Fashion

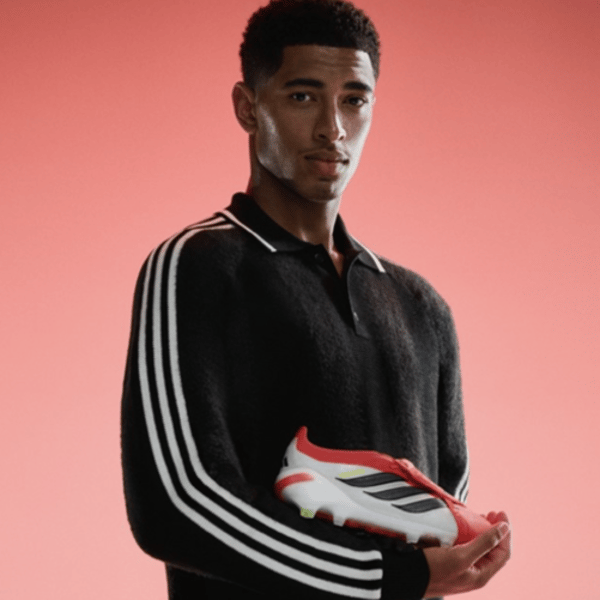

Adidas challenges players to ‘Choose a Side’ as Yamal and Bellingham front latest Predator and F50 campaign

Published

January 12, 2026

Do you choose chaos or control? That’s the question behind the latest Adidas football boot spring/summer campaign for its latest Predator and F50 products.

Consumers are asked that same question, inviting players to choose either chaos (via Lamine Yamal and F50), or control (Jude Bellingham and Predator), with both Adidas styles receiving “striking” colour updates for spring/summer 2026.

“More than just a boot launch”, the campaign “captures a playful rivalry that has taken over the game”, asking footballers around the world to “choose one” – either Team Predator or Team F50.

While the new Predator Elite FT is designed for “control, enabling players to execute with precision in high-pressure moments”, the F50 Elite is for those “who break with convention, players who push themselves to the limit to create unexpected brilliance”.

Of course, the campaign features two of football’s biggest names – Yamal (“chaos personified”) and Bellingham (“the master of control”), starring in a film that “brings to life picking between electrifying pace and game-breaking skill or calmly commanding any situation on the pitch”.

Predator will be also worn on pitch by star players including Bellingham, Trent Alexander-Arnold, Pedri, Alessia Russo and Aitana Bonmati while, alongside Yamal, F50 will be put through their paces by players including Ousmane Dembélé, Florian Wirtz, Vicky Lopez and Trinity Rodman.

Sam Handy, GM Football at Adidas, said: “Through this campaign, we’re igniting a conversation that sits at the heart of football culture. These boots are about more than just innovation; they represent the two fundamentally opposing forces that define the modern game: raw speed and ultimate control.”

The F50 Elite (£235/€270) and Predator Elite Fold-Over Tongue (£245/€280) models are available to purchase from today, in-store and online.

Copyright © 2026 FashionNetwork.com All rights reserved.

Fashion

India’s real GDP estimated to grow 7.6% in FY26 under new base FY23

Nominal GDP, or GDP at current prices, is estimated to grow at 8.6 per cent to reach ₹345.47 trillion in FY26 against ₹318.07 trillion in 2024-25.

India’s real GDP is estimated to grow at 7.6 per cent to ₹322.58 trillion (~$3.54 billion) in FY26 compared to the first revised GDP estimate of ₹299.89 trillion for FY25 (7.1 per cent growth).

It released the new series of annual and quarterly national accounts estimates with FY23 base.

Real GVA is projected to grow at 7.7 per cent to reach ₹294.40 trillion in FY26 against ₹273.36 trillion in FY25.

Real gross value added (GVA) is projected to grow at 7.7 per cent to reach ₹294.40 trillion in FY26 against ₹273.36 trillion in FY25 (a 7.3-per cent growth rate).

Nominal GVA is estimated to grow at 8.7 per cent to hit ₹313.61 trillion during FY26, against ₹288.54 lakh crore in 2024-25.

Robust economic performance in FY26 is primarily on account of robust real growth observed in the second quarter (8.4 per cent) and third quarter (7.8 per cent).

The manufacturing sector has been the major driver of resilient performance of the economy the consecutive three fiscals after rebasing, a release from the ministry said.

Both private final consumption expenditure and grossed fixed capital formation exhibited more than 7-per cent growth rate in FY26.

