Business

How to tell the health of a battery in a used EV

Chris BaraniukTechnology Reporter

Corbis via Getty Images

Corbis via Getty ImagesWhen Kerry Dunstan and his partner set out to buy a new electric car this summer, one of the questions they asked was, “How’s the battery?”.

They’d found a 2021 Nissan Leaf with just 29,000 miles on it, and the dealer told them the condition of the battery, or its state of health (SOH), was still around 93%.

The couple were sold. For £12,500, they got an EV with a big boot and plenty of room for passengers.

Though Mr Dunstan, a cabinetmaker who also owns a somewhat snazzier electric Volvo SUV, hasn’t quite fallen in love with the aging Leaf.

“I like sporty, jazzy cars – and it’s just a bit ‘meh’,” he says.

However, he adds the Leaf has performed exactly as expected during the three months they’ve owned it.

It used to be that age and mileage were the two headline details pored over by would-be buyers of second-hand cars. But as more people shift to electric, scrutinising the health of a car’s battery has become arguably even more important.

How has that battery been treated? Did the last owner regularly fast charge it to 100%, for example? That has the potential to shorten an EV battery’s lifespan.

This battery black box problem has put some consumers off buying a second-hand EV. But battery analytics firms say they can reveal the condition of an old EV’s battery with high accuracy. And industry experts say some EVs are lasting longer than many predicted.

Take Mr Dunstan’s Nissan Leaf. This is a model of EV built without the kind of sophisticated, liquid-based battery cooling system common to many other EVs. While Nissan has rectified this in the latest generation of Leafs, earlier models show a considerable shortening of their range year by year, according to data analysed by US insurance and research firm NimbleFins.

Mr Dunstan is unfazed. “I charge both my EVs to 100% and I put them on charge when I need to charge them – I don’t worry about it,” he says.

Kerry Dunstan

Kerry DunstanFor people in the market for a second-hand EV who are plagued by battery anxieties, however, Austria-based firm Aviloo says it has a solution. “We really can, completely independently, determine the state of health of a battery,” says chief product officer, Patrick Schabus.

Aviloo is one of several battery analytics businesses in the market. The company, which provides battery health certificates for major UK outlet British Car Auctions, offers two products.

There’s a premium test, where EV owners plug a data logging box roughly the size of a glasses case into their car so that it can monitor battery performance while they use the car over a few days, going from 100% charge down to 10%.

Or, they can opt for a quicker flash test, which uses a different box to suck up data from the car’s battery management software and then analyse it with the help of a computer model. “We can do this at a standstill in under two minutes,” says Mr Schabus.

The premium test observes battery discharge closely, picking up fluctuations in current or voltage, and can reveal extra detailed information about the health of individual cells in the battery, says Aviloo.

Marcus Berger, Aviloo’s chief executive, says his company’s analytics results sometimes diverge “substantially” from the battery SOH percentages produced by some cars’ own built-in analytics systems.

He challenges conventional wisdom that batteries with an SOH below 80% are too far gone: “An EV with a state of health below 80% can still be a great car… It just needs to be priced [appropriately].”

In New Zealand, EV owner Lucy Hawcroft, who works in a sustainability role for an infrastructure firm, bought a Nissan Leaf with her husband roughly three years ago. She recalls getting an SOH result of 95% or so from the dealership. But a year later an independent mechanic checked the SOH again for them.

“It dropped quite a bit,” she recalls. “My husband was a bit surprised, or concerned, about that.”

However, the car still has a range of around 160km (100 miles) when fully charged. The pair mostly use it for short journeys of up to 10km. Mrs Hawcroft says she has friends whose EVs have much bigger ranges, of around 400km: “That would be ideal.”

For David Smith, sales director at Cleevely Electric Vehicles in Cheltenham, being able to analyse used EVs’ batteries in detail is a deal-maker. Most customers ask for this information, he says. His company uses SOH reports from ClearWatt, another battery analytics firm.

“They’re completely independent. We can’t interfere with the reports,” he says. “Once customers have seen the report, that aids the sale nine times out of 10.”

Matt Cleevely, managing director at Cleevely Electric Vehicles, adds that it’s often possible to replace groups of cells or modules within a battery pack – far cheaper than installing a whole new battery.

Lucy Crawford

Lucy CrawfordAs for how you should charge your own EV in order to best take care of its battery, Simona Onori at Stanford University says, “There is likely a sweet spot between frequent fast charging and avoiding it altogether.” However, she adds that, to her knowledge, this is not something that has yet been thoroughly studied.

