Business

The firms looking to destroy harmful ‘forever chemicals’

Technology Reporter

374Water

374Water“There’s a lot of destruction that needs to be done,” sums up Parker Bovée of Cleantech Group, a research and consulting firm.

He is referring to PFAS (Perfluoroalkyl and Polyfluoroalkyl Substances), also known as “forever chemicals”.

These man-made chemicals can be found in items such as waterproof clothing, non-stick pans, lipsticks and food packaging.

They are used for their grease and water repellence, but do not degrade quickly and have been linked to health issues such as higher risks of certain cancers and reproductive problems.

The extraordinarily strong carbon-fluorine bonds they contain gives them the ability to persist for decades or even centuries in nature.

PFAS can be detected and removed from water and soil and then concentrated into smaller volumes of high strength waste.

But what to do with that waste?

Currently, concentrated PFAS waste is either put in long-term storage which is expensive, or incinerated (often incompletely, leading to toxic emissions), or sent to landfills for hazardous waste.

But now clean-tech companies are bringing techniques to market that can destroy them.

These are being tested in small-scale pilot projects with potential customers including some industrial manufacturers, municipal wastewater treatment plants and even the US military.

There’s a “large and growing” market opportunity for PFAS destruction companies notes Mr Bovée.

While it is mostly currently centred in the US, others are dipping their toes, he says.

In the UK, funding for water companies to look into PFAS destruction has been provided by water regulator Ofwat, with Severn Trent Water leading a project to examine the potential technologies and suppliers.

One factor driving the market forward in the US is legal risk. Thousands of lawsuits claiming PFAS-related contamination and harm have been filed with some large chemical manufacturers, notably 3M, having already paid out billions in class-action settlements.

Regulation is also beginning to tighten worldwide.

Legal limits for two PFAS in drinking water are now scheduled to take effect in the US in 2031.

PFAS remains a bipartisan issue, says Mr Bovée, and many expect that future US regulation will expand beyond drinking water to cover industrial discharge and other sources.

The EU also has legal limits for PFAS in drinking water, which member states must begin enforcing from next year.

Axine Water Technologies

Axine Water TechnologiesThere are a variety of technologies for destroying PFAS – each with their own advantages and limitations.

According to Mr Bovée, one technology that is almost commercially ready is electrochemical oxidation (EO) technology.

Electrodes are placed in water contaminated by PFAS and a current is passed through, resulting in the chemicals’ breakdown.

While energy intensive, it doesn’t require high temperature or pressure, and is easy to operate and integrate into existing treatment systems for concentrating PFAS, says Mark Ralph, CEO of Canadian-based start-up Axine Water Technologies.

Last year, following a successful pilot project, it sold its first commercial-scale unit to a Michigan-based producer of automotive components. It is now up and running and the customer is planning to purchase additional systems for other sites.

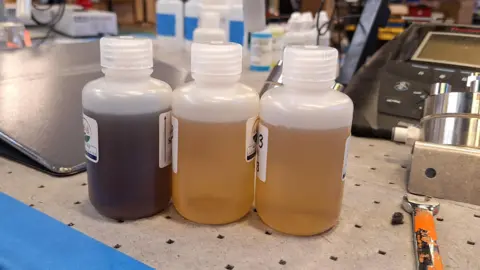

374Water

374WaterAnother technology not far behind is Supercritical Water Oxidation (SCWO).

It relies on heating and pressurising water to such a high degree that it enters a new state of matter: a so-called supercritical state. When the PFAS waste stream is introduced, it breaks the carbon-fluorine bonds.

One advantage is that it can process both solid and liquid PFAS waste, says Chris Gannon, CEO of North Carolina-based 374Water.

He says his technology can even destroy PFAS in plastics if they are ground up.

It can be expensive to buy and maintain – the process is so intense it requires a complex reactor and regular cleaning. But it can be more cost effective if the PFAS is first concentrated before it enters the process.

