Business

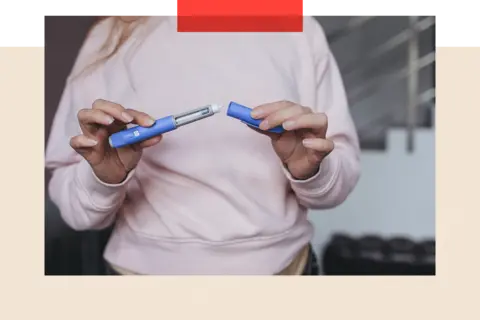

How weight-loss injections are making obesity a wealth issue

Nick TriggleHealth correspondent

Nick TriggleHealth correspondent BBC

BBCThree years ago, a fashion editor friend returned from Milan Fashion Week bursting with a story to tell.

Most fashion editors stayed at the same hotel, she explained, and each bedroom had its own mini fridge. After checking out, en route to the airport, a stylist in her party cried out that he’d left “an important package” in his fridge and telephoned the hotel, pleading with them not to throw it away.

“Turns out he’d forgotten his Ozempic,” my editor friend whispered. We were baffled. Ozempic?

Back then, Ozempic was not part of the common lexicon. But quietly, in certain circles, this injectable drug, which is licensed for the treatment of type 2 diabetes, was being prescribed privately and off-label for weight loss.

Flash forward to today and the picture is vastly different. “So many fashion people are on it,” she tells me today. “And now they’re very vocal.”

Serena Williams, Elon Musk and Whoopi Goldberg have all spoken about using weight-loss injections. Some are now prescribed by the NHS, including Wegovy and Mounjaro, generating scores of headlines.

Really, this should have made it a great leveller. In theory, anyone struggling with obesity can – without the expense of a private doctor – get help to manage their weight.

Only that’s not the full picture.

AFP via Getty Images

AFP via Getty ImagesThousands of NHS patients are believed to be missing out. And with the NHS tightly restricting access, some working in the field warn a two-tier system around weight-loss drugs is developing – one that’s benefitting the most well-off.

Martin Fidock, who is UK managing director of Ovivia, which provides Wegovy and lifestyle support to NHS patients, claims that thanks to varying thresholds of eligibility in different regions, NHS prescriptions are a “postcode lottery”.

An estimated 1.5 million people in the UK use these drugs – but more than nine in 10 are believed to pay privately. Prices vary but it generally costs between £100 and £350 a month, depending on the dose and lifestyle support.

Then, last month, it was reported that pharmaceutical giant Eli Lilly was expected to increase the list price of Mounjaro by as much as 170%.

They have since done a deal for UK distributors, meaning rises are likely to be less, and the deal doesn’t affect the cost to the NHS – but it has still caused concern in some quarters.

“It’s scary,” says Brad, a tech company worker in his 40s. He has been taking Mounjaro for a year and worries he may not be able to afford to continue.

“I’ve lost 20kg and want to keep using it, but it’s a lot of money. It’s unfair.”

Getty Images (R) AFP via Getty Images (L)

Getty Images (R) AFP via Getty Images (L)Nutritionists and GPs I spoke to have also expressed concerns about the broader system, and in particular whether existing health inequalities could worsen.

“We cannot allow good health to become a luxury for the wealthiest by limiting access to weight-loss drugs to those who can pay privately,” argues Katharine Jenner, executive director of Obesity Health Alliance.

So could it really be that weight-loss injections – for all of their benefits – are turning obesity into a wealth issue?

The NHS ‘postcode lottery’

Weight-loss drugs have been available on the NHS for some time, but the landscape changed significantly with the introduction of some newer medications – among them, semaglutide, marketed under the brand name Wegovy, and tirzepatide, sold as Mounjaro.

Wegovy was first prescribed for obesity by the NHS in 2023, while Mounjaro followed earlier this year. They work in part as an appetite suppressant by mimicking a hormone, which makes people feel fuller.

Studies have suggested patients can lose as much as a fifth of their body weight.

They are licensed for people with a BMI of 27 or more for those with a health condition or above 30 for those without (adjusted for certain ethnic groups). But tougher NHS criteria are being applied, and in England and Wales the drugs are mostly restricted to those with a BMI of over 35.

Plus there are more restrictions too.

For Wegovy, local areas are making their own decisions on access.

