Business

US–Venezuela Conflict: What It Could Mean For Crude Oil Prices And India’s Economy

Last Updated:

US forces captured Venezuela President Nicolas Maduro and Cilia Flores on drug charges. India faces minimal impact due to reduced Venezuelan oil imports.

US action against Venezuela has put crude oil markets on alert, with potential ripple effects for India’s economy.

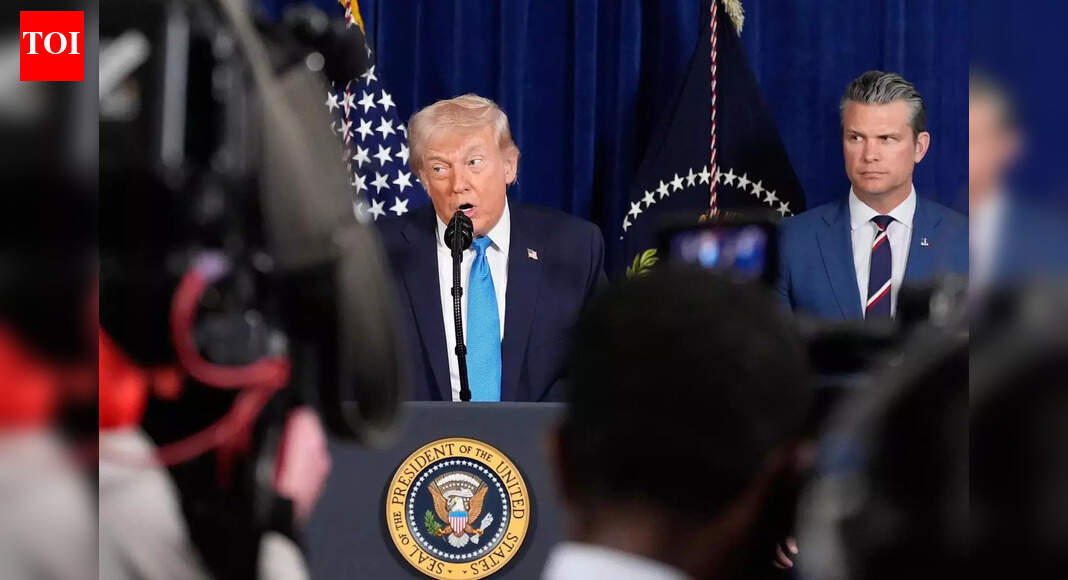

US–Venezuela Conflict: The conflict between the United States of America and Venezuela has escalated after the former’s military raided and captured the latter’s President, Nicolas Maduro, and his wife.

US President Donald Trump said that Venezuela’s President Nicolas Maduro and his wife, Cilia Flores, who were captured in Caracas during a US military operation on January 03, have been indicted on charges of alleged “drug trafficking and narco-terrorism conspiracies” in the Southern District of New York, and will face trial.

Trump said that Maduro and his wife “will soon face the full might of American justice and stand trial on American soil”. According to an unsealed indictment shared by Attorney General Pamela Bondi on X, Maduro and Flores face multiple counts of statutory allegations related to “drug trafficking and narco-terrorism conspiracies”.

A plane carrying Maduro landed near New York City on Saturday night, and he was helicoptered to the city before being taken by a large convoy to the Metropolitan Detention Center in Brooklyn under a heavy police guard.

Venezuela’s Supreme Court ordered Vice President Delcy Rodriguez to assume the powers and duties of acting president after the US removed Nicolas Maduro, CNN reported.

With a sudden geopolitical turmoil and being a major oil supplier country, there are concerns regarding the spike in crude oil prices, which could have an impact on the Indian economy.

Will the US-Venezuela Crisis Have an Impact On India?

Global Trade Research Initiative (GTRI), in a note, said that India is unlikely to be affected by the ongoing crisis in Venezuela in terms of material economy or energy.

The trade body said that India has been reducing crude shipments from Venezuela in recent years. It added that since 2019, when US sanctions took effect, the country reduced imports and commercial activity, and curbed trade from the South American nation.

In 2024–25, India’s imports from Venezuela declined sharply to $364.5 million, with crude oil accounting for $255.3 million of the total. This represented a steep 81.3 percent fall from imports worth $1.4 billion in 2023–24.

India’s exports to Venezuela remained modest at $95.3 million during the year, led by pharmaceutical shipments valued at $41.4 million.

Given the limited trade exposure, ongoing sanctions and the significant geographical distance, the Global Trade Research Initiative (GTRI) said the latest developments in Venezuela are unlikely to have any material impact on India’s economy or its energy security.

India May Benefit If Sanctions Ease

India is expected to re-emerge as a key buyer if Venezuelan supplies return. “If sanctions are eased… trade flows can resume rapidly,” said Kpler analyst Nikhil Dubey, noting that Indian refineries are technically well suited to process Venezuelan heavy crude, as quoted by PTI.

