Business

Higher tariffs are kicking in. Here’s what Walmart and other retailers said about their impact

Customer with shopping cart in the snack aisle of a Walmart store in Florida City, Florida, Aug. 5, 2025.

JC Milhet | AFP | Getty Images

As some of the biggest names in retail, including Walmart and Home Depot, delivered earnings results in recent weeks, they updated Wall Street on how they and their shoppers are responding to President Donald Trump‘s wave of tariff increases.

The takeaway?

Tariff costs are rising for retailers, and they’ve had to get creative to avoid widespread price hikes.

Yet consumer spending has largely stayed strong so far — and the pinch from higher duties hasn’t been as severe as some companies had feared. Compared with their concerns in the spring, retail executives struck a measured tone and said they don’t expect their costs, or customers’ prices, to jump dramatically.

Walmart had given one of the strongest warnings in May, as CFO John David Rainey said he expected some prices to rise during the summer. In an interview with CNBC on Thursday, however, Rainey said the nation’s biggest retailer has raised prices on some items, but in other parts of its stores has kept prices down or expanded discounts.

“There are certainly areas where we have fully absorbed the impact of higher tariff costs,” he said. “There are other areas where we’ve had to pass some of those costs along. But when you look across the basket of items, we’re certainly trying to keep prices as low as we can.”

Scot Ciccarelli, a retail analyst for Truist, said retailers are raising prices “but not nearly to the degree that might have been expected in early April” when Trump first announced his steep tariffs on dozens of countries.

“Most of the companies are kind of downplaying the impact of tariffs,” he said. “They’ve all talked about substantial mitigation efforts, whether that is diversifying sourcing, whether that is pushing price back to vendors.”

Here are three takeaways from a busy couple of weeks of retail earnings.

Consumer spending is steady — with some exceptions

The drumbeat of steady, but selective, U.S. consumer spending continued this quarter.

At Walmart, the nation’s largest grocer by revenue, sales of private-label items, which tend to cost less than national name brands, were roughly flat, Rainey told CNBC. When customers trade down to those cheaper brands or smaller packs of items, it can signal U.S. households feel strapped for cash.

As companies closely watch the consumer, Rainey said Walmart has seen shopper behavior that’s “very consistent.”

“They continue to be very resilient,” he said.

Walmart and Coach parent company Tapestry both raised their sales outlooks for the full year. Both companies said they saw healthy sales of discretionary items, such as clothing and handbags.

Sales of fashion items, including ladies’ apparel and shoes, accelerated at Walmart in the quarter, Rainey said.

One of Coach’s handbags, the large Kisslock bag that costs $695, sold out within minutes of launching in July, Tapestry CEO Joanne Crevoiserat said last week on the company’s earnings call.

Yet some categories are still a tough sell. And lower-income shoppers have been more sensitive to price changes.

Walmart CEO Doug McMillon said Thursday that the effect of tariffs on spending “has been somewhat muted.” Still, he added some shoppers have noticed and responded when prices creep up.

“As we replenish inventory at post-tariff price levels, we’ve continued to see our costs increase each week, which we expect will continue into the third and fourth quarters,” he said. “Not surprisingly, we see more adjustments in middle- and lower-income households than we do with higher-income households and discretionary categories where item prices have gone up.”

Sales at Home Depot and Lowe’s improved as the quarter went on, with the strongest in July. Still, the companies weren’t ready to predict a turnaround for home improvement.

Lowe’s CEO Marvin Ellison attributed some of the recent pickup in demand to better weather and said “it’s too early for us to call that a trend.” Higher mortgage rates and borrowing costs have dinged homeowners’ willingness to tackle a major renovation or move to a new home, which tends to spur home projects.

Other brands had more dire warnings about spending. On the company’s earnings call, Crocs CEO Andrew Rees described the backdrop for the second half of the year as “concerning” and said its retail orders are weak.

He described Crocs’ customers as “super cautious.”

“They’re not purchasing. They’re not even going to the stores, and we see traffic down,” he said, adding that’s also true at its outlets, which draw more lower-income households.

Customers shop at a Home Depot store on August 19, 2025 in Chicago, Illinois.

Scott Olson | Getty Images

Retailers have blunted the effects of tariffs … so far

Retailers have jumped into action to try to minimize cost increases from tariffs or avoid them altogether.

Those tactics have included importing goods from a wider range of countries, getting items to the U.S. early and stocking up on high-frequency purchases or fresh merchandise that consumers are more likely to buy, even at higher prices, according to interviews of retail executives and earnings calls.

Yet as Walmart showed, retailers have been strategic about price increases — to not only avoid spooking customers, but also to dodge potential scrutiny from the White House. Trump criticized Walmart in May after the company warned it would have to raise prices.

Sharkninja, which makes a wide range of items including blenders and hairstyling tools, has “increased sell price on products, but done it very, very carefully,” CEO Mark Barrocas said in an interview. And in some cases, it had to roll back part of those price increases, he said.

