Business

Deepening CPEC-II collaboration under China’s new Five-Year Plan | The Express Tribune

Pakistan stands to benefit from joint ventures in EV components, solar equipment & AI skill development

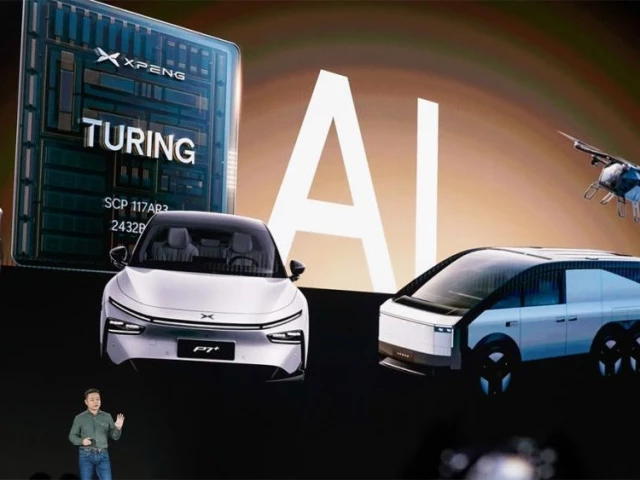

Shanghai Auto Show opens with bold message as China leads global electric vehicle race. PHOTO: SHANGHAI AUTO SHOW

KARACHI:

China’s economy is showing unmistakable signs of slowing in 2025, and the ripple effects are being felt across Asia. Its third-quarter GDP growth slipped to 4.8% from 5.2% in the previous quarter, marking the weakest pace in a year. Much of the drag stems from persistent structural weaknesses, particularly in the property market.

Real estate investment has declined 13.9% year-to-date as of September, while home prices in major cities continue to fall despite targeted stimulus measures. Consumer sentiment is subdued as retail sales have grown by just 3%, the lowest in a year, reflecting the cautious attitude of households facing job market uncertainty and shrinking wealth.

Deflationary pressures remain a concern, with producer and consumer prices both depressed, complicating Beijing’s efforts to stabilise demand.

Despite these difficulties, growth has averaged 5.2% during the first nine months of the year – enough for China to meet its annual target of around 5%. Exports have provided some support, though this strength is vulnerable to escalating tensions with the United States, including new tariffs, tighter restrictions on rare earth minerals and additional controls on the transfer of advanced technology.

These frictions signal a structural shift in the relationship between the world’s two largest economies rather than a temporary disruption. In response, policymakers in Beijing are easing monetary conditions, offering selective tax relief and considering interest rate cuts to lift consumption and private investment. At the same time, China is finalising a new Five-Year Plan that prioritises high-tech manufacturing, AI-driven innovation, productivity upgrades and greener industry, aiming to shift the economic model away from property-led growth. For Pakistan, China’s economic trajectory is not a distant macroeconomic development. It directly shapes trade flows, investment inflows, energy availability and industrial expansion. A further slowdown in China would have immediate consequences.

With bilateral trade touching $23.1 billion in 2024, weakening Chinese demand would hit Pakistan’s exports of cotton yarn, copper scrap, seafood, leather and semi-processed foods. This would worsen Pakistan’s already delicate trade deficit, which stood at $17.4 billion last year. Even if global commodity prices fall and offer some import relief, the loss of export earnings would outweigh the benefit.

A deeper Chinese slowdown would also cloud the outlook for CPEC — the backbone of Pakistan’s infrastructure and energy modernisation. China has financed power plants, transmission lines, motorways, ports and industrial zones.

If economic pressures force Beijing to scale back or delay overseas commitments, Pakistan could experience slower progress on Special Economic Zones, reduced momentum in Gwadar’s port and free zone development, postponement of energy upgrades, and delays in railway modernisation, including Main Line-1.

Domestic industries that are dependent on Chinese machinery and components, such as textiles, pharmaceuticals, construction, and renewable energy, could face increased costs or supply disruptions. Foreign exchange reserves would come under pressure as export receipts soften and project financing slows, complicating Pakistan’s efforts to stabilise inflation, interest rates and the exchange rate. In such a scenario, Pakistan would need to diversify export markets, attract investment from a broader pool of countries and push ahead with overdue structural reforms to build resilience.

However, if China succeeds in stabilising growth around the 5% mark, the outlook for Pakistan will become considerably more favourable. Stable Chinese demand would support Pakistan’s industrial and agricultural exports, helping maintain a more manageable trade balance and providing predictability for businesses engaged in cross-border commerce. Crucially, steady economic conditions in China would help sustain momentum under CPEC. Ongoing projects in transport infrastructure, grid modernisation, renewable energy and industrial zones could proceed without major delays. Improvements in logistics and energy availability would strengthen Pakistan’s productive capacity and competitiveness.

