Business

Good for mortgages, bad for food prices – how inflation dip affects you

Kevin PeacheyCost of living correspondent

Getty Images

Getty ImagesWalking around your local supermarket and you’ll struggle to find much that’s healthy for your finances on the shelves – food price rises are accelerating.

The cost of the weekly shop is, and will continue to be, a worry for millions of people.

Beyond just food, prices of goods and services in general are going up, but the rate of those price rises have slowed.

And that is likely to bring better news for the cost of borrowing, in particular mortgage rates for homeowners and first-time buyers.

Are prices going up or down?

Prices pretty much always rise. Official statistics chart the movement in the cost of hundreds of goods and services in the UK.

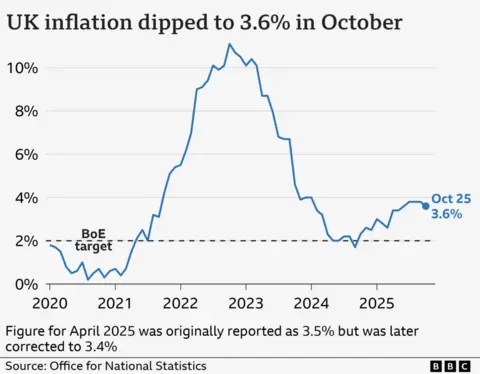

It is the rate of increase that is crucial, and that inflation rate is published every month by the Office for National Statistics (ONS).

On Wednesday, the ONS said the rate of inflation had fallen to 3.6%, which means prices are rising more slowly than they were and will foster hope that inflation has peaked.

Delve a little further into the data, and there are more details about what is behind the latest trends.

For example, fish, vegetables, chocolate and confectionary were among the products that rose in price, although fruit prices fell slightly.

Recent research by the Bank of England found that people on average are still buying the same amount of food, but paying more for it. That said, they are changing the way they shop.

“Concerns about rising food costs and utility bills still dominate conversations,” it said.

“Households continue to change their shopping habits to reduce spending, such as buying more vegetables and reducing meat consumption.”

Getty Images

Getty Images“Staples like bread, meat and potatoes all cost more than they did even a month ago,” says Danni Hewson, head of financial analysis at investment platform AJ Bell.

But she does point to a silver lining – the dip in the inflation rate means the Bank of England is now more likely to cut interest rates in December.

The Bank uses its benchmark interest rate – which heavily influences the cost of borrowing for households and businesses – to try to bring inflation to its target rate of 2%.

“Inflation remains well above the Band of England’s happy place of 2%,” says Alice Haine, personal finance analyst at Bestinvest.

But, she says, the latest figures could pave the way for a sixth interest rate cut since August last year.

The prospect of an interest rate cut has seen lenders make changes already. In recent weeks, many major lenders have lowered their rates for people getting a new fixed-rate mortgage or renewing their current one.

“There has been particular emphasis placed on rates for home movers with some of the best rates available for purchases,” says David Hollingworth, of mortgage brokers L&C.

Data from the financial information service Moneyfacts shows that the average rate on a new two-year fixed deal has fallen to 4.88%, and is down to 4.93% for the average five-year fixed deal.

Average rates for those only able to put down a deposit of 5% or 10% – often first-time buyers – are now looking lower than they have been at any time in the last two or three years.

Why are lenders cutting rates now?

Inflation is only one factor in lenders’ decisions to cut mortgage rates now.

Generally, Christmas is a quiet time for the housing market as potential buyers and sellers concentrate on turkey and trimmings instead.

So, they may be lowering rates in a bid to stimulate custom.

The same cannot be said for savings rates. “Competition has been scarce,” says Caitlyn Eastell, from Moneyfacts.

That is compounded by the fact that many of those buyers, sellers and savers have put plans on hold until they find out what happens in the Budget delivered by Chancellor Rachel Reeves on 26 November.

The Budget looms large over the housing market, with talk of taxation on high value properties, as well as over economic activity in general.

Reeves wants to introduce measures to lower the rate of inflation, and help people with the cost of living. However, she also needs to bring in more money or cut government spending to meet her own fiscal rules.

It is a delicate balancing act that will affect individual and family finances, affecting the money people have to spend in the supermarket and the appetite they have to save, as well as buy or sell a home.

Business

Faisal Islam: Is Reeves right in saying we’re turning a corner?

The Chancellor is trying to use this moment as a launching pad for a wider attempt to gee up consumer and business confidence.

Source link

Business

Oil market price battle: Russia and Iran offer deeper discounts to China as crude piles up at sea – The Times of India

Russian and Iranian oil producers are reportedly offering deeper discounts to compete for the same limited pool of Chinese buyers after India pulled back from purchases. Analysts say India’s imports from Russia could fall by 40 per cent from January levels, to around 600,000 barrels a day, according to a scenario from Rystad Energy, as reported by Bloomberg.Much of the displaced crude is heading east, sparking a price war with Iranian suppliers, long favoured by China’s independent refiners, known as teapots. Russian Urals crude is reportedly selling at about $12 a barrel below ICE Brent, up from a $10 discount last month. Iranian Light crude is going for as much as $11 below the global benchmark, widening from $8–$9 in December, according to traders.

