Business

Credit Card Spends Ease In October As Point‑Of‑Sale Transactions Grow 22%

New Delhi: Credit card spending eased by Rs 2.5 billion in October to Rs 2,142 billion, a moderation of 1.1 per cent month‑on‑month but an increase of 6.1 per cent year‑on‑year, driven by a sharp shift toward point‑of‑sale transactions, a report said on Tuesday.

“The strong POS growth can likely be attributed to festive (Diwali) spending, whereas muted online spends are due to the elevated base of the previous month,” the report from Asit C. Mehta Investment Intermediates Limited said.

Point‑of‑sale transactions grew 22 per cent month‑on‑month and 11.4 per cent year‑on‑year, while online spending declined 12.7 per cent MoM and rose 2.7 per cent YoY. The top 10 banks accounted for 94 per cent of total spending, with HDFC Bank recording the highest MoM spending market share gain in October.

An increase of 6.7 per cent is seen in the total number of cards outstanding on a YoY basis, adding a total of 0.63 million cards, the report said. Transaction volumes saw a healthy growth of 4.6 per cent MoM and 19.2 per cent YoY. The YoY growth is lower than the historical average due to a high base last year.

Since volume growth outpaced spend growth, the average spend per transaction declined by 6 per cent MoM and 11 per cent YoY. With card issuance rising and overall spending remaining flat, the average spend per card declined 1.7 per cent MoM and 0.5 per cent YoY.

IndusInd Bank reported a steep 36 per cent MoM decline in average spend per card, due to a sharp fall of 34 per cent in its total spends. Among major banks, HDFC Bank led with 0.14 million new cards, followed by SBI (0.13mn), ICICI Bank (0.1mn), and Axis Bank (0.08mn). HDFC Bank reported the highest YoY gain of 1.12 per cent.

Business

Gold steadies near record high as trade war risks sour global sentiment – SUCH TV

Gold and silver traded near record highs on Tuesday, as US President Donald Trump’s threats to acquire Greenland soured global sentiment and sparked a rush into safe-haven assets.

Spot gold was up 0.1% at $4,675.32 per ounce, as of 0336 GMT, after scaling an all-time high of $4,689.39 in the previous session.

US gold futures for February delivery climbed 1.9% to $4,680.30 per ounce.

Spot silver fell 1.4% to $93.33 an ounce, after hitting a record high of $94.72 earlier in the session.

“Gold is biding its time today and consolidating recent gains, with traders waiting to see what happens next regarding Trump’s latest spat with the EU over Greenland,” said Tim Waterer, KCM Trade’s chief market analyst.

“If Trump continues to turn the heat up regarding tariff threats, gold could feasibly be eying off a run north of $4,700 in the near term,” Waterer said, adding that if European Union leaders managed to patch things up with Trump at Davos this week, gold’s risk premium might fade.

Trump has intensified his push to wrest sovereignty over Greenland from fellow NATO member Denmark, prompting the European Union to weigh hitting back with its own measures.

The dollar retreated to its lowest in a week after tariff threats triggered a broad selloff across US stocks and government bonds.

Gold also found support as concerns lingered around the Federal Reserve’s independence with the US Supreme Court this week expected to hear a case around Trump’s attempt to fire Fed Governor Lisa Cook over alleged mortgage fraud.

The Fed is broadly expected to maintain interest rates at its January 27-28 meeting despite Trump’s calls for cuts.

Gold, which does not yield interest, typically performs well during periods of low interest rates.

Kelvin Wong, a senior market analyst at OANDA, expects the Fed to continue its rate-cut cycle into 2026, citing a sluggish labour market and lacklustre consumer sentiment, with the next reduction now being priced further down the calendar in either June or July.

Among other precious metals, spot platinum slid 1.8% to $2,331.20 an ounce, while palladium dropped 2% to $1,804.15.