Fibre2Fashion News Desk (DS)

Fashion

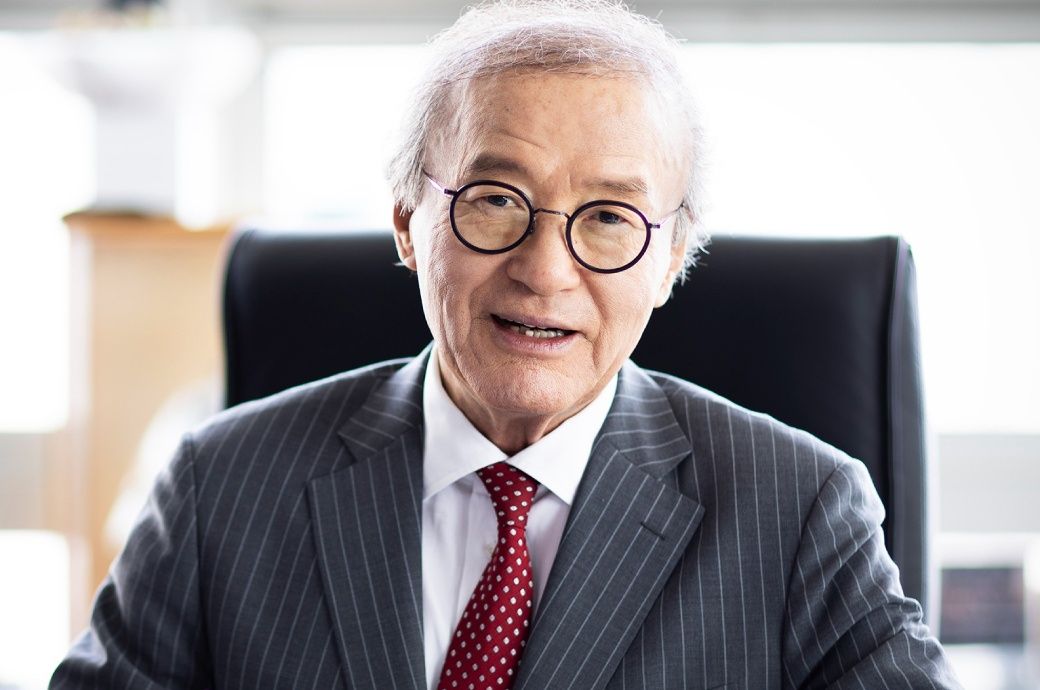

South Korea’s Misto Holdings completes planned leadership transition

The transition marks the formal handover of executive leadership to President and CEO Keun-Chang (Kevin) Yoon, reinforcing management continuity while preserving the founder’s long-term strategic vision.

Misto Holdings founder Gene Yoon has transitioned to honorary chairman in a planned leadership succession, formally handing executive control to president and CEO Kevin Yoon.

The founder, who expanded the group through the FILA global trademark acquisition and the takeover of Acushnet, will continue guiding long-term strategy as the rebranded Misto focuses on governance and sustainable growth.

Gene Yoon founded the business that would become Misto Holdings in the early 1990s, introducing the FILA brand to the Korean market and later leading a series of transformative transactions. In 2007, the company acquired the global FILA trademark rights through a leveraged buyout, followed by the 2011 acquisition of Acushnet Company, owner of the Titleist and FootJoy brands. The transaction was among the largest cross-border deals in Korea’s consumer sector at the time and significantly expanded the group’s global footprint.

Under his leadership, the company evolved into a multi-brand global portfolio spanning sportswear, golf equipment and apparel, generating approximately USD 3.08 billion in annual revenue.

As Honorary Chairman, Gene Yoon will remain closely engaged with the company, providing guidance on long-term strategy and global portfolio development while supporting management from a broader strategic perspective.

The leadership transition marks a new chapter under President and CEO Kevin Yoon, who has spent nearly two decades in senior roles across the group’s global operations, building deep operational and strategic expertise.

The company’s 2025 rebranding to “Misto” underscores its evolution into a global brand house focused on disciplined capital allocation, enhanced shareholder returns and sustainable long-term growth.

“Building on the founder’s legacy, our priority is to expand our global portfolio, strengthen governance and deliver sustainable value creation,” said Kevin Yoon, President and CEO of Misto Holdings.

Note: The headline, insights, and image of this press release may have been refined by the Fibre2Fashion staff; the rest of the content remains unchanged.

Fibre2Fashion News Desk (RM)

Fashion

Bangladesh commerce minister seeks Chinese investment in jute sector

-

Tech1 week ago

Tech1 week agoA $10K Bounty Awaits Anyone Who Can Hack Ring Cameras to Stop Sharing Data With Amazon

-

Business1 week ago

Business1 week agoUS Top Court Blocks Trump’s Tariff Orders: Does It Mean Zero Duties For Indian Goods?

-

Fashion1 week ago

Fashion1 week agoICE cotton ticks higher on crude oil rally

-

Tech1 week ago

Tech1 week agoDonald Trump Jr.’s Private DC Club Has Mysterious Ties to an Ex-Cop With a Controversial Past

-

Entertainment1 week ago

Entertainment1 week agoThe White Lotus” creator Mike White reflects on his time on “Survivor

-

Politics7 days ago

Politics7 days agoPakistan carries out precision strikes on seven militant hideouts in Afghanistan

-

Business7 days ago

Business7 days agoEye-popping rise in one year: Betting on just gold and silver for long-term wealth creation? Think again! – The Times of India

-

Sports1 week ago

Sports1 week agoBrett Favre blasts NFL for no longer appealing to ‘true’ fans: ‘There’s been a slight shift’