Business

CoinDCX’s H1 2025 Report: Volume Growth, Product Wins & Long-Term Investor Conviction

Last Updated:

In India, this global momentum is mirrored by a surge in CoinDCX’s trading volumes and deeper investor conviction

CoinDCX recorded ₹23,497.35 crore in spot trading volume in H1 2025, up 37% compared to H1 2024.

CoinDCX, India’s largest crypto exchange, today unveiled the Half-Year Report at a pivotal moment for the global digital asset ecosystem. The re-election of U.S. President Donald Trump has triggered a wave of pro-crypto policy momentum, including proposals for a Strategic Bitcoin Reserve and the GENIUS Act, a comprehensive stablecoin regulation bill. At the same time, institutional confidence is rising globally, with the European Union beginning implementation of its MiCA framework and Hong Kong introducing Asia’s most advanced stablecoin licensing regime. These shifts are fueling a renewed sense of legitimacy and long-term potential in crypto markets.

In India, this global momentum is mirrored by a surge in CoinDCX’s trading volumes and deeper investor conviction.

CoinDCX recorded ₹23,497.35 crore in spot trading volume in H1 2025, up 37% compared to H1 2024. Over 70% of these volumes were concentrated in Bitcoin and foundational Layer 1 blockchains, demonstrating a decisive shift from speculative trading to infrastructure-focused conviction. The average number of tokens held per investor is four, reflecting growing portfolio diversification.

In a significant sign of long-term investor intent, CoinDCX saw over 2.08 lakh systematic investment plans (SIPs) created in H1 2025—a staggering 1071% year-on-year increase. This behavior shift indicates a maturing investor mindset, driven by awareness, patience, and a belief in long-term value creation.

India’s investor base also evolved demographically. The average age is 31, women now comprise 15% of CoinDCX’s user base, and smaller cities like Faridabad and Nashik have emerged as fast-growing crypto adoption hubs. CoinDCX’s registered user base grew by 18.75% in H1 2025 compared to H1 2024, driven by robust education efforts and sustained trust-building initiatives.

Sumit Gupta, Co-founder, CoinDCX, said, “Crypto remains one of the most dynamic asset classes today. H1 2025 saw strong trading activity on CoinDCX, and the momentum has only accelerated as we entered H2. In the first two weeks of July alone, our platform recorded over $192 million in trading volumes, a 40% jump from June. Bitcoin volumes grew even faster, up 80%, driven by renewed investor interest as BTC crossed $116,000.”

“What’s even more promising is the evolution of our investor base. The average age of our users has now risen to 30, with growing participation from the 25–35 age group, reflecting deeper conviction and maturity. We’re also seeing a healthy uptick in adoption from tier-2 and tier-3 cities, and female participation now stands at 13–14%, steadily rising year on year. These shifts reinforce our belief that crypto is becoming more inclusive, mainstream, and long-term focused,” Sumit added,

CoinDCX accelerated its India-first roadmap. In H1 2025, the company:

- Launched India’s largest crypto education initiative with Upsurge, empowering over 2.7 lakh users

- Upgraded its Pro-trader stack, integrating Tradetron-powered algo trading and MarketWind strategy signals

- Published monthly Transparency Reports, disclosing platform health, user protections, and TDS compliance.

About CoinDCX

Established in 2018, CoinDCX is India’s largest cryptocurrency exchange, trusted by over 2 crore registered users. Our mission is to provide easy access to Web3 experiences and democratize investments in virtual digital assets. We prioritize user safety and security, strictly adhering to KYC and AML guidelines.

CoinDCX’s Web3 arm Okto Chain is advancing chain abstraction by building a fully expressive orchestration layer. Through CoinDCX Ventures, we have invested in over 15 innovative Web3 projects, reinforcing our dedication to the Web3 ecosystem. Our flagship educational initiative, #NamasteWeb3, empowers Indians with crypto knowledge, preparing them for the future of virtual digital assets.

CoinDCX has gained the confidence of global investors, including Pantera, Steadview Capital, Kingsway, Polychain Capital, B Capital Group, Bain Capital Ventures, Cadenza, Draper Dragon, Republic, Kindred, and Coinbase Ventures.