China’s incoming Five-Year Plan, with its focus on “new quality productive forces” such as artificial intelligence, robotics, electric mobility and green technologies, offers opportunities for deeper collaboration under CPEC phase-II. Pakistan stands to benefit from joint ventures in electric vehicle components, solar equipment, battery assembly, AI skill development, agri-tech and smart manufacturing. Such cooperation could accelerate the country’s transition towards a higher value-added and innovation-oriented economy.

Stable Chinese investment and predictable financing flows would also support Pakistan’s macroeconomic stability, helping improve investor confidence and giving policymakers greater space to pursue long-term reforms rather than crisis management.

China’s economic performance in 2025 is, therefore, pivotal not only for Beijing but also for Islamabad. A sharper slowdown would test Pakistan’s resilience and force difficult adjustments, while a stable China would offer space to consolidate growth, modernise industry and deepen technological cooperation.

The coming months will determine whether Pakistan must brace for external headwinds or position itself to benefit from new opportunities emerging in China’s evolving economic landscape.

The writer is a Mechanical Engineer and is pursuing a Master’s degree

Business

John Swinney under fire over ‘smallest tax cut in history’ after Scottish Budget

John Swinney has been pressed over whether this week’s Scottish Budget gives some workers the “smallest tax cut in history” – with Tory leader Russell Findlay branding the reduction “miserly” and “insulting”.

The Scottish Conservative leader challenged the First Minister after Tuesday’s Holyrood Budget effectively cut taxes for lower earners, by increasing the threshold for the basic and intermediate bands of income tax.

But Mr Findlay said that would leave workers at most £31.75 a year better off – saying this amounts to a saving of just £61p a week

“That wouldn’t even buy you a bag of peanuts,” the Scottish Tory leader said.

“John Swinney’s Budget might even have broken a world record, because a Scottish Government tax adviser says it ‘maybe the smallest tax cut in history’.”

Raising the “miserly cut” at First Minister’s Questions in the Scottish Parliament, Mr Findlay demanded to know if the SNP leader believed his “insulting tax cut will actually help Scotland’s struggling households”.

The attack came as the Tory accused the SNP government of increasing taxes on higher earners, with its freeze on higher income tax thresholds, which will pull more Scots into these brackets.

This is needed to pay for the “SNP’s out of control, unaffordable benefits bill”, the Conservative added.

Mr Findlay said: “The Scottish Conservatives will not back and cannot back a Budget that does nothing to help Scotland’s workers and businesses.

“It hammers people with higher taxes to fund a bloated benefits system.”

Hitting out at Labour – whose leader Anas Sarwar has already declared they will not block the government’s Budget – Mr Findlay said: “It is absolutely mind-blowing that Labour and other so-called opposition parties will let this SNP boorach of a budget pass.

“Don’t the people of Scotland deserve lower taxes, fairer benefits and a government focused on economic growth?”

Mr Swinney said the Budget “delivers on the priorities of the people of Scotland” by “strengthening our National Health Service and supporting people and businesses with the challenges of the cost of living”.

He insisted income tax decisions in the Budget would mean that in 2026-27 “55% of Scottish taxpayers are now expected to pay less income tax than if they lived in England”.

The First Minister went on to say that showed “the people of Scotland have a Government that is on their side”.

Referring to polls putting his party on course to win the Holyrood elections in May, the SNP leader added that “all the current indications show the people of Scotland want to have this Government here for the long term”.

Benefits funding is “keeping children out of poverty”, he told MSPs, adding the Budget contained a “range of measures” that would build on existing support.

The First Minister said: “What that is a demonstration of is a Government that is on the side of the people of Scotland and I am proud of the measures we set out in the Budget on Tuesday.”

Meanwhile he said the Tories wanted to make tax cuts that would cost £1 billion, with “not a scrap of detail about how that would be delivered”.

With the weekly leaders’ question time clash coming less than 48 hours after the draft 2026-27 Budget was unveiled, the First Minister also faced questions from Scottish Labour’s Anas Sarwar, who insisted that the proposals “lacks ambition for Scotland”.

Pressing his SNP rival, the Scottish Labour leader said: “While he brags about his £6 a year tax cut for the lowest paid, one million Scots including nurses, teachers and police officers face being forced to pay more.

“Even his own tax adviser says this is a political stunt. So why does John Swinney believe that someone earning £33,500 has the broadest shoulders and therefore should pay more tax in Scotland?”

Mr Swinney, however, said that many public sector workers would be better off in Scotland.

He told the Scottish Labour leader: “A band six nurse at the bottom of the scale will take home an additional £1,994 after tax compared to the same band in England.

“A qualified teacher at the bottom of the band will take home £6,365 more after tax in Scotland than the equivalent in England. There are the facts for Mr Sarwar.”

Business

BP cautions over ‘weak’ oil trading and reveals up to £3.7bn in write-downs

BP has warned it expects to book up to five billion dollars (£3.7 billion) in write-downs across its gas and low-carbon energy division as it also said oil trading had been weak in its final quarter.