Crude Oil Prices May Jump In Near Future

Crude oil prices is likely to see a gap-up opening when the market opens on Monday, January 5, according to market experts told LiveMint.

“The US attack on Venezuela is expected to trigger geopolitical tension in the region, which is expected to fuel the uncertainty. Hence, I expect a gap-up opening for gold, silver, copper, crude oil, gasoline, and other commodities,” said Anuj Gupta, Director of Ya Wealth.

January 04, 2026, 16:14 IST

Read More

Business

Trump raises new global tariffs to 15% after hitting out at ‘terrible’ Supreme Court

Donald Trump has increased global tariffs to 15 per cent as he hit out at a Supreme Court ruling that struck down his previous import levies, calling the ruling “terrible” and branding the justices who rejected his trade policy as “fools”.

On Friday, the US president said he would replace the tariffs axed by the court with a 10 per cent tax on all goods entering the US. But in a post on Truth Social on Saturday he announced plans to increase this to 15 per cent.

The US president’s “reciprocal tariffs”, imposed on most of the rest of the world last April under an emergency powers law, were overturned by the US Supreme Court on Friday in a major blow to the president’s economic agenda.

But he doubled down on imposing levies following the decision, claiming the court “has been swayed by foreign interests” and other countries were “dancing in the streets, but they won’t be dancing for long, that I can assure you”.

The UK scrambled to respond in the wake of the announcement, with ministers saying they expect the country’s “privileged trading position with the US” to continue following the Supreme Court’s ruling.

The UK received the lowest tariff rate of 10 per cent, and a subsequent deal struck by Sir Keir Starmer and Mr Trump saw further carve-outs for Britain’s steel industry and car manufacturers.

The US president’s latest tariff announcements raise questions over whether those deals still stand, although officials are understood to believe it will not impact on most of the UK’s trade with America, including preferential deals on steel, cars and pharmaceuticals.

Posting on Truth Social on Saturday afternoon, Mr Trump said: “I, as President of the United States of America, will be, effective immediately, raising the 10% Worldwide Tariff on Countries, many of which have been ‘ripping’ the U.S. off for decades, without retribution (until I came along!), to the fully allowed, and legally tested, 15% level.”

It came after a post on Friday evening said: “It is my Great Honor to have just signed, from the Oval Office, a Global 10 per cent Tariff on all Countries, which will be effective almost immediately. Thank you for your attention to this matter! PRESIDENT DONALD J. TRUMP”

He later added in a follow-up post criticising the Supreme Court Justices who ruled against his levies: “Their decision was ridiculous but, now the adjustment process begins, and we will do everything possible to take in even more money than we were taking in before!”

Speaking at the White House earlier, Mr Trump said the Supreme Court decision affirmed his ability to charge more tariffs under different statutes.

He said: “In order to protect our country, a president can actually charge more tariffs than I was charging in the past… period of a year.

“Under the various tariffs authorities, so we can use other of the statutes, other of the tariff authorities, which have also been confirmed and are fully allowed.

“Therefore, effective immediately, all national security tariffs under Section 232 and existing Section 301 tariffs, they’re existing, they’re there, remain in place, fully in place. And in full force.

“Today I will sign an order to impose a 10 per cent global tariff under Section 122, over and above our normal tariffs already being charged.

“And we’re also initiating several Section 301 and other investigations to protect our country from unfair trading practises of other countries and companies.”

A UK government spokesperson said: “This is a matter for the US to determine but we will continue to support UK businesses as further details are announced.

“Under any scenario, we expect our privileged trading position with the US to continue and will work with the administration to understand how the ruling will affect tariffs for the UK and the rest of the world.”

It was an updated version of a statement released earlier in response to the court ruling, but removed a reference to the UK enjoying “the lowest reciprocal tariffs globally”.

In the wake of the announcement, Liberal Democrat leader Sir Ed Davey said the UK government should sue Mr Trump for $100bn for the damage caused to the UK by trade tariffs, arguing it is “the only language he understands”.

He branded Mr Trump the “most dangerous, damaging US president of modern times” as he welcomed the “brilliant” decision by the US Supreme Court on Friday.

It came after Mr Trump said that some trade deals negotiated after he imposed his reciprocal tariffs will no longer be valid after the US Supreme Court ruling.

“Some of them stand. Many of them stand. Some of them won’t, and they’ll be replaced with the other tariffs,” he said.

When he first announced the 10 per cent “global tariff”, the US president said it would be in place for around five months.

“We’re going straight ahead with 10 per cent straight across the board… and then during that period of about five months, we are doing the various investigations necessary to put fair tariffs, or tariffs period, on other countries.

“So we’re doing that, period, but we’re immediately instituting the 10 per cent provision, which we’re allowed to do. And in the end, I think we’re taking more money than we’ve taken in before.”

