Business

GST rationalisation impact: Higher RBI dividend expected to offset revenue shortfall; CareEdge flags tax pressure – The Times of India

The recent rationalisation of Goods and Services Tax (GST) rates is likely to create a net revenue loss of around 0.1 per cent of GDP in the current financial year. However, this shortfall may be compensated by the higher dividend payout from the Reserve Bank of India (RBI), according to a report by CareEdge Ratings.The report, cited by ANI, highlighted that tax revenue growth has already slowed this year. With nominal GDP growth projected to be lower in FY26, achieving the full-year tax collection targets could become more difficult. The effect of the income tax relief announced in the last Budget, along with the revised GST structure, will need to be closely watched in the coming months.

CareEdge noted, “The net revenue shortfall from GST rationalisation is expected to be offset by the higher dividend transfer received from the RBI.”Despite the support from non-tax revenue, the report cautioned that weaker tax inflows could limit the government’s spending capacity in the latter half of the fiscal year. This could become more pronounced if the Centre continues to focus on its fiscal consolidation goal, which involves gradually lowering the fiscal deficit over time.When the GST rationalisation decision was announced, the GST Council had estimated the fiscal implication at about Rs 48,000 crore, or around 0.15 per cent of GDP based on FY24 consumption levels. The Council had also expected that stronger consumption could help recover part of this impact through improved GST receipts.A separate analysis by the State Bank of India (SBI), reported by ANI, projected that the central government’s revenue loss due to the GST rate cuts will be about Rs 3,700 crore in FY26. SBI noted that robust growth and increased consumer demand have helped soften the overall impact.SBI pointed out that while the initial estimated loss from GST rate changes was Rs 93,000 crore, additional GST collections led to the net loss narrowing to Rs 48,000 crore.During the first half of the current fiscal year, a slowdown in tax receipts was partly cushioned by strong non-tax revenue, particularly the higher dividend from the RBI. Meanwhile, the reduction in personal income tax rates announced in the Budget has contributed to slower income tax collections this year.While the complete fiscal impact of the GST rationalisation will become clearer over time, analysts suggest that the government may still be able to maintain fiscal balance. The combination of higher non-tax revenue and potential gains from stronger consumption-led GST inflows could help offset the pressure from moderating tax collections.

Business

NSE board approves IPO via OFS route – The Times of India

Mumbai: The board of the National Stock Exchange (NSE), the biggest stock exchange in India in terms of turnover and number of trades, on Friday gave its nod for the exchange to go for its long-awaited public offering. The NSE IPO will be an offer-for-sale. Currently, LIC, with a 10% stake in the bourse, is the largest shareholder, followed by the SBI group that holds 7.6% in the exchange. The exchange also set up a five-member panel consisting of its board members that will facilitate the IPO process. The members are Tablesh Pandey, Srinivas Injeti, Mamata Biswal, Abhilasha Kumari, G Sivakumar and Ashishkumar Chauhan.

Business

Hundreds of Google workers demand firm cuts ties with ICE

More than 900 Google employees signed a letter opposing company links to federal immigration actions.

Source link

Business

Stellantis CEO says automaker is stronger together as stock plummets amid $26 billion charge

Stellantis CEO Antonio Filosa speaks during an event in Turin, Italy, Nov. 25, 2025.

Daniele Mascolo | Reuters

DETROIT — Stellantis CEO Antonio Filosa on Friday said the automaker plans to move forward as one company amid speculation that it would be better off selling brands or splitting up after disappointing results.

“Stellantis is a very strong global company that is very proud to have very deep regional groups,” Filosa, an Italian native, told reporters during a media call. “It makes all of sense to stay together. We want to stay together for many years to come.”

His comments come hours after the company announced 22 billion euros ($26 billion) in charges from a business restructuring that includes pulling back on electrification plans and reintroducing V8 engines to U.S. models.

Filosa described the actions as an “important strategic reset of our business model, with the only intention to put our customer preferences back at the center of what we do globally and in each regions.” He said the “mission is to grow” after notable declines in market share in recent years.

Stellantis’ stock plunged more than 25% in trading in Milan and was down 23% on Wall Street.

Filosa on Friday did not specifically rule out the possibility of regionally refocusing or shrinking the company’s vast portfolio of 14 auto brands that includes U.S. brands Jeep, Ram and Chrysler, as well as Italian nameplates Fiat and Alfa Romeo, which have not performed well domestically.

