Business

How companies could save money by sending employees home on time

Many employers are demanding more from workers these days, pushing them to log as many hours as possible.

Google, for example, told all its employees that they should expect to spend 60 or more hours in the office every week. Some tech companies are demanding 12-hour days, six days a week, from their new hires.

More job applicants in health care, engineering and consulting have been told to expect longer hours than previously demanded due to a weak job market.

On the other hand, companies such as Cisco, Booz Allen Hamilton and Intuit have earned a reputation for supporting a strong work-life balance, according to Glassdoor employee ratings.

To promote work-life balance, they offer flexible work options, give workers tips on setting boundaries and provide benefits to promote mental and physical well-being, including mindfulness and meditation training and personal coaching outside of work.

As a psychologist who studies workplace performance and well-being, I’ve seen abundant evidence that overworking employees can actually make them less productive. Instead, research shows that when employees have the time and space to lead a fulfilling life outside work, such as being free to spend time with their families or pursue creative hobbies, it improves their performance on the job.

Falling prey to the ‘focusing illusion’

For example, a team of researchers reviewed 70 studies looking at how managers support workers’ family lives.

They found that when supervisors show consideration for workers’ personal roles as a family member, including providing help to workers and modeling work-family balance, those employees are more loyal and helpful on the job and are also less likely to think about quitting.

Another study found that workers who could take on creative projects outside of work became more creative at work, regardless of their own personalities. This was true even for workers who didn’t consider themselves to be very creative to start with, which suggests it was the workplace culture that really made a difference.

When employers become obsessed with their workers’ productivity, they can get hung up on tracking immediate goals such as the number of emails sent or sales calls made. But they tend to neglect other vital aspects of employees’ lives that, perhaps somewhat ironically, sustain long-term productivity.

Daniel Kahneman, the late psychologist whose research team won a Nobel Prize in economics, called this common misconception the “focusing illusion.”

In this case, many employers underestimate the hidden costs of making people work more hours than they can muster while maintaining some semblance of work-life balance.

Among them are mental health problems, burnout and high turnover rates. In other words, overly demanding policies can ultimately hinder the performance employers want to see.

Taking it from Simone Biles

Many top performers recognize the value of work while also valuing the time spent away from it.

“At the end of the day, we’re human too,” said Simone Biles, who is widely considered the best gymnast on record.

“We have to protect our mind and body, rather than just go out there and do what the world wants us to do.”

Elite athletes like Biles require time away from the spotlight to recuperate and hone their skills.

Others who are at the top of their professions turn to hobbies to recharge their batteries. Albert Einstein’s passion for playing the violin and piano was not merely a diversion from physics – it was instrumental to the famous and widely beloved scientist’s groundbreaking scientific insights.

Einstein’s second wife, Elsa Einstein, observed that he took short breaks to play music when he was thinking about his scientific theories.

Taking a break

I’ve reviewed hundreds of studies that show leisure time isn’t a luxury − it fulfills key psychological needs.

Taking longer and more frequent breaks from your job than your workaholic boss might like can help you get more rest, recover from work-related stress and increase your sense of mastery and autonomy.

That’s because when employees find fulfillment outside of work they tend to become better at their jobs, making their employers more likely to thrive.

That’s what a team of researchers found when they studied the workforce at a large city hospital in the U.S. Employees who thought their bosses supported their family life were happier with their jobs, more loyal and less likely to quit.

Unsurprisingly, the happier, more supported workers also gave their supervisors higher ratings.

Researchers who studied the daily leisure activities of 100 Dutch teachers found that when the educators could take some of their time off to relax and engage in hobbies outside work, they felt better and had an easier time coping with the demands of their job the next day.

Another study of German emergency service workers found that not having enough fun over the weekend, such as socializing with friends and relatives, can undermine job performance the following week.

Finding the hidden costs of overwork

The mental health consequences of overwork, spending too many hours on the job or getting mentally or physically exhausted by your work are significant and measurable.

