Business

Current account posts $254 million deficit in July | The Express Tribune

KARACHI:

Pakistan’s current account (CA) posted a deficit of $254 million in July 2025, according to the latest figures released by the State Bank of Pakistan (SBP) on Tuesday.

Last month, the country recorded a CA surplus of $335 million, while in July 2024, the deficit had stood at $348 million.

The SBP data shows a CA deficit of $254 million in July 2025, reflecting a notable improvement compared to the $348 million deficit recorded in July 2024. This marks a year-on-year reduction of $94 million, indicating a positive shift in the country’s external sector dynamics as the new fiscal year begins. However, the monthly CA data from July 2024 to July 2025 highlights a period of mixed performance, with several months showing strong surpluses that helped offset periods of modest deficits.

The fiscal year began with three consecutive months of deficits; July ($0.35 billion), August ($0.08 billion), and September 2024 ($0.04 billion). However, this was followed by a shift in October 2024, which recorded a surplus of $310 million. The external position continued to improve in November and December 2024, with surpluses of $720 million and $470 million, respectively.

In early 2025, the trend briefly reversed. January 2025 posted the highest monthly deficit of the year at $380 million, followed by a smaller deficit of $80 million in February. March 2025 marked a strong recovery, as Pakistan recorded its highest monthly surplus during the period at $1.28 billion, reflecting either a surge in exports, remittances, or possibly one-off inflows.

The CA remained relatively stable in the closing months of the fiscal year, with April 2025 posting a marginal surplus of $20 million, May returning to a small deficit of $80 million, and June rebounding with a surplus of $340 million.

Speaking to The Express Tribune, JS Global Head of Research Waqas Ghani said, “The shortfall of $254 million in July 2025 as opposed to a surplus of $335 million last month was driven primarily by a widening trade deficit, as a strengthening domestic economy spurred a rebound in imports.”

He expected the CA to end the fiscal year in deficit, driven by the pickup in imports. Even so, stable global commodity prices should help limit import pressures, while resilient workers’ remittances are likely to anchor external stability.

He anticipated a further buildup in foreign exchange reserves going forward, with workers’ remittances expected to exceed $40 billion in FY26. Ghani believed that the sustained inflow of remittances are driven by a shift towards official channels which are a key support to the CA. He projected the external financing requirements for FY26 to remain broadly in line with last year’s levels.

REER

The Real Effective Exchange Rate (REER) index appreciated to 98.6 in July 2025, up from 96.6 in June 2025, according to data released by the SBP. This two-point increase reflects a slight strengthening of the rupee in real terms against a basket of trading partner currencies.

While the REER remains below the benchmark level of 100, the recent appreciation suggests a marginal rise in the relative value of the Pakistani rupee, which could impact export competitiveness if the trend continues. Nonetheless, the REER is still broadly aligned with historical averages, indicating relative external stability.

Meanwhile, the local currency extended its winning streak on Tuesday, August 19, 2025, appreciating 0.02% against the US dollar in the interbank market. The local currency closed at 281.96, strengthening slightly from the previous day’s rate of 282.02.

This marks the eighth consecutive session of gains for the rupee, reflecting continued stability in the foreign exchange market and improved sentiment around the economy.

Business

Shop price inflation eases but food costs still 3.5% up on a year ago

Shop price inflation eased in February but consumers are still paying 3.5% more for food than a year ago, figures show.

Overall shop inflation fell slightly to 1.1% from January’s 1.5%, in line with the three-month average of 1.1%, as fierce competition between retailers kept price rises in check and customers benefited from promotions across health, beauty and fashion, according to the British Retail Consortium (BRC) and NIQ.

Prices of products other than food were down 0.1% year on year, a significant drop from January’s growth of 0.3%.

Overall food inflation fell slightly to 3.5% from 3.9% in January, while fresh food prices remained 4.3% higher than last February, a slight drop from January’s 4.4% and above the three-month average of 4.2%.

However falling global costs pushed ambient food inflation down to 2.3% – its lowest level in four years and a significant fall from January’s 3.1%.

BRC chief executive Helen Dickinson said: “Households got some welcome relief in February as shop price inflation eased.

“While the direction of travel is promising, prices are still rising, and many consumers remain under pressure.”

