameras to develop photos that their iPhones can’t quite replicate.

And in her college circle, the most popular brand for camera film is Eastman Kodak, a company she calls a “household name.”

“Pretty much everybody uses Kodak films — the average film user, when they reach for film, is going to reach for Kodak,” Sapilewski said.

But on the other side of the lens, Kodak may be singing a different tune.

The 133-year-old photography company indicated in its second-quarter earnings report on Monday that its finances “raise substantial doubt” in its ability to continue operations as a going concern.

The company reported a net loss of $26 million, down 200% from net income of $26 million for the second quarter of 2024. Kodak also posted a 12% decrease in gross profit with millions in debt obligations.

“Kodak has debt coming due within 12 months and does not have committed financing or available liquidity to meet such debt obligations if they were to become due in accordance with their current terms,” the company wrote in a regulatory filing.

Shares of the company are down more than 15% year to date.

Kodak plans to terminate its retirement pension plan and a company spokesperson told CNBC that Kodak aims to use money that it will receive from the settlement to pay off its debts.

“Kodak is confident it will be able to pay off a significant portion of its term loan well before it becomes due, and amend, extend or refinance our remaining debt and/or preferred stock obligations,” the spokesperson said.

This isn’t the first time the company has faced struggles.

Founded in Rochester, New York, in the late 1800s, Kodak rode the wave of photography with a goal of simplifying the process for consumers. But as the era of digital technology took over, the company faced increasing struggles with staying relevant as cameras moved beyond film and disposables.

In the 2000s, the company tried to keep up with the growing trend of digital cameras but struggled, according to Melius Research analyst Ben Reitzes, who said Kodak was ignoring concerns at the time about the evolving macroenvironment.

“Digital technology wasn’t ready right away to cut sales of film — but common sense told us differently,” Reitzes wrote in a March note. “At the time, Kodak management told us that film would co-exist with digital cameras and more photos would be taken — and more would need to be printed by Kodak.”

Instead, Kodak filed for bankruptcy in 2012. It reemerged a year later in 2013 with four main business components: print, advanced materials and chemicals, motion picture, and consumer, which includes cameras and accessories.

A ‘rebellion against digital perfection’

In recent years, however, the retro camera trend has been seeing a resurgence.

In 2020, then-General Manager Ed Hurley told NBC News that Kodak made more than twice the number of film rolls in 2019 than it made in 2015.

And on last year’s third-quarter earnings call, Kodak CEO Jim Continenza said the company was experiencing such high demand for film that it needed to upgrade its Rochester factory.

“Our film sales have increased,” Continenza said at the time. “As we continue to see our commitment and our customer commitment to film, still and motion picture, we are going to continue to invest in that space and continue with that growth.”

According to Fortune Business Insights, the global cinema camera market size is fast growing and estimated to reach $535 million by 2032. The Global Wellness Institute named “analog wellness” — including pre-digital technology — its top trend for 2025.

That growth has been driven in large part by Gen Z, which has turned to old-school aesthetics in what’s been a “divorce” from the hyperrealism of digital photography, according to Alex Cooke, the editor-in-chief of Fstoppers, a photography news site.

“I think there’s this rebellion against digital perfection where film feels real in this kind of hyper-curated Instagram and TikTok world, where images are filtered and Facetuned and algorithm-tested,” Cooke said.

For members of Gen Z, who grew up in the smartphone age, Cooke said this type of photography brings a “nostalgia without lived experience,” where younger people are romanticizing a slower culture and breaking the instant feedback loop.

The aesthetics of film are also at play, Cooke added, with the unique colors and grains capturing something a smartphone could not. Ironically, social media even feeds into amplifying the trend, he said.

Using film cameras and developing that film also plays into a Gen Z trend of digital minimalism, according to Digital Camera World U.S. Editor Hillary Grigonis.

As a professional photographer, Grigonis said she’s seen Gen Z lean into the feeling of “disconnecting” when using film, which provides a more tangible photography experience than smartphones.

“Part of the rise in film photography among Gen Z is likely from that desire to disconnect and the craving for that retro aesthetic,” Grigonis said, adding that she was surprised at Kodak’s financial struggles given the overall rise in demand.

For 25-year-old Madison Stefanis, Kodak was her entry point into the camera world. A Gen Z herself, Stefanis created 35mm Co, a film camera company specifically aimed at making the photography style easy and accessible for her generation.

Stefanis said she’s seen that younger people are leaning into the emotional connection created by the delayed gratification of waiting for photos to be developed, something that’s become “lost in the digital age.”