Martin Fidock claims that in recent months a third of regional health boards have increased the BMI threshold, which he says has resulted in fewer people being able to get it. (The BBC has been unable to verify this data.)

A spokesperson for Novo Nordisk, the pharmaceutical giant that makes Wegovy, told the BBC it is “concerned about the growing disparity” in access to NHS specialist weight management services.

“This has led to a large proportion of people needing to pay out of pocket, an option which is out of reach in areas of depravation where obesity rates are significantly higher.”

NHS England has said the differences could be related to different levels of need and other providers being more active in certain regions, but confirmed it was up to local areas to decide how much to spend.

Reuters

ReutersFor Mounjaro, NHS England has started it for people with a BMI above 40 who also have certain health conditions. The NHS roll-out officially began in June, but a report published earlier this month suggests that not all general practices had started offering it.

Just 18 out of 42 NHS boards across England confirmed that they’d begun prescribing it in line with the roll-out plan, according to data obtained by freedom of information requests published in the BMJ.

The NHS has previously said it is supporting the phased rollout for eligible patients and that “these represent brand-new services in primary care that are being established and scaled up over time”.

But Mr Fidock believes we are seeing a “postcode lottery”.

“We have got an obesity epidemic and these drugs provide us with an opportunity to tackle it in a way we have never been able to do before. But your ability to benefit is dependent largely on whether you have the means to pay.”

Adding to the challenge is the fact that more people from deprived areas struggle with obesity in the first place: more than a third of people in the most deprived areas are obese – twice that of more affluent neighbourhoods.

Beyond the physical health risks – and there are many, including higher risks of cancer and heart disease, plus mental health problems – there may be social consequences too.

One US study found that obese men with a bachelor’s degree earn 5% less than their thinner colleagues, while those with a graduate degree earn 14% less. For obese women it is worse still, earning 12% and 19% less respectively, based on data concerning 23,000 US workers, published in The Economist in 2023.

NHS GP Matthew Calcasola, who is also involved in a service Get a Drip, which offers weight-loss drugs privately, has his own concerns.

“We’re concerned health inequality will build,” he says. “GPs worry about this.”

Private patients priced out

Meanwhile, a booming private market has emerged. Sara de Souza, a business analyst from Nottingham, is among those delighted that it has.

Following the birth of her son Vito in 2023, she put on 30kg. “I got to 96kg,” she recalls. “Me and my husband both got into bad habits. We were so busy, we were eating junk food and having chocolates.

“I was always tired and struggled to pick up my baby. But I just couldn’t lose the weight.”

Sara tried dieting and went to see her GP who referred her to a lifestyle diet and activity programme. But still the pounds stuck.

At her heaviest her BMI was 37.5, but she wasn’t eligible for NHS access and paid £200 a month for the drug through an app called Juniper, which also gave her diet and lifestyle advice. Within a year she had lost the full 30kg.

“It completely changed my life. I felt like a new person, alive again. It’s not just how I look, it’s how I feel and being able to keep up with my son.”

Sara says the cost didn’t impact her. “Even if it had, I’d have carried on, because of the benefits.”

Not everyone feels the same. Some 18% of overweight Britons would be willing to pay for weight-loss drugs – but if they were available on the NHS, 59% said they would be keen on using them, according to new polling by communications agency Strand Partners.

And some of those willing to pay privately fear they could find themselves being priced out following the proposed price spike.

Getty Images

Getty Images“If I’d had to pay £300 or even more, I would have really struggled to afford it,” says Pete Beech, 57, from Southampton.

He weighed 18 stone and paid £160 a month for a prescription of Mounjaro to help him lose weight to qualify for an ultrasound treatment as part of his treatment for prostate cancer.

“The way the NHS is rationing these drugs has consequences beyond just obesity.”

James O’Loan, head of online pharmacy Chemist 4 U, has already observed some people stretching themselves financially to get hold of weight-loss drugs – some have asked for payment plans, which they cannot offer.

“Some people can’t move on to the higher doses because of cost,” he explains.

Getty Images for ESSENCE

Getty Images for ESSENCEThen there are concerns about a weight-loss drug black market, or unscrupulous dispensing.

“Some services are desperate to dispense the stuff and don’t care what happens,” claims Professor Richard Donnelly, editor of medical journal Diabetes, Obesity and Metabolism. “People are just asked to fill in a quick questionnaire. There’s no proper medical assessment or follow up.”

