Business

Budget is ‘critical point’ for Unite’s continued Labour support – Sharon Graham

The upcoming Budget is a “critical point” for whether Unite members choose to disaffiliate from Labour, the union’s leader has said.

Unite general secretary Sharon Graham warned last month that workers could turn their backs on the party if they do not change course.

As Labour’s party conference began in Liverpool, she said it was getting “harder and harder to justify” affiliation with Labour and that the “time is getting close” to make a choice.

“My members are scratching their heads and they’re asking, ‘how does a Labour Government allow two oil refineries to shut with absolutely no plan? How have we got a net zero plan that has workers at the end of the queue? Where is the plan for workers? Where is the transition? Where is the money?’,” she told Sunday Morning With Trevor Phillips on Sky News.

“And so for my members, whether it’s public sector workers all the way through to defence, are asking ‘What is happening here?’

“Now when that question cannot be answered, when we’re effectively saying ‘look, actually we cannot answer why we’re still affiliated’, then absolutely I think our members will choose to disaffiliate, and that time is getting close. “

Ms Graham was asked how long Sir Keir Starmer has before Unite makes that decision.

“The Budget is an absolutely critical point of us knowing whether direction is going to change,” she said.

She called for a loosening of the fiscal rules Chancellor Rachel Reeves has pledged to stick to.

“Those fiscal rules need to be changed. Other countries are doing it. We should stop dancing around our handbag and do that.

“If that Budget is essentially nothing, it’s insipid, I think we’ve got a real problem our hands, because without the money to make the change, then nothing is going to change.”

Housing Secretary Steve Reed dismissed questions about potentially losing the support of Unite.

Asked if the fiscal rules are more important than keeping the union’s backing, Mr Reed told the Sunday Morning With Trevor Phillips programme on Sky News: “I don’t think Unite will walk.

“There is more money going into Unite members’ pockets, just like there’s more money going to everybody’s pockets, because wages are now rising faster than prices.”

Ms Graham said people feel they are “being kicked” and Labour needs to “help those people up”.

She also called for Labour to “wake up” and “do Labour things”.

The Unite boss said members are not that interested in Labour’s deputy leadership contest.

Amid speculation about a possible leadership challenge from Greater Manchester mayor Andy Burnham, she said there was “no point” changing around the person at the top if policies stay the same.

Business

Lucid widely misses earnings expectations, forecasts continued EV growth in 2026

A Lucid Gravity coming off the line at the company’s factory in Casa Grande, Arizona.

Lucid Group reported mixed fourth-quarter results Tuesday as the electric vehicle maker continues to face challenging market conditions and internal struggles.

The company widely missed Wall Street’s quarterly earnings expectations, while beating average revenue estimates by roughly 12%. It also revised its 2025 production results due to internal validation issues, but guided for a notable increase in vehicle production this year.

Here’s how the company performed in the fourth quarter compared with average estimates compiled by LSEG:

- Loss per share: $3.62 vs. a loss of $2.62 cents expected

- Revenue: $523 million vs. $468 million expected

Lucid’s results come days after the company laid off 12% of its U.S. salaried workforce in an effort to streamline operations and “operate with greater efficiency and deliver on our commitments to gross margin improvement and long term growth,” according to a statement from the company.

Interim Lucid CEO Marc Winterhoff described the cuts Tuesday to CNBC as a needed realignment of the company’s workforce amid broader market and economic concerns as well as needed gains in efficiency.

“We are adjusting and going to a level where we think we want to be and need to be,” he said. “But it’s nothing that will continue in the future.”

For 2026, the company announced a vehicle production target of between 25,000 and 27,000 units. That would mark an increase of roughly 40% to 51% compared with the year-end figures the company released Tuesday.

Lucid said the revision for the year — from 18,378 units to 17,840 units — came as “538 vehicles had not completed certain internal procedures required under its final validation process to be classified as produced.”

The company said the vehicles are expected to be completed this year, with the change not affecting its previously reported financial results.

Winterhoff described the expected growth as “healthy,” but not “outrageous” given the current slowdown in overall vehicle sales, including EVs.

“Our initial plans were higher, but we wanted to really be conservative and make sure that we are hitting the numbers that we are projecting,” he told CNBC.

Lucid is expected to begin production of a new, less expensive midsize vehicle at the end of this year, but Winterhoff said it will not be material to its 2026 production plans. He said the automaker’s Gravity SUV is expected to account for the majority of its production and sales this year, followed by the Air sedan. The company also plans to launch its first Lucid robotaxis with previously announced partners.

Winterhoff said the company’s main priorities this year are achieving its production target, growing sales, continuing efficiency gains and preparing for production of the midsize vehicle and robotaxis.

“We really want to make sure that we [are] on our path to profitability, make sure that we’re not spending money that we don’t have to. That’s very, very important,” he told CNBC.

Lucid has yet to say when the company expects to be profitable. It is scheduled to host an investor day on March 12 in New York.

Lucid said it ended last year with approximately $4.6 billion in total liquidity, which Lucid CFO Taoufiq Boussaid said was “strong” and would provide flexibility “to execute near-term objectives while investing in future growth.”