Because she’s seen Gen Z driving the resurgence of film, Stefanis said she was “shocked” at Kodak’s declaration about its ability to continue as a going concern.

“Gen Z are really craving something they can hold in their hands,” she said. “These days, at least for myself, most of my memories live either in my mind or in my phone, so I think having actual tangible, physical objects where we can store our keepsakes and those key moments feels really special to my generation.”

Business

West Asia conflict: Govt may ask companies to cut exports, increase auto fuel, LPG supplies – The Times of India

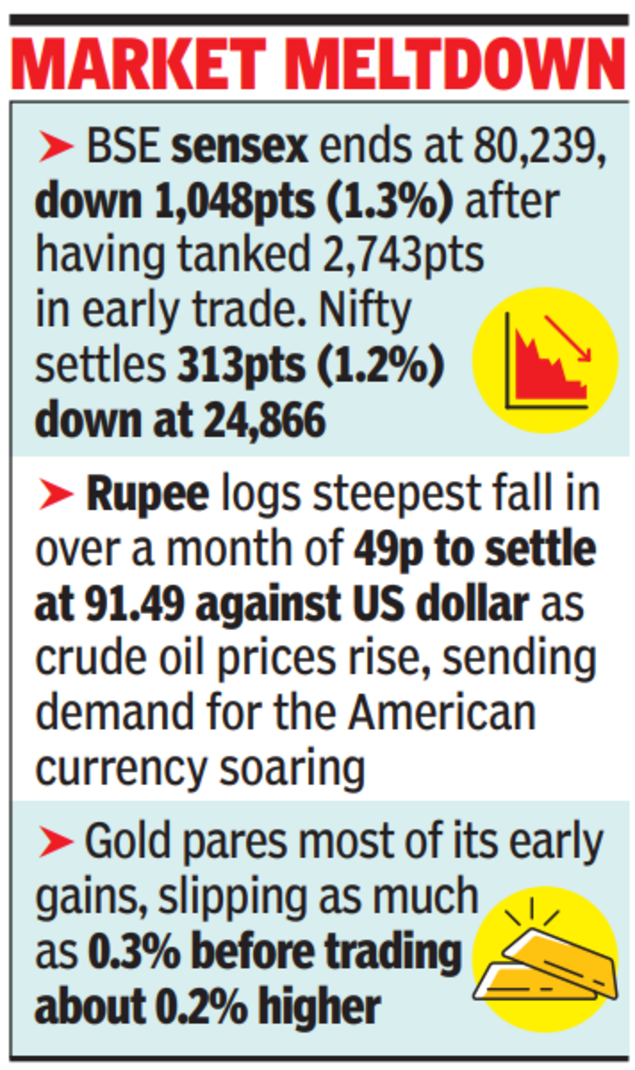

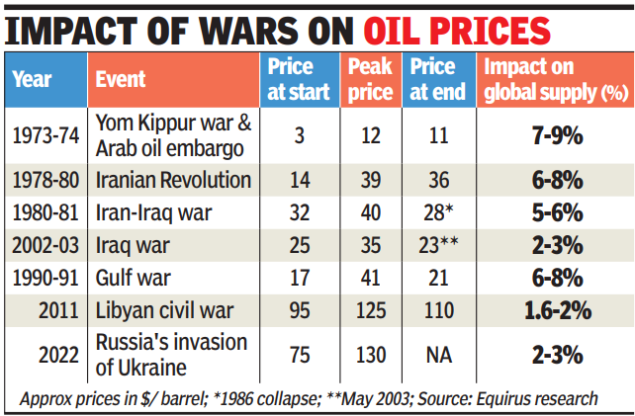

NEW DELHI: Amid fears of a shortage in crude supplies, govt is looking to nudge refiners to divert more auto fuel and LPG to the domestic market by cutting on exports and also increase cooking gas production so that there is no disruption in local supplies.While govt and oil companies insisted there’s no shortage, refiners are looking at alternate sources to partly compensate for crude coming from war-hit West Asia.

The tension has led to a spike in oil and gas prices, and given India’s dependence on imports, inflating the import bill and stoking inflationary pressures. Officials, however, said retail fuel prices may not rise immediately, as oil marketing companies follow a calibrated approach — absorbing losses when global prices are high and recouping them when prices soften. Retail petrol and diesel prices have remained unchanged since April 2022.Mantri meets oil cos to assess availability of crude and gasOn a day when Iranian drones damaged part of Saudi Aramco refinery and Qatar Energy’s facilities, the world’s largest LNG producer, announced an export pause, petroleum minister Hardeep Singh Puri and his team of officials met oil companies on Monday to assess the availability of crude and gas. “We are continuously monitoring the evolving situation, and all steps will be taken to ensure availability and affordability of major petroleum products in the country,” the oil ministry said in a post on X.India imports nearly 90% of its crude requirement. It also meets 60-65% of its LPG demand and about 60% of its LNG needs through imports, largely from West Asia, with shipments routed via Strait of Hormuz, which risks being choked due to the war.

