Business

Small businesses are being crushed by Trump’s tariffs, and economists say it’s a warning for the economy

President Donald Trump listens during a Cabinet meeting at the White House on April 30, 2025 in Washington, DC.

Andrew Harnik | Getty Images

Viresh Varma can’t sleep.

The CEO of AV Universal Corp., a small footwear company that sells through retailers like Macy’s, Nordstrom and DSW, said he needed to take out a $250,000 loan to pay his tariff bill on a container of shoes he imported from India for the holiday shopping season.

Varma didn’t have the cash on hand to pay the duties, which he said used to be around $7,500 for a similar-sized container before President Donald Trump‘s new tariffs. But without the financing, he wouldn’t have anything to sell during the holidays.

So the 64-year-old said he was faced with a choice: take on the line of credit— which came with onerous terms like weekly payments and a 32% interest rate — and raise prices to pay it back, or close the business he’s spent the last nine years building. He decided to take out the loan.

“Everybody believes that I’m a fighter, so I’m fighting it,” Varma told CNBC in an interview. “We’ve reduced some salaries. We had planned to hire some people we’re not going to hire anymore. … If things don’t look good, especially after increasing the prices, and we don’t get the sales, then obviously we may lay off some people, as well.”

AV Universal is just one of the many small businesses that are buckling under Trump’s global trade war, struggling to pay the sudden increase in duties and forecast what’s ahead as policy evolves. Businesses of all sizes have raised prices and negotiated with vendors to weather the tariff storm and many larger retailers have so far proven resilient, with minimal impact to their profitability and future growth outlooks. Better-than-expected quarterly reports have led investors to largely shrug off the tariff threat, as the S&P 500 hovers near record highs.

But the higher costs have hit smaller companies harder because they have fewer levers to pull than their larger competitors. Their margins are slimmer, their supply chains less diverse and their negotiating power with vendors dampened by the smaller sizes of their orders.

Small businesses owners interviewed by CNBC said they largely expect to be able to manage higher costs from tariffs by raising prices, but only if it doesn’t cause shoppers to buy less — which most are already starting to see.

Often called the backbone of the U.S. economy, small businesses routinely represent more than 40% of the nation’s GDP and employ nearly half of the American workforce, according to the U.S. Chamber of Commerce.

Trump says his tariffs allow the U.S. to reduce its trade deficits with other nations and encourage domestic manufacturing, but some of the small business owners who spoke to CNBC said that’s happening partially at their expense.

The struggles they’re facing could be a warning sign for the rest of the economy and bigger businesses in 2026, said Kent Smetters, a professor of business economics and public policy at the University of Pennsylvania’s Wharton School.

“The small businesses … they’re kind of like the canary in the coal mine here,” said Smetters, the faculty director of the Penn Wharton Budget Model. “They’re going to get hit first, and then I think you’re going to see more of an impact with some delay on larger businesses.”

Larger retailers have been able to manage higher tariff costs in part because they had the foresight and ability to order extra inventory before the new duties went into effect, said Smetters. At a certain point, that stock will run out and push costs higher, and those companies only have so many low-tariff countries where they can produce goods.

The fate of many of Trump’s tariffs is unclear after a federal court ruled them illegal, prompting an appeal from the White House that the Supreme Court is now reviewing. The nation’s highest court, which includes three Trump appointees and has a 6-3 conservative majority, agreed to hear the appeal on a faster-than-normal timeline with arguments scheduled for the first week of November. It’s unclear how fast the justices will issue a ruling, and the tariffs remain in effect during the appeal.

CNBC spoke with around a dozen business owners to better understand how tariffs are affecting them. Here’s how much the duties are costing some of those companies — and what the businesses are doing to offset them.

AV Universal Corp.

Total tariffs paid in 2024: $45,000

Total tariffs expected in 2025: $353,125

Employees: 10

Supply chain: India 80%, Vietnam 15%, Europe 5%

Varma, AV’s CEO, spent much of his career in corporate America before deciding to get into the footwear business about a decade ago. He built three brands from scratch that are now sold online by Amazon, Macy’s, DSW, Nordstrom and other retailers. Varma was in the process of sending orders for the 2025 holiday season — which typically accounts for about 40% of AV’s annual revenue — when Trump announced tariffs on dozens of trading partners on April 2.