Business

Asian stocks today: Markets trade mostly in red; Nikkei sheds 1%, HSI remains flat – The Times of India

Asian markets opened on a weak note on Tuesday, as most indices slipped into the red as investors reacted to trade tensions and political developments in Japan. In US, markets remained closed for the Martin Luther King Jr Day holiday.Hong Kong’s HSI was up 35 points to 26,599. Nikkei trimmed 519 points or 0.97% to 53,064. Shanghai and Shenzhen were down 0.12% and 0.89%, respectively. Meanwhile, Kospi was 0.36% up, trading at 4,922 at 11:30 am IST. Investors across the globe remained cautious after US President Donald Trump threatened to impose fresh tariffs on European imports, unsettling major trading partners that have significant investments in the United States. US stock futures fell sharply, tracking losses across European markets on Monday, while oil prices were steady. The announcement also triggered turbulence in Japan’s bond market. Government bond yields climbed rapidly after Takaichi indicated she would dissolve parliament to seek a stronger mandate, buoyed by high public approval ratings. She has also floated a proposal to temporarily suspend the food tax. Markets are increasingly concerned that a renewed mandate could lead to higher government spending, reigniting worries over Japan’s public finances. As a result, bond prices fell and yields jumped. The yield on the 40-year Japanese government bond rose to a record 4% on Tuesday, while yields on other long-term bonds surged to their highest levels in decades. Investors are now turning their attention to a busy week in the United States, which will feature more corporate earnings and fresh inflation data closely watched by the Federal Reserve. The US central bank meets in two weeks and is expected to keep its key interest rate unchanged as it balances signs of a slowing labour market against inflation that remains above its 2% target. Japan’s central bank is also set to conclude its policy meeting later this week.

Business

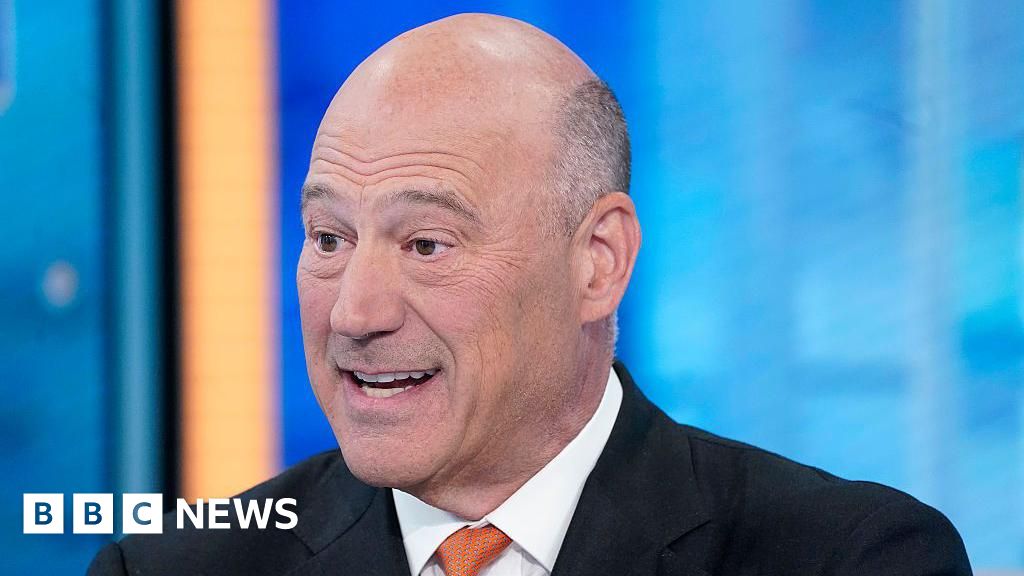

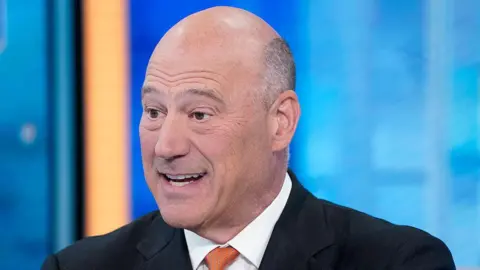

Greenland ‘will stay Greenland’, former Trump adviser declares

Faisal IslamEconomics editor

Getty Images

Getty ImagesOliver SmithBusiness producer, Davos

Donald Trump will not be able to force Greenland to change ownership, a former top adviser to the US president has told the BBC.

IBM’s vice chairman Gary Cohn, who advised Trump on the economy in his first term, said “Greenland will stay Greenland” and linked the need for access to critical minerals to his former boss’s plans for the territory.

Cohn is one of America’s top tech bosses, a leader in the race to develop AI and quantum computing, and served under Trump as director of the White House National Economic Council.