Currently the City of Orlando in Florida is testing 374Water’s technology at its largest wastewater treatment plant.

The City is trying to get ahead of the curve, explains Alan Oyler, its special projects manager for public works.

Levels of PFAS in sewage sludge aren’t currently regulated, but he expects them to be in the future.

So far, Mr Oyler is pleased with the destruction capability he has seen, but is also waiting to see how reliable the system is.

The scale of 374Water’s current technology is small: it can handle just a fraction of the tonnes of wet sludge the facility produces daily.

But the company is in the process of scaling up, and Mr Oyler imagines in a few years it will be able to handle all the facility’s material “ready for when the regulations require”.

Other technologies on their way to being commercially ready include hydrothermal alkaline treatment (HALT), which uses high temperature, high pressure, and an alkaline chemical to destroy PFAS; and plasma-based technology, which involves making an ionized gas (called a plasma) to attack and degrade the PFAS molecules.

Aquagga

AquaggaYet there is one potential issue with the technologies now coming through, says Jay Meegoda, a professor of civil and environmental engineering at the New Jersey Institute of Technology: nasty PFAS degradation byproducts.

For example, in the case of EO, highly corrosive hydrogen fluoride vapor. Each needs a “complete study” accounting for all their inputs and outputs, he says.

The companies have claimed they either don’t produce PFAS degradation products or deal with them adequately.

One important partner for many of the PFAS destruction companies in testing their technologies in the real world has been the US Department of Defence (DOD).

PFAS contamination at US military sites is a big, below-the-radar problem. It stems particularly from the use of older formulations of firefighting foam, used for example during training exercises or emergencies, but other routes too such as the cleaning of military equipment.

More than 700 sites are known or suspected to be contaminated, posing a threat to surrounding communities. A judge recently cleared the way for PFAS contamination and harm lawsuits against the military to proceed.

Clean up efforts are where the destruction companies could come in, and projects have been undertaken or are under way at various sites to assess the performance and cost effectiveness of many of their solutions.

One start-up, Aquagga, which specialises in HALT technology, recently completed a demonstration project for the DOD which involved destroying a firefighting foam mixture amongst other concentrated PFAS-containing liquids.

Immense volumes of the foam are currently stockpiled in all sorts of places, not just at military sites.

Like others, Aquagga sees a big opportunity over the next few years for both destroying the foam and remediating the environmental damage associated with its use.

And outside the military, there’s a tantalizing new PFAS waste stream on the horizon. The US is actively expanding domestic computer chip manufacturing – a process that uses PFAS in massive amounts. “We can destroy that,” says Mr Gannon, of 374Water.

Business

Green energy exports: $10-bn green ammonia project positions India as global clean-fuel supplier; Kakinada plant nears key milestone – The Times of India

