Business

‘Discarded like a used tissue’: Readers on ageism forcing over-50s out

Age discrimination is rife in the workplace, Independent readers say, after new ONS figures showed unemployment rising and vacancies falling.

Readers said the lack of jobs was hitting older people hard with those in their 50s and 60s finding themselves “discarded like a used tissue” after decades of loyal service.

Some described spiralling into depression and experiencing financial strain after redundancy, while others said they had been forced to take low-paid or part-time work stacking shelves despite years of professional experience.

Several blamed cost-cutting managers who see older employees as “expensive” and “outdated,” arguing this short-sighted approach sacrifices skills, mentorship and productivity.

Others said companies’ obsession with cheap labour and short-term profits has left them struggling to rebuild teams.

A number of readers have turned to early retirement or self-employment out of necessity, only to find both solutions exhausting and precarious.

While a few spoke of eventually finding rewarding work, most painted a bleak picture of insecurity, lost confidence and wasted experience – a generation of “old horses” who feel written off before their time.

Here’s what you had to say:

Discarded after 30 years

My wife worked for the same company for 30 years. She was then discarded like a used tissue purely because she earned too much.

This led to four years of agony for us as she spiralled into depression and heavy drinking, which almost led to the break-up of our relationship. I was angry because she had given most of her life to the company. Her experience and skills were completely disregarded. After a year of job hunting, she ended up in a local supermarket, which she hated.

Get a free fractional share worth up to £100.

Capital at risk.

Terms and conditions apply.

ADVERTISEMENT

Get a free fractional share worth up to £100.

Capital at risk.

Terms and conditions apply.

ADVERTISEMENT

Luckily, she had a private pension, which meant she could retire. I had, and still have, a relatively well-paid job which keeps us comfortable. I have every sympathy with those who are finding the adjustment difficult. Never give up, though. Something will turn up.

Belittling

At 62, I have never qualified for unemployment benefit when I was made redundant three times and always had private unemployment insurance. I was last let go three years ago. I had a stint as self-employed, where the exploitation was simply unbelievable.

I attended job interviews where I was told I was too senior/over-qualified for the roles. I had quite a few offers of paid work two days a week, but in reality had to be on-call throughout the week for no extra compensation. Could have worked for free, sorry, “volunteered,” doing exactly the same job as before, so I politely declined. Eventually, I made the decision to start drawing my very modest deferred council pension and to enjoy life with considerably fewer material things. It’s tough, but I am getting used to it.

The exploitation and belittling of my generation when applying for roles can destroy one’s self-confidence and mental health, which I experienced firsthand. I refuse to transfer my hard-earned skills to stack shelves at supermarkets.

Our kids will see no inheritance

I went through my first redundancy at 45 and found my next job after eight months. The second redundancy was at 55, and it took 18 months to find a job. The third redundancy was at 63, and after seven months I found a contract job that ended two months after my 65th birthday. Now unemployed, on the dole, I am waiting for November when my state pension kicks in, carefully using some of the funds in my private pension.

Our kids will likely see little to no inheritance, which is probably okay given it would have been taxed to worthlessness. When we have to move to a managed care facility and sell the house, that’ll finish off any money we have.

This country MUST pass an age discrimination law banning employers from only hiring younger workers OR face the oblivion of costs!

Older workers are more expensive

It has always been more difficult for older workers. If they aspire to stay within their field of work, an older worker is more experienced and therefore more expensive, and if they move to pastures new, they are regarded (usually wrongly) as more of a risk, less adaptable, and harder to train.

By the same token, many of the complaints from younger workers about finding it hard to get that all-important first job are horribly familiar from when I was job hunting for the first time 40 years ago. There’s a lot of panic about jobs, but despite the disruptive impact of AI, I’m not convinced there’s anything much new here.

Listen to us old horses

I’m 57 and used to work in accounting, doing audits for chartered accountants. I’ve been pushing trolleys at Tesco and filling shelves and working the tills at Co-op for six years now.