According to the World Health Organization, working more than 55 hours per week is associated with a 35% higher risk of having a stroke and a 17% higher risk of developing heart disease.

Working too many hours can also contribute to burnout, a state of physical, emotional and mental exhaustion caused by long-term work stress. The World Health Organization officially recognizes burnout as a work-related health hazard.

A Gallup analysis conducted in March 2025 found that even employees who are engaged at work, meaning that they are highly committed, connected and enthusiastic about what they do for a living, are twice as likely to burn out if they log more than 45 hours a week on the job.

Burnout can be very costly for employers, ranging anywhere from US$4,000 to $20,000 per employee each year. These numbers are calculated from the average hourly salaries of employees and based on the impact of burnout on aspects such as missed workdays and reduced productivity at work. That means a company with 1,000 workers could lose around $4 million every year due to burnout.

Ultimately, employers that overwork their workers have high turnover rates.

One study found that the onset of mandatory overtime for South Korean nurses made more of them decide to quit their jobs.

Similarly, a national study of over 17,000 U.S.-based nurses found that when they worked longer hours, turnover increased. This pattern is evident in many other professions besides health care, such as finance and transportation.

Seeing turnover increase

Conservative estimates of the cost of turnover for employers ranges from 1.5 to two times an employee’s annual salary. This includes the costs of hiring, onboarding and training new employees. Critically, there are also hidden costs that are harder to estimate, such as losing the departed employee’s institutional knowledge and unique connections.

Over time, making workers work extra hours can undercut an employer’s performance and threaten its viability.

Abundant evidence indicates that supporting employees’ aspirations for happier and more meaningful lives within the workplace and beyond leaves workers and their employers alike better off.

Louis Tay is a Professor of Industrial Organizational Psychology at Purdue University.

This article is republished from The Conversation under a Creative Commons license. Read the original article.

Business

Shop price inflation eases but food costs still 3.5% up on a year ago

Shop price inflation eased in February but consumers are still paying 3.5% more for food than a year ago, figures show.

Overall shop inflation fell slightly to 1.1% from January’s 1.5%, in line with the three-month average of 1.1%, as fierce competition between retailers kept price rises in check and customers benefited from promotions across health, beauty and fashion, according to the British Retail Consortium (BRC) and NIQ.

Prices of products other than food were down 0.1% year on year, a significant drop from January’s growth of 0.3%.

Overall food inflation fell slightly to 3.5% from 3.9% in January, while fresh food prices remained 4.3% higher than last February, a slight drop from January’s 4.4% and above the three-month average of 4.2%.

However falling global costs pushed ambient food inflation down to 2.3% – its lowest level in four years and a significant fall from January’s 3.1%.

BRC chief executive Helen Dickinson said: “Households got some welcome relief in February as shop price inflation eased.

“While the direction of travel is promising, prices are still rising, and many consumers remain under pressure.”

Mike Watkins, head of retailer and business insight at NIQ, said: “Since the start of the year, we have seen some competitive pricing across both the food and non-food channels which is helping to bring down inflation.

“Whilst the inclement weather and weak sentiment is making consumer demand rather unpredictable for retailers, at least shoppers are now seeing some of their cost-of-living pressures start to ease.”

Business

West Asia conflict: Govt may ask companies to cut exports, increase auto fuel, LPG supplies – The Times of India

