Business

‘I can do anything I want’: Trump warns of ‘even stronger methods’ after SC tariff blow – The Times of India

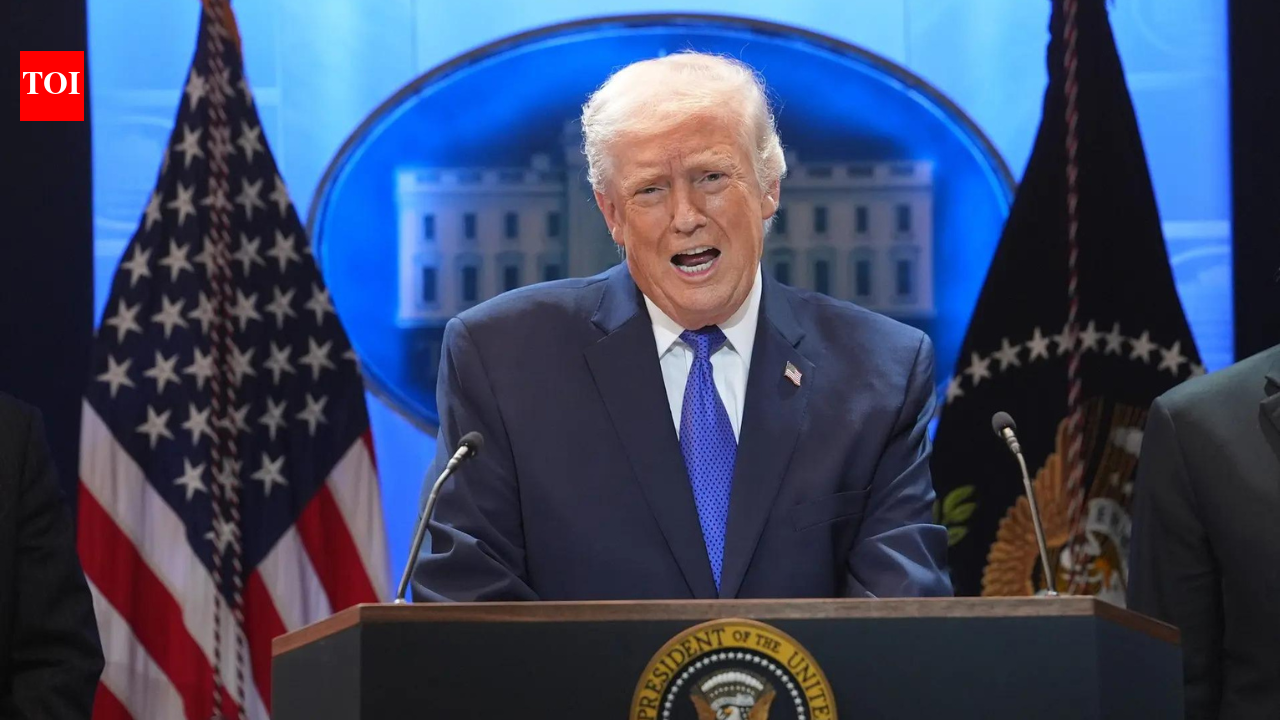

“I can do anything I want,” Donald Trump declared in his address as his first reaction to the Supreme Court’s landmark ruling on Friday, a major setback to his second stint in the presidency.“There are methods that are even stronger available to me,” he said in his White House address.Trump also said he was “absolutely ashamed” of the US Supreme Court justices who issued the “deeply disappointing” tariff decision.“The Supreme Court’s ruling is absolutely disappointing, and I am ashamed of certain members of the court for not having the courage to do what is right for our country,” he said.Frustrated and agitated by the Supreme Court ruling, Trump threatened to impose a 10 per cent global tariff. He added, “Today, I will sign an order to impose a 10% global tariff under Section 122, over and above our normal tariffs already being charged, and we’re also initiating several Section 301 and other investigations to protect our country from unfair trading practices.”The US top court on Friday struck down President Trump’s sweeping global tariffs, which were central to his second-term presidency and trade policies, handing him a major defeat.In a 6–3 ruling, the apex court examined tariffs imposed under an emergency powers law, including the broad “reciprocal” duties he placed on nearly all countries. The justices held that Trump’s use of emergency authority to impose import tariffs without congressional approval was unlawful.