Here’s some business advice from me: Cutting costs (i.e., wages) instead of increasing turnover with increased productivity leads to a decrease in value and quality of the product/service. It is false economy. The business folds. They sucked it dry – I saw so many young hotshot CEOs do this in my 30 years. Greed has, and always will, be around.

But they don’t take advice from us old ones anymore – we’re old horses that are outdated, expensive to feed, and a couple of steps away from being glue. I could be training a whole new bunch of finance staff, which could keep businesses going for the long haul, but instead I’m packing those shelves with your bread.

It’s scary out there

I’m 60 now. Just before Covid, my job was relocated to someone cheaper and younger in the EU. Then Covid hit and there weren’t interviews happening anywhere. Covid ate all my savings and settlement, and I finally found a job in a new industry on half the salary, although just for two years. Luckily, it gave me the experience to bounce into a better permanent role afterwards. I do not make anything like my old salary, but I have a great job that I enjoy… for now. It is scary out there. I’ve never been out of work before and I’m not sure if I could find a new role now.

Some of the comments have been edited for this article for brevity and clarity.

Want to share your views? Simply register your details below. Once registered, you can comment on the day’s top stories for a chance to be featured. Alternatively, click ‘log in’ or ‘register’ in the top right corner to sign in or sign up.

Make sure you adhere to our community guidelines, which can be found here. For a full guide on how to comment click here.

Business

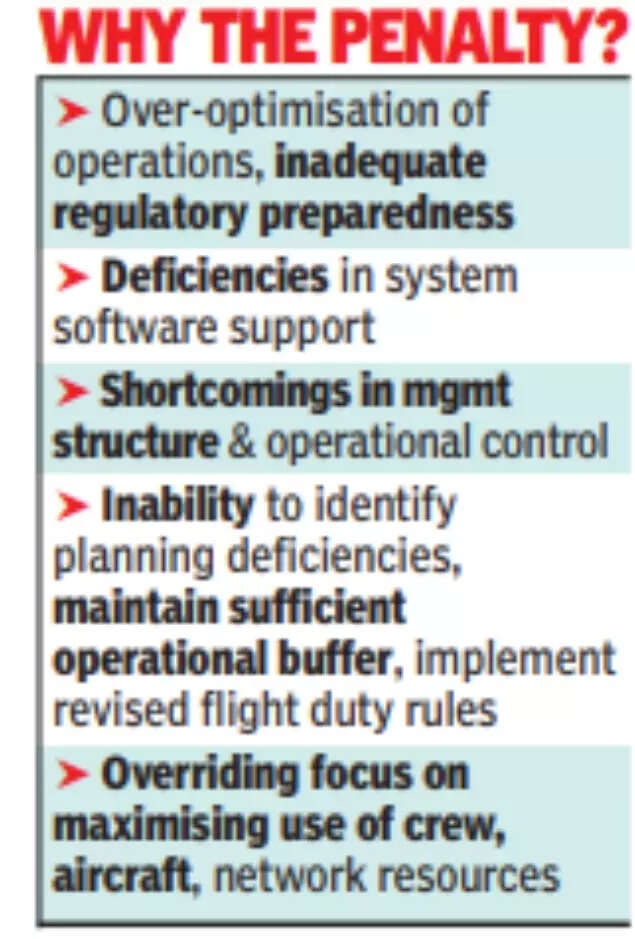

DGCA slaps IndiGo with fine of Rs 22 crore for flight disruptions – The Times of India

EW DELHI: The Directorate General of Civil Aviation (DGCA) has slapped IndiGo with the steepest fine ever for an Indian carrier – Rs 22.2 crore – for its massive flight disruptions last month.Additionally, the airline has to submit a bank guarantee of Rs 50 crore whose release is tied to implementing, among other things, the more humane flight duty norms for pilots aimed to enhancing flight safety. The regulator has warned senior airline officials, including the CEO & COO. The senior VP of operation control centre has to be removed from his position.