According to the International Energy Agency, in 2023, 5.9% of the country’s production was being exported. Between April and Dec 2025, India exported petroleum products worth nearly $330 billion, with the Netherlands, UAE, the US, Singapore, Australia and China being the main destinations. In 2024, it also exported petroleum gas worth $454 million, mostly to Nepal, China, and Myanmar. The Reliance refinery in Jamnagar is the largest exporter in the country.An oil company executive said refiners are already in contact with traders to tie up capacities amid fears of the blockade of Strait of Hormuz. By Monday, the global market had caught the jitters from Qatar’s decision to suspend gas shipments.An oil executive said while disruption could cause difficulties in the immediate term, Indian players had a wide portfolio that they can tap for LNG, including the US, with vessels being routed through the Suez Canal.“Even if there is a force majeure, we have other sources of supply, which we can tap. Besides, no one is going to stop supplies indefinitely,” the executive said. While oil and gas prices rose Monday, the focus is on ensuring that supply lines remain open.

Business

Travel stocks fall after thousands of flights grounded following Iran strikes

A display board shows canceled flights to Dubai and Doha amid regional airspace closures at Noi Bai International Airport, amid the U.S.-Israel conflict with Iran, in Hanoi, Vietnam, March 2, 2026. Picture taken with a mobile phone.

Thinh Nguyen | Reuters

Airline and travel stocks slipped Monday after airspace closures throughout the Middle East forced carriers to cancel thousands of flights, disrupting trips as far as Brazil and the Philippines.

Cruise lines stocks also fell sharply, with Royal Caribbean Cruises dropping 3% and Carnival Corp. losing more than 7%.

Norwegian Cruise Line Holdings‘ stock fell 10% after its earnings call disappointed investors. Elliott Investment Management said last month that it had built a more than 10% stake in the company and that it’s seeking changes. New CEO John Chidsey told analysts that “our strategy is sound, our execution and coordination have not been, and a culture of accountability is essential and necessary going forward.”

Oil prices also rose, potentially driving up airlines’ biggest cost after labor. Flights through the Middle East were grounded, including to destinations like Tel Aviv and Dubai.

United Airlines, which has the most international exposure of the U.S. carriers, fell nearly 3%. Service to Tel Aviv, Israel, one of the airline’s most profitable routes, was halted, but airlines were also was forced to pause flights to Dubai, in the United Arab Emirates, one of the busiest airport hubs in the world. Dubai is also a home base for the airline Emirates.

Shares of American Airlines lost 4% while Delta Air Lines fell 2%.

More than 11,000 Middle East flights have been canceled since the U.S.-Israeli strikes this weekend, according to aviation-data firm Cirium.

International travel has been a bright spot in the travel sector. In January, international air travel demand jumped 5.9% from a year ago while domestic flight demand was nearly flat, the International Air Transport Association, an airline industry group, said in a report Monday.

— CNBC’s Contessa Brewer contributed to this report.

Business

Brewdog: Bars close and hundreds lose jobs as beer firm sold in £33m deal

Beverage and cannabis company Tilray acquires the brewery, the brand and 11 bars after Brewdog went into administration.

Source link

-

Business6 days ago

Business6 days agoHouseholds set for lower energy bills amid price cap shake-up

-

Entertainment1 week ago

Entertainment1 week agoTalking minerals and megawatts

-

Politics5 days ago

Politics5 days agoWhat are Iran’s ballistic missile capabilities?

-

Sports1 week ago

Sports1 week agoEileen Gu comments on Alysa Liu’s historic gold medal

-

Business6 days ago

Business6 days agoLucid widely misses earnings expectations, forecasts continued EV growth in 2026

-

Business1 week ago

Business1 week agoHaryana Govt bars IDFC First Bank, AU Small Finance Bank over alleged Rs 590 crore fraud

-

Sports7 days ago

Sports7 days agoTop 50 USMNT players of 2026, ranked by club form: USMNT Player Performance Index returns

-

Sports5 days ago

Sports5 days agoSri Lanka’s Shanaka says constant criticism has affected players’ mental health