Business

Deepening CPEC-II collaboration under China’s new Five-Year Plan | The Express Tribune

Pakistan stands to benefit from joint ventures in EV components, solar equipment & AI skill development

Shanghai Auto Show opens with bold message as China leads global electric vehicle race. PHOTO: SHANGHAI AUTO SHOW

KARACHI:

China’s economy is showing unmistakable signs of slowing in 2025, and the ripple effects are being felt across Asia. Its third-quarter GDP growth slipped to 4.8% from 5.2% in the previous quarter, marking the weakest pace in a year. Much of the drag stems from persistent structural weaknesses, particularly in the property market.

Real estate investment has declined 13.9% year-to-date as of September, while home prices in major cities continue to fall despite targeted stimulus measures. Consumer sentiment is subdued as retail sales have grown by just 3%, the lowest in a year, reflecting the cautious attitude of households facing job market uncertainty and shrinking wealth.

Deflationary pressures remain a concern, with producer and consumer prices both depressed, complicating Beijing’s efforts to stabilise demand.

Despite these difficulties, growth has averaged 5.2% during the first nine months of the year – enough for China to meet its annual target of around 5%. Exports have provided some support, though this strength is vulnerable to escalating tensions with the United States, including new tariffs, tighter restrictions on rare earth minerals and additional controls on the transfer of advanced technology.

These frictions signal a structural shift in the relationship between the world’s two largest economies rather than a temporary disruption. In response, policymakers in Beijing are easing monetary conditions, offering selective tax relief and considering interest rate cuts to lift consumption and private investment. At the same time, China is finalising a new Five-Year Plan that prioritises high-tech manufacturing, AI-driven innovation, productivity upgrades and greener industry, aiming to shift the economic model away from property-led growth. For Pakistan, China’s economic trajectory is not a distant macroeconomic development. It directly shapes trade flows, investment inflows, energy availability and industrial expansion. A further slowdown in China would have immediate consequences.

With bilateral trade touching $23.1 billion in 2024, weakening Chinese demand would hit Pakistan’s exports of cotton yarn, copper scrap, seafood, leather and semi-processed foods. This would worsen Pakistan’s already delicate trade deficit, which stood at $17.4 billion last year. Even if global commodity prices fall and offer some import relief, the loss of export earnings would outweigh the benefit.

A deeper Chinese slowdown would also cloud the outlook for CPEC — the backbone of Pakistan’s infrastructure and energy modernisation. China has financed power plants, transmission lines, motorways, ports and industrial zones.

If economic pressures force Beijing to scale back or delay overseas commitments, Pakistan could experience slower progress on Special Economic Zones, reduced momentum in Gwadar’s port and free zone development, postponement of energy upgrades, and delays in railway modernisation, including Main Line-1.

Domestic industries that are dependent on Chinese machinery and components, such as textiles, pharmaceuticals, construction, and renewable energy, could face increased costs or supply disruptions. Foreign exchange reserves would come under pressure as export receipts soften and project financing slows, complicating Pakistan’s efforts to stabilise inflation, interest rates and the exchange rate. In such a scenario, Pakistan would need to diversify export markets, attract investment from a broader pool of countries and push ahead with overdue structural reforms to build resilience.

However, if China succeeds in stabilising growth around the 5% mark, the outlook for Pakistan will become considerably more favourable. Stable Chinese demand would support Pakistan’s industrial and agricultural exports, helping maintain a more manageable trade balance and providing predictability for businesses engaged in cross-border commerce. Crucially, steady economic conditions in China would help sustain momentum under CPEC. Ongoing projects in transport infrastructure, grid modernisation, renewable energy and industrial zones could proceed without major delays. Improvements in logistics and energy availability would strengthen Pakistan’s productive capacity and competitiveness.

China’s incoming Five-Year Plan, with its focus on “new quality productive forces” such as artificial intelligence, robotics, electric mobility and green technologies, offers opportunities for deeper collaboration under CPEC phase-II. Pakistan stands to benefit from joint ventures in electric vehicle components, solar equipment, battery assembly, AI skill development, agri-tech and smart manufacturing. Such cooperation could accelerate the country’s transition towards a higher value-added and innovation-oriented economy.