The News Desk is a team of passionate editors and writers who break and analyse the most important events unfolding in India and abroad. From live updates to exclusive reports to in-depth explainers, the Desk d…Read More

The News Desk is a team of passionate editors and writers who break and analyse the most important events unfolding in India and abroad. From live updates to exclusive reports to in-depth explainers, the Desk d… Read More

Read More

Business

TCS to buy AI advisory firm for $700 million – The Times of India

BENGALURU: TCS signed a definitive agreement to acquire US-based Salesforce consulting firm Coastal Cloud in an all-cash deal valued at $700 million. Founded in 2012, Coastal Cloud brings AI-led advisory and business consulting capabilities to help clients reimagine sales, service, marketing, revenue, and commerce. With the acquisitions of ListEngage and now Coastal Cloud, TCS said it’s placed among the top five Salesforce consulting firms globally. In Oct, TCS strengthened its Salesforce practice through the acquisition of ListEngage, with capabilities for its Agentforce, marketing cloud, and commerce cloud expertise. Coastal Cloud was nominated to the Salesforce Partner Advisory Board, allowing it to help shape product innovations and develop services to support new launches.The firm is led by Eric Berridge, a Salesforce veteran who built and scaled category-leading Salesforce services ventures. Salesforce Ventures has been a strategic investor in the company. The acquisition adds over 400 seasoned professionals with more than 3,000 multi-cloud certifications, strengthening TCS’ Salesforce advisory and consulting capabilities across verticals. Coastal Cloud’s client portfolio spans multiple industries, and the deal gives TCS greater access to the mid-market segment, along with cross-selling synergies across both firms’ customer bases.TCS COO Aarthi Subramanian said, “This acquisition marks a pivotal milestone in advancing our global Salesforce capabilities and accelerating our AI-led transformation agenda. It is another significant step towards realising TCS’s vision of becoming the world’s largest AI-led technology services company.” The transaction, however, is subject to approvals from regulatory bodies.

Business

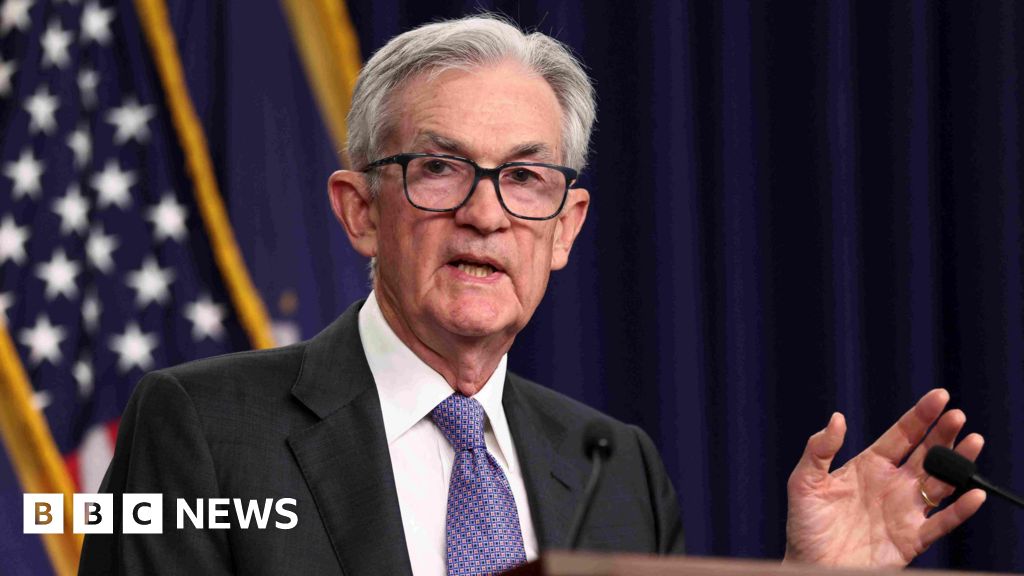

US Slashes Rates To Lowest Since 2022: What Powell’s Move Means For Jobs, Inflation And Your Wallet

Washington: The US Federal Reserve opened its final chapter of 2025 with a small but meaningful step, trimming its benchmark interest rate by 25 basis points even as the country digests delayed economic data from the recent government shutdown. With this move, which was announced after a closely watched meeting in Washington, the federal funds rate now stands in the range of 3.5 to 3.75 per cent, its lowest level since late 2022, according to a report by CBS News.