The company has also reduced discounting and raised the price of new merchandise when it debuts. For example, Sharkninja initially planned to launch a new infrared skin care mask called CryoGlow at $299, but instead decided to price it at $349, he said.

For Walmart, Target and Tapestry-owned Coach, importing goods early and having merchandise in warehouses before tariffs took effect have helped them curb the hit from higher rates.

Home Depot Chief Financial Officer Richard McPhail told CNBC most of the imported products the company sold during the quarter landed ahead of tariffs. And Home Depot is taking more steps to blunt the effects: More than half of what the company sells comes from the U.S. and it aims to import no more than 10% from any single country by the end of the year.

Yet the tariff bill is still adding up. Walmart’s McMillon said he expects higher costs from duties to continue through the second half of the fiscal year. Other companies also provided specific estimates of how much the higher duties will cost them.

Even as Tapestry posted sales growth, its shares tumbled last week after it said costs from higher duties would total $160 million this upcoming fiscal year and ding profits.

While Trump’s tariff policy appears more settled than in the spring, tariffs on some countries could still rise.

Many of Trump’s tariffs on countries began in early August, but one of the key rates still hangs in the balance. He delayed higher tariffs on China for 90 days last week. Those had jumped as high as 145%, but are now at 30% as negotiations continue.

Target acknowledged the trade uncertainty with its own strategy. It gave a wider than usual range for its full-year earnings per share outlook.

Inside a Crocs store at Queens Center in New York.

Ryan Baker | CNBC

Strong brands, new moneymakers matter more than ever

Strong brand loyalty and lucrative new businesses have made it easier for some companies to weather the uncertainty.

As homeowners postpone larger projects, Home Depot and Lowe’s have bulked up their business among home professionals to attract steadier traffic and prepare for when demand picks up again. Along with reporting earnings this week, Lowe’s announced it’s buying Foundation Building Materials for $8.8 billion, marking its second acquisition of a home professional-focused company in recent months.

Home Depot announced its own pro-focused deal earlier this summer and made the largest acquisition in its history when it bought SRS Distribution last year.

Walmart also has benefited from newer revenue streams, especially its advertising business and third-party marketplace. Global advertising grew 46% in the most recent quarter, including ad-enabled smart TV maker Vizio, which it acquired last year.

Its marketplace revenue grew by 17% year over year. That business includes sellers who get charged a commission and often pay for services, such as ads on Walmart’s site to promote their products or fulfillment services to have the big-box retailer store pack and ship orders to customers.

Those “more diversified set of profit streams,” which have higher margins than selling a gallon of milk or a T-shirt, make Walmart’s earnings steadier even as the company faces profit pressures, Rainey said on the company’s earnings call.

“We are more than just a standard brick-and-mortar retail business,” he said on the call.

For some brands, customer demand is high enough to help offset tariffs or allow them to charge more.

Sandal maker Birkenstock, for instance, “saw no pushback or cancellations” after its tariff-related July 1 price increases, CEO Oliver Reichert said on the company’s earnings call.

Coach, which has driven up its average price of items over the past five years and reduced its level of markdowns, can better “absorb a lot of these input costs,” Coach CEO Todd Kahn told CNBC.

On the flip side, tariff costs have hit some brands harder, especially if they don’t have the new products customers seem to want or are skittish about what sales will look like later this year. High-performing companies with massive scale such as Walmart often have leverage with vendors to pass on costs — but other businesses might not.

“If you’re a struggling brand, or you’re not really growing your business with a vendor, that vendor has less incentive to absorb incremental costs, whether it’s from tariffs or supply chain or whatever,” Truist’s Ciccarelli said.

Target said its profit margins in the quarter were hurt by the costs of cancelling orders. Crocs also said it is reducing orders for the back half of the year.

Crocs took another unusual step: Rees said the company is taking back older inventory from retailers that sell its Heydude shoe brand and swapping it out with fresher styles.

Business

Crude oil prices in focus: OPEC+ increases output by 206,000 bpd amid Middle East tensions – The Times of India

OPEC+ on Sunday announced a higher-than-expected increase in oil production quotas, days after US and Israeli strikes on Tehran triggered Iranian retaliation across the Middle East, according to AFP.The oil producers’ group, which includes Saudi Arabia, Russia and several Gulf states affected by the escalation, said it had “agreed on a production adjustment of 206 thousand barrels per day”.“This adjustment will be implemented in April,” OPEC+ said in a statement.While the cartel did not directly refer to the Iran conflict, it cited “a steady global economic outlook and current healthy market fundamentals” as the rationale behind the output increase.The move comes amid heightened geopolitical tensions in the Middle East, a region critical to global crude oil supply.