Thinking the president was bluffing, Varma placed an order for 20,000 pairs of shoes from his manufacturer in India, but ultimately only shipped half because he couldn’t line up the financing necessary to pay the expected tariff bill on the entire order. Varma expects holiday sales to drop about 30% because he’ll have less inventory to sell, but that decline could get worse if consumers balk at the higher prices he implemented. Since he increased prices earlier this year, sales fell about 30% in August and September.

Varma has searched across the globe to escape the Trump administration’s 50% tariff on Indian goods and is now considering moving his manufacturing to China, as long as Trump walks back his latest threat to raise tariffs on Chinese imports to 100%.

Talus Products

Total tariffs paid in 2024: ~$223,000*

Total tariffs expected in 2025: ~$499,000*

Employees: 9

Supply chain: primarily China

*The figures are adjusted for order volume

Talus Products co-founder and CEO David McClees (middle left) pictured with his team during the holidays.

Handout

David McClees, co-founder and CEO of Talus Products, opened his business 38 years ago with a single product: an inflatable travel pillow. The company has since expanded into a range of items, including car organizers and other travel accessories, that it distributes through retailers like The Container Store, Amazon and airport gift shops.

McClees said he’s not worried about having to shut down operations, but said he expects tariffs to put a “severe crimp” in his annual profitability. The company raised prices on certain products to offset tariffs, but is waiting until January to hike again, partially over concerns it could dampen consumer demand during the holiday shopping season. Sales on Amazon, which account for more than half of Talus’ revenue, have already been “soft” in recent weeks, he said.

“We’re nervous,” said McClees. “We don’t typically offer huge discounts on Prime Day, but we do see a bump from their increased traffic, and that was smaller than what we would normally see. It seems like buyers are being very cautious.”

McClees attempted to move some of Talus’ production to Mexico and Vietnam, but said he ultimately decided it was too expensive.

Village Lighting

Total tariffs paid in 2024: less than $50,000

Total tariffs expected in 2025: at least $1 million

Employees: between 11 and 17, depending on season

Supply chain: 50% spread across Vietnam, Cambodia, Indonesia, Myanmar and Thailand, the other 50% in China

Village Lighting CEO Jared Hendricks (center, pictured in white) with his wife, children and son-in-law.

Handout

Jared Hendricks, founder and CEO of Village Lighting, started his business 20 years ago making Christmas lighting and decorations before expanding into holiday storage, selling directly to consumers via his website and through big-box stores like Walmart and Target. Since his business is centered around the holidays, his buying and cash flow needs are unique compared with others in the retail industry.

Every year, just before Christmas, he said he uses a $2 million line of credit he took out against his home to buy the inventory he needs for the following year’s holiday and then uses that eventual revenue to pay back the debt. This year, he had to use that line of credit to pay his tariff bill.

“Hopefully I can turn around and mark things up enough for people to buy them from me so I can pay back my tariff debt,” said Hendricks. “It’s to the point now where it could kill us, it could take us down, and I could lose everything. I can’t afford to not bring stuff in because I’ll have nothing to sell. So that’s a game over scenario.”

Because of Village Lighting’s unique buying schedule, the company had to take a loss on about 40% of its annual sales because the orders and pricing were already contractually agreed upon when many of the new duties went into effect. Hendricks said he hopes to make it up by raising prices on his website and wholesale customers. Sales so far this season have been down between 8% and 10% and he owes millions of dollars to his suppliers, who have agreed to accept late payments. Hendricks said the situation has created massive stress for him and his wife, adding that the challenges the Covid-19 pandemic posed to his business feel like “a piece of cake” compared with now.

