Business

Stocks mixed despite GDP surprise amid hot US producer price inflation

The FTSE 100 struggled for direction on Thursday, weighing better-than-expected UK growth figures and a surprise pick-up in producer price inflation across the pond.

The FTSE 100 index closed up 12.01 points, 0.1%, at 9,177.24.

The FTSE 250 ended down 49.89 points, 0.2%, at 21,801.67, and the AIM All-Share finished 2.17 points higher, 0.3%, at 759.71.

In Europe, the CAC 40 in Paris rose 0.7%, while the DAX 40 in Frankfurt advanced 0.8%.

The Office for National Statistics said UK gross domestic product (GDP) rose 0.3% in the second quarter from the first, slowing from a 0.7% expansion in the first three months of the year.

According to market consensus cited by FXStreet, growth of 0.1% on-quarter had been expected for the three months to June.

Deutsche Bank analyst Sanjay Raja said the UK economy found an “unexpected second wind”.

“The economy expanded by 0.3% on the quarter. But mind the third decimal. Unrounded, UK GDP grew by 0.345% on the quarter – a hair’s breadth away from an even stronger surface print. This puts the UK on course to become the second fastest growing economy in the G7 (after claiming the top prize in Q1-25),” Mr Raja said.

But Mr Raja noted some areas of disappointment, such as household spending and business investment.

On-month, the UK economy rounded off the second quarter with a 0.4% expansion in June, following falls of 0.1% in each of May and April.

April’s figure was revised upwards from a drop of 0.3% before.

Goldman Sachs raised its forecasts for GDP growth in 2025 to 1.4% from 1.2%, above the 1.0% forecast by the Office for Budget Responsibility.

Mr Raja said: “To be sure, the economy is growing. Positive momentum is brewing.

“But animal spirits remain tepid.

“While the Chancellor is poised to focus her budget on improving productivity – a very welcome focus for the UK – Number 11 should also prioritise lifting household and business confidence to sustain the UK’s outperformance.”

In the US, producer prices shot up at a faster pace than expected in July.

The Bureau of Labour Statistics said the producer price inflation rate for July was 3.3%, the fastest 12-month gain since February and nearly a full percentage point up from June’s rate of 2.4%.

A much tamer acceleration to 2.5% was expected, according to consensus cited by FXStreet.

On-month, producer prices rose 0.9% in July from June, the largest monthly rise since January, and topping the consensus of a 0.2% increase.

Following a fairly benign consumer inflation print on Tuesday, the figures were seen as dampening hopes for widespread rate cuts later in the year.

“After a string of data pointing to greater odds of a September rate cut, the large upside surprise in producer prices highlights the dilemma the Federal Reserve faces in judging the risks to its dual mandate,” said Matthew Martin, at Oxford Economics.

But Veronica Clark, at Citi, said strength in services in both CPI and PPI was concentrated in a few specific components and not indicative of broad-based price pressures.

She continues to expect limited signs of persistent inflation and a weakening labour market will have Fed officials cutting rates by 25 basis points in September and each meeting after to a 3% to 3.25% rate.

Mr Martin is not so sure.

His baseline forecast expects the Federal Reserve to hold off on rate cuts until December, although he accepts “our near-term outlook for monetary policy is walking a tightrope” that will be shaped by the next employment and price reports.

The data saw stock markets ease, giving back a slice of recent gains, the dollar perk up, and bond yields push higher.

In New York, the Dow Jones Industrial Average was down 0.4%, the S&P 500 was 0.3% lower, as was the Nasdaq Composite.

The pound eased to 1.3541 dollars late on Thursday afternoon in London, compared with 1.3566 dollars at the equities close on Wednesday. The euro ebbed to 1.1650 dollars, lower against 1.1713 dollars. Against the yen, the dollar was trading higher at 147.72 yen compared with 147.24 yen.

The yield on the US 10-year Treasury was at 4.28%, widened from 4.23%. The yield on the US 30-year Treasury was 4.87%, stretched from 4.83%.