The announcement did not directly reference the outbreak of the Iran conflict, instead attributing the decision to “a steady global economic outlook and current healthy market fundamentals”.Before the meeting, analysts had projected a more modest increase of 137,000 barrels per day.However, Jorge Leon, an analyst at Rystad Energy, cautioned that the agreed hike may not be sufficient to offset the potential impact of escalating tensions on crude oil markets.Leon highlighted the risk of disruption in the Strait of Hormuz, a critical waterway through which nearly a quarter of the world’s seaborne oil supplies transit.Iran’s Revolutionary Guards have reportedly contacted vessels to declare the strait closed. Iranian state television on Sunday said an oil tanker attempting to “illegally” pass through the strait was struck and was sinking, broadcasting footage of a burning tanker at sea.“If oil cannot move through Hormuz, an extra 206,000 barrels per day does very little to ease the market,” Leon said, adding that “logistics and transit risk matter more than production targets right now”.He said the OPEC+ move “is unlikely to calm markets”, noting that “prices will respond to developments in the Gulf and the status of shipping flows, not to a relatively small increase in output.”Apart from Russia and Saudi Arabia, the V8 group includes Kuwait, Oman, Iraq and the United Arab Emirates — all of which were targeted by Iranian attacks for a second consecutive day on Sunday. Algeria and Kazakhstan are also part of the group.

Business

Cost Of Raising Kids: Raising kids in this economy: To DINK or not? Why more Indian couples are rethinking parenthood – The Times of India

