Business

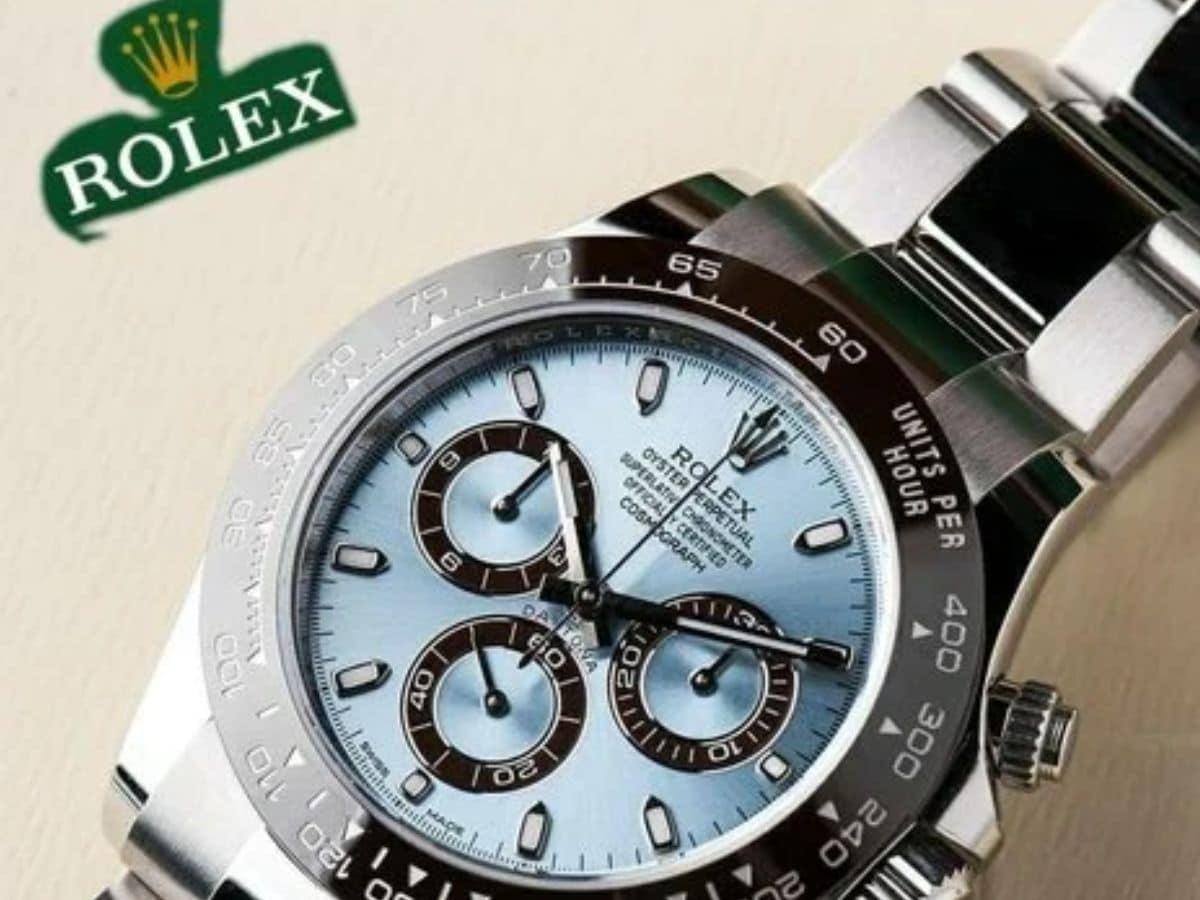

Why Is A Rolex Watch So Expensive? The Hidden Story Will Surprise You

In the rarefied world of luxury goods, few objects trigger as much awe, and as much sticker shock, as a Rolex. Starting at around Rs 4-5 lakh and often requiring a waiting period of several years, the watch has become a symbol of precision, status and engineering excellence. Yet, behind its global appeal lies a history that 99% of people have never heard, one that explains not only its high price, but also the extraordinary trust it commands. (News18 Hindi)

The Rolex story begins quietly in London in 1905, where Hans Wilsdorf and Alfred Davis founded a modest company called Wilsdorf & Davis. They were not selling watches under their own name. Instead, they manufactured finely crafted wristwatches and supplied them to jewellers, who stamped their own branding on the dials before selling them to customers. (News18 Hindi)

Wristwatches, at that time, were not considered accurate enough to replace pocket watches, which dominated the market despite their own vulnerabilities. A pocket watch could stop working if exposed to water or even slight shifts in altitude, but it remained the only reliable tool for timekeeping. (News18 Hindi)

Wilsdorf, however, sensed a shift long before the world did. He realised that a wristwatch, more convenient, more wearable, and more discreet, had the potential to become the preferred timekeeping device if only its precision could match that of a pocket watch. Determined to improve accuracy, he and Davis immersed themselves in experimentation and refinement until they finally succeeded in building what was soon hailed as one of the world’s most precise wristwatches. (News18 Hindi)