Despite some consumers’ wariness, battery technology has noticeably improved in recent years, says Max Reid, head of battery costs at market research firm CRU. “The older batteries might last maybe 500 to 1,000 [charging] cycles,” he explains. “Now, it’s 10,000 cycles in some of these new EV cells coming out.”

Batteries that are no longer good enough for the EV they were designed for can still be useful, says Paul Chaundy at Second Life EV Batteries, in Dorset. For instance, some of his customers are businesses that use former EV batteries to store electricity at their premises. They might have, say, six electric forklifts but a grid connection only large enough for charging ports to supply two or three of the forklifts.

Regarding the varying methodologies car manufacturers use to generate SOH reports for their own vehicles, Mr Chaundy says, “We need more standards around that, I think.”

Business

Want To Buy A House In Karnataka? Know About The ‘Namma Mane’ Scheme With Affordable Housing & Subsidies

Last Updated:

The programme aims to make land ownership more accessible for eligible residents while supporting the government’s wider goal of providing housing for all.

Under the ‘Namma Mane’ housing scheme 50,000 residential plots will be distributed at concessional rates over the next two years.

What if owning a home became a little more achievable? In the latest Karnataka Budget, the state government has announced a series of housing initiatives aimed at expanding access to affordable homes and residential plots. From the ‘Namma Mane’ scheme offering concessional sites to increased subsidies for beneficiaries and plans for a massive sports complex in Anekal, the announcements signal a renewed push towards housing development across the state.

The Karnataka government has unveiled several housing and infrastructure initiatives in the latest state budget, including the distribution of thousands of residential plots and the construction of a large sports complex in Bengaluru’s Anekal taluk. The announcements are part of broader efforts to expand housing access and improve public infrastructure across the state.

Karnataka Budget Housing Scheme: Key Benefits

One of the key proposals is the introduction of the ‘Namma Mane’ housing scheme, under which 50,000 residential plots will be distributed at concessional rates over the next two years. The programme aims to make land ownership more accessible for eligible residents while supporting the government’s wider goal of providing housing for all.

The Housing Department has also set a new target of sanctioning one lakh houses under various housing schemes in the state. These houses will be approved based on the Beneficiary Led Construction (BLC) model, which allows eligible beneficiaries to construct their own homes with financial support from the government.

As part of this initiative, the government has increased the subsidy amount provided under housing schemes. For beneficiaries in the general category, the subsidy has been raised from Rs 1.20 lakh to Rs 2 lakh. Meanwhile, beneficiaries from Scheduled Castes and Scheduled Tribes will receive increased assistance, with the subsidy rising from Rs 2 lakh to Rs 3 lakh.

The budget also introduces a change in the process used to select beneficiaries for state housing schemes. Instead of the traditional manual lottery system, selections will now be conducted through an online lottery in Gram Sabhas. The move is expected to improve transparency and streamline the allocation process.

In addition to housing initiatives, the Karnataka Housing Board has announced plans to develop a major sports facility in Anekal taluk of Bengaluru Urban district. The project, titled ‘KHB Surya Krida Grama’, will include the construction of an 80,000-seat cricket stadium designed to host international sporting events.

Meanwhile, the Karnataka Slum Development Board is continuing the implementation of housing projects under the Pradhan Mantri Awas Yojana (AHP). A total of 1.29 lakh houses are being constructed under the scheme, with 79,134 homes dedicated for the year 2025–26. The state government has allocated an additional grant of Rs 1,136 crore to support the project, providing permanent housing to many slum residents.

Since the Congress government came to power, Rs 7,328 crore has been spent on various housing schemes. So far, 4,19,454 houses have been completed and handed over to beneficiaries. The government has set a target to complete three lakh houses during the current year.

Authorities have also stated that steps will be taken to complete the 4.90 lakh houses sanctioned by the previous government, even though they were approved without grants.

March 07, 2026, 10:51 IST

Stay Ahead, Read Faster

Scan the QR code to download the News18 app and enjoy a seamless news experience anytime, anywhere.

Business

Emirates resumes some Dubai flights – what’s the latest on travel to UK?

New flights to the UK from the Middle East follow days of widespread air travel disruption which had left Britons stranded.