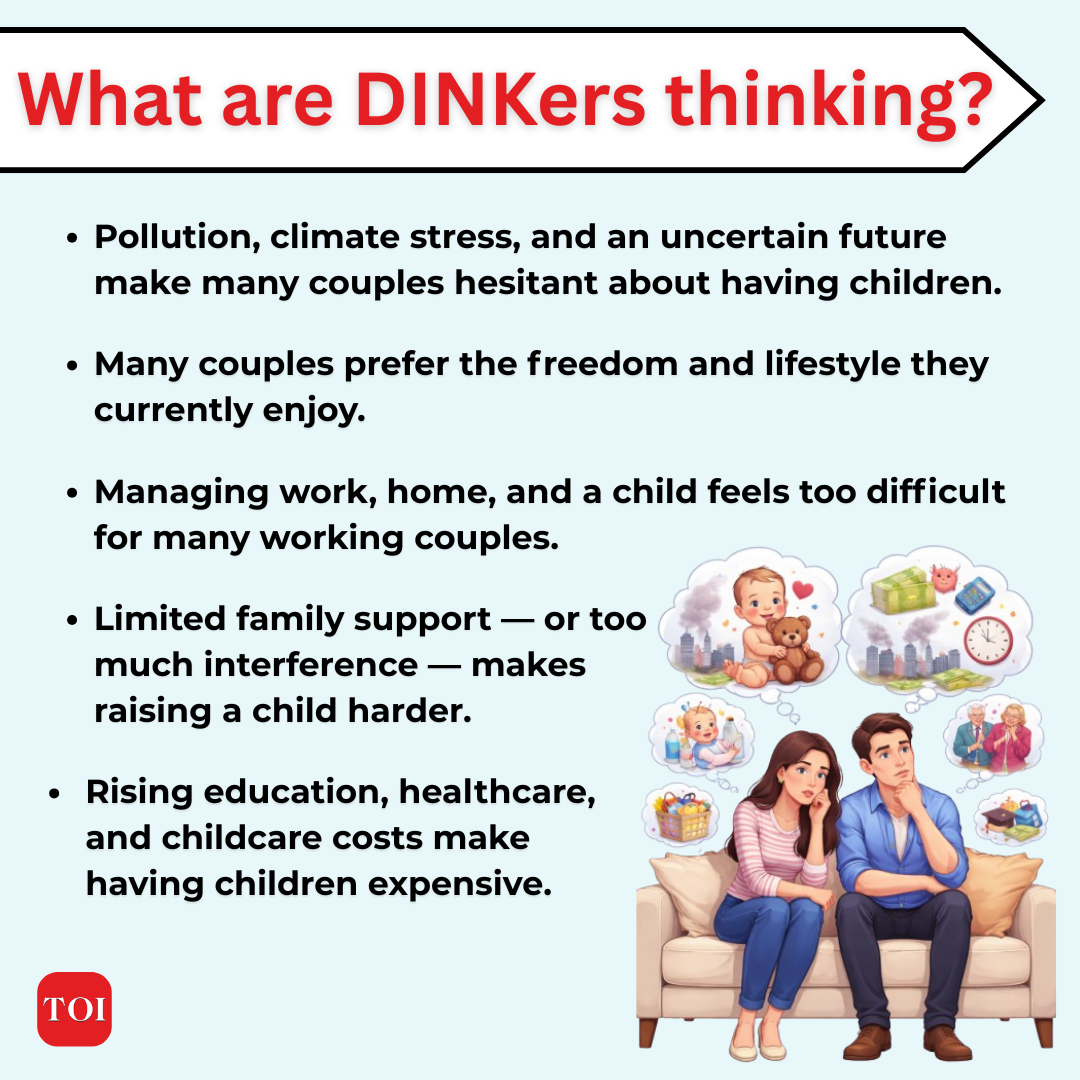

Raising a child in today’s economy isn’t just about love, care, and dreams. It’s more about smart planning and careful budgeting. Even before the baby is born, mamma and papa are already thinking ahead, carefully categorizing their everyday savings to secure their child’s future.As the cost of raising babies into full fledged adults continues to climb, many couples are hitting a pause button on parenthood and embracing the DINK — Double Income, No Kids — lifestyle. Once viewed largely as a Western trend, the DINK concept has now entered everyday vocabulary and is gaining ground in India, with a growing number of couples choosing to remain child-free.

Driving this shift is a mix of financial realities, emotional considerations and environmental concerns that is steadily reshaping how modern couples approach the idea of parenthood.

Why are so many couples choosing not to have children?

A world too harsh For many, the decision not to have children is shaped by the harsh realities of the world. “The air is terrible and life already feels quite demanding,” Nimish Rastogi, an entrepreneur, told TOI. A video journalist working in Delhi raised similar concerns and said, “resources are depleting, everything is only going to get costlier, and institutions are in decline. For months in Delhi-NCR, we can’t even breathe because of pollution, and the rest of the year, we’re dying from the heat. How do you raise a child in a world like this?”Balancing kid and work — Herculean job!For many working couples, raising a child can feel like an almost impossible balancing act. “Juggling work, home and a child can be taxing, and realistically you need a certain level of financial comfort to afford the kind of support that lets you enjoy everything without compromising too much on your own interests and lifestyle,” Nimish said. Anurag Kumar, assistant editor, added that the decision is also influenced by daily time and work pressure as “managing day-to-day work while keeping the household running is already demanding.”

Family plays a roleFor many, raising a child without strong family support feels overwhelming. “Unless there is strong support from family, raising a child on your own can feel almost impossible to balance,” Anurag said. Others find the idea of constant oversight intrusive. “Having a whole proverbial village breathing down my neck is not good for my mental health,” explained the video journalist, who did not wish to be named, that the concept clashes with the life they currently have.Personal preferencesFor many couples, maintaining personal freedom and lifestyle balance plays a key role in the decision to remain child-free. “We genuinely like having our freedom…right now, this kind of lifestyle feels fulfilling and balanced for us,” Nimish added. Anurag summed it up, saying, “The choice to have a child ultimately depends on the couple, their vision for life, where they stand at present, and how they see their future unfolding.”Education — a costly affairFor many, the decision not to have children is increasingly driven by practical considerations, citing the rising costs of childcare, schooling, healthcare, and housing becoming hard to ignore. “I went to a Catholic convent school for my schooling and my quarterly tuition fees was Rs 1800. Quarterly! What do you get for Rs 1800 today?” the video journalist told TOI. “In a volatile economy, anything can happen. I lost my job during COVID-19 for four months. Imagine if I had a child in school then — it would have been even harder,” she further added, throwing light on how unpredictable costs and economic uncertainty make the decision to have children a major financial consideration.Nimish added, “Education is so expensive now, healthcare costs are rising, and even basic things like good schools, extracurricular activities, childcare and daily expenses add up quickly.” For some, however, finances are only part of the equation. As Anurag said, “Finances are definitely a factor, but not the decisive one.”