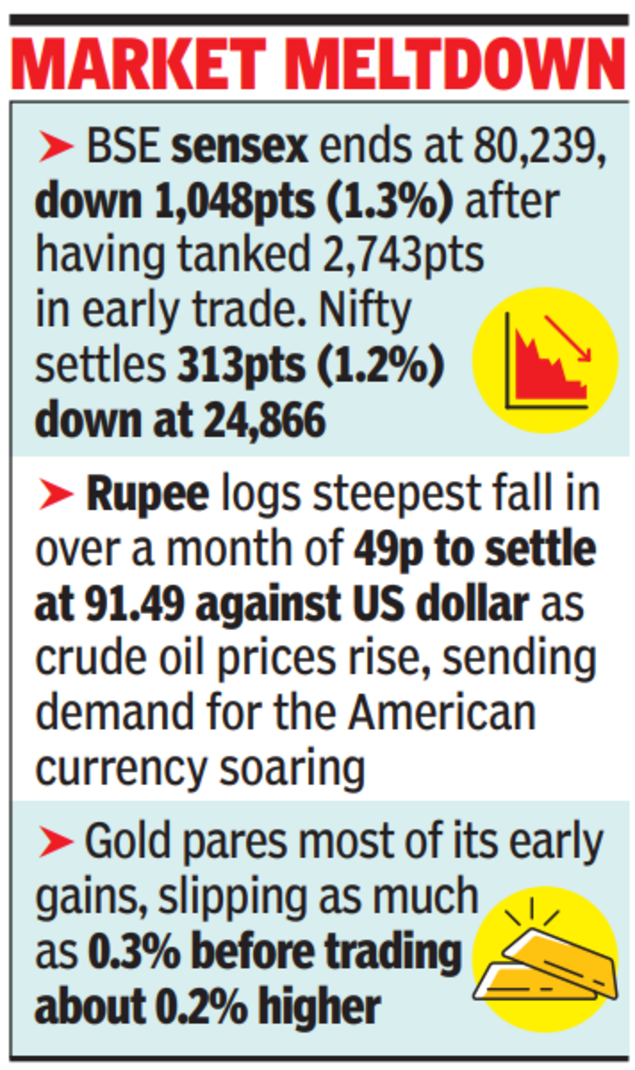

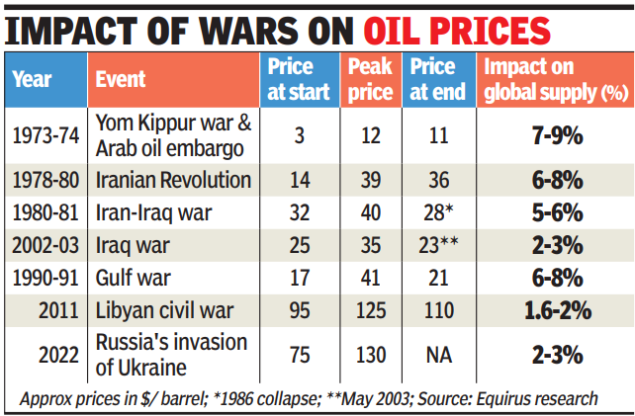

NEW DELHI: Amid fears of a shortage in crude supplies, govt is looking to nudge refiners to divert more auto fuel and LPG to the domestic market by cutting on exports and also increase cooking gas production so that there is no disruption in local supplies.While govt and oil companies insisted there’s no shortage, refiners are looking at alternate sources to partly compensate for crude coming from war-hit West Asia.

The tension has led to a spike in oil and gas prices, and given India’s dependence on imports, inflating the import bill and stoking inflationary pressures. Officials, however, said retail fuel prices may not rise immediately, as oil marketing companies follow a calibrated approach — absorbing losses when global prices are high and recouping them when prices soften. Retail petrol and diesel prices have remained unchanged since April 2022.Mantri meets oil cos to assess availability of crude and gasOn a day when Iranian drones damaged part of Saudi Aramco refinery and Qatar Energy’s facilities, the world’s largest LNG producer, announced an export pause, petroleum minister Hardeep Singh Puri and his team of officials met oil companies on Monday to assess the availability of crude and gas. “We are continuously monitoring the evolving situation, and all steps will be taken to ensure availability and affordability of major petroleum products in the country,” the oil ministry said in a post on X.India imports nearly 90% of its crude requirement. It also meets 60-65% of its LPG demand and about 60% of its LNG needs through imports, largely from West Asia, with shipments routed via Strait of Hormuz, which risks being choked due to the war.