Mike Watkins, head of retailer and business insight at NIQ, said: “Since the start of the year, we have seen some competitive pricing across both the food and non-food channels which is helping to bring down inflation.

“Whilst the inclement weather and weak sentiment is making consumer demand rather unpredictable for retailers, at least shoppers are now seeing some of their cost-of-living pressures start to ease.”

Business

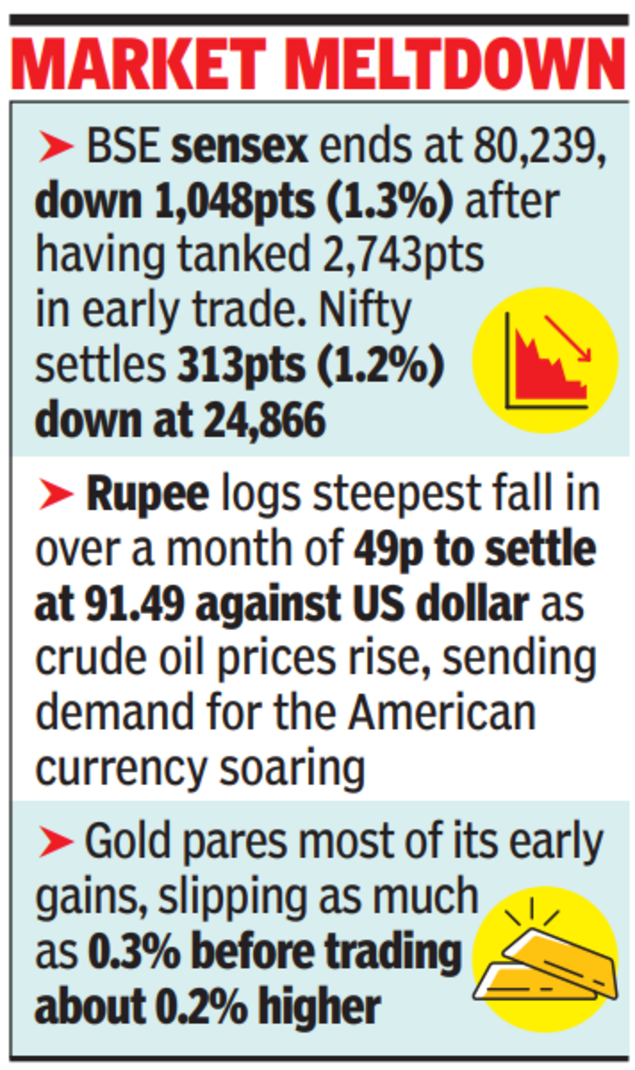

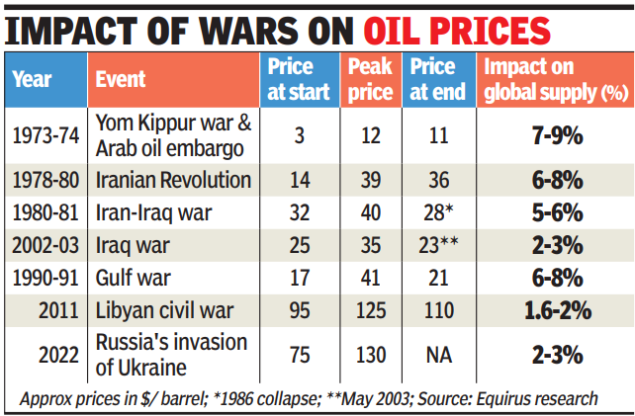

Chancellor Rachel Reeves urged to scrap fuel duty hike amid oil price fears

The Chancellor has been urged to scrap the proposed hike in fuel duty as concerns have been raised about the conflict in the Middle East.

Rachel Reeves announced last year that the long-held discount in fuel duty would be scrapped from September, with a 1p hike followed by two increases of 2p each in subsequent years.

But following the US and Israeli attacks on Iran at the weekend – which killed the country’s Supreme Leader Ayatollah Ali Khamenei – concerns have been raised about the impact of oil price hikes which could hit consumers at the pumps.

Following the attack, the price of oil jumped to 80 US dollars a barrel, with some analysts suggesting it could rise above 100 dollars.

Speaking ahead of the spring statement, SNP economy spokesman Dave Doogan said: ““With real fears that prices at the pump are now set to soar because of the situation in the Middle East – instead of stubbornly doubling down, the Chancellor needs to scrap her price hike plans before motorists face a devastating double hit.