The senior VP of operation control centre has to be removed from his position and not given any accountable position in the future. The aviation ministry has ordered “an internal inquiry to identify and implement systemic improvements within DGCA”.The regulator late on Saturday night released key findings of the report by its four-member panel that probed IndiGo schedule collapse last month. The airline’s unpreparedness and consequent inability to implement DGCA’s new flight duty time limitation (FDTL) for pilots has cost it dear. Each day’s exemption given for its Airbus A320 family pilots to ensure the airline was able to start resuming flights staring the second week of Dec is costing it Rs 30 lakh. This works out to Rs 20.4 crore for 68 days between Dec 5, 2025, & Feb 10, 2026.The airline has been fined one-time Rs 30 lakh each on six more counts, which add up the fine to Rs 22.2 crore. The six failures include failure to comply with new FDTL rules, rest periods, “inadequate buffer margins in roster planning… failure to strike balance between commercial imperatives and crew members’ ability to work effectively and failure of accountable management to ensure overall functioning, financing, and conduct of operations to DGCA standards.“Between Dec 3 and 5, 2,507 IndiGo flights were cancelled and 1,852 were delayed that left over 3 lakh passengers stranded at airports across the airline’s network. Flights had resumed gradually over the next week or so.What caused the crisis:“Over-optimisation of operations, inadequate regulatory preparedness along with deficiencies in system software support and shortcomings in management structure & operational control on the IndiGo”, have been identified as the “primary causes for the disruption” by the DGCA probe panel. “The airline’s management failed to adequately identify planning deficiencies, maintain sufficient operational buffer, and effectively implement the revised FDTL provisions,” the report says.Action against IndiGo:Apart from fines, the airline’s CEO has been cautioned “for inadequate overall oversight of flight ops and crisis management.” Accountable manager & COO, Isidre Porqueras, has been warned for “failure to assess impact of winter schedule 2025 and revised FDTL leading to widespread disruptions.” Senior VP (ops control centre) has been asked to be relieved from the post and not be given any accountable position in future. Warnings have been issued to flight ops and crew resource planning “for operational, supervisory, manpower planning and roster management lapses.”Way ahead:DGCA has asked IndiGo to take appropriate action against any other personnel identified through its inquiry and submit a compliance report regarding the same. Sources say IndiGo has been made aware of the lapses of its senior officials, especially COO, and now the airline is expected to take action against them. “The findings underscore the need for operational planning, and effective management oversight to ensure sustainable operations and passenger safety & convenience,” report says.IndiGo statement:Confirming receipt of DGCA ruling, airline said it is “committed to taking full cognisance of the orders and will, in a thoughtful and timely manner, take appropriate measures… an in-depth review of the robustness and resilience of the internal processes at IndiGo (is) underway to ensure that the airline emerges stronger out of these events in its otherwise pristine record of 19 plus years of operations”.

Business

Amid plans to induct Noel’s son, Tata trust cancels meet – The Times of India

MUMBAI: The Sir Ratan Tata Trust (SRTT) cancelled its Saturday board meeting, which was expected to consider the induction of chairman Noel Tata’s son, Neville Tata, as a trustee. In contrast, board meetings of Sir Dorabji Tata Trust (SDTT) and Tata Education and Development Trust (TEDT) proceeded as scheduled.The cancellation suggests that Neville’s appointment may have been pushed back to give trustees more time for discussions – since appointing a trustee requires unanimous approval. No new date for the SRTT meeting has been notified. An email query to Tata Trusts on the cancellation of the board meeting received no response. Sir Ratan Tata Trust (SRTT), Sir Dorabji Tata Trust (SDTT), and Tata Education and Development Trust (TEDT) have several trustees in common. Except for Jehangir HC Jehangir and Jimmy Tata, the other SRTT trustees — Noel, Venu Srinivasan, Vijay Singh and Darius Khambata — also serve on SDTT’s board and participated in its meeting on Saturday, people familiar with the matter said. Jimmy, Noel’s older half-brother, usually does not attend SRTT meetings.Saturday’s development comes amid unresolved issues from the last round of inductions in Nov 2025 when the inductions of Neville and former Titan MD Bhaskar Bhat were approved by SDTT but failed to secure approval at SRTT. SDTT, together with SRTT, controls India’s largest conglomerate, the Tata Group.At the Nov 11, 2025 SDTT meeting, Khambata proposed Neville’s appointment, while Noel proposed Bhat, as TOI reported in its Nov 12 edition. Neither name was on the formal board agenda. All trustees of SDTT approved the appointments (Srinivasan did not attend the meeting as his term had expired). Later, at SRTT’s meeting on the same day, both proposals were put off for consideration at a later date.Srinivasan, who participated in the SRTT meeting, reportedly expressed reservations, stating that these proposals were not on the agenda and that such matters should not be raised under “any other items for discussion.” While items not listed on the agenda can be introduced with the chairman’s permission, Srinivasan suggested they be considered at the next board meeting, according to a person familiar with the discussion.This time, Neville’s appointment was formally listed on the SRTT agenda but the meeting was cancelled. Bhat’s name did not appear on Saturday’s agenda. Neville participated at the SDTT meeting on Saturday, marking his first formal role at the flagship foundation.