Stable Chinese investment and predictable financing flows would also support Pakistan’s macroeconomic stability, helping improve investor confidence and giving policymakers greater space to pursue long-term reforms rather than crisis management.

China’s economic performance in 2025 is, therefore, pivotal not only for Beijing but also for Islamabad. A sharper slowdown would test Pakistan’s resilience and force difficult adjustments, while a stable China would offer space to consolidate growth, modernise industry and deepen technological cooperation.

The coming months will determine whether Pakistan must brace for external headwinds or position itself to benefit from new opportunities emerging in China’s evolving economic landscape.

The writer is a Mechanical Engineer and is pursuing a Master’s degree

Business

Oil prices spike! Will petrol, diesel rates be hiked in India as crude nears $80 mark on Middle East tensions? – The Times of India

Internationally, oil prices have risen by around 9-10% following Israel-US strikes on Iran, and amid the rising tensions in the Middle East are likely to remain elevated. Does that mean that petrol and diesel prices in India will go up?Brent crude, the international benchmark, moved close to $80 per barrel, while US crude futures advanced 8.6 per cent to $72.79, compared with roughly $67 on Friday.

India, which meets about 88% of its crude oil demand through imports before refining it into fuels such as petrol and diesel, faces a higher import burden when global prices rise, along with possible inflationary effects.

Middle East tensions : Will petrol, diesel prices go up?

Despite the sharp increase in global oil prices, retail petrol and diesel prices in India are not expected to be revised upward in the immediate future, according to a PTI report.According to sources quoted in the report, the government is maintaining a calibrated approach that allows oil marketing companies to improve margins during periods of lower international prices while protecting consumers when global rates increase.Also Read | Middle East oil shock risks: How much do China, India, Japan depend on Middle Eastern crude, gas?Pump prices for petrol and diesel have remained unchanged since April 2022. During this period, state-run retailers including Indian Oil Corporation, Bharat Petroleum Corporation Ltd and Hindustan Petroleum Corporation Ltd have absorbed losses when crude prices were elevated and benefited when prices declined.As a result, domestic fuel prices have stayed steady even when global fuel rates climbed due to higher crude costs. Likewise, when international fuel prices softened in line with lower crude, retail rates in India did not see a reduction.Sources added that the government intends to continue shielding consumers under this policy framework, unless crude prices witness an exceptionally sharp surge.With assembly elections approaching in key states such as West Bengal, Tamil Nadu and Assam, the government is keen to avoid developments that could provide political ammunition to the opposition, the report said.

India assesses oil security

Amid intensifying hostilities in the Middle East, Oil Minister Hardeep Singh Puri on Monday assessed the crude oil, LPG and petroleum products situation in a meeting with senior officials from his ministry and executives of public sector oil companies.