“The Chinese private refiners cannot take in much more as their capacity is likely maxed out,” said Jianan Sun, an analyst at Energy Aspects, noting that sanctioned barrels are building up in both onshore and offshore storage.China’s teapots historically act as a pressure valve, absorbing barrels shunned by others, but their capacity is limited; they account for roughly a quarter of the country’s refining capacity and are also subject to government import quotas. Major state-owned refiners, meanwhile, have traditionally avoided Iranian crude and have recently largely stayed away from Russian barrels as well.With China unable to fully absorb the displaced supply, unsold oil is piling up in Asian waters, leaving Russia and Iran scrambling. The Kremlin has already cut output, depriving it of funds for its war in Ukraine, while Iran is trying to ship as much oil as possible amid fears of a potential US strike.Data shows Russian oil deliveries to Chinese ports rose to 2.09 million barrels a day in the first 18 days of February, a roughly 20 per cent increase from January and nearly 50 per cent higher than December. By contrast, Iranian exports to China have fallen about 12 per cent from a year earlier, to roughly 1.2 million barrels a day, according to Kpler. The firm estimates nearly 48 million barrels of Iranian crude are now at sea, up from about 33 million in early February. Russian cargoes sitting in Asian waters total around 9.5 million barrels.A potential US strike on Iran could disrupt exports if oil facilities are targeted or shipments through the Strait of Hormuz are blocked. Russian barrels carry a “relatively lower level of risk” for Chinese buyers compared with Iranian crude, said Lin Ye, vice president of oil markets at consultancy Rystad Energy, citing optimism over a potential ceasefire in Ukraine.

Business

HSBC reclaims top spot as FTSE 100 hits new high

The FTSE 100 reached fresh heights on Wednesday, with well-received results from HSBC, and gains in mining stocks, paving the way for another record-breaking day.

“The strong showing from the UK stock market so far in 2026, on top of a major success in 2025, bodes well for changing its reputation from unloved to admired,” said Russ Mould, investment director at AJ Bell.

The FTSE 100 index ended up 125.82 points, 1.2%, at 10,806.41, a record close and its best level for the day.

The FTSE 250 ended up 135.85 points, 0.6%, at 23,636.89, and the AIM All-Share closed up 1.26 points, 0.2%, at 816.79.

London’s brighter mood was reflected elsewhere in Europe.

The CAC 40 in Paris closed up 0.5% on Wednesday, while the DAX 40 in Frankfurt ended 0.8% higher.

Stocks in New York were also higher. The Dow Jones Industrial Average was up 0.4%, the S&P 500 index was 0.6% higher, and the Nasdaq Composite advanced 1.0%.

Across the pond all eyes point towards earnings from Nvidia, due for release after the New York market close.

David Morrison, senior market analyst at Trade Nation, said: “Tonight’s results will focus initially on revenues and earnings. In prior quarters, Nvidia has often surprised investors with bullish forward guidance, and if there’s good news here, then that should underpin the share price.

“But data centre revenue, chip demand and hyperscale cloud spending are all important elements, while competition (another recent issue) and margins will also be poured over by analysts.”

The pound was little changed at 1.3537 dollars on Wednesday afternoon, from 1.3536 dollars at the equities close on Tuesday.

The euro stood higher at 1.1804 dollars, from 1.1787 dollars. Against the yen, the dollar was trading higher at 156.39 yen, compared with 155.71 yen.

The yield on the US 10-year Treasury widened to 4.05% on Wednesday from 4.04% on Tuesday. The yield on the US 30-year Treasury was flat at 4.69%.

In London, shares in HSBC hit an all-time high after better-than-expected fourth-quarter results.

The 7.9% gain took the Asia-focused lender’s market value to £239.29 billion, overtaking AstraZeneca as the most valuable listed UK company.

Cambridge-based drugs firm AstraZeneca has a market value of a touch below £236 billion after falling 0.7% on Wednesday, with oil major Shell, up 1.3%, a distant third at £169.72 billion.

For the fourth quarter of 2025, HSBC said adjusted pre-tax profit rose to 8.59 billion dollars from 7.32 billion dollars a year ago, ahead of 7.85 billion dollars consensus.

JPMorgan said the profit beat was driven by strong banking net interest income, and impairments coming in 12% lower than forecast.

Looking ahead, chief executive Georges Elhedery said HSBC is “raising our ambition and targeting a 17% [return on tangible equity] or better, excluding notable items, in each year from 2026 to 2028”.

“We are also targeting year-on-year revenue growth over the same period on the same basis, rising to 5% in 2028,” he added.