Stellantis-listed shared in Milan and New York

“We want to really manage our brands in the sense to provide to them the products and the technology that our customers, that are now at the center of our strategic reset, will tell us that they want and they need,” he said. “This is our core mission.”

Filosa said additional information about the company’s plans moving forward will come at a May 21 investor day.

Friday’s announcement comes days after Stellantis executives met with the company’s U.S. franchised dealers at their annual National Automobile Dealers Association conference with a message that the automaker planned to grow sales across its U.S. lineup of brands, according to two dealers who attended the meeting.

$26 billion in charges

The majority of Friday’s announced charges — 14.7 billion euros — are related to realigning product plans with consumer preferences and new emission regulations in the U.S.

Other charges include 2.1 billion euros in resizing the company’s EV supply chain, 4.1 billion euros in warranty costs and 1.3 billion euros in restructuring European operations.

The automaker also canceled its dividend for 2026 and issued a 5 billion euro nonconvertible hybrid bond.

2026 Jeep Grand Wagoneer

Jeep

The charges related to EVs follow General Motors and Ford Motor announcing billions of dollars in similar expenses due to pullbacks in plans for all-electric vehicles.

Shares of Ford and GM were not as impacted as much as Stellantis, which also issued lower-than-expected guidance amid years of strategic problems with the company.

Stellantis said it anticipates a net loss for 2025. For 2026, the auto giant is targeting a mid-single-digit percentage increase in net revenue and a low-single-digit rise in its adjusted operating income margin.

“While charges were expected, the amount comes in above F ($19.5B) and GM ($7.6B). Expect shares to trade meaningfully lower today as a result. We continue to believe STLAM is a show-me-story. In the US, the company has lost substantial market share given high pricing and a perceived lack of product investment,” RBC Capital Markets analyst Tom Narayan said in a Friday investor note.

Past mistakes

Filosa on Friday called out mistakes by former company leaders more than he has since he succeeded Carlos Tavares as CEO in June.

Tavares, who was ousted in December 2024 amid disagreements with the Stellantis board, in a book last year reportedly said that the group’s French, Italian and U.S. operations might have to be split amid pressure from its main stakeholders.

It’s been just over five years since Stellantis was created through a $52 billion combination of Italian American automaker Fiat Chrysler and France-based Groupe PSA on Jan. 16, 2021.

The merger formed the fourth-largest automaker by volume, but the company has run into significant problems in recent years amid its investments in all-electric vehicles, focus on profits over market share and cost-cutting efforts to the detriment of products.

Stellantis’ global sales under Tavares fell 12.3% from 6.5 million in 2021 — the year the company was formed — to 5.7 million in 2024. That included a roughly 27% collapse in the U.S. in that period to 1.3 million vehicles sold. The automaker dropped from fourth in U.S. sales to sixth, declining from an 11.6% market share to 8% during that time frame.

Stellantis’ global market share has fallen from 8.1% in 2020 to an estimated 6.1% last year, according to S&P Global Mobility.

Correction: Global market share for Stellantis has fallen from 8.1% in 2020 to an estimated 6.1% last year, according to S&P Global Mobility. An earlier version mischaracterized the percentage.

-

Business1 week ago

Business1 week agoPSX witnesses 6,000-point on Middle East tensions | The Express Tribune

-

Tech5 days ago

Tech5 days agoHow to Watch the 2026 Winter Olympics

-

Business5 days ago

Business5 days agoPost-Budget Session: Bulls Push Sensex Up By Over 900 Points, Nifty Reclaims 25,000

-

Tech1 week ago

Tech1 week agoRight-Wing Gun Enthusiasts and Extremists Are Working Overtime to Justify Alex Pretti’s Killing

-

Fashion1 week ago

Fashion1 week agoItaly’s Brunello Cucinelli debuts Callimacus AI e-commerce experience

-

Tech6 days ago

Tech6 days agoI Tested 10 Popular Date-Night Boxes With My Hinge Dates

-

Fashion5 days ago

Fashion5 days agoCanada could lift GDP 7% by easing internal trade barriers

-

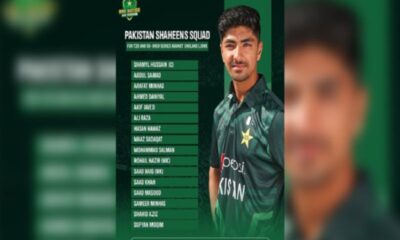

Sports5 days ago

Sports5 days agoPakistan Shaheens announce squad for T20’s, ODI’s – SUCH TV