A $10-billion green hydrogen and green ammonia project at Kakinada in Andhra Pradesh is set to cross a major construction milestone, reinforcing India’s ambition to emerge as a global supplier of clean energy to markets such as Germany, Japan and Singapore.The first major equipment erection ceremony of AM Green’s Green Hydrogen and Green Ammonia Complex will be held on January 17 and will be attended by Chief Minister N Chandrababu Naidu and Deputy Chief Minister Konidala Pawan Kalyan, state government officials said, PTI reported.Billed as one of the largest clean-energy investments in India to date, the project involves a total outlay of $10 billion and is expected to generate up to 8,000 jobs during the construction phase, besides substantial high-skill employment during operations and across allied sectors including renewable energy, logistics, storage and port services.AM Green is developing India’s first and the world’s largest green ammonia complex at Kakinada, with a planned capacity of 1.5 million tonnes per annum, through the brownfield conversion of an existing ammonia-urea facility. The project will be commissioned in phases, beginning with 0.5 million tonnes per annum by 2027, scaling up to 1 million tonnes by 2028 and reaching full capacity by 2030.Once operational, the facility will enable India’s first exports of green ammonia, which is increasingly being adopted globally as a clean shipping fuel, for power generation and as a carrier for green hydrogen.The integrated project spans 7.5 gigawatts of solar and wind capacity, 1,950 megawatts of electrolyser capacity and 2 gigawatts of round-the-clock renewable power, supported by pumped hydro storage, including India’s first such facility at Pinnapuram in Andhra Pradesh.AM Green has already signed long-term supply agreements with Germany-based utility Uniper and is in advanced discussions with potential buyers in Japan and Singapore, establishing India’s first green-energy export linkages with Europe and advanced Asian economies.The project is aligned with Andhra Pradesh’s Integrated Clean Energy Policy, 2024, which seeks to position the state as India’s primary hub for green hydrogen and green ammonia. Once fully commissioned, the facility is expected to mark a structural shift from energy import dependence towards clean-energy exports, placing Andhra Pradesh at the centre of the global green-energy value chain.AM Green, backed by the founders of the Greenko Group, is developing the project through AM Green Ammonia, a partnership involving Malaysia-based Gentari, Singapore’s sovereign wealth fund GIC and the Abu Dhabi Investment Authority. Construction at the Kakinada site is already under way, placing it among a limited set of large-scale green ammonia facilities globally that meet Renewable Fuels of Non-Biological Origin (RFNBO) standards.Beyond production, the project showcases an end-to-end clean-energy ecosystem within a single state, encompassing large-scale renewable generation, round-the-clock green power backed by storage, hydrogen and ammonia production, and port-based export infrastructure.AM Green has also moved to strengthen global linkages. In May last year, it announced a partnership with the Port of Rotterdam Authority to create a dedicated green-fuel corridor linking India with north-western Europe, aimed at enabling annual trade of up to 1 million tonnes of green fuels valued at nearly $1 billion. Earlier, it tied up with global logistics firm DP World to develop green fuel storage and export facilities in India and overseas.“This is not merely an industrial project, but a strategic step in positioning Andhra Pradesh and India as leaders in clean-energy exports and climate action,” the state government said.

Business

Budget 2026 Should Support MSMEs, Critical Minerals For Boosting Trade Resilience: Deloitte

Last Updated:

Deloitte India urges FY27 Budget to boost MSME support and critical mineral security, job protection and advancing India’s global manufacturing and clean energy goals.

Budget 2026 Expectations.

Budget 2026: Deloitte India has pitched a sharper focus on MSME support and critical mineral security in the FY27 Union Budget, arguing that these measures are essential to strengthen India’s trade resilience and reduce external vulnerabilities amid rising global uncertainty.

In its Budget expectations note, Deloitte India said micro, small and medium enterprises play a pivotal role in the economy, accounting for nearly 46% of India’s exports and emerging as the second-largest employer after agriculture. According to the firm, easing financial and compliance-related pressures on MSMEs would help them cope with global volatility, sustain production and remain competitive in overseas markets.

The Union Budget 2026-27 will be tabled on Sunday, February 1.

“Strengthening MSMEs will safeguard jobs and drive inclusive economic growth, boost rural incomes and support India’s ambition to become a global manufacturing hub,” Deloitte said.

The firm recommended measures such as enhanced export credit availability, concessional financing and simplified digital compliance systems to reduce the regulatory burden on small businesses. It also called for comprehensive training programmes to improve last-mile competitiveness of MSMEs, particularly those linked to global value chains.

Deloitte further suggested targeted export incentives or enhanced duty drawback support for tariff-sensitive sectors such as ready-made garments, gems and jewellery, and leather, which are more vulnerable to global trade disruptions.

Highlighting the risks from an increasingly protectionist global environment, Deloitte Economist Rumki Majumdar said rising uncertainty from tariff hikes, changes in rules of origin and non-tariff barriers could disproportionately affect Indian exporters. While the direct impact of global trade frictions on GDP growth may be limited to 40-80 basis points, the spillover effects on MSMEs and employment could be far more severe.