This reduction becomes the third straight cut since September, adding up to a total easing of 0.75 percentage points for the year. The central bank has been handling a difficult moment in the US economy, where job creation is cooling noticeably while inflation remains stubborn in key pockets.

Even without the full set of timely numbers, Fed officials kept a close eye on private-sector indicators, including an Automatic Data Processing (ADP) report that showed a loss of 32,000 jobs in November, a sign that pressure on the labour market has intensified.

In its statement, the Federal Open Market Committee said it would keep evaluating “incoming data, the evolving outlook and the balance of risks” before deciding on any further adjustments. The message reflected the Fed’s attempt to stay measured as it heads into a leadership transition next year.

New quarterly projections shared by the Fed show officials expect only one rate cut in 2026, offering a hint of the caution inside the boardroom. Updated forecasts also paint a clearer picture of where the central bank believes the economy is heading. The Fed expects its preferred inflation gauge, the Personal Consumption Expenditures index, to ease to 2.4 per cent next year, a step down from the 2.9 per cent median estimate for 2025.

Economic growth, meanwhile, is projected to reach 2.3 per cent in 2026, with unemployment holding consistently at 4.4 per cent.

Economists outside the central bank read the signals in a similar way. Ryan Sweet, chief global economist at Oxford Economics, told investors that the Fed’s latest guidance points to what he described as an “extended pause” in the rate-cut cycle.

“The Fed is not going to be able to help the labour market because of what ails it,” he said, adding that monetary policy alone cannot address the structural issues weighing on hiring.

The latest cut brings the benchmark rate back to levels last seen in early November 2022, a period when the Fed was still tightening aggressively to respond to runaway inflation in the aftermath of the pandemic.

Lower rates typically encourage borrowing, which in turn supports hiring and consumer spending, but the central bank appears determined to proceed carefully.

The decision itself exposed a rare division inside the Federal Open Market Committee (FOMC). While Jerome Powell and eight members backed the 0.25-percentage-point cut, three policymakers disagreed. This is the highest level of dissent in six years.

Austan Goolsbee and Jeffrey Schmid argued for keeping rates unchanged, while Stephen Miran pushed for a 0.5-percentage-point reduction.

These debates come at a moment for the institution. Powell’s term as Fed chair ends in May 2026, and US President Donald Trump is preparing to select his successor. In a note shared with clients and cited by CBS News, Jeff Schulze of ClearBridge Investments said that “the outlook from the Powell-led FOMC bears less than usual on future Fed policy decisions given the imminent change in leadership”. It captures the sense of transition that now hangs over the central bank.

Business

Fed cuts rate but future easing uncertain

Danielle KayeBusiness reporter

Reuters

ReutersThe US Federal Reserve has lowered interest rates for the third time this year, even as internal divisions create uncertainty about additional cuts in the coming months.

The central bank said on Wednesday it was lowering the target for its key lending rate by 0.25 percentage points, putting it in a range of 3.50% to 3.75% – its lowest level in three years.

But policymakers disagree about how the Fed should balance competing priorities: a weakening job market on the one hand, and rising prices on the other.

The Fed’s economic projections released on Wednesday suggest one rate cut will take place next year, although new data could change this.

Fed chair Jerome Powell said central bankers need time to see how the Fed’s three cuts this year work their way through the US economy. Policymakers will closely examine incoming data leading up to Fed’s next meeting in January, he added.

“We are well-positioned to wait to see how the economy evolves,” Powell told reporters.

Those hoping for interest rates to keep coming down, including President Donald Trump, might have to wait.

The Fed is facing a “very challenging situation” as it confronts risks of rising inflation and unemployment, Powell said, adding: “you can’t do two things at once”.

The decision to lower rates on Wednesday was not unanimous, suggesting widening divisions among central bankers over the outlook for the US economy.

Three Fed officials broke ranks and officially dissented.

Stephen Miran, who is on leave from his post leading Trump’s Council of Economic Advisers, voted for a larger 0.5 percentage point cut.

Austan Goolsbee, president of the Federal Reserve Bank of Chicago, and Jeffrey Schmid, president of the Federal Reserve Bank of Kansas City, voted to hold rates steady.