In London, insurance stocks were the flavour of the day with gains for Aviva and Admiral.

Aviva, which has more than 33 million customers and operates in more than 16 countries globally, rose 2.5% as it said pre-tax profit surged 30% to £1.27 billion in the first six months of the year from £978 million a year prior.

The London-based insurer said operating profit was 22% higher on-year at £1.07 billion from £875 million a year prior.

Gross written premiums were 4.7% higher at £6.29 billion from £6.01 billion.

It lifted its interim dividend by 10% to 13.1 pence per share from 11.9p.

“With operating profit up 22% (10% ahead of consensus) and the interim dividend up 10% (2% ahead of consensus), Aviva’s recent run of success appears to have continued,” Jefferies analyst Philip Kett said.

Admiral jumped 5.6% after reporting strong first-half results, led by growth in its motor insurance business, where profits leapt 56% year-on-year.

The FTSE 100-listing said pre-tax profit rose 67% to £516.1 million in the six months to June 30 from £309.8 million the year prior.

Pre-tax profit from continuing operations jumped 69% to £521.0 million from £307.6 million, beating the £508 million Visible Alpha consensus.

“Another great update from the gift that keeps on giving,” said Bank of America.

Centrica climbed 3.4% as it said it had agreed, along with Energy Capital Partners LLP, to buy the Isle of Grain liquefied natural gas terminal in Kent from National Grid for an enterprise value of £1.5 billion.

Rolls-Royce rose 2.1% as UBS raised its share price target to 1,375 pence from 1,075p, driven primarily by “our likely above-management pricing expectations and above-guidance margin assumptions in Civil and Power Systems, where we see further opportunity for turnaround benefits to be realised”.

In an upside scenario, UBS sees 2,000p fair value as “credible”.

A barrel of Brent rose to 66.80 dollars late on Thursday afternoon from 65.51 dollars on Wednesday. Gold eased to 3,339.74 dollars an ounce against 3,356.28 dollars.

The biggest risers on the FTSE 100 were Admiral, up 192 pence at 3,560p, Centrica, up 5.5p at 167.6p, BAE Systems, up 44.5p at 1,776p, Aviva, up 16.2p at 675.2p and Babcock International, up 21.5p at 988.5p.

The biggest fallers on the FTSE 100 were Rio Tinto, down 188p at 4,480.5p, Beazley, down 24p at 776p, Diploma, down 130p at 5,315p, Persimmon, down 26p at 1,103p, and Halma, down 62p at 3,224p.

There are no significant events in the local corporate calendar on Friday.

The global economic calendar on Friday has US retail sales and industrial production data.

Contributed by Alliance News

Business

Emirates resumes some Dubai flights – what’s the latest on travel to UK?

New flights to the UK from the Middle East follow days of widespread air travel disruption which had left Britons stranded.

Source link

Business

‘Indians been good actors’: Why US ‘agreed to let’ India resume buying Russian oil temporarily – The Times of India