Business

Equinox chairman says ‘health is the new luxury’ as wellness spending soars

Equinox’s $40,000-a-year membership has a waiting list of more than 1,000 people, as demand for luxury health and wellness programs soars, according to the company’s chairman.

The high-end fitness chain’s “Optimize by Equinox,” launched in 2024, is one of the most expensive gym memberships in the world and includes everything from personal training and nutrition to sleep coaching, massage therapy and a “health concierge.”

Harvey Spevak, Equinox’s executive chairman, told Inside Wealth that the program has seen remarkable demand and highlights the “insatiable” demand by the wealthy for longevity and wellness products.

“Health is the new luxury,” Spevak said. “The No. 1 thing in the experience economy, besides travel, that the consumer wants, is, ‘How do I live a high-performance lifestyle?'”

The Optimize program is all part of Equinox’s strategy to become the leading luxury brand in the fast-growing business of health and wellness.

The global wellness market is expected to reach nearly $10 trillion by 2030, up from $6.8 trillion in 2024, according to estimates from the Global Wellness Institute. With the population of millionaires and billionaires aging, and an explosion in companies and products promising miracle cures, the wealthy are driving much of the spending.

Equinox has grown beyond fitness clubs to expand into hotels and hospitality, personalized performance programs, IV centers, blood-testing collaborations and more.

The company opened its first hotel, in Manhattan’s Hudson Yards neighborhood, in 2019 and is about to open a second, in Saudi Arabia. Spevak said Equinox will likely have close to a dozen hotels around the world — including in the Middle East, the Caribbean and the U.S. — within the next seven to eight years.

Equinox currently has 115 fitness clubs and has plans for 40 more — including locations in Nashville, Tennessee; Toronto; Charlotte, North Carolina; and South Florida. Despite being the largest retailer in New York by square feet, it’s continuing to add more in its home city, Spevak said.

The Optimize membership leverages Function Health, a lab test company, to provide clients with tests for 100 biomarkers twice a year, which could then serve as guides for a fitness, nutrition and lifestyle program tailored to each client.

Spevak said the program has rolled out in Los Angeles and Dallas and will eventually launch in New York.

The company also recently created a personalized program for women called EQX ARC. Using diagnostics, wearables and specialized coaching, the program is designed around the different stages of a woman’s life and health journey, and already has its own waitlist.

Spevak said the company’s IV-drip lounge at the Equinox Hotel in Hudson Yards — its only drip lounge thus far — has already become “a seven-figure business.”

Equinox Hudson Yards is the brand’s truest realization of its holistic lifestyle promise, giving members access to signature group fitness classes, a 25-yard indoor saltwater pool, hot and cold plunge pools and a 15,000 square foot outdoor leisure pool and sundeck. The Equinox at Hudson Yards footprint offers ample opportunity for training, working, regenerating, socializing, community building, eating and more.

Matthew Peyton | Getty Images Entertainment | Getty Images

While Equinox is private and doesn’t disclose financials, Spevak said 2025 was a “record year” for the company and he expects 2026 “to be even bigger.” He said other high-end consumer companies are reaching out to Equinox to partner on health and wellness.

“When you think about the economy moving from a product economy to an experience economy, a lot of big consumer companies are saying, ‘Well, how do I continue to serve my consumer and health and wellness, and who do I talk to?’

“There’s truly only one brand that has the authority and the brand equity,” he said.

A version of this article first appeared in CNBC’s Inside Wealth newsletter with Robert Frank, a weekly guide to the high-net-worth investor and consumer. Sign up to receive future editions, straight to your inbox.