As demand for these watches grew, the two founders recognised an irony; jewellers, not the makers, were receiving the credit. The time had come to establish a brand identity of their own. In 1908, they chose a new name, short, crisp, and suitable for the dial, Rolex. Alongside the rebranding came a strategic relocation. Switzerland, already celebrated for its exacting horological standards, became Rolex’s new headquarters. After closing the London office in 1919 due to wartime taxation, the shift to Geneva proved to be a turning point. A “Swiss Made” Rolex did not need much persuasion; the name itself inspired trust, and customers bought the watches readily. (News18 Hindi)

By now, Rolex was not content with precision alone. Wilsdorf envisioned a watch that could defy not only time but the elements. After years of experimentation, the company unveiled the world’s first waterproof wristwatch, the Oyster, in 1926. It was an engineering triumph, but one that needed public proof. Traditional advertising would not be enough to convince sceptics. Wilsdorf responded with a visionary marketing idea. He placed the watch on the wrists of athletes and adventurers. When a young swimmer crossed the English Channel wearing a Rolex that survived the journey unscathed, the company showcased the feat in shop windows across Europe. Confidence in the brand soared. (News18 Hindi)

Through such dramatic demonstrations, Rolex cultivated an identity that blended craftsmanship with adventure. Its watches were not merely accessories; they were instruments of endurance, capable of accompanying human beings to the deepest oceans, the highest mountains and the harshest terrains. (News18 Hindi)

This long heritage of innovation explains, in part, why Rolex watches are costly even today. The materials themselves set them apart. The company uses 904L steel, a metal significantly more expensive and more resistant to corrosion than the 316L steel used by most luxury watchmakers. (News18 Hindi)

Many models incorporate solid gold or platinum, demanding an extraordinary level of craftsmanship and finishing. Every watch undergoes rigorous testing, often surpassing official chronometer certifications. Production remains deliberately limited not because of marketing strategy, but because the manufacturing process is slow, meticulous and resistant to shortcuts. (News18 Hindi)

Over more than a century, Rolex has built not just watches, but a narrative of reliability and endurance that no rival has fully replicated. The true reason behind its high price is not merely the steel, the gold or the platinum. It is the unwavering promise set forth by Hans Wilsdorf; a Rolex must keep accurate time, anywhere on the planet, under any possible condition. That promise has defined the company’s engineering philosophy for generations, and continues to justify the extraordinary value placed on every watch that bears its name. (News18 Hindi)

Business

Top stocks to buy: Stock recommendations for the week starting January 19, 2026 – check list – The Times of India

Stock market recommendations: According to Motilal Oswal Financial Services Ltd, the top stock picks for the week (starting January 19, 2026) are 360 One, and Canara HSBC Life. Let’s take a look:

360 One360 One WAM is a structural growth story given tailwinds from India’s expanding wealth pool, new team onboarding, and synergies from recent acquisitions which underpin long-term growth visibility. It delivered a strong 3QFY26, driven by robust inflows and operating leverage. Operating revenue grew 33% YoY, led by a sharp 45% YoY rise in ARR income, while disciplined cost control reduced the cost-to-income ratio by 320bp YoY to 49.6%, supporting healthy profit growth. PAT grew 20% YoY despite a sharp decline in other income. Growth was fueled by strong net ARR inflows of ₹147b, with record AMC inflows and sustained momentum in wealth management driven by wallet share gains and carry income-led retention improvement. Management remains confident of further CI ratio improvement toward 45–46% as ET Money and HNI businesses move toward breakeven. Management guides for 22–24% AUM growth, translating into 21%/22% revenue/PAT CAGR over FY25-28.Canara HSBC LifeCanara HSBC Life Insurance represents a compelling banca-led compounding story, underpinned by strong distribution moats and significant headroom for efficiency-driven growth. The insurer has consistently outperformed the industry over the past decade by leveraging its deep bancassurance partnerships, led by Canara Bank and complemented by HSBC, which together provide access to a large, sticky, and increasingly segmented customer base.With penetration among Canara Bank customers still very low and branch productivity materially below private-bank peers, incremental gains from better analytics, digital enablement, and branch activation offer a long runway for growth at low acquisition cost. HSBC adds a high-quality layer through affluent, NRI, salary, and corporate customers, supporting superior persistency and value accretion. Alongside this, gradual diversification into agency and other channels improves reach and reduces concentration risk without materially diluting long-term economics. A favorable shift in product mix toward non-par and protection, improving operating efficiency, and rising scale are driving steady expansion in value creation metrics, positioning Canara HSBC Life as a structurally improving, capital-efficient life insurer with sustained growth visibility and strong return potential over the medium term.(Disclaimer: Recommendations and views on the stock market, other asset classes or personal finance management tips given by experts are their own. These opinions do not represent the views of The Times of India)

Business

China hits 2025 economic growth target as exports boom

China’s economy grew by 5% last year, as record exports helped the world’s second largest economy meet its annual target.