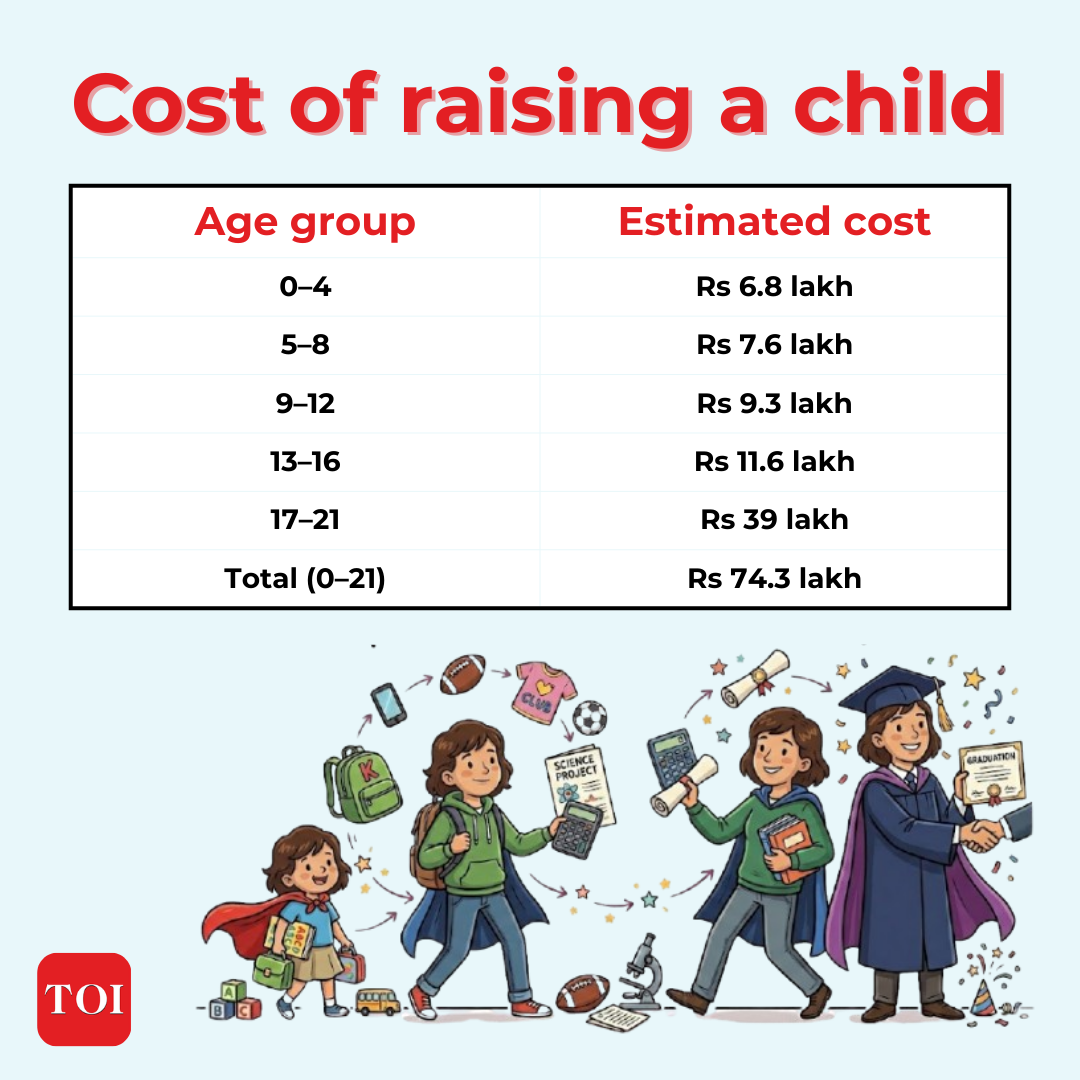

How much does it actually cost to raise a child?