“I call them my demons. They’re my two or three o’clock in the morning demons, where they just wake me up in a panic, like, ‘how am I going to pay for this? Or how am I going to make this work? What have I done? Should I have quit last April and just cashed in?'” said Hendricks. “Being a small business owner isn’t worth it when your country turns on you.”

Picnic Time

Total tariffs paid in 2024: $950,000

Total tariffs expected in 2025: $2.25 million

Employees: 75

Supply chain: 85%-90% in China, the remainder in India

Picnic Time CEO Paul Cosaro, shown in a gray shirt, with his family outside of the company’s headquarters.

Handout

Paul Cosaro’s family business, Picnic Time, was started 43 years ago by his father, an Italian immigrant on a mission to sell high-quality picnic baskets. The company now sells a wide range of products, from coolers to beach chairs, to major retailers like Kohl’s, Target and Macy’s. Since Trump’s new tariffs went into effect, Picnic Time had to freeze hiring and capital expenditures, limiting its ability to produce and release new products, Cosaro said.

“It absolutely has stifled innovation,” he said. “You don’t want to take risks anymore … there’s no room for error.”

Cosaro said he attempted to move his supply chain to other countries during Trump’s first term, hiring additional staff and conducting sourcing missions in India and Mexico. But years later, he was only able to move about 10% of production. He said he raised his prices earlier this year to account for the new tariffs and the third quarter has so far been “very, very, very soft.” Sales are down about 20% and key retailers have pulled back on orders. The holiday season is always important to Picnic Time, as it accounts for about 35% of annual revenue, but this year it feels like the company is putting “all of our eggs in one basket,” said Cosaro.

“For us, it’s critically important,” he said. “We’re literally going to be waiting until the last day of the year to find out if this is going to be a profitable year or not.” For now, Cosaro said he will keep his supply chain primarily in China. He’s considered moving some of it to the U.S., but said he doesn’t have the budget available to take the risk.

Citibin

Total tariffs paid in 2024: $67,883

Total tariffs expected in 2025: $380,000

Employees: 8

Supply chain: 90% Vietnam, 5% China, 5% U.S.

Frank Picarazzi, the chief operating officer of Citibin (left) with his wife Liz Picarazzi, the company’s founder and CEO (right).

Courtesy: Frank Picarazzi

When Liz Picarazzi first started Citibin, which makes rat-proof trash enclosures for cities, parks and homes, the company manufactured in the U.S. After a few years, she said she found U.S. producers couldn’t meet her expectations on price, quality or lead time. She moved production to China and for several years, the business enjoyed manageable tariffs and reliable partners. However, in the lead-up to the 2024 election, she and her husband Frank Picarazzi, Citibin’s COO, started looking for other options over concerns that either candidate would raise tariff rates.

“I told Frank two days after the election, ‘we’re going to Vietnam, like, as soon as we can,'” Liz Picarazzi said.

The couple spent the next few months moving most of their production to Vietnam, only to learn of Trump’s decision to raise tariffs on all aluminum and steel imports to 50%. That raised costs for just about every product Citibin sells. Though her supply chain is now more diversified, Liz Picarazzi said that moving to Vietnam was “somewhat pointless” as a result.

Meanwhile, she said higher costs are affecting talent retention, research and development, and revenue. The company has added a 15% tariff surcharge to products to offset the cost of tariffs. Frank Picarazzi said it has contributed to a 25% decline in sales to homeowners, which the company expects will account for about 50% of overall revenue this year.

Reekon Tools

Total tariffs paid in 2024: $65,000

Total tariffs expected in 2025: more than $400,000

Employees: 20

Supply chain: Malaysia, Thailand, Vietnam and China

Christian Reed, founder and CEO of Reekon Tools, on a job site holding the T1R Hybrid Laser Tape Measure

Handout

Research and development is critical for Christian Reed’s tool startup Reekon. He said the company had to cut back R&D spending by 20% because of tariffs.

“This certainly put a thorn in the side of our hiring plan for the rest of the year around engineers for R&D activities,” said Reed. “That’s something that will continue to have to either be paused or completely canceled if nothing changes.”