Business

SC verdict on Trump tariffs: Dissent highlights India in Russia oil context – The Times of India

India found itself directly referenced in a landmark US Supreme Court judgment limiting presidential tariff authority, after justices examined how tariffs imposed under emergency powers were used as tools of foreign policy– including pressure linked to Russian oil imports.The ruling in Learning Resources, Inc. v. Trump held that the International Emergency Economic Powers Act (IEEPA) does not authorise a US president to impose tariffs, significantly narrowing executive power over trade policy even when tied to diplomatic negotiations.

While the majority struck down the tariffs, the Court’s dissent highlighted India as an example of how such measures had been deployed in foreign affairs.India cited in tariff diplomacy linked to Russia-Ukraine conflictIn his dissenting opinion, Justice Brett Kavanaugh described how the US administration used tariffs during sensitive geopolitical negotiations.“As with tariffs on foreign imports historically, the IEEPA tariffs on foreign imports at issue in this case implicate foreign affairs,” the dissent noted.According to the judgment, the US government argued that tariffs had been leveraged in negotiations with major trading partners.“The Government says that the tariffs have helped make certain foreign markets more accessible to American businesses and have contributed to trade deals with foreign nations worth trillions of dollars.”India was specifically mentioned in connection with US efforts tied to the Russia-Ukraine conflict.“To that end, on August 6, 2025, the President imposed tariffs on India for ‘directly or indirectly importing Russian Federation oil.’”The dissent further recorded that the tariffs were later eased, noting “And on February 6, 2026, the President reduced the tariffs on India because, according to the Government, India had ‘committed to stop directly or indirectly importing Russian Federation oil.’”

Foreign policy versus constitutional limits

The dissent argued that tariffs have historically functioned as instruments of diplomacy and national security, warning that courts should not restrict presidential authority in foreign affairs using doctrines typically applied to domestic regulation.“Presidential actions pursuant to broad congressional authorizations related to foreign affairs often have long historical pedigrees,” the dissent stated, arguing that statutes should be interpreted “as written, not with a thumb on the scale against the President.”Justice Kavanaugh contended that applying the “major questions doctrine” — which requires clear congressional approval for sweeping executive action — represented a novel judicial intervention in foreign policy decision-making.

Majority rejects foreign affairs justification

The Supreme Court’s majority, however, rejected the argument that foreign policy considerations expand tariff authority.Chief Justice John Roberts wrote that tariffs are fundamentally a form of taxation and therefore fall within Congress’s exclusive constitutional powers under Article I.The Court concluded that even emergency statutes dealing with international threats cannot transfer core taxing authority to the president without explicit language from Congress.The justices emphasised that no president had previously used IEEPA to impose tariffs in its nearly five-decade history, reinforcing their conclusion that Congress never intended to delegate such sweeping authority.

Business

FTSE 100 climbs on strong retail sales data

Stock prices in London closed higher on Friday, as a swathe of domestic economic data was well-received and the US Supreme Court ruled President Donald Trump’s tariff programme is illegal.

The FTSE 100 index closed up 59.85 points, 0.6%, at 10,686.89.

The FTSE 250 ended up 178.07 points, 0.8%, at 23,751.56, and the AIM all-share closed up 3.97 points, 0.5%, at 815.11.

In European equities on Friday, the CAC 40 in Paris closed up 1.4%, while the DAX 40 in Frankfurt ended 0.9% higher.

The pound climbed to 1.3492 dollars on Friday afternoon from 1.3455 dollars at the equities close on Thursday.

The euro stood slightly higher at 1.1780 dollars from 1.1768 dollars.

Against the yen, the dollar was trading marginally higher at 154.95 yen compared to 154.90 yen.

The US Supreme Court ruled that President Donald Trump exceeded his authority in imposing a swathe of tariffs that upended global trade, blocking a key tool the president has wielded to impose his economic agenda.

The conservative-majority high court ruled six-three in the judgment, saying the International Emergency Economic Powers Act “does not authorise the president to impose tariffs”.

While Mr Trump has long used tariffs as a lever for pressure and negotiations, he made unprecedented use of emergency economic powers upon returning to the presidency last year to slap new duties on virtually all US trading partners.

These included “reciprocal” tariffs over trade practices that Washington deemed unfair, alongside separate sets of duties targeting major partners Mexico, Canada and China over illicit drug flows and immigration.