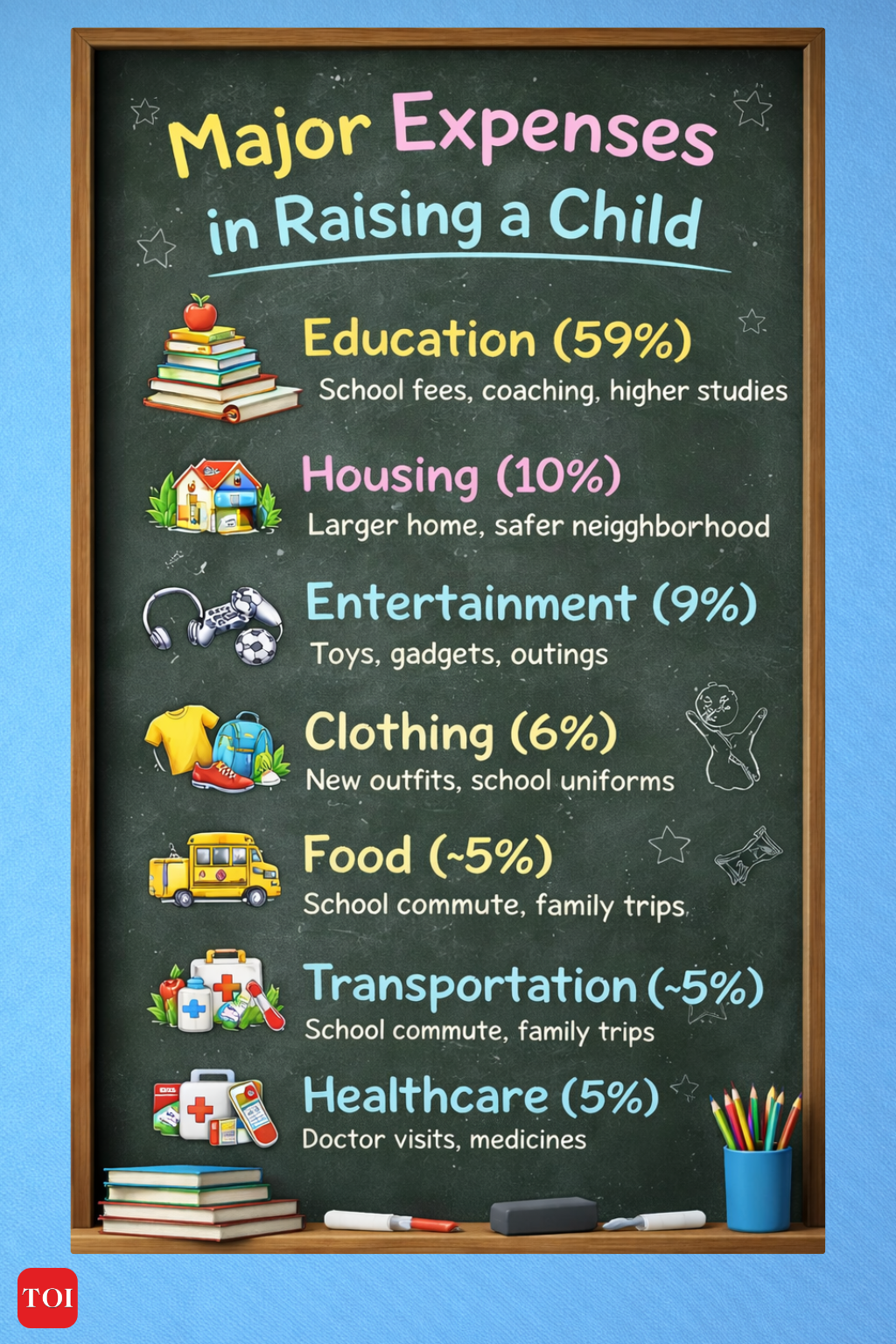

Raising a child from conception until the age of 21 costs an estimated Rs 74.3 lakh — and that’s without factoring in inflation.Rohit Saran explains in his book ‘100 Ways to See India: Stats, Stories, and Surprises’ that the total expense rises to approximately Rs 1.16 crore when adjusted for a 3% annual inflation rate. At a 6% inflation rate, the figure climbs even higher, reaching nearly Rs 1.83 crore. Couples today often find themselves stuck between two equally important dreams. Imagine you’ve finally saved up Rs 25–30 lakh for the down payment on a bigger 3BHK in a better neighbourhood, closer to work, with more space and security. But at the same time, you know that sending your child abroad for a master’s degree could easily cost Rs 40–60 lakh.So the question becomes real: do you upgrade your living standard now, or park that money in a fund that might one day pay for tuition fees in London or New York? For many families, these aren’t hypothetical situations — they’re monthly conversations at the dining table. A government official shared, “I’ve started a Voluntary Provident Fund for my daughter so that over the years, enough money will build up for her higher studies, learning new skills, or even starting her own business. I want her to have the freedom to chase her dreams without financial limits.” These decisions aren’t just about lump sums, they trickle down into everyday spending, shaping how families allocate resources across different categories. From education and housing to entertainment, clothing, food, transportation, and healthcare, every rupee is carefully planned to balance current needs with long-term goals.

Raising a child goes beyond planned savings, their needs often reshape how families earn, spend, and prioritize money. Vacations, lifestyle upgrades, and even retirement plans are adjusted to give children the best opportunities. As a parent shared, “Sacrifice is part of being a parent. When you know your child needs a high-end laptop to study comfortably, you don’t dwell on your slow phone or the winter vacation you had planned, it’s not even a question.” Meanwhile, Swasti Choudhary, mother of a 2 year old, explained, “having both parents earning definitely makes a big difference. When I found out I was pregnant, my husband and I created a full budget plan. With both of us earning, the risk from sudden financial emergencies is much lower. That said, it comes with challenges. We constantly ensure that both of us are present for our son. Leaving our jobs isn’t an option — it would be a major setback for the family.”

Spending on kids — A bigger picture

EducationEducation alone accounts for more than half of the total cost of raising a child. At least 59% of overall childcare expenses are directed towards education. Think about it — school admissions, annual fees, uniforms, books, private coaching…year after year, these costs quietly add up, keeping parents on their toes and always planning the next step. And careful planning doesn’t end the moment their kids graduate — it continues with competitive exams, skill-building classes, technology needs, and even the possibility of studying abroad. Of all the expenses parents manage, education consistently emerges as the largest and most demanding category.HousingAbout 10% of child-rearing expenses go towards housing, as many parents upgrade to larger homes in safer, better-connected neighbourhoods. A government officer shared that he moved to a bigger flat before his daughter was born to ensure a child-friendly environment. “Moreover, since my job requires frequent transfers, I’m planning to settle my family near the NCR so she has access to all the major educational institutions and can choose freely. It will be expensive, yes, but it’s a financially sustainable decision that will benefit in the long run,” he further added.Entertainment Nearly 9% of the total child-rearing cost goes towards entertainment — and this share tends to rise sharply during the teenage years. What begins as spending on toys and birthday parties in early childhood gradually shifts to bigger expenses like smartphones, laptops, hobby classes, sports coaching, movie outings, and holidays with friends. For instance, a simple 16th birthday celebration at a cafe, combined with gifts and decorations, can easily cost Rs 25,000–40,000. Add in a new phone for school and social use, music or dance classes, and a yearly trip with friends, and entertainment quickly turns into a regular and often overlooked expense.ClothingClothing alone accounts for around 6% of the total cost of raising a child, reflecting the need to regularly replace everyday wear, school uniforms, shoes, and seasonal outfits as children grow.