The US has collected more than $133bn (£98.4bn) since Mr Trump imposed the tariffs, but now faces the prospect of having to refund that money to importers.

Friday’s decision, approved by a 6-3 majority, found that a 1977 law did not give Mr Trump the power to impose tariffs without the approval of the US Congress.

The British Chambers of Commerce (BCC) said the decision did little to “clear the murky waters for business” around US tariffs.

William Bain, head of trade policy at the BCC, said Mr Trump could use other legislation to reimpose tariffs.

He said: “For the UK, the priority remains bringing tariffs down wherever possible. It’s important the UK government continues to negotiate on issues like steel and aluminium tariffs and reduces the scope of other possible duties.”

Campaign group Best for Britain said the decision “underlines the instability of doing deals with Trump’s USA and the importance of forging deeper, more reliable trade with our EU neighbours”.

Business

Slovakia threatens to cut Ukraine electricity | The Express Tribune

Slovakia’s Prime Minister and leader of Smer party Robert Fico. PHOTO: REUTERS

BENGALURU:

Slovakia’s Prime Minister Robert Fico threatened on Saturday to cut off emergency electricity supplies to Ukraine unless Kyiv acts within two days to resume the pumping of Russian oil to Slovakia over Ukraine’s territory, cut off for nearly a month.

Slovakia, along with Hungary, is one of just two EU countries that still rely on significant amounts of Russian oil shipped via the Soviet-era Druzhba pipeline over Ukraine. Both also have leaders that have maintained close relations with Moscow, bucking a largely pro-Ukrainian European consensus.

Russian oil through the main Druzhba pipe has been cut off since January 27, when Kyiv says a Russian drone strike hit pipeline equipment in Western Ukraine. Slovakia and Hungary have become increasingly vocal this week in demanding it resume.

Slovakia, meanwhile, is also a major source of European electricity for Ukraine, needed as Russian attacks have damaged its grid. Energy sector experts say Slovakia provided 18% of record-setting Ukrainian electricity imports last month.

“If oil supplies to Slovakia are not resumed on Monday, I will ask SEPS, the state-owned joint-stock company, to stop emergency electricity supplies to Ukraine,” Fico said in a post on X.

Ukraine has proposed alternative transit routes to ship oil to Europe while emergency pipeline repair works are under way. In a letter seen by Reuters, the Ukrainian mission to the EU proposed shipments through Ukraine’s oil transportation system or a maritime route, potentially including the Odesa-Brody pipeline linking Ukraine’s main Black Sea port to the EU.

Business

US eyes investment in IT, mining, energy | The Express Tribune

.

24 revenue estates digitised in capital to stop fraud practices. Photo file

ISLAMABAD:

The United States has expressed interest in investing in Pakistan’s IT, mining, minerals and energy sectors, as both countries agreed, on Saturday, to maintain engagement on large-scale projects, according to the Ministry of Finance.

Federal Minister for Finance Muhammad Aurangzeb met US Secretary of Commerce Howard Lutnick in Washington, where the two sides discussed promoting trade and investment between Pakistan and the United States.

The ministry said American interest was conveyed in ICT, mining, minerals and energy. Both countries reaffirmed their commitment to strengthening economic cooperation and welcomed the holding of the US-Pakistan Trade and Investment Forum on March 31, 2026.

Prominent companies from both sides and ministerial-level participation are expected at the forum. The finance minister is likely to attend the US Department of Commerce event. A Pakistani delegation, led by Aurangzeb, met Lutnick at the Department of Commerce in Washington DC. The finance minister was accompanied by the secretary commerce, Pakistan’s ambassador to the United States and trade and economic ministers.

According to the statement, both sides reiterated their desire to enhance economic cooperation, particularly in trade and investment, and agreed to continue engagement on investment in major projects in the coming months.

-

Entertainment5 days ago

Entertainment5 days agoQueen Camilla reveals her sister’s connection to Princess Diana

-

Tech5 days ago

Tech5 days agoRakuten Mobile proposal selected for Jaxa space strategy | Computer Weekly

-

Politics5 days ago

Politics5 days agoRamadan moon sighted in Saudi Arabia, other Gulf countries

-

Entertainment5 days ago

Entertainment5 days agoRobert Duvall, known for his roles in "The Godfather" and "Apocalypse Now," dies at 95

-

Sports5 days ago

Sports5 days agoUsman Tariq backs Babar and Shaheen ahead of do-or-die Namibia clash

-

Tech5 days ago

Tech5 days agoBusinesses may be caught by government proposals to restrict VPN use | Computer Weekly

-

Fashion5 days ago

Fashion5 days agoAustralia’s GDP projected to grow 2.1% in 2026: IMF

-

Business5 days ago

Business5 days agoTax Saving FD: This Simple Investment Can Help You Earn And Save More