Business

Acumen launches $90m agri-resilience fund | The Express Tribune

ISLAMABAD:

Acumen Pakistan has launched a $90 million Agriculture Resilience Fund to support climate adaptation in the country’s agriculture sector, one of the most vulnerable to climate change.

The initiative was discussed during a meeting between Acumen Pakistan’s CEO and Country Head Dr Ayesha Khan and her team with Federal Minister for Finance and Revenue Senator Muhammad Aurangzeb at the Finance Division on Tuesday.

According to an official statement, the Acumen team briefed the minister on the fund, which has been designed as a blended finance facility to strengthen food systems, promote smart farming practices, and enhance farmer resilience through targeted investments in agribusinesses. The finance minister welcomed the initiative, stressing that Pakistan’s agriculture-dependent economy faces severe risks from climate change. He said innovative financing models were critical for building adaptive capacity, improving food security, and protecting rural livelihoods.

Aurangzeb acknowledged Acumen’s continued commitment to Pakistan, noting its efforts to channel investment into sustainable development and climate resilience. He assured the government’s support for initiatives aligned with national priorities.

It was further shared that a high-level delegation of Acumen Board members and global investors will visit Pakistan next month. The delegation will hold meetings with key stakeholders in Islamabad, Lahore, and Karachi to explore opportunities in light of the country’s improving macroeconomic indicators.

Both sides reaffirmed their commitment to working together for the development of a resilient and sustainable agriculture sector in Pakistan.

Business

He Started In A Garage, Built An Indian IT Empire, And Now Donates Rs 7 Crore Daily

Last Updated:

From a modest garage to a IT powerhouse, his journey reshaped India’s tech dreams. But what truly sets him apart is how quietly his wealth flows back into society every single day

Shiv Nadar founded HCL in a garage in 1976, growing it into a global IT giant. (Photo Credit: Shiv Nadar Foundation)

Success Story: One name stands out whenever India’s IT success stories are told: Shiv Nadar. What began in a modest garage in 1976 went on to become Hindustan Computers Limited (HCL), one of India’s leading global IT companies.

Today, Shiv Nadar is not only a celebrated entrepreneur but also one of the country’s most generous philanthropists, donating nearly Rs 7.4 crore every day.

From A Small Garage: The Birth Of HCL

Shiv Nadar was born on July 14, 1945, in the Tiruchirappalli district of Tamil Nadu. After completing his engineering education, he joined the DCM Group. During his time there, discussions with colleagues about the future of computers and electronics in India sparked a bold idea, that is, to start something of their own.

In 1976, Shiv Nadar and a small group of engineers founded HCL from a garage in Delhi. Initially, the company focused on computer hardware and electronic products, with a clear aim: to bring computer technology to India and create employment opportunities for young professionals.

Challenges On The Road To Success

The early years were far from easy. HCL faced financial constraints, technical hurdles, and intense market competition. However, Shiv Nadar’s long-term vision and commitment to innovation kept the company moving forward. He firmly believed that technology should simplify lives and drive progress for everyone.

During the 1980s and 1990s, HCL diversified from hardware manufacturing into software development and IT services. The company steadily expanded beyond India, establishing operations across the US, Europe, and Asia.

Today, HCL Technologies operates in nearly 60 countries and employs more than 2,22,000 people. It is a major player in areas such as cloud computing, cyber security, digital transformation, and enterprise software solutions.

Passing The Baton To Roshni Nadar Malhotra

After leading HCL for over four decades, Shiv Nadar stepped down as chairman in 2020. He appointed his daughter, Roshni Nadar Malhotra, as the new chairman, making her the first woman to hold the position in the company’s history.

Shiv Nadar now serves as Chairman Emeritus and Strategic Advisor.

According to the Bloomberg Billionaires Index, Shiv Nadar’s net worth stands at $38.2 billion (approx. Rs 3.17 lakh crore), placing him among the world’s richest individuals at 54th position globally. As of now, HCL’s market capitalisation is Rs 4,49,369 crore.

Commitment To Social Service and Philanthropy

Shiv Nadar’s legacy extends far beyond business. Through the Shiv Nadar Foundation, he has made significant contributions to education by establishing schools and universities across India.

As per the ‘EdelGive-Hurun Philanthropy List 2025’, Shiv Nadar and his family topped the list of India’s biggest philanthropists for the fourth time in five years. In the past year alone, the family donated Rs 2,708 crore, averaging Rs 7.4 crore every day. In recognition of his contribution to the IT sector and his vision for empowering India’s youth, Shiv Nadar was awarded the Padma Bhushan in 2008. Today, HCL symbolises India’s technological strength on the global stage.

Shiv Nadar’s journey proves that extraordinary success can begin with the smallest of steps. From a single garage to a global IT empire, his story remains one of vision, perseverance, and purpose.

December 17, 2025, 08:07 IST

Read More

Business

Misty Winter Mornings Slow Flights Across North and East India: IndiGo Urges Passengers To Plan Ahead

New Delhi: IndiGo has issued a travel advisory for Wednesday (December 17) morning as thick winter mist and dense fog are expected to blanket parts of North and East India, leading to reduced visibility and slower flight movements.

In a post shared on X, the airline said, “As the morning approaches under misty winter skies, fog is predicted across parts of North and East India, which may lead to reduced visibility and a slower pace of flight movements during the early hours. In the interest of safety, some flights may experience delays or adjustments.”