The court on Friday noted that “had Congress intended to convey the distinct and extraordinary power to impose tariffs” with IEEPA, “it would have done so expressly, as it consistently has in other tariff statutes”.

The ruling does not impact sector-specific duties that Mr Trump has separately imposed on imports of steel, aluminium and various other goods.

Formal probes which could ultimately lead to more such sectoral tariffs remain in the works.

“The Supreme Court ruling on Trump’s tariffs will unlikely be a big game changer for markets,” said Ebury analyst Matthew Ryan.

“Not only was the decision broadly expected, but the president has already signalled that he will quickly pivot to other legal tools to achieve similar trade restrictions, and he has at his disposal multiple levers to pull in order to circumvent the verdict.”

“This means that while we could see some near-term disruption, his long-term tariff strategy is unlikely to be derailed so long as the White House can replicate the regime through alternative methods.”

Meanwhile, Mr Trump said he is contemplating a limited military strike on Iran, in case a deal on its nuclear programme is not reached.

Asked by a reporter if he is “considering a limited military strike if Iran doesn’t make a deal,” Mr Trump answered: “The most I can say – I am considering it.”

Back in the UK, a torrent of positive economic data was in focus.

Analysts said positive retail sales and purchasing managers’ index data for the UK provided further evidence that economic activity picked up in the new year as uncertainty from the Government autumn budget faded.

Retail sales increased 1.8% on-month in January, compared with a 0.4% rise in December and far outstripping the consensus forecast for a 0.2% rise.

The flash UK purchasing managers’ composite output index rose to a 22-month high of 53.9 points in February from 53.7 in January, beating the FXStreet-cited market consensus of 53.4 points, which would have meant a deceleration of growth.

Climbing further above the neutral 50-point mark separating growth from contraction, it indicates the pace of activity accelerated in February.

“Retail sales provide further evidence that economic activity is picking up smartly in the new year as budget uncertainty fades,” said Pantheon Macroeconomics analyst Rob Wood.

Stocks in New York were higher.

The Dow Jones Industrial Average was slightly higher, the S&P 500 index was up 0.4%, and the Nasdaq Composite 0.8% higher.

The yield on the US 10-year Treasury widened slightly to 4.09% on Friday from 4.08% on Thursday.

The yield on the US 30-year Treasury widened to 4.73% from 4.71%.

US economic growth was slower than expected in the final quarter of the year, though separate numbers showed inflationary pressure picked up in December, giving the US Federal Reserve some food for thought.

Gross domestic product rose 1.4% on an annualised basis quarter-on-quarter, the Bureau of Economic Analysis said, slowing from a 4.4% rise in the third quarter, and below FXStreet cited expectations of a 3.0% rise.

“The contributors to the increase in real GDP in the fourth quarter were increases in consumer spending and investment. These movements were partly offset by decreases in government spending and exports. Imports, which are a subtraction in the calculation of GDP, decreased,” the BEA said.

Back in London, Diageo ended 3.9% higher and led the FTSE 100 after the Financial Times reported Dave Lewis, who took over as chief executive at the start of this year, is planning major changes to his executive team.

Mr Lewis, who earned a reputation for cost-cutting as chief executive of UK grocer Tesco, wants to change the “fat and happy” culture at brewer and distiller Diageo, the newspaper said, citing “two people familiar with the matter”.

This will include replacing several members of the 14-person executive committee, the people told the FT.

Segro closed up 2.0% after it reported a decline in pre-tax profit for 2025, despite increased revenue, as lower valuation gains offset record rental income.

The London-based property developer reported £560 million in pre-tax profit for 2025, down 12% from £636 million in 2024.

Adjusted pre-tax profit, which strips out property valuations, increased 8.3% to £509 million from £470 million.

The weaker earnings amid the improved top line are owed to smaller realised and unrealised property gains, down 72% at £55 million, compared to £195 million a year earlier.

On the FTSE 250 index, TBC Bank closed up 7.0% as it said a positive final quarter of 2025 helped it reach strong full-year results, allowing for a double-digit increase in its annual dividend.