Lucid reported a net loss of $2.7 billion in 2025, in line with a $2.71 billion loss a year earlier. That includes more than doubling its year-over-year losses during the fourth quarter to $814 million. It reported a loss of $12.09 per share for the year.

The company’s 2025 revenue was up 68% to $1.35 billion, including more than doubling year-over-year results during the fourth quarter.

Business

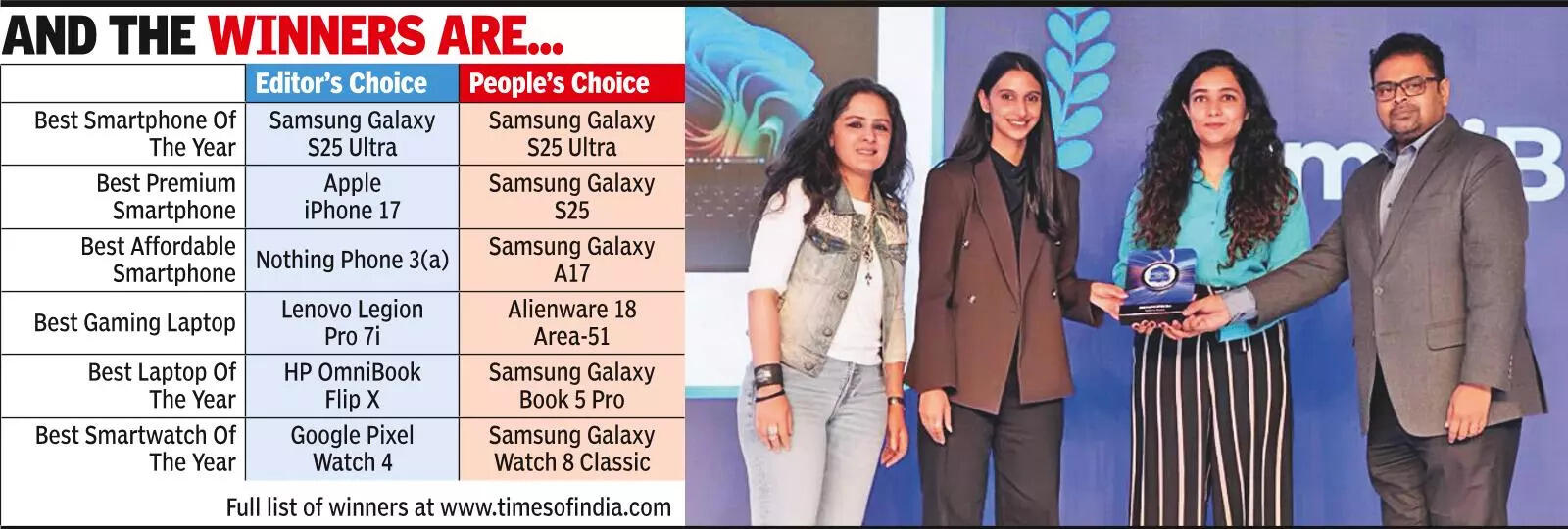

Gadgets Now Awards 2025 recognise tech excellence – The Times of India

NEW DELHI: The Times of India Gadgets Now Awards 2025 celebrated last year’s standout gadgets at an event on Monday where technology met glamour. The event drew an eclectic gathering of distinguished guests who came together to recognise technological excellence across key categories, including smartphones, smartwatches, audio products, televisions and more.This year, the Awards that are in its 6th edition went a step further and also recognised India’s leading influencers and creators who are redefining the tech content landscape.

The winners included Samsung Galaxy S25 Ultra, which scored a double win as the Best Smartphone Editor’s Choice and Popular Choice.Apple iPhone 17 was adjudged the Best Premium Smartphone Editor’s Choice, while Samsung Galaxy S 25 won the Popular Choice in the same category.Samsung once again picked up 2 awards as Galaxy Z Fold 7 was crowned the Editor’s Choice and Popular Choice winner in the Best Foldable Smartphone category.Samsung Galaxy Book 5 Pro won the Editor’s Choice Best AI-powered gadget, while Neosapien Neo 1 was the Popular Choice winner.

Business

Google apologises for Baftas alert to ‘see more’ on racial slur

Google said the news alert was an error that should not have happened.

Source link

-

Entertainment1 week ago

Entertainment1 week agoQueen Camilla reveals her sister’s connection to Princess Diana

-

Tech1 week ago

Tech1 week agoRakuten Mobile proposal selected for Jaxa space strategy | Computer Weekly

-

Politics1 week ago

Politics1 week agoRamadan moon sighted in Saudi Arabia, other Gulf countries

-

Entertainment1 week ago

Entertainment1 week agoRobert Duvall, known for his roles in "The Godfather" and "Apocalypse Now," dies at 95

-

Business1 week ago

Business1 week agoTax Saving FD: This Simple Investment Can Help You Earn And Save More

-

Politics1 week ago

Politics1 week agoTarique Rahman Takes Oath as Bangladesh’s Prime Minister Following Decisive BNP Triumph

-

Tech1 week ago

Tech1 week agoBusinesses may be caught by government proposals to restrict VPN use | Computer Weekly

-

Sports1 week ago

Sports1 week agoUsman Tariq backs Babar and Shaheen ahead of do-or-die Namibia clash