Source link

Business

‘Indians been good actors’: Why US ‘agreed to let’ India resume buying Russian oil temporarily – The Times of India

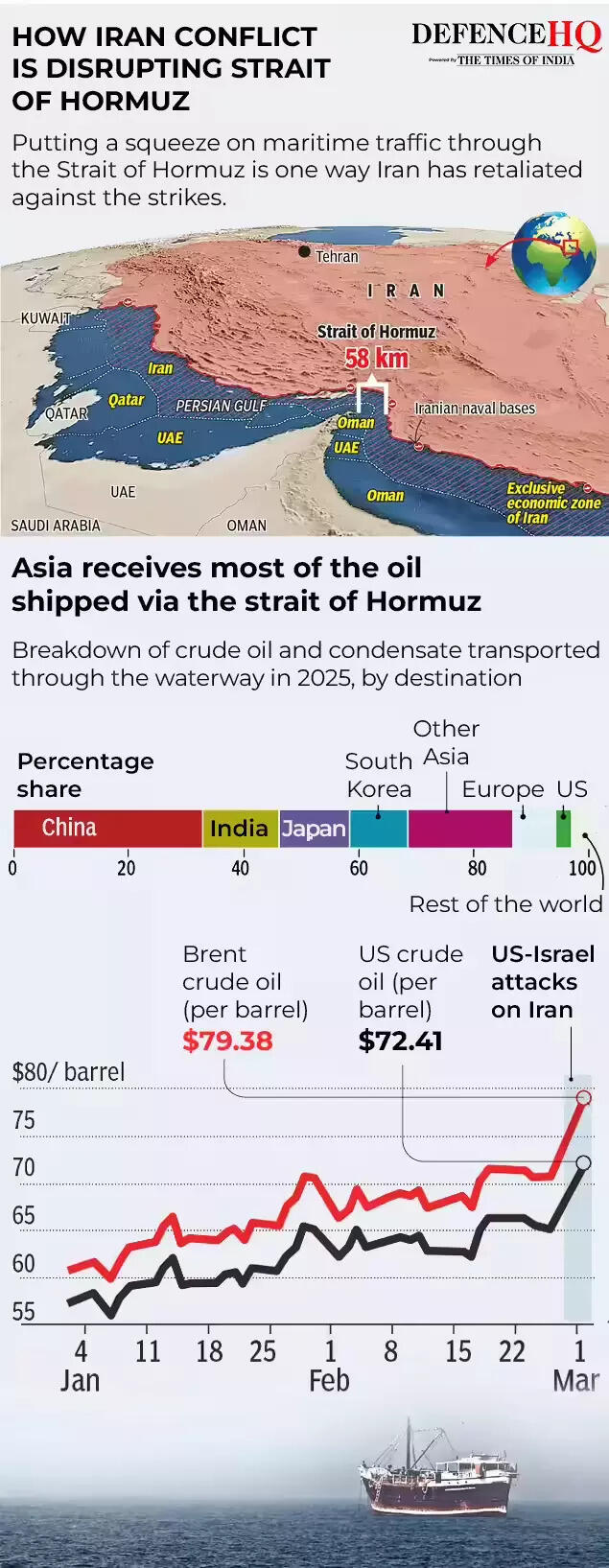

The United States has given “permission” to India to buy Russian oil already stranded at sea issuing a temporary waiver aimed at stabilising global oil supplies amid disruptions caused by the escalating conflict in West Asia.US President Donald Trump’s aide Scott Bessent referred to India as a “very good actor” for previously complying with Washington’s request to halt purchases of sanctioned Russian oil and said the temporary measure would help ease supply pressures in the global market.

The move comes a day after Washington issued a 30-day waiver permitting the sale of Russian crude currently stranded at sea to continue to India.

US cites temporary supply concerns

Speaking to Fox Business, US treasury secretary Bessent said the decision was intended to ease short-term supply constraints during the ongoing crisis.“The world is very well supplied in oil. The Treasury (Department) agreed to let our allies in India start buying Russian oil that was already on the water,” Bessent said.“The Indians had been very good actors. We had asked them to stop buying sanctioned Russian oil this fall. They did. They were going to substitute it with US oil,” he said.“But to ease the temporary gap of oil around the world, we have given them permission to accept the Russian oil. We may unsanction other Russian oil,” he added.Bessent also noted that a large volume of sanctioned crude remains stranded at sea stating that, “There are hundreds of millions of sanctioned barrels of sanctioned crude on the water,” he said, adding that “by unsanctioning them, Treasury can create supply.”“And we are looking at that. We are going to keep a cadence of announcing measures to bring relief to the market during this conflict,” he added.