According to the International Energy Agency, in 2023, 5.9% of the country’s production was being exported. Between April and Dec 2025, India exported petroleum products worth nearly $330 billion, with the Netherlands, UAE, the US, Singapore, Australia and China being the main destinations. In 2024, it also exported petroleum gas worth $454 million, mostly to Nepal, China, and Myanmar. The Reliance refinery in Jamnagar is the largest exporter in the country.An oil company executive said refiners are already in contact with traders to tie up capacities amid fears of the blockade of Strait of Hormuz. By Monday, the global market had caught the jitters from Qatar’s decision to suspend gas shipments.An oil executive said while disruption could cause difficulties in the immediate term, Indian players had a wide portfolio that they can tap for LNG, including the US, with vessels being routed through the Suez Canal.“Even if there is a force majeure, we have other sources of supply, which we can tap. Besides, no one is going to stop supplies indefinitely,” the executive said. While oil and gas prices rose Monday, the focus is on ensuring that supply lines remain open.

Business

Travel stocks fall after thousands of flights grounded following Iran strikes

A display board shows canceled flights to Dubai and Doha amid regional airspace closures at Noi Bai International Airport, amid the U.S.-Israel conflict with Iran, in Hanoi, Vietnam, March 2, 2026. Picture taken with a mobile phone.

Thinh Nguyen | Reuters

Airline and travel stocks slipped Monday after airspace closures throughout the Middle East forced carriers to cancel thousands of flights, disrupting trips as far as Brazil and the Philippines.

Cruise lines stocks also fell sharply, with Royal Caribbean Cruises dropping 3% and Carnival Corp. losing more than 7%.

Norwegian Cruise Line Holdings‘ stock fell 10% after its earnings call disappointed investors. Elliott Investment Management said last month that it had built a more than 10% stake in the company and that it’s seeking changes. New CEO John Chidsey told analysts that “our strategy is sound, our execution and coordination have not been, and a culture of accountability is essential and necessary going forward.”

Oil prices also rose, potentially driving up airlines’ biggest cost after labor. Flights through the Middle East were grounded, including to destinations like Tel Aviv and Dubai.

United Airlines, which has the most international exposure of the U.S. carriers, fell nearly 3%. Service to Tel Aviv, Israel, one of the airline’s most profitable routes, was halted, but airlines were also was forced to pause flights to Dubai, in the United Arab Emirates, one of the busiest airport hubs in the world. Dubai is also a home base for the airline Emirates.

Shares of American Airlines lost 4% while Delta Air Lines fell 2%.

More than 11,000 Middle East flights have been canceled since the U.S.-Israeli strikes this weekend, according to aviation-data firm Cirium.

International travel has been a bright spot in the travel sector. In January, international air travel demand jumped 5.9% from a year ago while domestic flight demand was nearly flat, the International Air Transport Association, an airline industry group, said in a report Monday.

— CNBC’s Contessa Brewer contributed to this report.

-

Business6 days ago

Business6 days agoHouseholds set for lower energy bills amid price cap shake-up

-

Politics5 days ago

Politics5 days agoWhat are Iran’s ballistic missile capabilities?

-

Entertainment1 week ago

Entertainment1 week agoTalking minerals and megawatts

-

Business6 days ago

Business6 days agoLucid widely misses earnings expectations, forecasts continued EV growth in 2026

-

Sports1 week ago

Sports1 week agoEileen Gu comments on Alysa Liu’s historic gold medal

-

Tech6 days ago

Tech6 days agoHere’s What a Google Subpoena Response Looks Like, Courtesy of the Epstein Files

-

Politics1 week ago

Politics1 week agoSupreme Court ruling angers Trump: Global tariffs to rise from 10% to 15%

-

Sports1 week ago

Sports1 week agoSouth Africa thrash India by 76 runs in T20 World Cup Super 8 – SUCH TV