He also stresses that they should not be seen as a quick fix. “They’re not there to lose a bit of fat around the tummy.”

Whilst generally well tolerated, there are risks of certain side effects — including nausea, constipation and diarrhoea. A study into potential serious side effects of weight loss jabs has also been launched after hundreds of people reported problems with their pancreas.

The NHS advises people never take a medicine for weight management if it has not been prescribed for them.

‘Not a magic bullet’

Some argue that the answer is, simply, to widen NHS access. The issue, of course, comes in part down to cost.

Michael Shah, senior analyst at Bloomberg Intelligence, believes that this could start to resolve itself in time.

“There are more than 160 weight-loss drugs in clinical development,” he says. Once available, he predicts that the competition could push costs down across the board.

“NHS bargaining power should improve as additional players and treatments enter the space.”

Kevin Mazur/WireImage via Getty Images

Kevin Mazur/WireImage via Getty ImagesEarlier this year the Tony Blair Institute suggested that the drugs should be offered to everyone with BMIs over 27, arguing that it costs even more to deal with the consequences of obesity.

Obesity is estimated to cost the economy £98bn a year, according to research commissioned by the think tank, once you take into account lost productivity as well as the NHS treatment costs and the impact on the individual.

The Institute suggests a means-tested system with those entitled to free prescriptions getting it free and others self-funding or encouraging employers to share the cost.

NHS England has said it is looking at an option to “accelerate roll out to even more people in the future”.

But it also pointed out that weight loss drugs should not be seen as a “magic bullet”.

Are we medicalising a social issue?

All of this begs a broader question – that is, in medicalising debates around tackling obesity, do we risk overlooking the wider social issue?

“By thinking we have a treatment for obesity we lose focus and stop thinking about the more difficult issues around the food industry and regulation, which are the root cause of this,” warns Greg Fell, president of the Association of Directors of Public Health.

“I do have concerns about equity of access,” he adds. “But I think the NHS has carefully thought about this and probably is, more or less, in the right place.”

Getty Images

Getty ImagesIn post-war Britain, obesity was rare due to food shortages and physically demanding lifestyles – lower-income groups were more likely to suffer from malnutrition.

Only since the 1980s have obesity rates risen across all social classes, with a growing disparity between rich and poor.

It is driven by several interconnected factors. Katharine Jenner argues there needs to be more done to address one of them in particular: our “broken food system”.

“People in poorer areas are surrounded by junk food advertising, more unhealthy takeaways, and face bigger barriers to buying healthy food,” she says.

“Without investment in prevention, health will get worse, inequalities will widen, and the costs will fall on all of us.”

How to effectively achieve that is perhaps the biggest question of all. But whatever the answer – and regardless of whether the onus really should be on the state or as others argue, the individual – it runs far deeper than the cost of a weight-loss jab.

“We live in a society that prizes freedom of choice and expression, values material wealth and tolerates vast inequality,” argues Chris Rojek, sociology professor at City St George’s, University of London. “In such a system, casualties are inevitable.

“It would be naïve — or even pious — to claim we can simply solve this. The answer is complex and touches the very fabric of our society.”

Top picture credit: Onzeg/ Getty Images

BBC InDepth is the home on the website and app for the best analysis, with fresh perspectives that challenge assumptions and deep reporting on the biggest issues of the day. And we showcase thought-provoking content from across BBC Sounds and iPlayer too. You can send us your feedback on the InDepth section by clicking on the button below.

Business

Shop price inflation eases but food costs still 3.5% up on a year ago

Shop price inflation eased in February but consumers are still paying 3.5% more for food than a year ago, figures show.

Overall shop inflation fell slightly to 1.1% from January’s 1.5%, in line with the three-month average of 1.1%, as fierce competition between retailers kept price rises in check and customers benefited from promotions across health, beauty and fashion, according to the British Retail Consortium (BRC) and NIQ.

Prices of products other than food were down 0.1% year on year, a significant drop from January’s growth of 0.3%.

Overall food inflation fell slightly to 3.5% from 3.9% in January, while fresh food prices remained 4.3% higher than last February, a slight drop from January’s 4.4% and above the three-month average of 4.2%.

However falling global costs pushed ambient food inflation down to 2.3% – its lowest level in four years and a significant fall from January’s 3.1%.

BRC chief executive Helen Dickinson said: “Households got some welcome relief in February as shop price inflation eased.