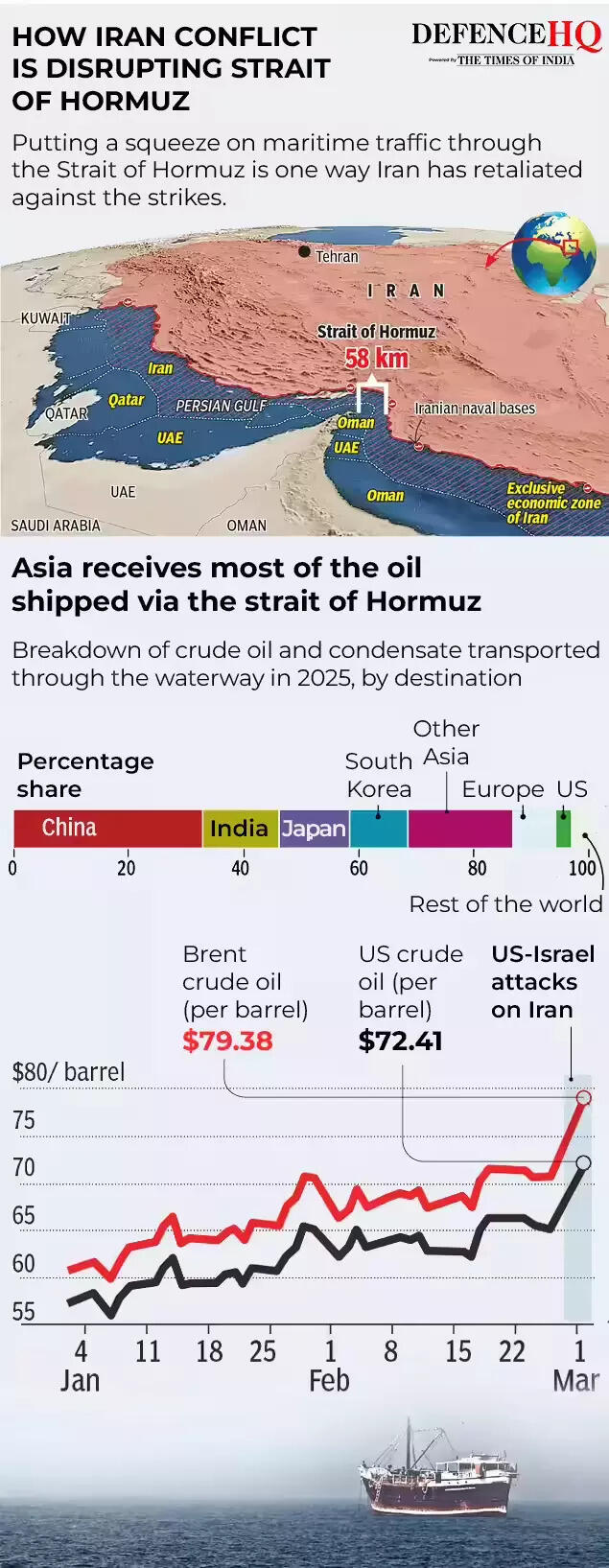

The United States has given “permission” to India to buy Russian oil already stranded at sea issuing a temporary waiver aimed at stabilising global oil supplies amid disruptions caused by the escalating conflict in West Asia.US President Donald Trump’s aide Scott Bessent referred to India as a “very good actor” for previously complying with Washington’s request to halt purchases of sanctioned Russian oil and said the temporary measure would help ease supply pressures in the global market.

The move comes a day after Washington issued a 30-day waiver permitting the sale of Russian crude currently stranded at sea to continue to India.

US cites temporary supply concerns

Speaking to Fox Business, US treasury secretary Bessent said the decision was intended to ease short-term supply constraints during the ongoing crisis.“The world is very well supplied in oil. The Treasury (Department) agreed to let our allies in India start buying Russian oil that was already on the water,” Bessent said.“The Indians had been very good actors. We had asked them to stop buying sanctioned Russian oil this fall. They did. They were going to substitute it with US oil,” he said.“But to ease the temporary gap of oil around the world, we have given them permission to accept the Russian oil. We may unsanction other Russian oil,” he added.Bessent also noted that a large volume of sanctioned crude remains stranded at sea stating that, “There are hundreds of millions of sanctioned barrels of sanctioned crude on the water,” he said, adding that “by unsanctioning them, Treasury can create supply.”“And we are looking at that. We are going to keep a cadence of announcing measures to bring relief to the market during this conflict,” he added.