The hundreds of thousands of dollars Reed planned to use to hire between three and five designers and engineers is now going to tariffs instead, he said. The company, which makes innovative products like digital tape measures for tradespeople, needs to ensure every tool it produces is effective and able to withstand tough conditions on worksites.

“There’s a unique combination of making a product that you can feed up, throw on the concrete, you know, slam around and not break, and at the same time add this digital aspect,” said Reed. “So that puts a very high burden on the testing, the research we have to do … it’s a very costly product as most of the products we’re making are new to [the] world.”

Reed said he’s avoided raising prices on most items, choosing to take the hit to profit margins, but recently increased the price of a new tool – a smaller version of its digital tape measure. Initially, Reekon wanted to price it at $99 and while the margins would’ve been slim, the company expected to be able to make it up in volume, Reed said. However, after tariff rates rose, the company priced it at $119 when it launched in September to help it offset losses in other parts of the business. While the product has been well received, sales so far have fallen short of the company’s projections.

Business

DGCA slaps IndiGo with fine of Rs 22 crore for flight disruptions – The Times of India

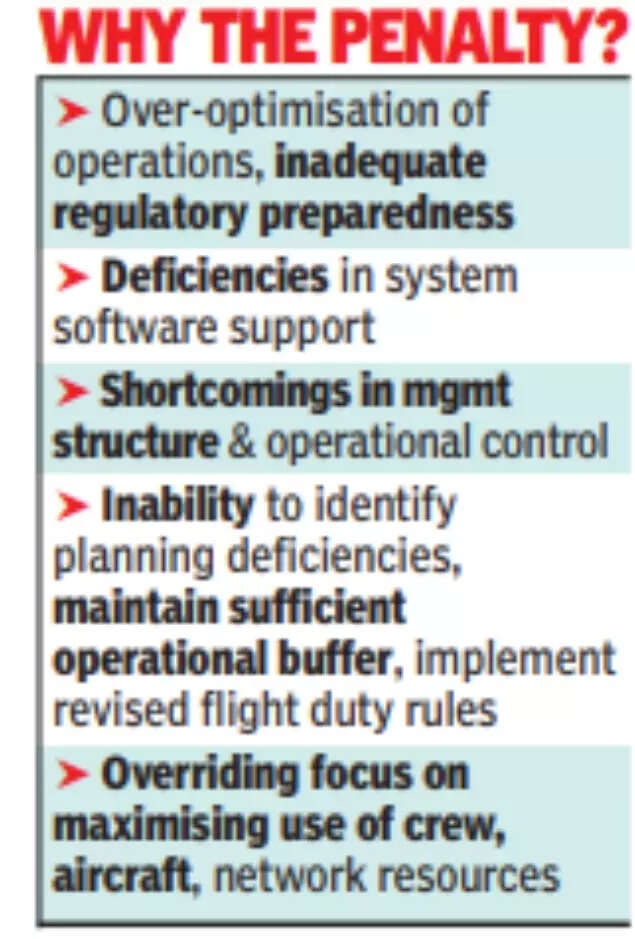

EW DELHI: The Directorate General of Civil Aviation (DGCA) has slapped IndiGo with the steepest fine ever for an Indian carrier – Rs 22.2 crore – for its massive flight disruptions last month.Additionally, the airline has to submit a bank guarantee of Rs 50 crore whose release is tied to implementing, among other things, the more humane flight duty norms for pilots aimed to enhancing flight safety. The regulator has warned senior airline officials, including the CEO & COO. The senior VP of operation control centre has to be removed from his position.