“While the direction of travel is promising, prices are still rising, and many consumers remain under pressure.”

Mike Watkins, head of retailer and business insight at NIQ, said: “Since the start of the year, we have seen some competitive pricing across both the food and non-food channels which is helping to bring down inflation.

“Whilst the inclement weather and weak sentiment is making consumer demand rather unpredictable for retailers, at least shoppers are now seeing some of their cost-of-living pressures start to ease.”

Business

Chancellor Rachel Reeves urged to scrap fuel duty hike amid oil price fears

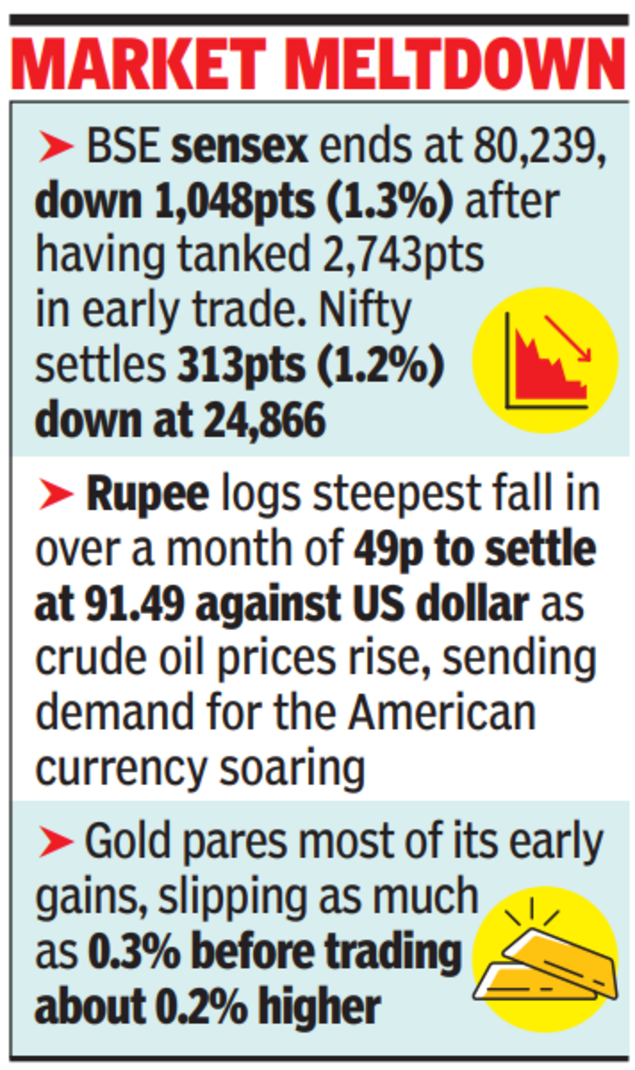

The Chancellor has been urged to scrap the proposed hike in fuel duty as concerns have been raised about the conflict in the Middle East.

Rachel Reeves announced last year that the long-held discount in fuel duty would be scrapped from September, with a 1p hike followed by two increases of 2p each in subsequent years.

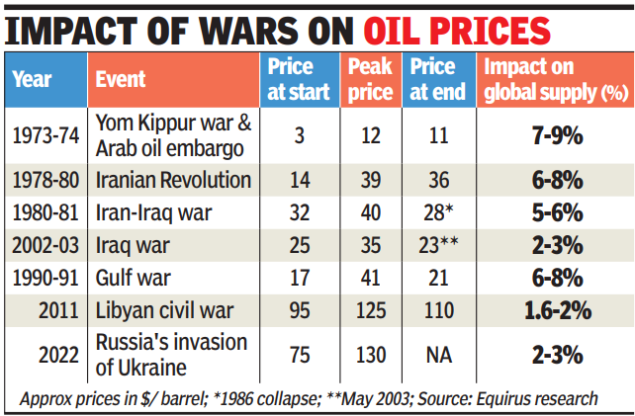

But following the US and Israeli attacks on Iran at the weekend – which killed the country’s Supreme Leader Ayatollah Ali Khamenei – concerns have been raised about the impact of oil price hikes which could hit consumers at the pumps.

Following the attack, the price of oil jumped to 80 US dollars a barrel, with some analysts suggesting it could rise above 100 dollars.