‘Short term measures to help keep oil prices down’

Other officials in the Trump administration have also confirmed that Washington has “permitted” India to buy Russian crude that is already loaded on ships.Earlier, US energy secretary Chris Wright said the step was intended to quickly move existing oil supplies into the market.“We have implemented short term measures to help keep oil prices down. We are allowing our friends in India to take oil that is already on ships, refine it, and move those barrels into the market quickly. A practical way to get supply flowing and ease pressure,” Wright said in a post on X.In an interview with ABC News Live, Wright emphasised that the measure was temporary.“But as oil gets bid up a little bit because of those constraints coming out of the Strait of Hormuz, we’re taking a short-term action to say all this floating Russian oil storage that’s around Southern Asia, it’s China just backed up, China does not treat their suppliers well, so there’s a bunch of floating barrels just sitting there,” he said.“We’ve reached out to our friends in India and said, ‘Buy that oil. Bring it into your refineries’. That pulls stored oil immediately into Indian refineries and releases the pressure on other refineries around the world to buy oil that they’re no longer competing with the Indians for in that marketplace,” Wright added.“So we have a number of measures like that that are short-term and temporary. This is no change in policy towards Russia. This is a very brief change in policy just to keep oil prices down a little bit better than we could otherwise,” he further noted.

Waiver amid Strait of Hormuz tensions

The US Treasury earlier issued an order granting a 30-day licence allowing delivery and sale of Russian crude and petroleum products to India. The decision comes as shipping routes through the strategically important Strait of Hormuz face disruptions due to the ongoing conflict in the region.“President Trump’s energy agenda has resulted in oil and gas production reaching the highest levels ever recorded. To enable oil to keep flowing into the global market, the Treasury Department is issuing a temporary 30-day waiver to allow Indian refiners to purchase Russian oil,” Bessent said earlier.He stressed that the step was a limited measure and would not significantly benefit Moscow.“This deliberately short-term measure will not provide significant financial benefit to the Russian government, as it only authorises transactions involving oil already stranded at sea,” he said.“India is an essential partner of the United States, and we fully anticipate that New Delhi will ramp up purchases of US oil. This stop-gap measure will alleviate pressure caused by Iran’s attempt to take global energy hostage,” he added.

India’s oil supply position

The move comes months after the Trump administration imposed 25% punitive tariffs on India over its purchases of Russian oil, arguing that such imports were helping finance Moscow’s war against Ukraine.However, the tariffs were later lifted after the two countries agreed on a framework for an interim trade agreement and India committed to reducing imports from Russia while increasing purchases of American energy.India currently imports nearly 5.5–5.6 million barrels of crude oil per day, accounting for about 90% of its domestic consumption. Officials say the country’s energy position remains comfortable despite the regional tensions.Around 15 million barrels of crude are currently on tankers in the Arabian Sea and the Bay of Bengal, while vessels carrying another seven million barrels are waiting near Singapore. Additional tankers in the Mediterranean and the Suez Canal are also heading towards Indian ports and could arrive within a week.According to data from Kpler, India imported slightly over 1 million barrels per day of Russian crude in February, compared with 1.1 million bpd in January and 1.2 million bpd in December.Before the Ukraine war in 2022, Russian crude accounted for just 0.2% of India’s imports, but purchases increased sharply after Moscow began offering deep discounts.

-

Business1 week ago

Business1 week agoAttock Cement’s acquisition approved | The Express Tribune

-

Politics1 week ago

Politics1 week agoWhat are Iran’s ballistic missile capabilities?

-

Business1 week ago

Business1 week agoIndia Us Trade Deal: Fresh look at India-US trade deal? May be ‘rebalanced’ if circumstances change, says Piyush Goyal – The Times of India

-

Fashion1 week ago

Fashion1 week agoPolicy easing drives Argentina’s garment import surge in 2025

-

Sports1 week ago

Sports1 week agoLPGA legend shares her feelings about US women’s Olympic wins: ‘Gets me really emotional’

-

Entertainment1 week ago

Entertainment1 week agoBobby J. Brown, “The Wire” and “Law & Order: SUV” actor, dies of smoke inhalation after reported fire

-

Fashion1 week ago

Fashion1 week agoSouth Korea’s Misto Holdings completes planned leadership transition

-

Fashion1 week ago

Fashion1 week agoTexwin Spinning showcasing premium cotton yarn range at VIATT 2026