Beijing had set a goal of “around 5%” economic growth in 2025, despite struggles to boost domestic spending and a prolonged property crisis.

China reported the world’s largest-ever trade surplus last week – the value of goods and services sold overseas compared to its imports – of $1.19tn (£890bn), driven by a rise in exports to markets outside the US, as President Donald Trump continued his tariffs policy.

But official figures released on Monday also showed that China’s economic growth slowed to a rate of 4.5% in the final three months of 2025 compared to a year earlier.

As well as China’s exporters moving away from the American market, China’s economic resilience was helped by lower-than-expected US tariffs after Beijing and Washington agreed a tariffs pause.

While China’s manufacturers continued to boost exports, the country is grappling with a number of issues in its domestic economy.

The country has been struggling with an ongoing property crisis and rising local government debt, which has made businesses more hesitant to invest and consumers cautious about spending.

Other new data on Monday showed that new home prices continued to fall in December, as the government struggled to stabilise the property market. Prices dropped 2.7% last month compared to a year earlier, the sharpest decline in five months. Property investment also fell 17.2% last year.

At the same time retail sales rose by just 0.9% in December, the slowest rate in three years.

But the country’s factory output increased by 5.2% in December from a year earlier, beating the 4.8% growth in November.

China’s leaders have pledged “proactive” policies this year as they look to increase domestic spending and shift reliance away from exports and investments.

Business

Rachel Reeves says UK listing rules ‘reinvigorating’ City amid hopes of revival

Chancellor Rachel Reeves will say that cutting red tape for firms listing their shares on the London stock markets is “reinvigorating” the City after early signs of a revival.

Ms Reeves also set her hopes on the FTSE 100’s standout year encouraging more Britons to get investing.

The Chancellor’s remarks coincide with the financial watchdog introducing new rules in the UK’s capital markets on Monday.

The new measures lower costs and speed things up for UK businesses looking to secure investment.

“Two years ago, some said the City’s best days were behind it. They were wrong,” Ms Reeves is expected to say at an event in the City of London on Monday.

“As the FTSE 100 reaches record highs and global firms once again choose London, we are seeing the first signs of a new golden age for the City.

“By cutting paperwork and speeding up access to capital, these reforms back the entrepreneurs, innovators and investors who drive our economy – while preserving the high standards and investor protections that make the UK one of the most trusted markets in the world.”

She will add that simpler and faster prospectuses and a more competitive listings regime are “reinvigorating that spirit” of openness in the London markets.

Under the new rules, companies that are already listed on London’s stock markets will not need to publish lengthy prospectuses in order to issue more shares and raise funds, in most cases.

The changes will also halve the time it takes between initial documents being published and an IPO (initial public offering) to list on the London Stock Exchange (LSE).

Furthermore, the LSE hailed the launch of its new “access bonds” initiative on the back of changes that make it easier for bonds to be issued in smaller values, therefore making them more accessible to a wider range of individual investors.

The changes come after the LSE was bolstered by a late spurt in listing activity towards the end of 2025, including the flotations of Princes Group and Shawbrook Bank.

It sparked hopes of a rebound after a prolonged drought in activity and a flurry of UK-listed businesses abandoning London for international rivals.

Meanwhile, Ms Reeves is banking on the recent record performance of the FTSE 100 ushering in more retail investors.

The index, which tracks the performance of the UK’s biggest listed companies, surpassed the milestone 10,000 mark earlier this month for the first time in its history.

It follows a standout year that saw the FTSE rise by 21.5%, the most since 2009.

The Government is working on reforms that will build a retail investment culture in the UK and remove barriers it says are unnecessary, with Britain trailing behind other countries such as the US.

-

Tech6 days ago

Tech6 days agoNew Proposed Legislation Would Let Self-Driving Cars Operate in New York State

-

Sports1 week ago

Sports1 week agoClock is ticking for Frank at Spurs, with dwindling evidence he deserves extra time

-

Entertainment6 days ago

Entertainment6 days agoX (formerly Twitter) recovers after brief global outage affects thousands

-

Fashion1 week ago

Fashion1 week agoSouth India cotton yarn gains but market unease over US tariff fears

-

Fashion1 week ago

Fashion1 week agoChina’s central bank conducts $157-bn outright reverse repo operation

-

Sports1 week ago

Sports1 week agoUS figure skating power couple makes history with record breaking seventh national championship

-

Sports4 days ago

Sports4 days agoPak-Australia T20 series tickets sale to begin tomorrow – SUCH TV

-

Business1 week ago

Business1 week agoModern seafood processing zone planned at Korangi harbour | The Express Tribune