JPM said the new targets are slightly above consensus expectations for annual revenue growth of 4.2% in 2028.

Citi analyst Andrew Coombs said it was “a good print”, with “potential for high-single digit consensus EPS upgrades”.

Mining stocks were also in demand as metals prices rose.

Gold firmed to 5,204.64 dollars an ounce on Wednesday from 5,142.02 dollars on Tuesday. Silver rose 4.1% and copper gained 0.9%.

Miners Fresnillo, Antofagasta and Anglo American rose 7.3%, 5.7% and 4.4% respectively.

Also in the green was St James’s Place, after it said it will increase shareholder returns after reporting better-than-expected 2025 results.

The London-based asset manager rose 6.6%, as it reported a post-tax underlying cash result of £462.3 million in 2025, up 3.4% from £447.2 million the year prior, and ahead of £445.5 million company-compiled consensus. Pre-tax profit increased 28% to £1.34 billion from £1.05 billion.

Post-tax underlying cash basic earnings per share of 87.0 pence, increased 6.1% from 82.0p, ahead of 84.2p consensus.

In addition, the firm intends to increase total annual shareholder distributions to 70% (from 50%) of the underlying cash result through a combination of dividends and share buy-backs.

But Diageo shareholders had a day to forget, as shares plunged 13% after it cut full-year sales guidance and slashed its dividend.

London-based Diageo operates in more than 180 countries with a portfolio of more than 200 brands, including top sellers such as Johnnie Walker whisky, Smirnoff vodka, Tanqueray gin and Guinness stout.

It said net sales fell 4.0% year-on-year to 10.46 billion dollars in the six months to December 31, from 10.90 billion dollars a year ago, below VA consensus of 10.57 billion dollars.

Sales declined 2.8% on an organic basis, compared to VA consensus for a 2.0% drop, with organic volumes down 0.9% and a negative price/mix of 1.9%.

“Trading conditions remained challenging in the first half of the year. We believe this was largely due to further macroeconomic and geopolitical uncertainty, and weak consumer confidence in key markets,” the company said in a statement.

For the financial year, Diageo now expects a full-year organic net sales decline of 2% to 3%, “given further weakness in the US”. It had previously predicted an outcome between “flat to slightly down”.

In addition, the firm halved its first-half payout to 20 cents per share from 40.50 cents a year prior.

New chief executive Dave Lewis said he is “confident that this is the right action” to “drive stronger shareholder value over the coming years”.

Dan Coatsworth, head of markets at AJ Bell, said: “There is no point trying to dress up the six-month figures. These are awful results, and the repair job is massive.”

On the FTSE 250, Trainline shares buckled as chief executive Jody Ford signalled his departure.

Shares in the London-based digital rail and coach ticketing platform fell 7.5%, as it said Mr Ford intends to step down as chief executive after more than six years at the company.

A formal search process to find his successor has begun, the firm added.

Brent oil traded lower at 70.76 dollars a barrel on Wednesday afternoon, from 71.16 dollars late Tuesday.

The biggest risers on the FTSE 100 were HSBC, up 102.60p at 1,394.00p, Metlen Energy & Metals, up 2.70p at 37.65p, Fresnillo, up 294.00p at 4,326.00p, St James’s Place, up 83.50p at 1,343.00p and Relx, up 142.00p at 2,415.00p.

The biggest fallers on the FTSE 100 were Diageo, down 238.00p at 1,636.00p, Haleon, down 27.80p at 377.90p, Croda, down 99.00p at 3,113.00p, Babcock International, down 29.00p at 1,374.00p and Tesco, down 8.30p at 492.20p.

Thursday’s global economic calendar has US initial jobless claims data.

Thursday’s domestic corporate calendar has full-year results from jet engine maker Rolls-Royce, advertising agency WPP, exchange operator and data provider London Stock Exchange and kitchen supplier Howden Joinery.

Contributed by Alliance News

-

Entertainment1 week ago

Entertainment1 week agoQueen Camilla reveals her sister’s connection to Princess Diana

-

Tech1 week ago

Tech1 week agoRakuten Mobile proposal selected for Jaxa space strategy | Computer Weekly

-

Politics1 week ago

Politics1 week agoRamadan moon sighted in Saudi Arabia, other Gulf countries

-

Entertainment1 week ago

Entertainment1 week agoRobert Duvall, known for his roles in "The Godfather" and "Apocalypse Now," dies at 95

-

Business1 week ago

Business1 week agoTax Saving FD: This Simple Investment Can Help You Earn And Save More

-

Politics1 week ago

Politics1 week agoTarique Rahman Takes Oath as Bangladesh’s Prime Minister Following Decisive BNP Triumph

-

Tech1 week ago

Tech1 week agoBusinesses may be caught by government proposals to restrict VPN use | Computer Weekly

-

Sports1 week ago

Sports1 week agoUsman Tariq backs Babar and Shaheen ahead of do-or-die Namibia clash