The airline emphasised that it is taking proactive steps to ensure passenger safety. “Our teams across airports are fully prepared and working in close coordination to manage schedules smoothly, assist customers and maintain a steady flow of operations,” the post added.

Passengers are being urged to plan ahead, allowing extra travel time to reach the airport and to check the latest flight status through IndiGo’s website or mobile app.

“Foggy conditions may also impact road traffic, with slower movement and longer travel times expected while commuting to the airport. Customers travelling early are advised to plan with additional buffer time and check the latest flight status on our website or app before leaving home,” the advisory stated.

IndiGo also expressed gratitude to passengers for their patience. “Thank you for your patience and continued trust as we work steadily through the early hours, with visibility expected to improve as the day progresses,” the airline added.

The advisory coincides with similar warnings from the Indira Gandhi International (IGI) Airport in Delhi. On Tuesday (December 17) morning, the IGI Airport issued a fog advisory, cautioning that departures and arrivals might face disruptions due to low visibility. Around 6:06 am, Delhi Airport reported that flight operations were “steadily recovering” but warned that some delays could persist.

The airport urged passengers to remain in touch with their respective airlines for the most accurate schedule updates. “We appreciate your cooperation and understanding,” the airport said, adding that ground staff and personnel have been deployed across terminals to assist travellers.

The situation is further complicated by Delhi’s deteriorating air quality. According to data from the Central Pollution Control Board (CPCB), the city’s overall Air Quality Index (AQI) was recorded at 378 around 8 am on Tuesday, placing it in the “very poor” category.

The combination of dense fog and heavy pollution has reduced visibility in the early morning hours, disrupting air traffic and prompting repeated advisories from both airlines and airport authorities. Passengers are being urged to remain vigilant and plan their journeys with extra time, as conditions are expected to improve gradually as the day progresses.

Business

Azerbaijan open to investing $2b | The Express Tribune

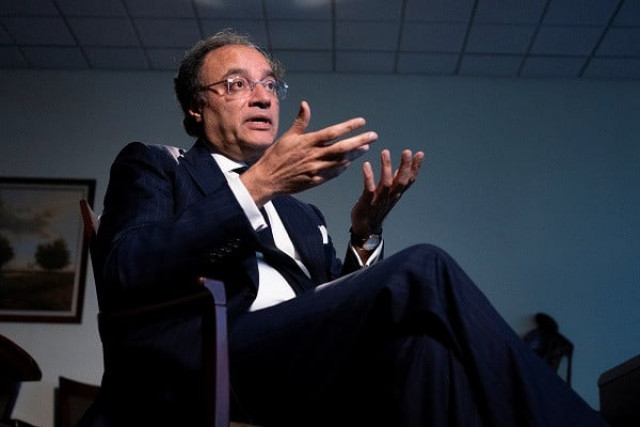

Finance Minister Muhammad Aurangzeb is interviewed during the G20 Finance Ministers and Central Bank Governors’ Meeting at the IMF and World Bank’s 2024 annual Spring Meetings in Washington. PHOTO: REUTERS

ISLAMABAD:

Federal Minister for Finance and Revenue Senator Muhammad Aurangzeb on Tuesday said Pakistan and Azerbaijan were working to translate their strong relations into tangible trade and investment outcomes, with Azerbaijan expressing an appetite to invest close to $2 billion in Pakistan.

In an interview with Report, the minister said bilateral relations, particularly with Azerbaijan, had grown stronger since the current government assumed office, with frequent high-level engagements including visits by Prime Minister Muhammad Shehbaz Sharif and Pakistan’s participation during the COP29 timeframe in Baku.

He said the focus was now on enhancing trade and investment flows, adding that energy, oil and gas, as well as minerals and mining, had emerged as key sectors for potential joint projects. “These are clear areas of focus as we move forward,” he remarked.

Providing details on the proposed investment package, Aurangzeb said discussions were underway with Azerbaijan’s state oil company SOCAR, which was exploring the possibility of investing in an oil pipeline project in Pakistan. He termed the talks as being at an early stage but expressed hope that it could be among the first projects to materialise.

Commenting on Azerbaijan’s readiness to provide a further $1 billion loan to Pakistan, the finance minister said the financing could take multiple forms, including placements with the State Bank of Pakistan or support for Azerbaijani investors operating in Pakistan. He said the current bilateral trade of less than $50 million did not reflect the true potential, and efforts were underway to identify priority sectors to make trade flows more meaningful.

-

Politics1 week ago

Politics1 week agoThailand launches air strikes against Cambodian military: army

-

Fashion1 week ago

Fashion1 week agoGermany’s LuxExperience appoints Francis Belin as new CEO of Mytheresa

-

Politics6 days ago

Politics6 days agoTrump launches gold card programme for expedited visas with a $1m price tag

-

Tech1 week ago

Tech1 week agoJennifer Lewis ScD ’91: “Can we make tissues that are made from you, for you?”

-

Business6 days ago

Business6 days agoRivian turns to AI, autonomy to woo investors as EV sales stall

-

Business3 days ago

Business3 days agoHitting The ‘High Notes’ In Ties: Nepal Set To Lift Ban On Indian Bills Above ₹100

-

Entertainment1 week ago

Entertainment1 week agoToo big to fail? IndiGo crisis exposes risks in Indian aviation

-

Sports6 days ago

Sports6 days agoU.S. House passes bill to combat stadium drones