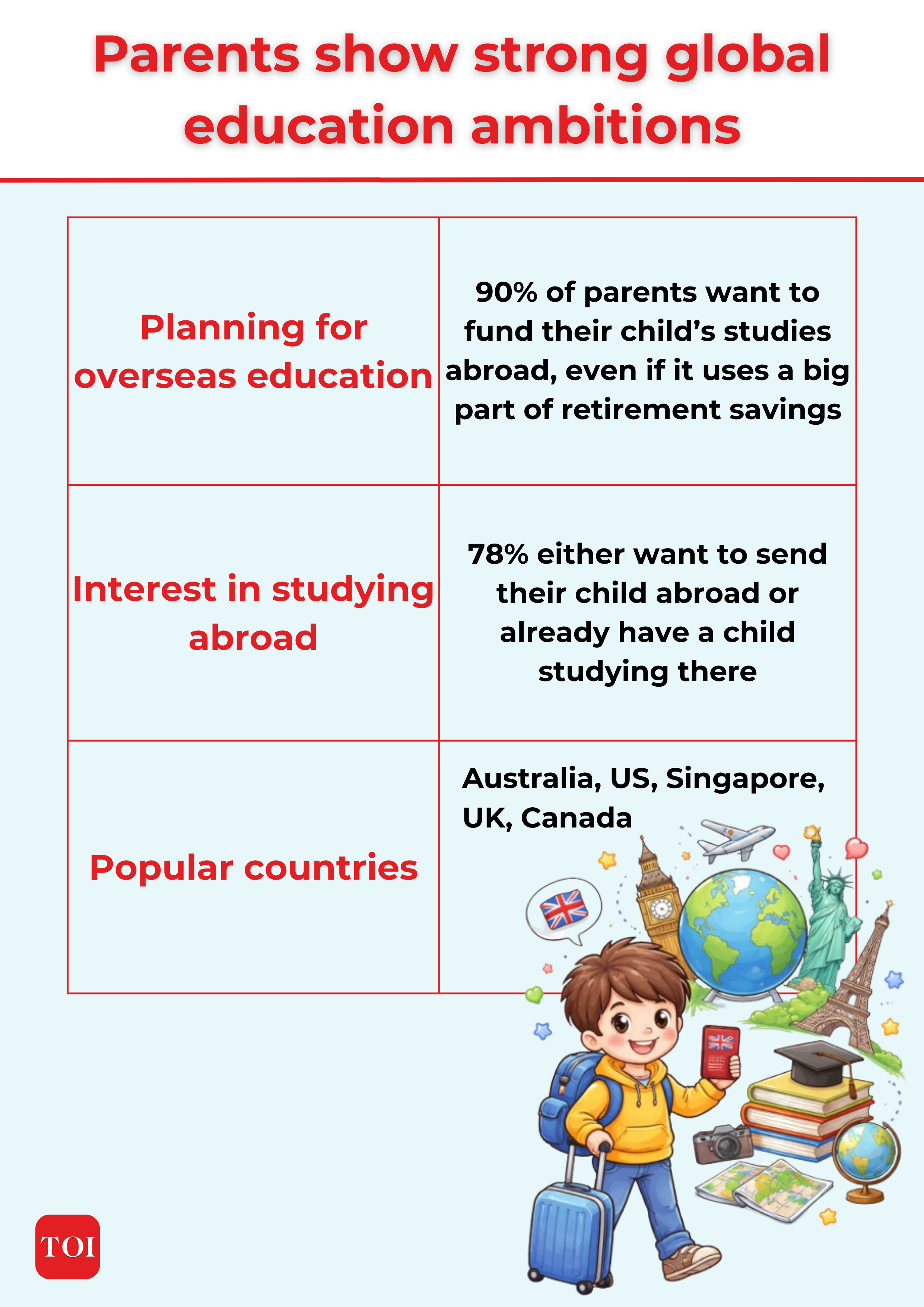

Education: the biggest slice of family expenses

According to the CMS Education Survey, part of the 80th round of the National Sample Survey (NSS) 2025, households across India are spending significantly on school education. Government vs private schooling: A sharp cost divideGovernment schools still enroll most students in India — 55.9% nationwide, 66% in rural areas, and 30% in cities. But the cost of education varies widely. Households spent an average of Rs 2,863 per student on school education in government schools, while spending in non-government schools cost nine times more, at Rs 25,002. Course fees are the biggest expense, with urban families paying Rs 15,143 and rural families Rs 3,979 on average. Textbooks, stationery, uniforms, and transport add further costs, showing that “free” education often still comes with a price.Coaching and tuition cultureBeyond school fees, private coaching and tuition are emerging as parallel expenses. Nearly 27% of students nationwide are enrolled in private coaching — 30.7% in urban areas and 25.5% in rural regions.Urban families spend an average of Rs 3,988 annually on coaching per student, compared to Rs 1,793 in rural areas. At the higher secondary level, the gap widens sharply — Rs 9,950 in urban India versus Rs 4,548 in rural areas. Nationally, coaching costs rise with grade levels, from Rs 525 at pre-primary to Rs 6,384 at higher secondary.Study abroadAccording to a report by HSBC titled Quality of Life Report 2024, 90% of affluent Indian parents intend to fund their child’s overseas education. However, the cost of a three- or four-year international degree in destinations like the US or UK could consume up to 64% of parents’ retirement savings .The report also notes that 40% of parents expect their children to take student loans, 51% hope for scholarships and 27% would consider selling assets to fund overseas studies .

Fur babies over babies: A growing DINK trend

As more couples rethink what a “perfect” family means to them, many are opting for pets instead of children. For these couples, the choice is both practical and personal — offering companionship without the financial and lifestyle pressures that come with raising a child.With the rising costs of raising children, pets, particularly dogs, are increasingly viewed as a more manageable and predictable responsibility. “Once you get a dog and it’s healthy, you have a fairly fixed cost for its lifetime. Sure, you buy toys or treats, but that’s it. A child? The costs just keep growing. It never stops. Everything is so expensive!” the video journalist told TOI.While more couples are embracing the DINK lifestyle, broader social expectations still lean toward parenthood. Anurag said, “Most of my married friends are planning or already having children. I’m the only one who chose to have a dog instead.”“Among our friends, some have children, but I’ve noticed a growing number of couples choosing pets or delaying plans for kids. People are thinking more consciously about the life they want rather than just following the traditional path,” Nimish added, further sharing the flexibility that pets offer over having kids. “We genuinely value our freedom. We love travelling, making spontaneous plans, and spending time with friends and our dogs, who are basically our babies. For us, this lifestyle feels fulfilling and balanced right now.”