The senior VP of operation control centre has to be removed from his position and not given any accountable position in the future. The aviation ministry has ordered “an internal inquiry to identify and implement systemic improvements within DGCA”.The regulator late on Saturday night released key findings of the report by its four-member panel that probed IndiGo schedule collapse last month. The airline’s unpreparedness and consequent inability to implement DGCA’s new flight duty time limitation (FDTL) for pilots has cost it dear. Each day’s exemption given for its Airbus A320 family pilots to ensure the airline was able to start resuming flights staring the second week of Dec is costing it Rs 30 lakh. This works out to Rs 20.4 crore for 68 days between Dec 5, 2025, & Feb 10, 2026.The airline has been fined one-time Rs 30 lakh each on six more counts, which add up the fine to Rs 22.2 crore. The six failures include failure to comply with new FDTL rules, rest periods, “inadequate buffer margins in roster planning… failure to strike balance between commercial imperatives and crew members’ ability to work effectively and failure of accountable management to ensure overall functioning, financing, and conduct of operations to DGCA standards.“Between Dec 3 and 5, 2,507 IndiGo flights were cancelled and 1,852 were delayed that left over 3 lakh passengers stranded at airports across the airline’s network. Flights had resumed gradually over the next week or so.What caused the crisis:“Over-optimisation of operations, inadequate regulatory preparedness along with deficiencies in system software support and shortcomings in management structure & operational control on the IndiGo”, have been identified as the “primary causes for the disruption” by the DGCA probe panel. “The airline’s management failed to adequately identify planning deficiencies, maintain sufficient operational buffer, and effectively implement the revised FDTL provisions,” the report says.Action against IndiGo:Apart from fines, the airline’s CEO has been cautioned “for inadequate overall oversight of flight ops and crisis management.” Accountable manager & COO, Isidre Porqueras, has been warned for “failure to assess impact of winter schedule 2025 and revised FDTL leading to widespread disruptions.” Senior VP (ops control centre) has been asked to be relieved from the post and not be given any accountable position in future. Warnings have been issued to flight ops and crew resource planning “for operational, supervisory, manpower planning and roster management lapses.”Way ahead:DGCA has asked IndiGo to take appropriate action against any other personnel identified through its inquiry and submit a compliance report regarding the same. Sources say IndiGo has been made aware of the lapses of its senior officials, especially COO, and now the airline is expected to take action against them. “The findings underscore the need for operational planning, and effective management oversight to ensure sustainable operations and passenger safety & convenience,” report says.IndiGo statement:Confirming receipt of DGCA ruling, airline said it is “committed to taking full cognisance of the orders and will, in a thoughtful and timely manner, take appropriate measures… an in-depth review of the robustness and resilience of the internal processes at IndiGo (is) underway to ensure that the airline emerges stronger out of these events in its otherwise pristine record of 19 plus years of operations”.

Business

Amid plans to induct Noel’s son, Tata trust cancels meet – The Times of India

MUMBAI: The Sir Ratan Tata Trust (SRTT) cancelled its Saturday board meeting, which was expected to consider the induction of chairman Noel Tata’s son, Neville Tata, as a trustee. In contrast, board meetings of Sir Dorabji Tata Trust (SDTT) and Tata Education and Development Trust (TEDT) proceeded as scheduled.The cancellation suggests that Neville’s appointment may have been pushed back to give trustees more time for discussions – since appointing a trustee requires unanimous approval. No new date for the SRTT meeting has been notified. An email query to Tata Trusts on the cancellation of the board meeting received no response. Sir Ratan Tata Trust (SRTT), Sir Dorabji Tata Trust (SDTT), and Tata Education and Development Trust (TEDT) have several trustees in common. Except for Jehangir HC Jehangir and Jimmy Tata, the other SRTT trustees — Noel, Venu Srinivasan, Vijay Singh and Darius Khambata — also serve on SDTT’s board and participated in its meeting on Saturday, people familiar with the matter said. Jimmy, Noel’s older half-brother, usually does not attend SRTT meetings.Saturday’s development comes amid unresolved issues from the last round of inductions in Nov 2025 when the inductions of Neville and former Titan MD Bhaskar Bhat were approved by SDTT but failed to secure approval at SRTT. SDTT, together with SRTT, controls India’s largest conglomerate, the Tata Group.At the Nov 11, 2025 SDTT meeting, Khambata proposed Neville’s appointment, while Noel proposed Bhat, as TOI reported in its Nov 12 edition. Neither name was on the formal board agenda. All trustees of SDTT approved the appointments (Srinivasan did not attend the meeting as his term had expired). Later, at SRTT’s meeting on the same day, both proposals were put off for consideration at a later date.Srinivasan, who participated in the SRTT meeting, reportedly expressed reservations, stating that these proposals were not on the agenda and that such matters should not be raised under “any other items for discussion.” While items not listed on the agenda can be introduced with the chairman’s permission, Srinivasan suggested they be considered at the next board meeting, according to a person familiar with the discussion.This time, Neville’s appointment was formally listed on the SRTT agenda but the meeting was cancelled. Bhat’s name did not appear on Saturday’s agenda. Neville participated at the SDTT meeting on Saturday, marking his first formal role at the flagship foundation.