The oil giant joined FTSE 100 rival Shell, after it also last week cautioned over a weaker performance from trading, which comes amid a drop in the cost of crude.

BP said Brent crude prices averaged 63.73 dollars per barrel in the fourth quarter of last year compared with 69.13 dollars a barrel in the previous three months.

Oil prices have slumped in recent weeks, partly driven lower due to US President Donald Trump’s move to oust and detain Venezuela’s leader and lay claim to crude in the region, leading to fears of a supply glut.

In its update ahead of full-year results, BP also said it expects to book a four billion dollar (£3 billion) to five billion dollar (£3.7 billion) impairment in its so-called transition businesses, largely relating to its gas and low-carbon energy division.

But it said further progress had been made in slashing debts, with its net debt falling to between 22 billion and 23 billion dollars (£16.4 billion to £17.1 billion) at the end of 2025, down from 26.1 billion dollars (£19.4 billion) at the end of September.

It comes after the firm’s surprise move last month to appoint Woodside Energy boss Meg O’Neill as its new chief executive as Murray Auchincloss stepped down after less than two years in the role.

Ms O’Neill will start in the role on April 1, with Carol Howle, current executive vice president of supply, trading and shipping at BP, acting as chief executive on an interim basis until the new boss joins.

Ms O’Neill’s appointment has made history as she will become the first woman to run BP – and also the first to head up a top five global oil company – as well as being the first ever outsider to take on the post at BP.

Shares in BP fell 1% in morning trading on Wednesday after the latest update.

Business

Budget 2026: Kolkata realtors seek tax relief, revised affordable housing cap; eye demand revival – The Times of India

Real estate developers in Kolkata have urged the Centre to use the Union Budget to recalibrate housing policies to reflect rising land and construction costs, calling for higher tax benefits for homebuyers and a long-pending revision of the affordable housing definition to revive demand, especially in the mid-income segment, PTI reported.With the Budget set to be tabled on February 1, industry players said measures such as revisiting price caps for affordable homes, rationalising GST on under-construction properties and easing approval processes could significantly improve affordability and sales momentum.Sushil Mohta, president of CREDAI West Bengal and chairman of Merlin Group, said reforms must align with current market realities. “Revisiting the affordable housing definition, rationalising housing loan interest deductions and streamlining GST rates will significantly improve affordability and demand, especially for middle-income homebuyers,” he told PTI, adding that a policy push for rental housing and wider access to formal housing finance is crucial amid rapid urbanisation.Mahesh Agarwal, managing director of Purti Realty, said continued policy support through tax rationalisation and infrastructure spending remains critical. “A re-evaluation of affordable housing price limits in line with rising land and construction costs, along with adjustments to GST on under-construction property, will enhance affordability,” he said, stressing that simpler tax frameworks and incentives for first-time buyers would help stabilise the market and speed up project execution.Echoing similar concerns, Merlin Group MD Saket Mohta pointed to sharp increases in construction costs since the introduction of GST in 2017, underscoring the need for further rationalisation. He also called for raising the affordable housing price cap from Rs 45 lakh to around Rs 80–90 lakh and expanding unit size norms. “Mid-income housing will be the key demand driver going into 2026, and supportive tax and policy measures are essential to sustain growth,” he said.Eden Realty MD Arya Sumant said the Budget must strike a balance between fiscal discipline and growth-oriented reforms. “Higher home loan interest deductions for mid-income and first-time buyers, an updated affordable housing definition, GST rationalisation and faster approvals will improve project viability and speed-to-market,” he said, adding that sustained urban infrastructure investment would unlock demand across residential and commercial segments.Sahil Saharia, CEO of Bengal Shristi Infrastructure Development Ltd, said policy focus should shift towards large, integrated developments. “Support for mixed-use townships, rental housing and commercial hubs, along with faster clearances and digital single-window mechanisms, can help create self-sustained urban ecosystems and improve execution efficiency,” he said.Developers said clear and stable policy signals in the Budget could help restore homebuyer confidence, attract long-term capital and ensure sustainable growth for the real estate sector in eastern India.

-

Politics1 week ago

Politics1 week agoUK says provided assistance in US-led tanker seizure

-

Entertainment1 week ago

Entertainment1 week agoDoes new US food pyramid put too much steak on your plate?

-

Entertainment1 week ago

Entertainment1 week agoWhy did Nick Reiner’s lawyer Alan Jackson withdraw from case?

-

Business1 week ago

Business1 week agoTrump moves to ban home purchases by institutional investors

-

Sports5 days ago

Sports5 days agoClock is ticking for Frank at Spurs, with dwindling evidence he deserves extra time

-

Sports1 week ago

Sports1 week agoPGA of America CEO steps down after one year to take care of mother and mother-in-law

-

Business1 week ago

Business1 week agoBulls dominate as KSE-100 breaks past 186,000 mark – SUCH TV

-

Business1 week ago

Business1 week agoGold prices declined in the local market – SUCH TV