Business

Greggs to reveal trading amid pressure from cost of living and weight loss drugs

Greggs is to shed light on demand from customers as the high street bakery chain contends with the rise of weight loss treatments and cost of living pressures on shoppers.

The high street chain is also wrestling with other factors including increases to labour costs and tax changes.

As a result, on Tuesday March 3, Greggs is expected to reveal pre-tax profits of around £173 million for the year to December 27, representing a 9% drop.

In its previous update shortly after Christmas, Greggs pointed to a strong finish to 2025 as sales growth accelerated in the final quarter of the year.

Like-for-like sales growth rose from 1.5% in the third quarter to 2.9% in the final months of 2025.

Totals sales were up 7.4% in the final quarter amid a boost from the group’s continued store opening programme.

The company opened 121 stores last year.

However, analysts at Deutsche Bank said expectations “have already been set low” for 2026 and are “unlikely to change”.

In January, Greggs said it was “cautious but hopeful” about its outlook for 2026, highlighting “subdued” consumer confidence.

Roisin Currie, chief executive of Greggs, also warned alongside its previous update that there was “no doubt” appetite-suppressing medication is having an impact on the bakery chain’s business.

It may provide more detail on how this continues to change customer eating habits.

Meanwhile, the group also announced that inflation was likely to be shallower than last year.

The group increased the price on a number of products and deals last year, so shareholders will also be keen to see how these changes have continued to impact trading.

Aarin Chiekrie, equity analyst at Hargreaves Lansdown, said: “Investors are keen to hear how 2026 is shaping up in the early months.

“While the picture on the cost front is beginning to look more favourable, Greggs has plenty of other challenges still to wrestle with.

“Unhelpful changes to tax rules and minimum wages, slowing UK economic growth, and cost-conscious consumers are all weighing on the outlook.”

-

Business1 week ago

Business1 week agoUS Top Court Blocks Trump’s Tariff Orders: Does It Mean Zero Duties For Indian Goods?

-

Fashion1 week ago

Fashion1 week agoICE cotton ticks higher on crude oil rally

-

Entertainment1 week ago

Entertainment1 week agoThe White Lotus” creator Mike White reflects on his time on “Survivor

-

Business1 week ago

Business1 week agoEye-popping rise in one year: Betting on just gold and silver for long-term wealth creation? Think again! – The Times of India

-

Politics1 week ago

Politics1 week agoPakistan carries out precision strikes on seven militant hideouts in Afghanistan

-

Sports1 week ago

Sports1 week agoBrett Favre blasts NFL for no longer appealing to ‘true’ fans: ‘There’s been a slight shift’

-

Politics1 week ago

Politics1 week agoUS Supreme Court strikes down Trump’s trade tariff measures

-

Entertainment1 week ago

Entertainment1 week agoSaturday Sessions: Say She She performs "Under the Sun"