Business

Number of SMEs in Scotland down since 2020, figures from Lib Dems show

New figures from the Scottish Liberal Democrats show that small businesses have declined in Scotland since 2020.

The party’s economy spokesman, Jamie Greene MSP, has called on the SNP Government to urgently boost support for small businesses as he revealed significant drops in the number of small or medium-sized enterprises (SMEs) across Scotland.

Mr Greene asked the Scottish Government to provide the number of SMEs in every Scottish parliamentary constituency in each year since 2015.

The data showed that since 2020, the number of SMEs in Scotland has fallen from 177,020 to 171,660 – a decline of 5,360.

Over the past decade, 24 parliamentary constituencies have seen a fall in the number of SMEs, with notable declines in more rural parts of the country, according to the Scottish Liberal Democrats.

This includes a 13.8% fall in SMEs in constituencies across Aberdeen and Aberdeenshire since 2015, and an 8% fall in Caithness, Sutherland and Ross.

The Scottish Liberal Democrats have secured tens of millions in support for business in this year’s draft Scottish budget, including a new £2.5 million package backing young entrepreneurs and an initial £36 million for business rates relief.

Mr Greene said: “These figures show concerning drops in the number of small and medium-sized businesses across Scotland.

“I’ve spoken to lots of skilled and entrepreneurial people who feel there are too many barriers to starting their own business, from the SNP’s economic incompetence to the crushing burden of red tape.

“I am pleased that Scottish Liberal Democrats secured some support for businesses in the draft budget, but we think the Scottish Government can go further.

“That’s why, in the coming weeks, we will be squeezing the Scottish budget for every penny to deliver for businesses.”

Deputy First Minister Kate Forbes said: “Entrepreneurs and start-up companies are the backbone of our economy and the Scottish Government has been working systematically to develop the pipeline of support required to help them develop, grow and prosper.

“The facts show that we are making clear progress in establishing the right conditions to help business founders succeed.

“There was a 17.9% increase in Scottish start-up businesses in the first half of 2025, while investment deals in Scotland grew by 24% in the first half of 2025 compared to the second half of 2024.

“The Scottish Budget 2026-27 continues to support business, investment and a skilled workforce to accelerate economic growth, including record funding for our entrepreneurs and start-ups as we act to harness Scotland’s strengths and opportunities to drive long-term prosperity.”

-

Tech5 days ago

Tech5 days agoNew Proposed Legislation Would Let Self-Driving Cars Operate in New York State

-

Sports1 week ago

Sports1 week agoClock is ticking for Frank at Spurs, with dwindling evidence he deserves extra time

-

Sports1 week ago

Commanders go young, promote David Blough to be offensive coordinator

-

Entertainment4 days ago

Entertainment4 days agoX (formerly Twitter) recovers after brief global outage affects thousands

-

Fashion7 days ago

Fashion7 days agoSouth India cotton yarn gains but market unease over US tariff fears

-

Fashion1 week ago

Fashion1 week agoChina’s central bank conducts $157-bn outright reverse repo operation

-

Business1 week ago

Business1 week agoSoftBank reduces Ola Electric stake to 13.5% from 15.6% – The Times of India

-

Sports7 days ago

Sports7 days agoUS figure skating power couple makes history with record breaking seventh national championship