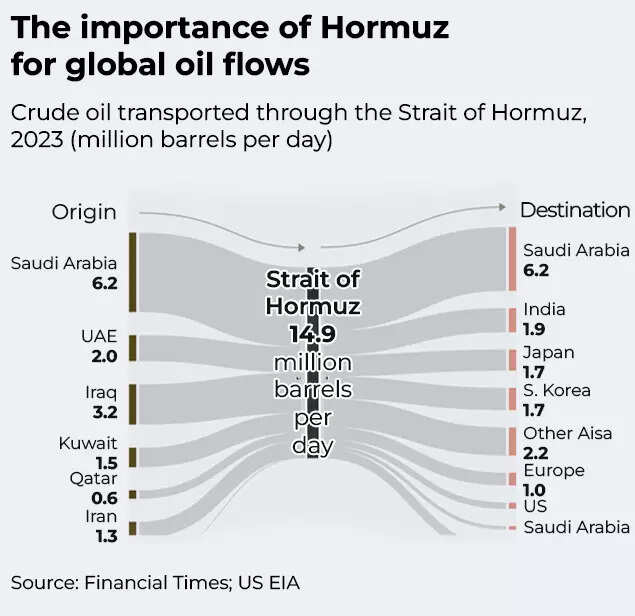

Importance of Hormuz for global oil flows

Much of India’s crude oil and gas supplies transit through the Strait of Hormuz, which Iranian authorities have threatened to close following US and Israeli strikes.“They have sufficient buffers to manage this kind of price spike,” a source with direct knowledge of the matter said, referring to oil companies. “We witnessed crude touching $119 per barrel in June 2022 after Russia’s invasion of Ukraine. That year their profits were modest, but in FY24 they recorded a record profit of Rs 81,000 crore.”Should interruptions continue, cargoes may need to be diverted around the Cape of Good Hope, resulting in longer transit durations and higher transportation expenses, along with increased freight and insurance costs.According to media accounts, the ongoing hostilities have in effect shut down the Strait of Hormuz, the vital artery for worldwide energy transportation. Nearly one-third of global seaborne crude oil exports and around 20 per cent of liquefied natural gas cargoes pass through this narrow channel.Also Read | 1970s-style oil shock loading? Crude may hit $100 if Strait of Hormuz shuts amid Middle East tensions – what it means

Business

Limited flights leave UAE while disruption continues amid Iran strikes

From the UK, flights have also been cancelled for many Middle East destinations, including all flights to Israel and Bahrain, three-quarters of the day’s scheduled flights to the United Arab Emirates, and more than two-thirds (69%) of flights to Qatar.

Business

IIP sees 4.8% YoY growth in January; manufacturing & electricity support rise – The Times of India

India’s Index of Industrial Production saw a 4.8% increase year-on-year in January 2026, according to the Ministry of Statistics & Programme Implementation. The rise in industrial output was largely driven by a 4.8 per cent expansion in manufacturing and a 5.1 per cent improvement in electricity generation. Mining activity also supported overall growth, registering a 4.3 per cent uptick during the month.Estimates placed IIP at 169.4 for January 2026, compared with 161.6 in January 2025. This follows a stronger reading in December 2025, when industrial production had grown by 7.8 per cent. For January 2026, the sector-specific indices stood at 157.2 for mining, 167.2 for manufacturing and 212.1 for electricity.Within manufacturing, 14 of the 23 industry groups at the NIC two-digit level posted year-on-year gains in January. The strongest contributors were manufacture of basic metals, which rose 13.2 per cent; manufacture of motor vehicles, trailers and semi-trailers, up 10.9 per cent; and manufacture of other non-metallic mineral products, which increased 9.9 per cent. Growth in basic metals was supported by items such as flat products of alloy steel, MS slabs, and hot-rolled coils and sheets of mild steel.The automobile category advanced on the back of higher output of auto components and spare parts, commercial vehicles, and bus and minibus bodies or chassis. In the non-metallic mineral products segment, cement of all types, cement clinkers and stone chips were key contributors.According to use-based classification, output of primary goods grew 3.1 per cent, capital goods rose 4.3 per cent and intermediate goods increased 6 per cent compared with January 2025. Infrastructure and construction goods recorded the sharpest rise at 13.7 per cent, while consumer durables expanded 6.3 per cent. In contrast, consumer non-durables declined by 2.7 per cent. The ministry identified infrastructure and construction goods, intermediate goods and primary goods as the leading drivers of growth under this classification.

-

Politics1 week ago

Politics1 week agoPakistan carries out precision strikes on seven militant hideouts in Afghanistan

-

Tech1 week ago

Tech1 week agoThese Cheap Noise-Cancelling Sony Headphones Are Even Cheaper Right Now

-

Entertainment1 week ago

Entertainment1 week agoViral monkey Punch makes IKEA toy global sensation: Here’s what it costs

-

Sports1 week ago

Sports1 week agoKansas’ Darryn Peterson misses most of 2nd half with cramping

-

Sports1 week ago

Mike Eruzione and the ‘Miracle on Ice’ team are looking for some company

-

Business6 days ago

Business6 days agoHouseholds set for lower energy bills amid price cap shake-up

-

Entertainment1 week ago

Entertainment1 week agoTalking minerals and megawatts

-

Business6 days ago

Business6 days agoLucid widely misses earnings expectations, forecasts continued EV growth in 2026