‘Short term measures to help keep oil prices down’

Other officials in the Trump administration have also confirmed that Washington has “permitted” India to buy Russian crude that is already loaded on ships.Earlier, US energy secretary Chris Wright said the step was intended to quickly move existing oil supplies into the market.“We have implemented short term measures to help keep oil prices down. We are allowing our friends in India to take oil that is already on ships, refine it, and move those barrels into the market quickly. A practical way to get supply flowing and ease pressure,” Wright said in a post on X.In an interview with ABC News Live, Wright emphasised that the measure was temporary.“But as oil gets bid up a little bit because of those constraints coming out of the Strait of Hormuz, we’re taking a short-term action to say all this floating Russian oil storage that’s around Southern Asia, it’s China just backed up, China does not treat their suppliers well, so there’s a bunch of floating barrels just sitting there,” he said.“We’ve reached out to our friends in India and said, ‘Buy that oil. Bring it into your refineries’. That pulls stored oil immediately into Indian refineries and releases the pressure on other refineries around the world to buy oil that they’re no longer competing with the Indians for in that marketplace,” Wright added.“So we have a number of measures like that that are short-term and temporary. This is no change in policy towards Russia. This is a very brief change in policy just to keep oil prices down a little bit better than we could otherwise,” he further noted.

Waiver amid Strait of Hormuz tensions

The US Treasury earlier issued an order granting a 30-day licence allowing delivery and sale of Russian crude and petroleum products to India. The decision comes as shipping routes through the strategically important Strait of Hormuz face disruptions due to the ongoing conflict in the region.“President Trump’s energy agenda has resulted in oil and gas production reaching the highest levels ever recorded. To enable oil to keep flowing into the global market, the Treasury Department is issuing a temporary 30-day waiver to allow Indian refiners to purchase Russian oil,” Bessent said earlier.He stressed that the step was a limited measure and would not significantly benefit Moscow.“This deliberately short-term measure will not provide significant financial benefit to the Russian government, as it only authorises transactions involving oil already stranded at sea,” he said.“India is an essential partner of the United States, and we fully anticipate that New Delhi will ramp up purchases of US oil. This stop-gap measure will alleviate pressure caused by Iran’s attempt to take global energy hostage,” he added.

India’s oil supply position

The move comes months after the Trump administration imposed 25% punitive tariffs on India over its purchases of Russian oil, arguing that such imports were helping finance Moscow’s war against Ukraine.However, the tariffs were later lifted after the two countries agreed on a framework for an interim trade agreement and India committed to reducing imports from Russia while increasing purchases of American energy.India currently imports nearly 5.5–5.6 million barrels of crude oil per day, accounting for about 90% of its domestic consumption. Officials say the country’s energy position remains comfortable despite the regional tensions.Around 15 million barrels of crude are currently on tankers in the Arabian Sea and the Bay of Bengal, while vessels carrying another seven million barrels are waiting near Singapore. Additional tankers in the Mediterranean and the Suez Canal are also heading towards Indian ports and could arrive within a week.According to data from Kpler, India imported slightly over 1 million barrels per day of Russian crude in February, compared with 1.1 million bpd in January and 1.2 million bpd in December.Before the Ukraine war in 2022, Russian crude accounted for just 0.2% of India’s imports, but purchases increased sharply after Moscow began offering deep discounts.

Business

Home heating oil: ‘Most of my pension has gone on home heating oil’

Rising heating oil prices are hitting Northern Ireland harder than the rest of the UK – here’s everything you need to know.

Source link

-

Business1 week ago

Business1 week agoAttock Cement’s acquisition approved | The Express Tribune

-

Politics1 week ago

Politics1 week agoUS arrests ex-Air Force pilot for ‘training’ Chinese military

-

Fashion1 week ago

Fashion1 week agoPolicy easing drives Argentina’s garment import surge in 2025

-

Politics1 week ago

Politics1 week agoWhat are Iran’s ballistic missile capabilities?

-

Business1 week ago

Business1 week agoIndia Us Trade Deal: Fresh look at India-US trade deal? May be ‘rebalanced’ if circumstances change, says Piyush Goyal – The Times of India

-

Sports1 week ago

Sports1 week agoLPGA legend shares her feelings about US women’s Olympic wins: ‘Gets me really emotional’

-

Sports1 week ago

Sports1 week agoSri Lanka’s Shanaka says constant criticism has affected players’ mental health

-

Entertainment1 week ago

Entertainment1 week agoBobby J. Brown, “The Wire” and “Law & Order: SUV” actor, dies of smoke inhalation after reported fire