“MSMEs contribute 30.1 per cent to GDP, account for 45.79 per cent of India’s exports and employ nearly 290 million people; disruptions in export markets or tightening trade rules pose serious risks to jobs and income stability,” Majumdar said.

Beyond MSMEs, Deloitte emphasised the need for a strategic push on critical minerals to secure supply chains and support India’s clean energy transition. It proposed setting up a dedicated critical minerals fund to finance overseas acquisitions and technology partnerships, ensuring long-term access to essential resources.

The firm also recommended deeper global collaboration with regions such as Africa, Australia and Latin America to secure upstream access to minerals, alongside joint research and development in mineral processing and recycling. In addition, it called for incentives to promote investments in renewable energy, green hydrogen and grid-scale energy storage.

Deloitte said expanded funding for exploration, extraction and processing of key critical minerals, including lithium, cobalt and rare earth magnets, would be crucial to reduce import dependence and strengthen India’s strategic and economic security in the years ahead.

January 16, 2026, 15:02 IST

Read More

Business

Pakistan Stock Exchange staged a strong comeback – SUCH TV

Pakistan Stock Exchange (PSX) on Friday staged a strong comeback, breaking the long bearish momentum as snowballing forex reserves have lifted investor sentiment.

During intraday trading, the PSX’s benchmark KSE-100 index gained a whopping 3,146.23 points to climb to 184,602.56 points, marking a positive change of 1.70%.

Out of 562 active companies, share prices of 375 advanced and of 67 declined while rates of 120 companies remained unchanged.

Economic analysts said the uptick offered some breathing space for the economy, even as the country continued to keep a close watch on external inflows and outflows.

Pakistan’s foreign exchange reserves inched up by $16 million over the past week, according to figures released by the State Bank of Pakistan.

The central bank said its official reserves rose from $16.0557 billion to $16.0718 billion, showing a modest gain during the week.

Overall, the country’s total reserves climbed to $21.2484 billion.

The State Bank also noted that commercial banks’ holdings went up by $5.6 million, reaching $5.1927 billion.

The central bank projects the FY26 current account deficit at 0–1% of GDP and sees reserves at $17.8 billion by June 2026 with planned official inflows.

A day earlier, the stock exchange dropped by over 1,100 points due to massive selling pressure.

The PSX had extended losses after recording an increase for a brief period as investors seemed cautious amid rising geopolitical tensions involving Iran.

During intraday trading, the KSE-100 index touched 183,717.53 due to strong buying in the early sessions before it turned bearish by losing 69.29 points to close at 182,500.52 points.

International officials have warned that US military intervention in Iran now appears likely and could take place within the next 24 hours amid sharply escalating tensions in the Middle East.

American, European and Israeli sources said preparations for possible action were under way as Washington began evacuating personnel from its major air base in Qatar.

-

Politics1 week ago

Politics1 week agoUK says provided assistance in US-led tanker seizure

-

Entertainment1 week ago

Entertainment1 week agoDoes new US food pyramid put too much steak on your plate?

-

Entertainment1 week ago

Entertainment1 week agoWhy did Nick Reiner’s lawyer Alan Jackson withdraw from case?

-

Sports5 days ago

Sports5 days agoClock is ticking for Frank at Spurs, with dwindling evidence he deserves extra time

-

Business1 week ago

Business1 week agoTrump moves to ban home purchases by institutional investors

-

Sports1 week ago

Sports1 week agoPGA of America CEO steps down after one year to take care of mother and mother-in-law

-

Tech3 days ago

Tech3 days agoNew Proposed Legislation Would Let Self-Driving Cars Operate in New York State

-

Business1 week ago

Business1 week agoBulls dominate as KSE-100 breaks past 186,000 mark – SUCH TV