Business

Number of SMEs in Scotland down since 2020, figures from Lib Dems show

New figures from the Scottish Liberal Democrats show that small businesses have declined in Scotland since 2020.

The party’s economy spokesman, Jamie Greene MSP, has called on the SNP Government to urgently boost support for small businesses as he revealed significant drops in the number of small or medium-sized enterprises (SMEs) across Scotland.

Mr Greene asked the Scottish Government to provide the number of SMEs in every Scottish parliamentary constituency in each year since 2015.

The data showed that since 2020, the number of SMEs in Scotland has fallen from 177,020 to 171,660 – a decline of 5,360.

Over the past decade, 24 parliamentary constituencies have seen a fall in the number of SMEs, with notable declines in more rural parts of the country, according to the Scottish Liberal Democrats.

This includes a 13.8% fall in SMEs in constituencies across Aberdeen and Aberdeenshire since 2015, and an 8% fall in Caithness, Sutherland and Ross.

The Scottish Liberal Democrats have secured tens of millions in support for business in this year’s draft Scottish budget, including a new £2.5 million package backing young entrepreneurs and an initial £36 million for business rates relief.

Mr Greene said: “These figures show concerning drops in the number of small and medium-sized businesses across Scotland.

“I’ve spoken to lots of skilled and entrepreneurial people who feel there are too many barriers to starting their own business, from the SNP’s economic incompetence to the crushing burden of red tape.

“I am pleased that Scottish Liberal Democrats secured some support for businesses in the draft budget, but we think the Scottish Government can go further.

“That’s why, in the coming weeks, we will be squeezing the Scottish budget for every penny to deliver for businesses.”

Deputy First Minister Kate Forbes said: “Entrepreneurs and start-up companies are the backbone of our economy and the Scottish Government has been working systematically to develop the pipeline of support required to help them develop, grow and prosper.

“The facts show that we are making clear progress in establishing the right conditions to help business founders succeed.

“There was a 17.9% increase in Scottish start-up businesses in the first half of 2025, while investment deals in Scotland grew by 24% in the first half of 2025 compared to the second half of 2024.

“The Scottish Budget 2026-27 continues to support business, investment and a skilled workforce to accelerate economic growth, including record funding for our entrepreneurs and start-ups as we act to harness Scotland’s strengths and opportunities to drive long-term prosperity.”

-

Tech5 days ago

Tech5 days agoNew Proposed Legislation Would Let Self-Driving Cars Operate in New York State

-

Sports1 week ago

Sports1 week agoClock is ticking for Frank at Spurs, with dwindling evidence he deserves extra time

-

Sports1 week ago

Commanders go young, promote David Blough to be offensive coordinator

-

Entertainment4 days ago

Entertainment4 days agoX (formerly Twitter) recovers after brief global outage affects thousands

-

Fashion7 days ago

Fashion7 days agoSouth India cotton yarn gains but market unease over US tariff fears

-

Fashion7 days ago

Fashion7 days agoChina’s central bank conducts $157-bn outright reverse repo operation

-

Business1 week ago

Business1 week agoSoftBank reduces Ola Electric stake to 13.5% from 15.6% – The Times of India

-

Sports7 days ago

Sports7 days agoUS figure skating power couple makes history with record breaking seventh national championship