In a sign of how seriously business leaders are taking the crisis, he warned “invading an independent country that is part of Nato” would be “over the edge”.

He also suggested the president’s recent comments about Greenland “may be part of a negotiation”.

“I just came from a US congressional delegation meeting, and I think there’s pretty uniform consensus with both Republicans and Democrats that Greenland will stay Greenland”, he said.

Greenland would be happy for the US to increase its military presence on the island, he said, with the North Atlantic and Arctic Ocean “becoming much more of a military threat”.

The US could also negotiate an “offtake” agreement for Greenland’s vast yet largely untapped supplies of rare earth minerals, Cohn suggested.

“But I think, you know, invading a country that doesn’t want to be invaded – that’s part of a militaristic alliance, Nato – seems to me to be a little bit over the edge at this point”, he said.

Cohn indicated the president may be overstating his demands as part of a negotiating tactic – something he says the president has done successfully in the past.

“You’ve got to give Donald Trump some credit for the successes he’s had and he’s many times tried to overreach to get something in a compromise situation,” he said.

“He has overreached in advertising something to end up getting what he actually wants. Maybe what he actually wants is a larger military presence and an offtake.”

The start of this year’s World Economic Forum in the Swiss ski resort of Davos has been overshadowed by the president’s increasingly aggressive stance on the arctic territory, with many political and business leaders alarmed about the potential geopolitical and economic impact. Trump is due to address delegates at the gathering on Wednesday.

While Cohn expressed reservations about some of the president’s actions, he said the US administration had “various different motives” for what they were doing.

He said Trump’s decision to intervene in Venezuela was “a path” to disrupt the country’s relationship with China, the biggest market for its oil, as well as Russia and Cuba.

Cohn also thinks that the president has become increasingly focused on the importance of rare earth minerals, noting that “Greenland has quite a supply” of the resources.

Those minerals are critical to the development of Artificial Intelligence (AI) and quantum computing – also a major talking point in Davos.

US Treasury Secretary Scott Bessent on Monday hit back at claims Trump has blamed his escalating threats over Greenland on the fact he was not awarded the Nobel Peace Prize.

In a message to Norway’s Prime Minister Jonas Gahr Støre, Trump blamed the country for not giving him the prize and said he no longer feels obliged to think only of peace.

Bessent said: “I don’t know anything about the president’s letter to Norway, and I think it’s complete canard that the President will be doing this because of the Nobel Prize.

“The president is looking at Greenland as a strategic asset for the United States. We are not going to outsource our hemispheric security to anyone else.”

AI ‘to be part of every business’

Developments in quantum computing and AI are seen as critical not just for the US economy and productivity, but for US strategic influence in the world.

“IBM is dead centre in what’s going on in quantum today. We have the largest amount of quantum computers in use today” Cohn said, highlighting that his company has put many of these computers into use across America in firms from the banking industry to medicine.

“AI is going to be the backbone for data that feeds into quantum to solve problems we’ve never been able to solve”, he added.

“Where we’re heading is AI is going to be part of everyone’s enterprise. AI and quantum are going to be working in the enterprise behind the scenes to make every company more efficient. And we’re just at the beginning of that sort of long road, and that’s going to take probably another three to five years to get there.”

Earlier this month, Google, also a US company, told the BBC it had the world’s best-performing quantum computer. The race to develop the technology is the other key talking point – apart from Greenland – at the World Economic Forum.

-

Tech1 week ago

Tech1 week agoNew Proposed Legislation Would Let Self-Driving Cars Operate in New York State

-

Entertainment7 days ago

Entertainment7 days agoX (formerly Twitter) recovers after brief global outage affects thousands

-

Sports5 days ago

Sports5 days agoPak-Australia T20 series tickets sale to begin tomorrow – SUCH TV

-

Fashion3 days ago

Fashion3 days agoBangladesh, Nepal agree to fast-track proposed PTA

-

Business4 days ago

Business4 days agoTrump’s proposed ban on buying single-family homes introduces uncertainty for family offices

-

Tech4 days ago

Tech4 days agoMeta’s Layoffs Leave Supernatural Fitness Users in Mourning

-

Politics3 days ago

Politics3 days agoSaudi King Salman leaves hospital after medical tests

-

Tech5 days ago

Tech5 days agoTwo Thinking Machines Lab Cofounders Are Leaving to Rejoin OpenAI