“Oil prices are already spiking – the last thing motorists and businesses now need is another damaging tax hike from the Labour Party.

“The Chancellor needs to see sense, recognise what is unfolding globally, and immediately scrap her plans to hike prices at pumps.

“Everyone knows that Keir Starmer’s Labour Party has broken their promise to cut energy bills by £300 – it would be another slap in the face for families if Labour made the cost-of-living crisis even worse with a plan that will inevitably increase prices.

“After 14 U-turns from this chaotic Labour Government – scrapping their plans to hike fuel duty is one U-turn motorists, businesses and families right across Scotland would actually welcome.”

A spokeswoman for the Treasury said: “We have extended the 5p fuel duty cut from this month to the end of August to support drivers across the country.”

Business

West Asia conflict: Govt may ask companies to cut exports, increase auto fuel, LPG supplies – The Times of India

NEW DELHI: Amid fears of a shortage in crude supplies, govt is looking to nudge refiners to divert more auto fuel and LPG to the domestic market by cutting on exports and also increase cooking gas production so that there is no disruption in local supplies.While govt and oil companies insisted there’s no shortage, refiners are looking at alternate sources to partly compensate for crude coming from war-hit West Asia.

The tension has led to a spike in oil and gas prices, and given India’s dependence on imports, inflating the import bill and stoking inflationary pressures. Officials, however, said retail fuel prices may not rise immediately, as oil marketing companies follow a calibrated approach — absorbing losses when global prices are high and recouping them when prices soften. Retail petrol and diesel prices have remained unchanged since April 2022.Mantri meets oil cos to assess availability of crude and gasOn a day when Iranian drones damaged part of Saudi Aramco refinery and Qatar Energy’s facilities, the world’s largest LNG producer, announced an export pause, petroleum minister Hardeep Singh Puri and his team of officials met oil companies on Monday to assess the availability of crude and gas. “We are continuously monitoring the evolving situation, and all steps will be taken to ensure availability and affordability of major petroleum products in the country,” the oil ministry said in a post on X.India imports nearly 90% of its crude requirement. It also meets 60-65% of its LPG demand and about 60% of its LNG needs through imports, largely from West Asia, with shipments routed via Strait of Hormuz, which risks being choked due to the war.

According to the International Energy Agency, in 2023, 5.9% of the country’s production was being exported. Between April and Dec 2025, India exported petroleum products worth nearly $330 billion, with the Netherlands, UAE, the US, Singapore, Australia and China being the main destinations. In 2024, it also exported petroleum gas worth $454 million, mostly to Nepal, China, and Myanmar. The Reliance refinery in Jamnagar is the largest exporter in the country.An oil company executive said refiners are already in contact with traders to tie up capacities amid fears of the blockade of Strait of Hormuz. By Monday, the global market had caught the jitters from Qatar’s decision to suspend gas shipments.An oil executive said while disruption could cause difficulties in the immediate term, Indian players had a wide portfolio that they can tap for LNG, including the US, with vessels being routed through the Suez Canal.“Even if there is a force majeure, we have other sources of supply, which we can tap. Besides, no one is going to stop supplies indefinitely,” the executive said. While oil and gas prices rose Monday, the focus is on ensuring that supply lines remain open.

-

Politics5 days ago

Politics5 days agoWhat are Iran’s ballistic missile capabilities?

-

Business6 days ago

Business6 days agoHouseholds set for lower energy bills amid price cap shake-up

-

Entertainment1 week ago

Entertainment1 week agoTalking minerals and megawatts

-

Sports1 week ago

Sports1 week agoEileen Gu comments on Alysa Liu’s historic gold medal

-

Business6 days ago

Business6 days agoLucid widely misses earnings expectations, forecasts continued EV growth in 2026

-

Business1 week ago

Business1 week agoHaryana Govt bars IDFC First Bank, AU Small Finance Bank over alleged Rs 590 crore fraud

-

Sports1 week ago

Sports1 week agoTop 50 USMNT players of 2026, ranked by club form: USMNT Player Performance Index returns

-

Sports5 days ago

Sports5 days agoSri Lanka’s Shanaka says constant criticism has affected players’ mental health