Pretax profit was 1.67 billion Georgian lari in 2025, up 8.4% from 1.54 billion lari in 2024, as total income before credit loss provisions and expenses rose 20% to 3.39 billion lari from 2.83 billion lari.

Within that, net interest income was 2.35 billion lari in 2025, up 24% from 1.90 billion lari in 2024.

TBC Bank declared a final dividend of 3.87 lari per share for a total dividend for 2025 of 8.87 lari per share, up 10% from 2024 and representing a payout ratio of 35%.

TBC also carried out a 75 million lari share buyback programme last year.

Aston Martin Lagonda shares closed down 1.4% after it issued a profit warning as it noted the impact of “heightened tariffs” in the US.

The Warwickshire-based luxury car maker said it expects to report a gross margin for 2025 of around 29.5%, down from 36.9% in 2024.

Aston Martin also anticipates adjusted earnings before interest and tax “slightly below” the lower end of the analyst expectations of a £184 million loss, widening from a £82.8 million loss.

Looking ahead, Aston Martin said it expects a “material improvement” in its 2026 financial performance.

This expectation is driven by a combination of an enhanced product mix, ongoing benefits from its transformation programme and a “continued disciplined approach to operations”.

On the AIM market, SkinBioTherapeutics closed 8.9% higher.

The stock has fallen 2.0% this week.

The Newcastle Upon Tyne-based life sciences firm said non-executive director Alyson Levett will oversee an independent investigation of the events that led to the departure of Stuart Ashman as chief executive officer.

Ms Levett, who chairs the board’s audit committee, will work with FRP Advisory, which the board has engaged to undertake a “forensic review”.

On Monday, SkinBioTherapeutics said Mr Ashman “misrepresented material information to the board, senior management, auditors and advisors” regarding accrued royalty income reported for the financial year that ended in June last year.

The resulting removal of £770,000 in accrued royalty income will reduce financial 2025 revenue to £3.9 million from the previously reported £4.6 million.

The stock has fallen 19% this week.

Brent oil was slightly lower at 71.33 dollars a barrel on Friday afternoon from 71.71 dollars late on Thursday.

Gold climbed to 5,066.90 dollars an ounce from 5,003.14 dollars.

The biggest risers on the FTSE 100 were Diageo, up 69.0p at 1,850.5p, Antofagasta, up 143.0p at 4,018.0p, Burberry, up 35.5p at 1,210.0p, British American Tobacco, up 97.0p at 4,570.0p, and Lloyds Banking, up 2.0p at 104.0p.

The biggest fallers on the FTSE 100 were BP, down 11.08p at 467.92p, DCC, down 65.0p at 5,135.0p, Associated British Foods, down 18.5p at 1,958.0p, Mondi, down 8.4p at 926.6p, and Convatec, down 1.8p at 228.8p.

On Monday’s global economic data are US factory orders figures and a reading on Germany’s business climate.

On the corporate slate for Monday are full year results from Mony Group, with major results due later in the week from HSBC, Diageo and Rolls-Royce among others.

– Contributed by Alliance News

-

Business1 week ago

Business1 week agoTop stocks to buy today: Stock recommendations for February 13, 2026 – check list – The Times of India

-

Fashion1 week ago

Fashion1 week agoIndia’s PDS Q3 revenue up 2% as margins remain under pressure

-

Politics1 week ago

Politics1 week agoIndia clears proposal to buy French Rafale jets

-

Fashion1 week ago

Fashion1 week ago$10→ $12.10 FOB: The real price of zero-duty apparel

-

Tech1 week ago

Tech1 week agoElon Musk’s X Appears to Be Violating US Sanctions by Selling Premium Accounts to Iranian Leaders

-

Tech4 days ago

Tech4 days agoRakuten Mobile proposal selected for Jaxa space strategy | Computer Weekly

-

Entertainment3 days ago

Entertainment3 days agoQueen Camilla reveals her sister’s connection to Princess Diana

-

Politics3 days ago

Politics3 days agoRamadan moon sighted in Saudi Arabia, other Gulf countries