Trump, who has repeatedly urged Powell to lower rates, said after the meeting on Wednesday that the Fed’s cut could have been “at least doubled”.

“Our rates should be much lower,” he said at a roundtable at the White House. “We should have the lowest rates in the world.”

A data blackout during the longest-ever US government shutdown, which ended in November, has left policymakers partially in the dark about the state of the economy. But concerns about a slowing job market continue to outweigh inflation fears, at least for now.

The unemployment rate ticked up from 4.3% to 4.4% in September, Labor Department figures showed in a delayed report released last month. Cutting interest rates is aimed at stimulating the job market by creating lower borrowing costs for businesses.

Fears about tariff-driven inflation had taken centre stage earlier this year when Trump pushed forward with sweeping tariffs on many of the country’s largest trading partners.

Inflation is still above the Fed’s 2% target. In September, it hit 3% for the first time since January.

But while tariffs appear to be boosting some consumer prices, recent milder-than-expected inflation readings have allowed the Fed to focus on boosting the labour market by lowering rates, analysts said.

Dissents and disagreements

Still, policymakers remain divided over the path forward for interest rates.

Asked about disagreement among policymakers, Powell acknowledged that it’s “unusual” to have “persistent tension” between the Fed’s two mandates to keep prices stable and unemployment low.

“And when you do, this is what you see,” he said, referring to growing divisions.

Still, Powell characterised the internal debate between Fed officials as thoughtful and respectful.

“We come together and we reach a place where we can make a decision,” he said.

The central bank’s so-called dot plot, a quarterly anonymous economic forecast, showed on Wednesday a median expectation for one additional 0.25 percentage point cut in 2026.

That prediction was unchanged from the previous dot plot in September.

Central bankers are poised to have a bit more clarity next week, with the expected release of official data on the labour market and inflation for November.

The incoming data could shift policymakers’ outlook, potentially bolstering calls for further easing next year if there are new signs that the job market is stalling.

Who will succeed Powell?

Trump’s search for Powell’s replacement as Fed chair, once his term ends next May, is adding to uncertainty about the path forward for Fed policy.

Trump could announce his pick as soon as within the next few weeks.

Kevin Hassett, a long-time conservative economist and key Trump economic adviser, is seen as the front-runner to succeed Powell.

A Trump loyalist, Hassett served as chair of the White House Council of Economic Advisers during Trump’s first term and now leads the National Economic Council.

He has been a stalwart defender of Trump’s economic policies, downplaying data showing signs of weakness in the US economy, doubling down on allegations of bias at the Bureau of Labor Statistics and backing Trump’s handling of the Fed.

Hassett’s allegiance to the president has drawn questions from analysts about whether he would act independently and how much sway he would have with other members of the board.

Other names that have been floated for the Fed chair include economist Kevin Warsh, current Fed Governor Christopher Waller and even Treasury Secretary Scott Bessent.

Trump is “still making up his mind, and he’s looking for someone who will be in his way of thinking,” Thomas Hoenig, a distinguished senior fellow at the Mercatus Center, told the BBC.

The candidates, he added, “have to project that they will be independent, or the markets will become quite nervous – and that will create more volatility”.

Asked on Wednesday whether Trump’s search for a new Fed chair is hindering his job or changing his thinking, Powell responded with a resounding “no”.

-

Business1 week ago

Business1 week agoCredit Card Spends Ease In October As Point‑Of‑Sale Transactions Grow 22%

-

Business1 week ago

Business1 week agoIndiGo Receives Rs 117.52 Crore Penalty Over Input Tax Credit Denial

-

Business1 week ago

Business1 week agoMeesho IPO Opens Tomorrow: From Price Band To Lot Size And More, Here Are10 Key Things To Know

-

Business1 week ago

Business1 week agoGold And Silver Prices Today, December 2: Check 24 & 22 Carat Rates In Delhi, Mumbai And Other Cities

-

Fashion1 week ago

Fashion1 week agoWorld goods trade growth set to moderate as barometer index dips: WTO

-

Fashion1 week ago

Fashion1 week agoNorth India cotton yarn prices steady on average demand

-

Politics4 days ago

Politics4 days ago17 found dead in migrant vessel off Crete: coastguard

-

Fashion1 week ago

Fashion1 week agoOutlook on Philippines’ long-term rating positive: S&P Global Ratings