Speaking ahead of the spring statement, SNP economy spokesman Dave Doogan said: ““With real fears that prices at the pump are now set to soar because of the situation in the Middle East – instead of stubbornly doubling down, the Chancellor needs to scrap her price hike plans before motorists face a devastating double hit.

“Oil prices are already spiking – the last thing motorists and businesses now need is another damaging tax hike from the Labour Party.

“The Chancellor needs to see sense, recognise what is unfolding globally, and immediately scrap her plans to hike prices at pumps.

“Everyone knows that Keir Starmer’s Labour Party has broken their promise to cut energy bills by £300 – it would be another slap in the face for families if Labour made the cost-of-living crisis even worse with a plan that will inevitably increase prices.

“After 14 U-turns from this chaotic Labour Government – scrapping their plans to hike fuel duty is one U-turn motorists, businesses and families right across Scotland would actually welcome.”

A spokeswoman for the Treasury said: “We have extended the 5p fuel duty cut from this month to the end of August to support drivers across the country.”

Business

West Asia conflict: Govt may ask companies to cut exports, increase auto fuel, LPG supplies – The Times of India

NEW DELHI: Amid fears of a shortage in crude supplies, govt is looking to nudge refiners to divert more auto fuel and LPG to the domestic market by cutting on exports and also increase cooking gas production so that there is no disruption in local supplies.While govt and oil companies insisted there’s no shortage, refiners are looking at alternate sources to partly compensate for crude coming from war-hit West Asia.

The tension has led to a spike in oil and gas prices, and given India’s dependence on imports, inflating the import bill and stoking inflationary pressures. Officials, however, said retail fuel prices may not rise immediately, as oil marketing companies follow a calibrated approach — absorbing losses when global prices are high and recouping them when prices soften. Retail petrol and diesel prices have remained unchanged since April 2022.Mantri meets oil cos to assess availability of crude and gasOn a day when Iranian drones damaged part of Saudi Aramco refinery and Qatar Energy’s facilities, the world’s largest LNG producer, announced an export pause, petroleum minister Hardeep Singh Puri and his team of officials met oil companies on Monday to assess the availability of crude and gas. “We are continuously monitoring the evolving situation, and all steps will be taken to ensure availability and affordability of major petroleum products in the country,” the oil ministry said in a post on X.India imports nearly 90% of its crude requirement. It also meets 60-65% of its LPG demand and about 60% of its LNG needs through imports, largely from West Asia, with shipments routed via Strait of Hormuz, which risks being choked due to the war.

According to the International Energy Agency, in 2023, 5.9% of the country’s production was being exported. Between April and Dec 2025, India exported petroleum products worth nearly $330 billion, with the Netherlands, UAE, the US, Singapore, Australia and China being the main destinations. In 2024, it also exported petroleum gas worth $454 million, mostly to Nepal, China, and Myanmar. The Reliance refinery in Jamnagar is the largest exporter in the country.An oil company executive said refiners are already in contact with traders to tie up capacities amid fears of the blockade of Strait of Hormuz. By Monday, the global market had caught the jitters from Qatar’s decision to suspend gas shipments.An oil executive said while disruption could cause difficulties in the immediate term, Indian players had a wide portfolio that they can tap for LNG, including the US, with vessels being routed through the Suez Canal.“Even if there is a force majeure, we have other sources of supply, which we can tap. Besides, no one is going to stop supplies indefinitely,” the executive said. While oil and gas prices rose Monday, the focus is on ensuring that supply lines remain open.

-

Business6 days ago

Business6 days agoHouseholds set for lower energy bills amid price cap shake-up

-

Politics5 days ago

Politics5 days agoWhat are Iran’s ballistic missile capabilities?

-

Entertainment1 week ago

Entertainment1 week agoTalking minerals and megawatts

-

Business6 days ago

Business6 days agoLucid widely misses earnings expectations, forecasts continued EV growth in 2026

-

Sports1 week ago

Sports1 week agoEileen Gu comments on Alysa Liu’s historic gold medal

-

Tech6 days ago

Tech6 days agoHere’s What a Google Subpoena Response Looks Like, Courtesy of the Epstein Files

-

Business6 days ago

Business6 days agoIncome Tax Draft Rules 2026: Key Changes On How And When Pan Card Will Be Required?

-

Politics1 week ago

Politics1 week agoSupreme Court ruling angers Trump: Global tariffs to rise from 10% to 15%